Security mechanisms in Dukascopy

Dukascopy offers several different types of mechanisms to protect against unauthorized third-party logins, loss of a significant part or even the entire capital, thanks to our funds can feel definitely safer here. These are both classic solutions like the Stop Loss defense order and less common functions. Below we present a description of each of them.

Stop Loss

The popular SL is certainly known to all those who spent a few weeks on a demo account, but it is worth reading how it actually works. This is an order that aims to minimize our losses from an open position (or secure a profit). We always set them in the opposite direction to our position, i.e. if we buy this SL must be under the current market rate. Analogically for the sales item.

The price set on the SL order is not the execution price, but the activation price. The difference is that our position does not necessarily have to be closed at the level indicated by us, only after it is reached, the instruction is transferred for execution at the first possible price. In other words, it can occur price slippage.

READ NECESSARY: Review of the Dukascopy transaction platform - JForex 3

Of course, in such a liquid market as Forex it will rarely happen that this strike price will be different than the activation price. In a calm market, such situations are rare. The main risks are the period of low liquidity, price gaps (e.g. at the opening on Sunday) and the publication of macro data (distributed liquidity).

Margin Call and Stop-Out

By far the second most-known way of securing among traders. Often these two concepts are confused with each other, however, both options have slightly different functions.

Margin Call (MC) - this is translating the call to supplement from the English. Its consequence is the inability to open further positions and thus the warning that if we do not top up the account with new funds, the Stop-Out mechanism will work. In Dukascopy margin Call it is activated using a leverage of 100% to 200% (indicator displayed at the bottom of the platform).

Stop-Out (SO) - it is a mechanism that aims to protect us from crediting the overdraft on the account. Usually Forex brokers as a result of SO, they close all open positions or start from the most lossy until the balance of the account. In the case of Dukascopy, SO opens an opposite hedge position, which will stop our loss from increasing further. Then reduce the open position or close it completely to reduce the use of the jack.

Stop-Out is activated by using the lever above 200% (indicator displayed at the bottom of the platform).

Leverage reduction before the weekend

This kind of security will not usually appeal to people who are losing losses and leverage leverage to a large extent. The leverage reduction by approx. 1 / 3 takes place in Dukascopy once a week in the last trading hours on Fridays around 20: 00 of Polish time. This action is to limit the risk exposure before the end of trading and, at the same time, significantly reduce the likelihood of debit due to the weekend's opening gap on Sunday.

The reduction takes place at the lever:

- from 1: 100 to 1: 30,

- 1: 200 to 1:60,

- 1: 300 to 1: 100 (available in Dukascopy Europe).

Pursuant to the guidelines of the Polish Financial Supervision Authority, brokers notified by this institution, including Dukascopy Europe, can not offer Polish residents greater leverage than 1: 100.

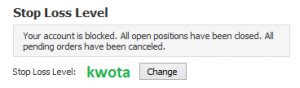

Stop Loss Level

SLL is a security mechanism that we can optionally set on our account. It is expressed in the currency of the account and is intended to involuntarily block us from further trading. If the deposit goes below the level we set.

For example: we have PLN 10 on the bill, we set SLL to PLN 000. If, as a result of our trading, the account balance (including open positions) drops to PLN 5, all positions will be closed. Moreover, pending orders will be canceled and the trade option disabled. Then, in the customer panel, a message such as the image on the left will appear.

For example: we have PLN 10 on the bill, we set SLL to PLN 000. If, as a result of our trading, the account balance (including open positions) drops to PLN 5, all positions will be closed. Moreover, pending orders will be canceled and the trade option disabled. Then, in the customer panel, a message such as the image on the left will appear.

To continue trading, just change the limit and reactivate your account in this panel. This solution is extremely useful for people who sometimes get into a whirlwind of transactions and have problems with maintaining discipline, as well as for traders who use aggressive automatic strategies. As a result of the machine, which is looped or contains many transactions, we can reset our account. The trade block option will prevent him from doing so.

READ ALSO: Stop Loss - Everything You Need To Know About Defensive Orders

This option is available after logging in to the customer panel on the website Dukascopy -> Entry for Traders -> Summary -> My Account -> Stop Loss Level.

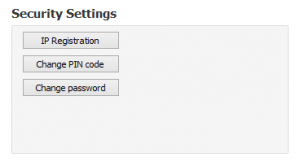

IP address protection

This security is not related to trade but log-in to the platform itself. We have the option of defining our IP address, thanks to which logging in to the account will be possible only from it or a given pool of addresses that have been added. This option is useful only for people with a permanent address, although it is very effective protection against unauthorized use of our account.

This security is not related to trade but log-in to the platform itself. We have the option of defining our IP address, thanks to which logging in to the account will be possible only from it or a given pool of addresses that have been added. This option is useful only for people with a permanent address, although it is very effective protection against unauthorized use of our account.

This option is available after logging in to the customer panel on the website Dukascopy -> Entry for Traders -> Summary -> My Account -> Security Settings.

Pin code

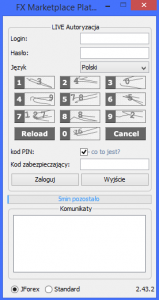

Pin code

Additional security is the use of a code PIN. In addition to the login and password given to us (which we can then change to our own), we have the option of defining a security PIN code. It will be used to log into the platform.

We set 4 digits, where when logging in on the platform in the PIN window other, randomly generated digits are displayed, which should be entered. For example below, if our PIN code is 1 2 3 4 enter the numbers in these fields into the window, i.e. 3 4 0 9.

Thanks to this, even if someone monitors the characters we press on the keyboard, it will not reveal our code.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)