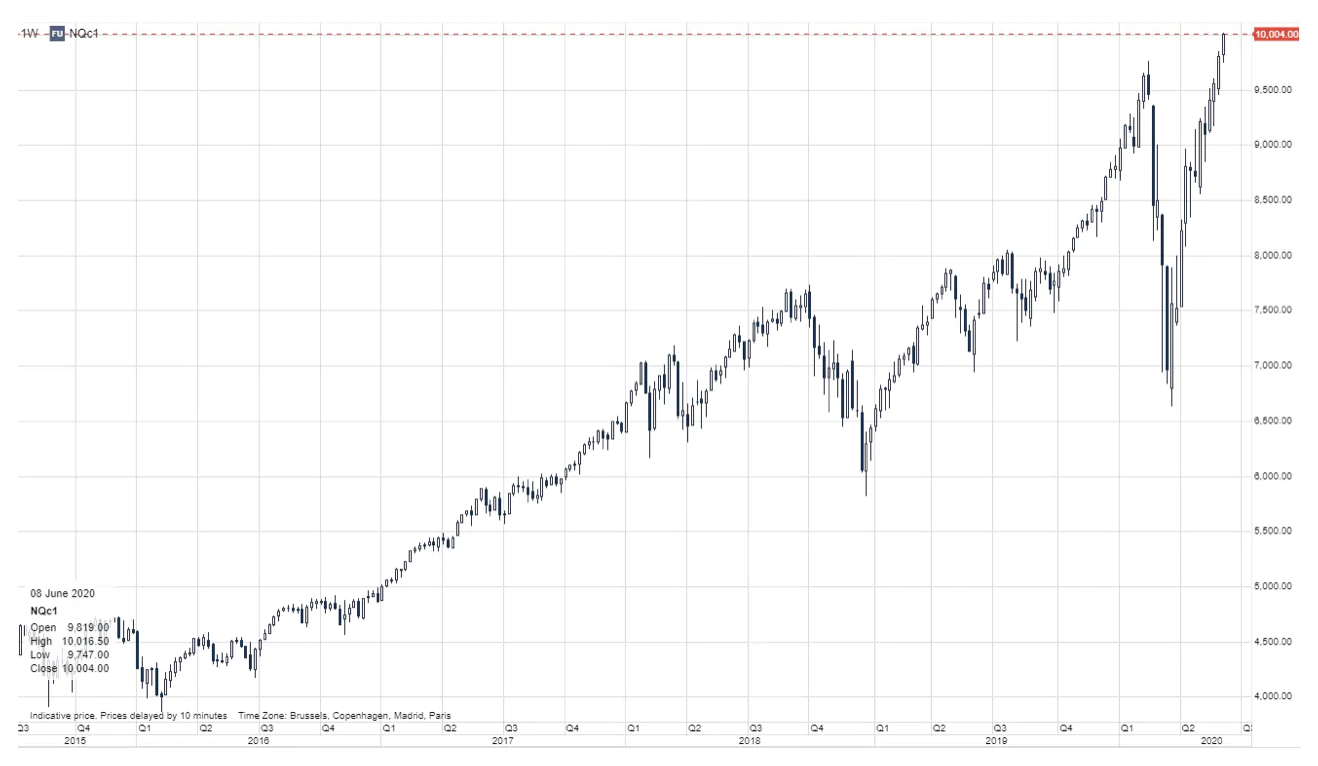

The Nasdaq 100 exceeds 10 points for the first time

The mood is still positive despite yesterday's fall in share prices, and investors quickly recovered, pushing the Nasdaq 100 index above 10 points after the end of normal trading hours. This morning, given the rise in stock prices and the Nasdaq 000 index to 100 points, it is worth considering the current situation and possible further scenarios.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

NASDAQ sets new ATH

The valuation on the Nasdaq 100 has reached eighteen EV / EBITDA, which is the highest level since February 2004 and significantly exceeds the valuation on the global stock market. Does this have to be a problem? Investors who invested in the Nasdaq 2004 in February 100 with such high valuations over the next 10 years would receive an annualized profit of 10,4% despite lowering the multiplier, as the EBITDA in that period recorded an annualized increase of 14,5% . if Fed This year it will introduce a control on the yield curve, we expect it to lead to an increase in the valuation multiplier of growth shares, which includes the Nasdaq 100. This means that even with a lower EBITDA growth rate in the coming years, the current trend for the Nasdaq 100 may continue.

Still many unknowns

In the short term, we would recommend investors to use technical indicators when deciding whether to maintain technology company shares. In our view, there is still so much uncertainty about the economy in the context of the COVID-19 pandemic that investors should be careful because the situation can be dynamic. Since the rebound in March, our preferred indicator is the 100-day moving average. As long as the Nasdaq XNUMX is above market sentiment, a positive opinion about US technology companies' shares is justified.

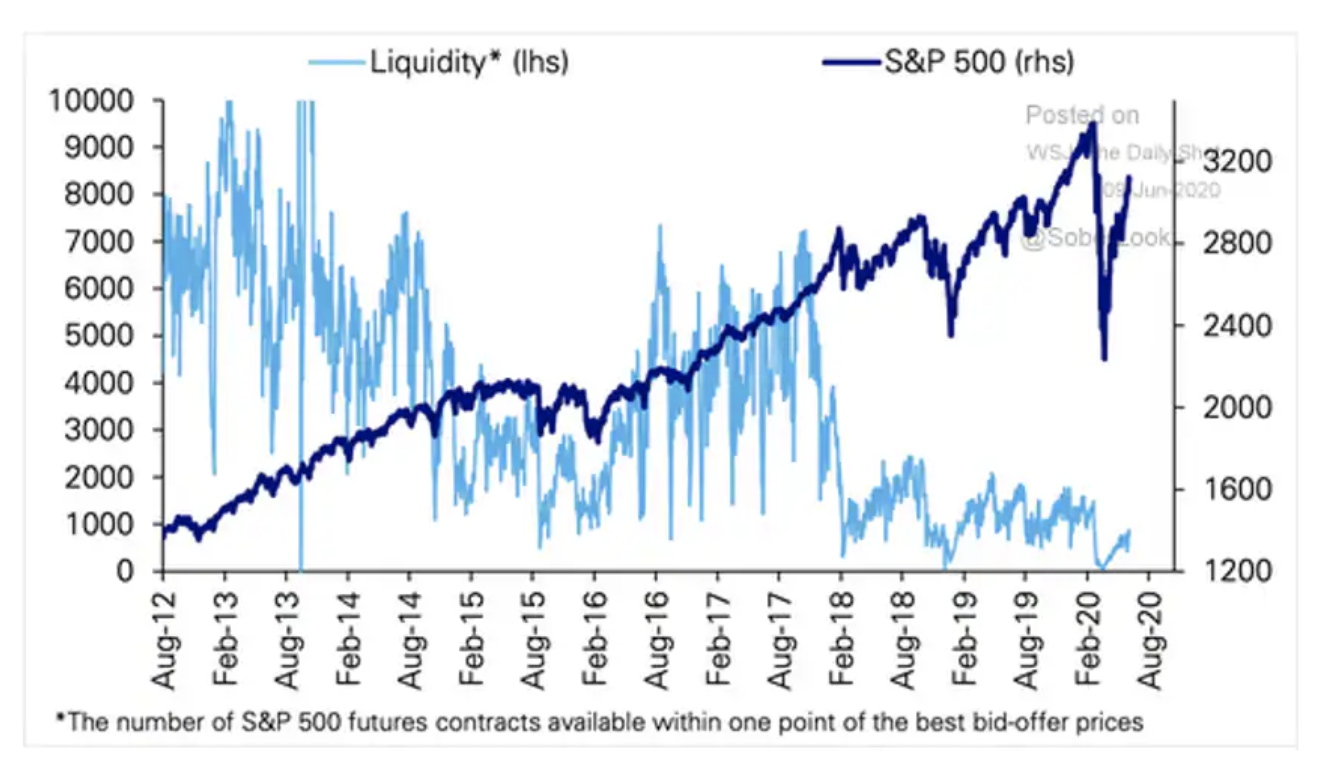

One aspect that we mentioned earlier that has deteriorated is the liquidity available in the financial markets. For market participants, and especially for the Fed, the breakthrough moment was the collapse in the US Treasury bond market. However, we also see the same low liquidity with the E-mini S&P 500 futures, and market makers are concerned about greater exposure that would at least bring the market closer to past conditions. This means that the current market structure allows for significant declines in the short term. This is probably the biggest risk for traders on the Nasdaq 100 i S & P 500because there can be a significant change in mood along with sharp drops. That is why we strongly emphasize that traders invest when applying strict risk management principles.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

shock ... and with such data from the labor market, gdp ... markets collapsed