Next Eleven (N-11) - Egypt, Nigeria and Iran. Forgotten markets? [Ch. III]

Next Eleven (N-11) is a very broad term. As we already know from part i i Part II cycle, N-11 is not a homogeneous group of countries. Some of them are treated with neglect by investors. Examples of such countries are the African representatives of Next Eleven and Iran. The reasons why investors avoid these markets vary. In the case of Egypt and Nigeria, the most likely reason is that institutional investors tend to treat Africa as one region. The easiest way for them to gain exposure to African companies is through the Johannesburg (South Africa) market. In the case of Iran, the reason is the sanctions that excluded this country from access to Western capital. This made investing in this market much more difficult for both individual and institutional investors.

In this section of the article, we will provide information on economies Egypt, Nigeria and Iran, and we will introduce you to the ways of investing in these markets from the point of view of a European and American investor.

Egypt – still below potential

Egypt is Africa's largest economy. Based on purchasing power parity, Egypt is the 18th largest economy in the world. Its GDP (PPP) is estimated at around $1 billion. The country is very populous. Its population is about 800 million inhabitants. This gives Egypt the 109th place in the world in terms of population living in a single country. It is therefore not surprising that in the years to come, the country will gain in importance on the international arena.

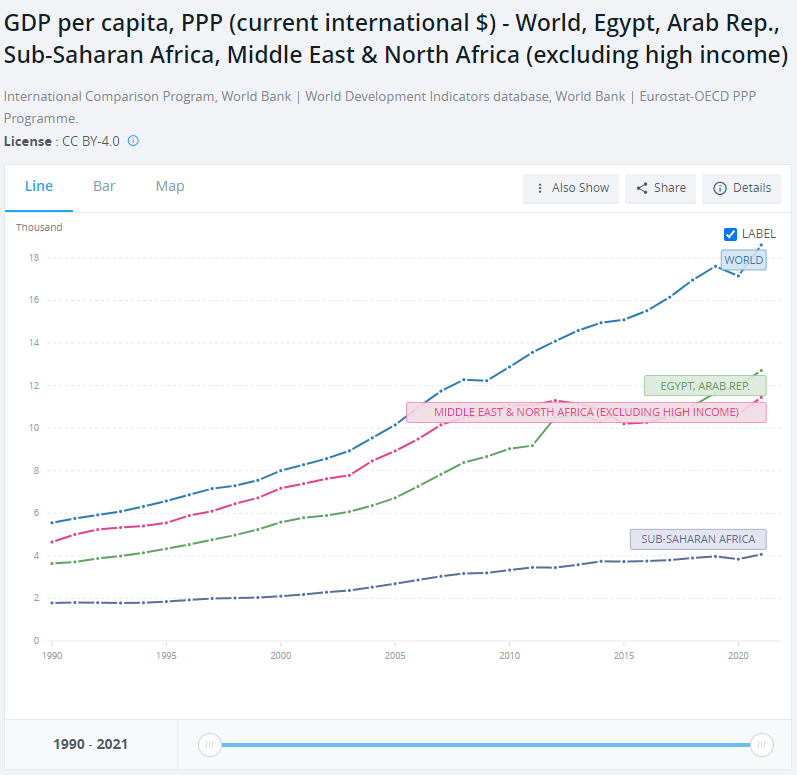

As in the case of Bangladesh, Egypt also benefited from market reforms. Privatization increased productivity, while liberalization of land trade increased the efficiency of agriculture. As a result, the poverty rate in the country has decreased. The development of exports, combined with the enrichment of the society, translated into a decrease in unemployment. In 2023, the unemployment rate for this country is 7,5%.

Thanks to political reforms, Egypt has lifted price controls in many areas and reduced subsidies in many economic areas. This helped market the economy. Liberalization of prices initially increased inflation, but allowed for the introduction of sound market principles. The liberalization of the economy caused small companies to spring up like mushrooms after the rain. This increased the demand for labor, which allowed for a partial migration of people from the countryside to the cities. This allowed for an increase in productivity in the economy, as people left the overcrowded villages to find better-paying jobs in the cities.

Source: World Bank

Traditionally, large cities have become islands of wealth, attracting populations from rural areas. The increase in urbanization improved the efficiency of resource allocation and increased productivity in the economy. This was due to the fact that in the countryside people often worked on small farms that had low efficiency. The transition of these workers to the service sector or industry contributed to the development of other branches of the economy. The Egyptian real estate market in large agglomerations also benefited.

The country has a very diversified export structure. However, as much as 25% of exports come from sale of hydrocarbons and petrochemical products. One of the most important export products is natural gas, clothes, Cotton, medical products, petrochemical products and vegetables, fruits and cereals. In addition, the country also exports cement, steel or ceramics.

It is worth mentioning that Egypt is open to foreign investors, who are encouraged by the still competitive production costs and large population. Also attractive is the demographic pyramid, which gives hope for market growth in the long term.

Banking sectorwhich is still heavily nationalized. State-owned banks control about 60% of deposits. The capital market has its center in Cairo. It is worth remembering, however, that the Egyptian stock exchange is local. The most important index is EGX 30, which groups the largest and most liquid stocks from the Egyptian stock market.

It is worth mentioning a few companies that play an important role in the economy. It is e.g. El Nasr Automotive Manufacturing Company. It is a state-owned company that produces many cars licensed by foreign companies (including Kia, Jeep, Peugeot). You can't forget about either Abu Qir Fertilizers Company. It is the largest producer of nitrogen fertilizers in Egypt. It also plays an important role on the fertilizer market EBIC (Egypt Basic Industries Corporation), which is the largest producer of ammonia in the country.

Lyxor Pan Africa UCITS ETF

An investor from Europe cannot use too much ETFs. For exposure to Egypt, he can do so by purchasing Lyxor Pan Africa UCITS ETF. Egypt's share in this ETF is 12,5%. This is mostly exposure to an Egyptian bank: CIB Bank Egypt (over 10% of ETF assets).

Lyxor Pan Africa UCITS ETF Chart, Weekly Timeframe. Source: TradingView

VanEck Egypt Index ETF

Another idea to gain exposure to the Egyptian market is to buy VanEck Egypt Index ETF. The ETF was established in 2010, but has not raised much capital until now. Assets under management (AUM) is just over $14 million. It was not the best investment in the last 10 years. Just look at the chart.

VanEck Egypt Index ETF chart, weekly time frame. Source: TradingView

Iran - under the burden of sanctions

Iran's economy had to operate in difficult conditions for many years. This is due to the fact that the country was quite often subjected to sanctions by the countries of the "West". The reason was development "nuclear energy". Israel and the United States believe that Iran is developing nuclear weapons projects. This is a violation of the non-proliferation rules for the production of nuclear weapons. Therefore, sanctions were applied to convince Iran to change its decision on the development of its nuclear program.

Sanctions slow down development, but at the same time create conditions for the expansion of domestic production. Iran, after the Islamic revolution decades ago, abandoned the free market economy. Currently, it is a country that, on the one hand, has a large share of state-owned companies, and on the other, allows for the development of private businesses. However, the operation of private companies is hampered by the fact that prices for some products are regulated from above. This applies in particular food and energy prices.

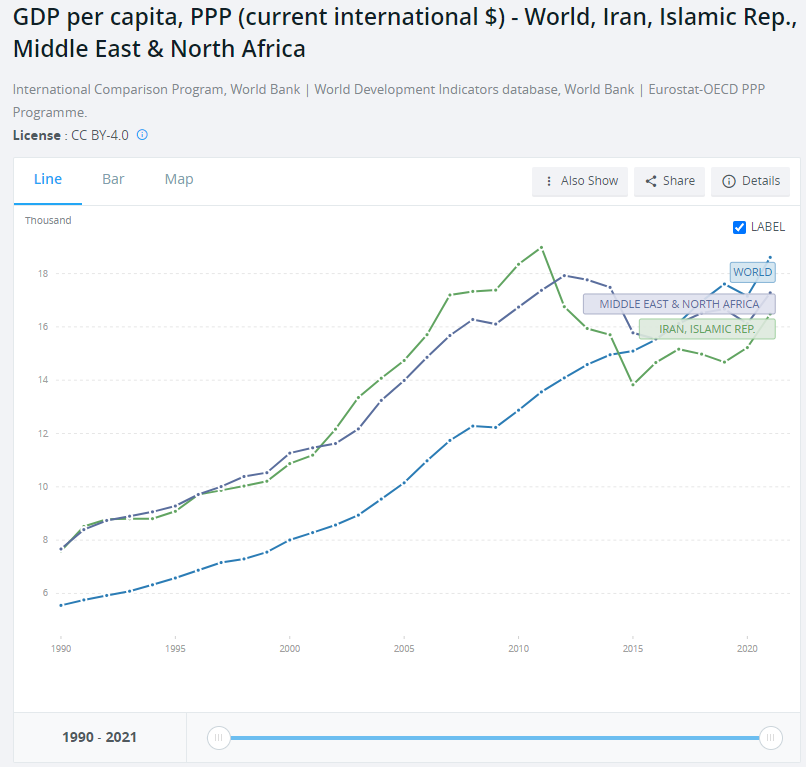

One of Iran's greatest resources are hydrocarbons. The country holds 10% of the world's reserves oil and 15% natural gas. Theoretically, the country could take advantage of high oil prices to quickly modernize its economy. Unfortunately, sanctions and a lack of willingness to carry out economic reforms prevented this. As a result, Iran passed through "lost decade"where the growth rate slowed down significantly.

Source: World Bank

Most of the export revenue comes from the sale of oil and natural gas. The hydrocarbon revenues subsidized certain products, such as imported food and medical equipment. Subsidies allowed to keep prices low for the most needed products. This allows you to calm down the social mood. However, this reduces productivity and hinders the development of small and medium-sized enterprises.

Iran has a good demographic structure and very high human development indicators. This contrasts with a closed economy in which few countries are willing to invest. This causes a slow brain drain. People who disagree with "Islamic state management" decide to emigrate. Despite its problems, Iran has one of the greatest potentials for development in the coming years. Interestingly, it does not have to integrate with Western countries, but only focus on economic cooperation with China.

There is a stock exchange in Iran with its headquarters in Tehran. However, access to investing in shares of Iranian companies is very limited. For this reason, investment solutions cannot be found for the regular investment account holder.

Nigeria – a large population: a chance for development or a ball and chain?

Together with Egypt, Nigeria is the largest economy in Africa. The country is famous for its own oil resources. In addition, it experiences political instability quite often. Suffice it to mention the problems with guerrillas in the north of Nigeria.

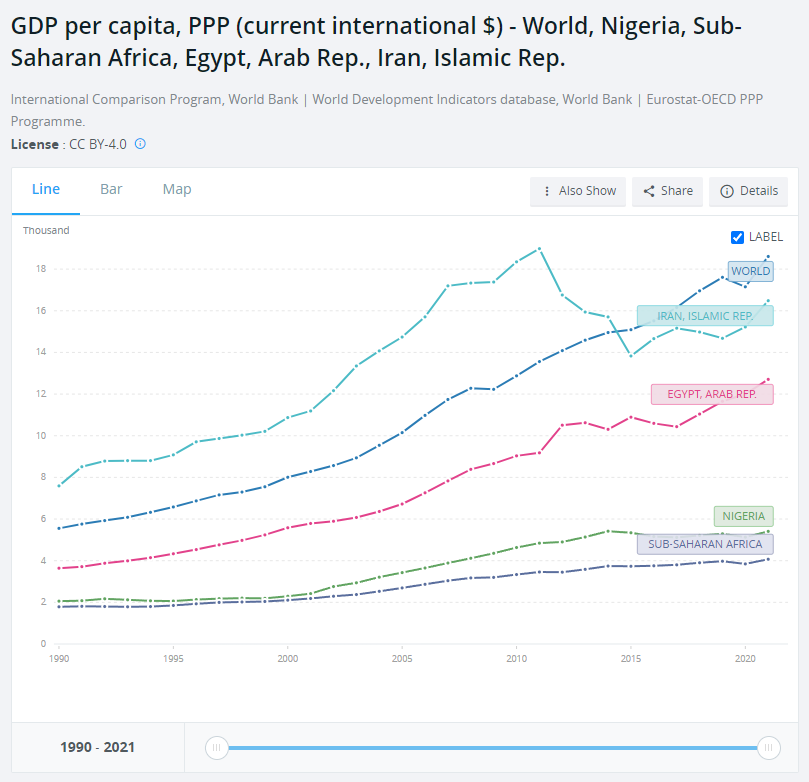

The country is classified as underdeveloped markets. In 2005, he had a bright future ahead of him. Large oil reserves were to help transform the country. Unfortunately, Nigeria did not take full advantage of its opportunity. This can be seen in the chart below. GDP per capita (PPP) is very low. Moreover, the distance between Egypt and Nigeria is only widening.

Source: World Bank

The country, despite its resources, has a very low GDP per capita. This is a development barrier, because with a rapidly growing population, it is difficult to create enough high-paid jobs. As a result, simple jobs with low wages dominate. What's more, natural increase in a weak economy creates development problems. Every year another 4-5 million people enter the labor market. The economy is growing slowly for a country with such a level of development (approx. 3%). As a result, it is unable to provide employment for such a large number of people. Unemployment in Nigeria is estimated at over 40%. So natural increase only exacerbates the problem. For now, there are no prospects for improving the situation. They create such conditions nepotism and corruption. At the same time, the increase in unemployment results in the radicalization of society, which may contribute to the destabilization of the country.

The state budget is largely based on oil exports. It accounts for more than half of budget revenues, even though the oil industry accounts for less than 10% of GDP. Nigeria alone accounts for about 2,7% of the world's oil supply.

The country is also struggling with inefficient agriculture. The reason is poverty, which prevents the introduction of more mechanized agriculture. Fertilizer consumption is also quite low. Increasing the efficiency of this sector is crucial with a rapidly growing population.

It is also a major development barrier low level of general education. This causes human capital to be underutilized. An uneducated society is less productive. This, in turn, is reflected in low GDP, which limits investment in education. It is necessary for the government and local governments to introduce broad development projects.

The big advantage of the country is well-developed banking sector. It is considered the largest in Africa. It is worth mentioning that the banking system of the society is much larger than in other West African countries. A developed and stable banking sector can be a workhorse for the entire country. It is only necessary to improve the business financing offer for small and medium-sized enterprises.

Global X MSCI Nigeria ETF

If the economic situation of the country does not scare the investor, then there is an ETF with exposure to this market. It is the Global X MSCI Nigeria ETF. It is quite an expensive ETF. Its annual cost of living (TER) is 0,83%. Despite the fact that it was established in 2013, it has raised little capital so far. Total assets under management amount to approximately $45 million. The largest item in this fund is Dangote Cement PLC, which has over 13% of the portfolio. It should be noted that ETF performance is dire for the long-term investor.

Global X MSCI Nigeria ETF Chart, Weekly Timeframe. Source: TradingView

Brokers offering ETFs and stocks

How to invest in country markets Next Eleven (N-11)? It is not as simple as we would like, and the selection of ETFs is simply very limited. However, an increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and involve a high risk of a quick loss of cash due to leverage. 76% of retail investor accounts record monetary losses as a result of trading CFDs with this CFD provider. Consider whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summary: more questions than answers

Egypt, Nigeria and Iran, although they belong to the N-11, their situation is completely different from the two previous groups. They are not the best in terms of development. They are not developing as fast as the Asian part of Next Eleven. Egypt and Iran are in the middle in terms of economic development. Both countries have a good demographic situation and a chance for economic growth in the coming years.

Iran's development is hampered by sanctions that prevent imports of Western products that would help modernize the economy faster. China, which is the main trading partner, is trying to take advantage of the situation. Maybe they will accelerate the transformation of the country. However, GDP per capita (taking into account the parity) is still below the world average. Certainly, opening the economy to trade with the whole world would be a strong opportunity to accelerate growth. It seems that we will have to wait for that.

Egypt, in turn, is transforming economically. Previously, the economy had been licking its wounds after the Arab Spring and political instability in the country for many years. Now Egypt is back on the path of growth. However, it must focus on economic transformation (more spending on research and development) to avoid the fate of a cheap assembly plant and competing on global markets solely on price.

Nigeria, on the other hand, was unable to capitalize on the previous boom in the oil market. The country was unable to modernize quickly. The reason is the inefficient state apparatus, high corruption and political instability. This does not mean that Nigeria has no potential for rapid growth. The political elite only needs to ensure conditions for economic development (transparent law, reduction of corruption). But will that actually happen?

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Next Eleven (N-11) - Egypt, Nigeria and Iran. Forgotten markets? [Ch. III] next eleven n-11 - 3](https://forexclub.pl/wp-content/uploads/2023/06/next-eleven-n-11-3.jpg?v=1685435346)

![Next Eleven (N-11) - Egypt, Nigeria and Iran. Forgotten markets? [Ch. III] cryptocurrency excavators canada](https://forexclub.pl/wp-content/uploads/2021/07/koparki-kryptowalut-kanada-102x65.jpg?v=1626935420)

![Next Eleven (N-11) - Egypt, Nigeria and Iran. Forgotten markets? [Ch. III] saudi arabia petroleum](https://forexclub.pl/wp-content/uploads/2020/09/arabia-saudyjska-ropa-naftowa-102x65.jpg?v=1600682277)

Leave a Response