We can forget about the dollar for PLN 4 for a long time [USDPLN analysis]

A month ago, the dollar was attacking the PLN 4 barrier. Now, however, he can forget about it for a long time. The analysis of the technical situation on the USDPLN chart leads to at least such conclusions. The change in the balance of power to EURUSD additionally supports this thesis.

USDPLN sharply down

On Monday the USDPLN rate fell below PLN 3,90, breaking the consolidation bottom in the range of PLN 3,8992-3,9909. It was in this range that it had remained in early June. A day later, this technical sell signal confirmed a breakout from the same. However, a slightly wider consolidation (PLN 3,8866-3,9994) and testing the lowest levels since the first half of March. This was accompanied by renewed sales signals on indicators (e.g. on MACD), and it was not a problem to sell out.

Chart USD / PLN, D1 interval. Source: MT4 Tickmill.

Where did these drops in USDPLN come from? There are several factors for this, all of which are almost equally important. First of all, the perception of the Polish economy and expectations as to the pace of its recovery from the covid recession have changed. Until recently, the markets were impressed by the pessimistic forecasts regarding GDP, which were published together with the communiqué from the last meeting RPP. They simply suggested that the related lack of inflationary pressure certainly precluded any interest rate hike before the end of the Council's term of office in 2022. However, these forecasts quickly ended up in the basket.

A very big surprise in the June industrial production data, another positive surprise from the retail sales data, surprises in the form of data on wages and employment, or earlier reports indicating a jump in inflation, changed the market view. Of course, it would be safer to wait for confirmation in the form of July data with the applications. However, by observing what is happening outside the window, one can probably argue that July will also be good.

So what do the data show? First of all, the recession will not be as deep as it recently feared NBP and the MPC, and the recovery from the crisis will be faster. Provided that the fall coronavirus wave does not turn out to be dramatic, of course.

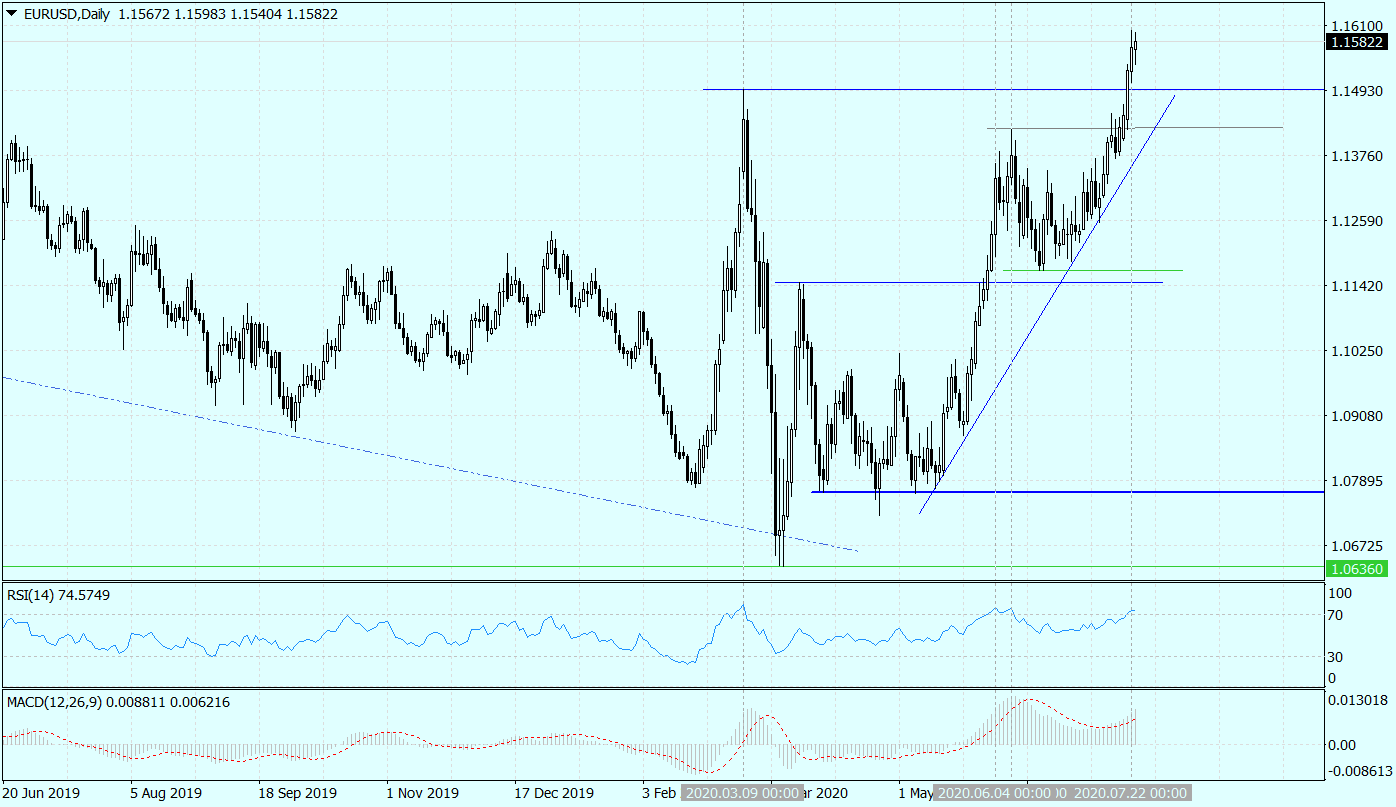

EUR / USD above 1.15

The zloty was also supported by good moods on global markets, which were additionally supported by the EU agreement on the Reconstruction Fund and the new budget. This increased the risk appetite, encouraging the zloty to buy and at the same time creating supply pressure on the dollar, which is clearly visible on the EUR / USD chart.

Chart EUR / USD, D1 interval. Source: MT4 Tickmill.

And the situation on the EUR / USD chart is the third factor. Breaking this pair above 1,15, breaking above the March high, changes the balance of power. On the basis of technical analysis, the road was first opened to the area of 1,18 and then 1,20 USD. This second level is predicted by Deutsche Bank analysts as a likely target for EUR / USD at the end of 2020.

Let's go back to USD / PLN. Currently, it is the supply that deals the cards. Depending on how we describe the 1,5-month consolidation, from which the rate hit the bottom this week, the target is either around PLN 3,80 or levels slightly above PLN 3,77. Seeing the strength of the supply, one has to reckon with an attack on this last level. There, the demand can already feel bolder. After all, it will be supported by the proximity of the hole from the beginning of March (PLN 3,7544). Therefore, at the moment, the 3,7544-3,7730 zone should be defended, which then may result in an upward correction of a few groszy. The March minimum has a chance to defend itself by the end of the summer holidays.

However, in a slightly longer period of 2-4 months, further declines are inevitable. This is because the March return from the 2016 peak marked a trend shift to a downtrend. So if only USD / PLN can cope with the support around PLN 3,70-3,80, and everything indicates it, it will have an open road towards PLN 3,30.

The above thesis is supported by the situation on the EUR / USD chart. At least until the rate stays above the 2,5-month uptrend line (currently 1,1380). The euro now has an open road to the aforementioned 1,20 level. Assuming that the EUR / PLN falls on the wave of rising risk appetite, but remains above PLN 4,30, the USD / PLN exchange rate will drop to PLN 3,58. And here we come back to the title of this comment. Yes, we can forget about PLN 4 to USD / PLN. Just as we forgot how much fear prevailed in the markets in mid-March. And this is the fear that is needed for the dollar to cost more than PLN 4 again.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![We can forget about the dollar for PLN 4 for a long time [USDPLN analysis] usdpln, zloty](https://forexclub.pl/wp-content/uploads/2020/07/usdpln-analiza-tickmill.jpg?v=1595514364)

![Best Strategies Using MACD [Video] macd strategies](https://forexclub.pl/wp-content/uploads/2022/02/strategie-macd-300x200.jpg?v=1645890245)

![We can forget about the dollar for PLN 4 for a long time [USDPLN analysis] metatrader 4 on macos catalina](https://forexclub.pl/wp-content/uploads/2020/07/metatrader-4-na-macos-catalina-102x65.jpg?v=1595333898)

![We can forget about the dollar for PLN 4 for a long time [USDPLN analysis]](https://forexclub.pl/wp-content/uploads/2020/07/0x-zrx-crypto-102x65.jpg?v=1595401696)

Leave a Response