Copper and platinum on the wave of green transformation

The commodity sector remains at the center of the current "everything boom" across asset classes. The substantial liquidity provided by governments and central banks, coupled with the anticipated rapid post-pandemic growth, has provided the sector with a turbo boost as local supply constraints hit. This means greater demand from investors looking for rollover profits and looking for investments that offer some protection against the expected increase in inflation.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Green transformation

In the recently published quarterly forecast, we summarized the fundamental reasons for the new boom in the commodity market in 2021. Some investors now pay attention not only to gold, in a period of extremely low real rates and the loosest monetary policy in history, but in particular to metals necessary to implement the green program transformation.

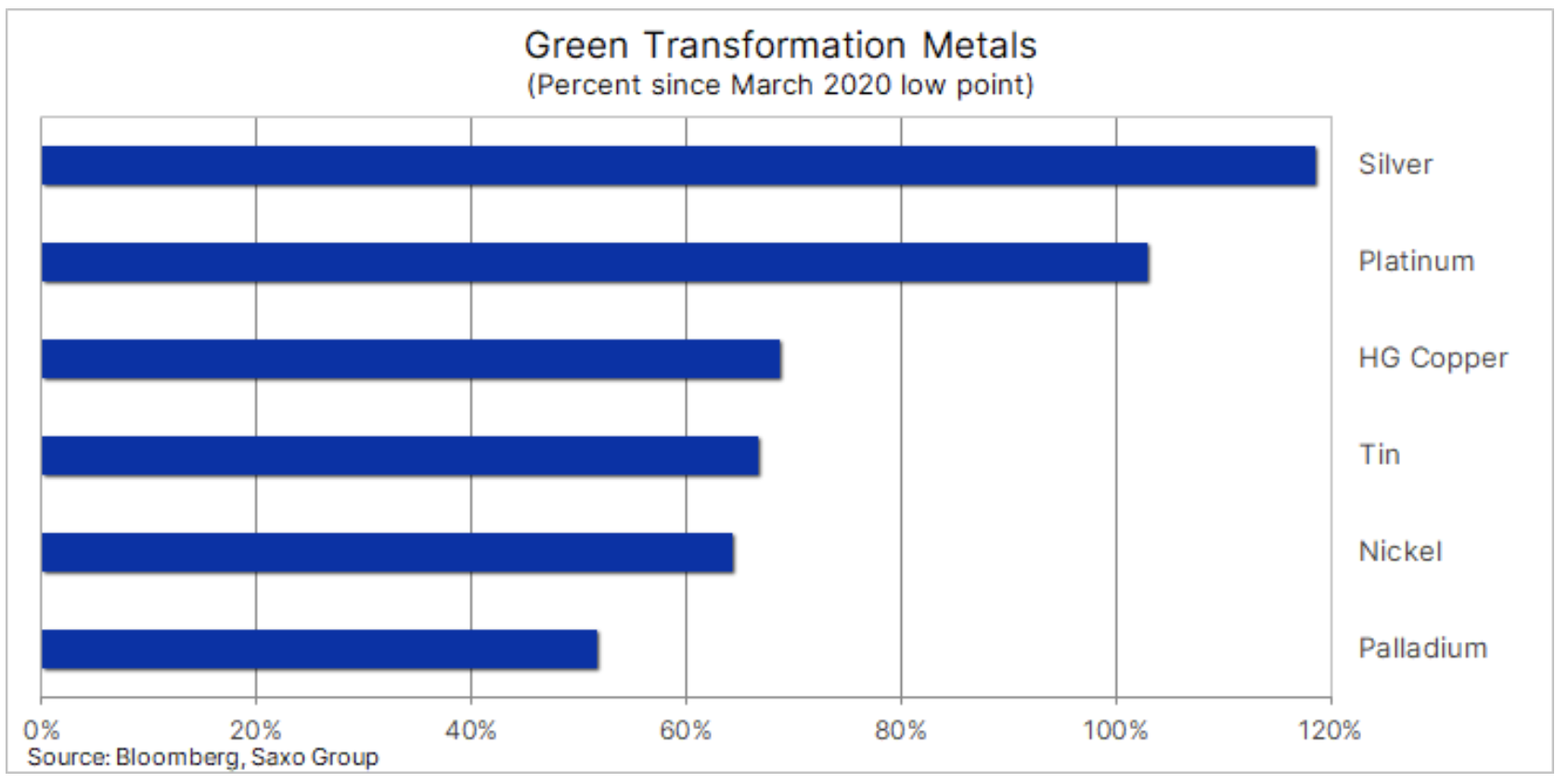

At the top of the list in terms of performance since the collapse in March 2020, we see metals such as silver (XAGUSD) due to its dual use - as an investment and as an industrial metal, where the solar PV market in particular is predicted to be in a strong position as many countries have already initiated renewable energy projects.

Platinum

Platinum market The (XPTUSD) received a strong positive push last year and at a discount to gold of $ +1 in early November, the spread narrowed by more than $ 000 and the price of platinum hit a six-year high above $ 400 / oz. The latest rally comes after the news that car sales in China in January increased by 1% compared to last year, and this growth has been going on for ten consecutive months. At the same time, the platinum market has experienced an oversupply for many years due to the fact that the automotive industry has taken an interest in palladium - this is now changing. According to the World Platinum Investment Council (WPIC), the return to platinum (at the expense of palladium) has already begun, but the scale of this process is currently a secret of the largest catalyst manufacturers: Johnson Matthey, BASF and Umicore.

What is known for this is a strong increase in demand for investments through exchange funds and, to a lesser extent, futures contracts - in the last few years ETF have accumulated an almost record position of 3,9 million ounces. If we add the ounces held by futures exchanges, investment demand now accounts for nearly 45% of known ground stocks. The shift towards the projected supply deficit is taking place at a time of increased interest in regulations limiting emissions from traditional combustion engines, while accelerating green hydrogen production, increasing the demand for platinum-based electrolysers.

After platinum has recorded a downward trend for almost a decade, its last break in November last year attracted new investors, including as gold reached the price of $ 2 / oz and increased its premium to platinum to over $ 000 / oz. Consequently, many investors became interested in one metal at the expense of another.

Copper

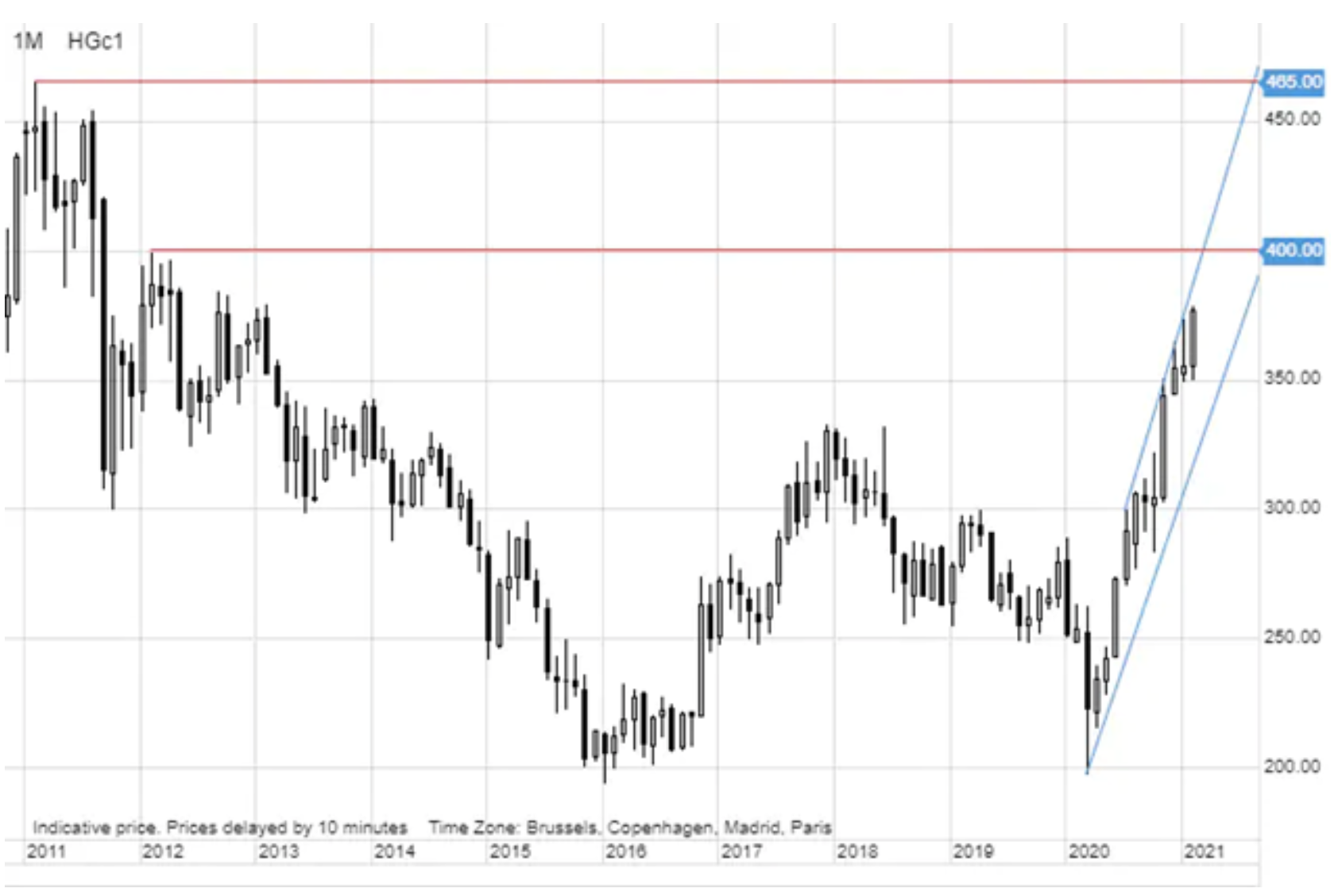

"Doctor Miedź" (COPPERMAR21 & HGH1) - the metal used for everything from cabling and electronics to electric vehicles and as such a good indicator of global growth and economic activity - saw an eight-year high on a wave of demand optimism after governments around the world initiated ventures related to green economy. Last week, copper briefly came close to support at $ 2,50 after China cut liquidity before the overnight rally pushed the metal to $ 3,7850, its highest level since October 2012. The data was an impulse from China, showing that factory prices rose for the first time in a year in January, increasing the risk of Chinese inflation exporting to other countries.

February is usually the weakest time of the year for copper due to the fact that the Chinese New Year reduces the demand from the largest consumer of this metal in the world. However, almost everything indicates that the market is narrowing, and the lack of an increase in supply from mines suggests an impending deficit. Demand is likely to pick up again in the spring months after the Covid-19 threat is addressed and governments draw up green spending plans. Demand will increase to a degree that apparently prevents the supply side from satisfying it.

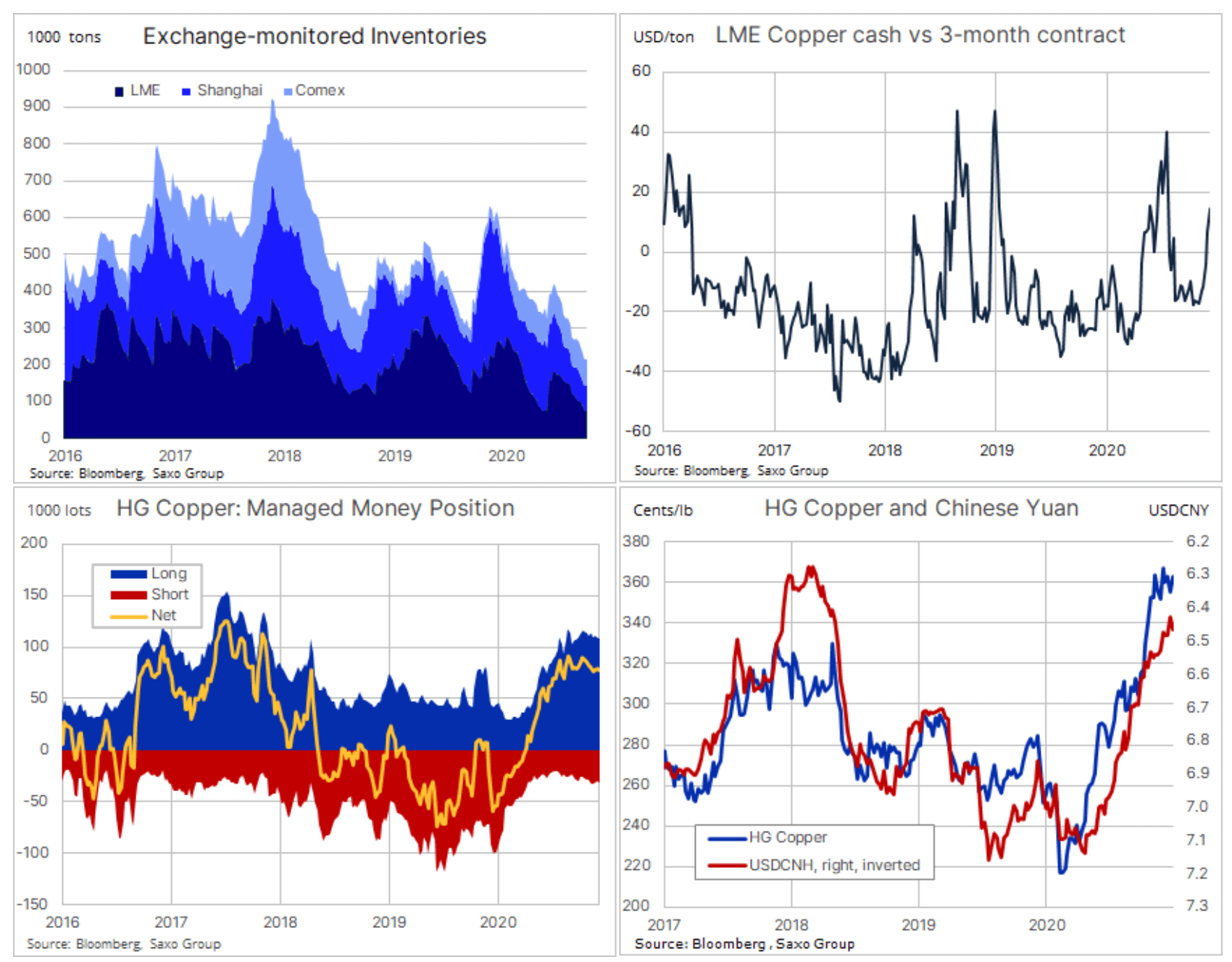

Copper inventories monitored by the three major exchanges in New York, London and Shanghai fell to the lowest level in many years (215 tons), which is less than half of 522 tons. average for the last five years. This phenomenon is also visible in the futures curves: the front end of the LME curve shows an increase in deportation, a sign of decreasing availability in the spot market.

However, even though the price has reached its highest level in almost a decade, speculators investing in COMEX HG contracts have growing doubts. They currently have a long net position of PLN 78. flights, which is close to the three-year high, but 38% below the record level of September 2017. Moreover, this position has been relatively constant since September. Another indicator that suggests that the market has not fully peaked is the long-to-short ratio. It currently stands at 3,5 long positions to one short position, well below the 6,4 record high of 2017.

As can be seen in the chart, the retracement during the + 60% growth period from the March 2020 low was very shallow, with buyers coming in with every attempt. Price recently found support at $ 3,50 / lb before commencing the last extension of its move upwards, in market opinion to $ 4 / lb, the 2012 high and a key psychological level.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response