MTF vs Stock Exchange vs ECN?

More and more enigmatic abbreviations appear in the world of financial markets, and technology continues to move forward. In order not to get lost in the depths of information, it is worth constantly exploring technical concepts and analyzing the changes taking place. A few years ago, hardly anyone was interested in what model our broker operates in, although the execution of orders itself was important. However, the awareness and needs of investors clearly evolved, and then three divisions suddenly emerged from one sack of brokers - Market Maker (MM) STP i ECN. The time has come that this is not the end.

A few words about LMAX

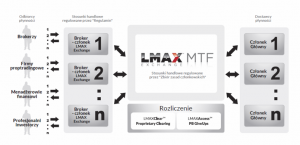

LMAX Exchange (London Multi Asset Exchange), is regulated by FCA (Financial Conduct Authority) as MTF * (Multilateral Trading Facility), providing a stock market model of order execution, complete transparency of trading, security and uniform trading conditions for all market participants. An open order sheet provides access to solid liquidity created only by limit orders. They come from leading global banks and proptrading companies.

What is MTF?

* MTF (Multilateral Trading Facility) in accordance with the understanding of the MiFID II Directive - this is a multilateral system of trading in financial instruments organized by investment companies or entities operating a regulated market, in accordance with the principles set out in advance by the system's operator, under which offers to purchase and sell financial instruments are associated in a way that results in entering into transactions. In addition to the requirements typical of investment companies, the provisions of the Directive impose additional criteria on the entities running MTF, whose aim is to guarantee a smooth and safe process of concluding and finalizing transactions.

READ NECESSARY: Forex brokers, always up-to-date list of offers

MiFID requires MTF operators to provide the following:

- total turnover transparency ('pre and post-trade transparency'),

- transparent and pre-determined operating rules, including procedures,

- guaranteeing fair and orderly marketing,

- transparent criteria defining financial instruments that may be traded,

- transparent criteria for accessing the system for potential users,

- access to reliable information on the basis of which it will be possible to make the right investment decision,

- appropriate technical security and emergency plans ensuring a high level of user safety,

- mechanisms guaranteeing efficient and correct settlement of concluded transactions.

Is LMAX Exchange similar to the stock exchange? What are the differences?

The MTF has been defined as an exchange lite because it provides a similar or competing service and has a similar structure, set of membership rules and is also subject to the market surveillance committee. Most stock exchanges operate on the stock markets and futures markets, offering additional services such as listing and a central settlement model. The main difference is that the MTF is not tradable and does not offer a central clearing model.

Lmax MTF. Order execution diagram.

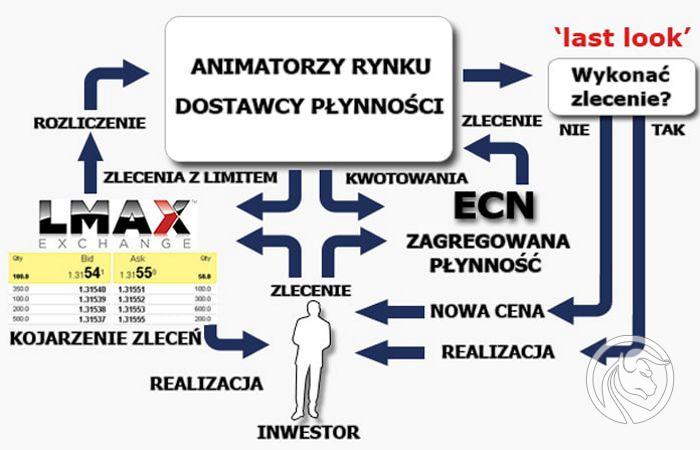

What are the differences between LMAX Exchange and ECN?

ECNs are electronic trading systems that automatically match buy and sell offers at certain prices. Most ECNs are registered at the SEC in the US as broker-dealers. ECNs operate on different asset classes, including shares, eg Nasdaq market and currencies. ECNs charge a commission on transactions or modify the price of an instrument.

LMAX Exchange has a clear order sheet containing only binding limit orders. Liquidity providers do not havelast look', which deprives them of the opportunity to re-pricing the price, it is not a practice to extend the spread, nor routing over the network in order to find the right price. LMAX Exchange only charges commissions on concluded transactions. As a result, the ability to perform transactions at a price visible on the platform is limited only by the laws of physics, ensuring precise and consistent quality of execution.

Nothing prevents ECNs from working in the same way as LMAX Exchange, unfortunately many ECNs still have last-look, interfering with the spread, adding an element of unpredictability to trading on FX. Regulatory requirements for ECNs are also less transparent compared to MTF regulations that are not negotiable.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Market Maker, STP, ECN - What is the difference between Forex brokers? [VIDEO] MM STP ECN V5b](https://forexclub.pl/wp-content/uploads/2021/04/MM-STP-ECN-V5b-300x200.jpg?v=1618421777)