Nobody is indestructible – Saxo Bank forecasts for QXNUMX

In the changing landscape of the US treasury bond market Federal Reserve is struggling with issues such as capital restrictions on Treasury securities dealers and increasing unrealized losses. Achieving balance within these challenges while evolving financial dynamics requires addressing critical issues and mapping out potential courses of action.

Wprowadzenie

In the wake of the unprecedented global pandemic, the US market treasury bonds, traditionally seen as a bastion of stability, has undergone a truly seismic transformation. On March 12, 2020, the world of U.S. Treasuries was unexpectedly thrown into chaos. Treasury securities dealers (primary dealers), which is a pillar of the US treasury bond market, were flooded with orders to sell debt securities. As a result, bid-ask spreads widened significantly, making it increasingly difficult to establish fair prices for these bonds. In response to this crisis, the Federal Reserve took extraordinary measures. It significantly expanded financing options for dealers and initiated a sweeping purchase of nearly a trillion dollars of Treasury securities in just three weeks.

US Treasury response: buyback program

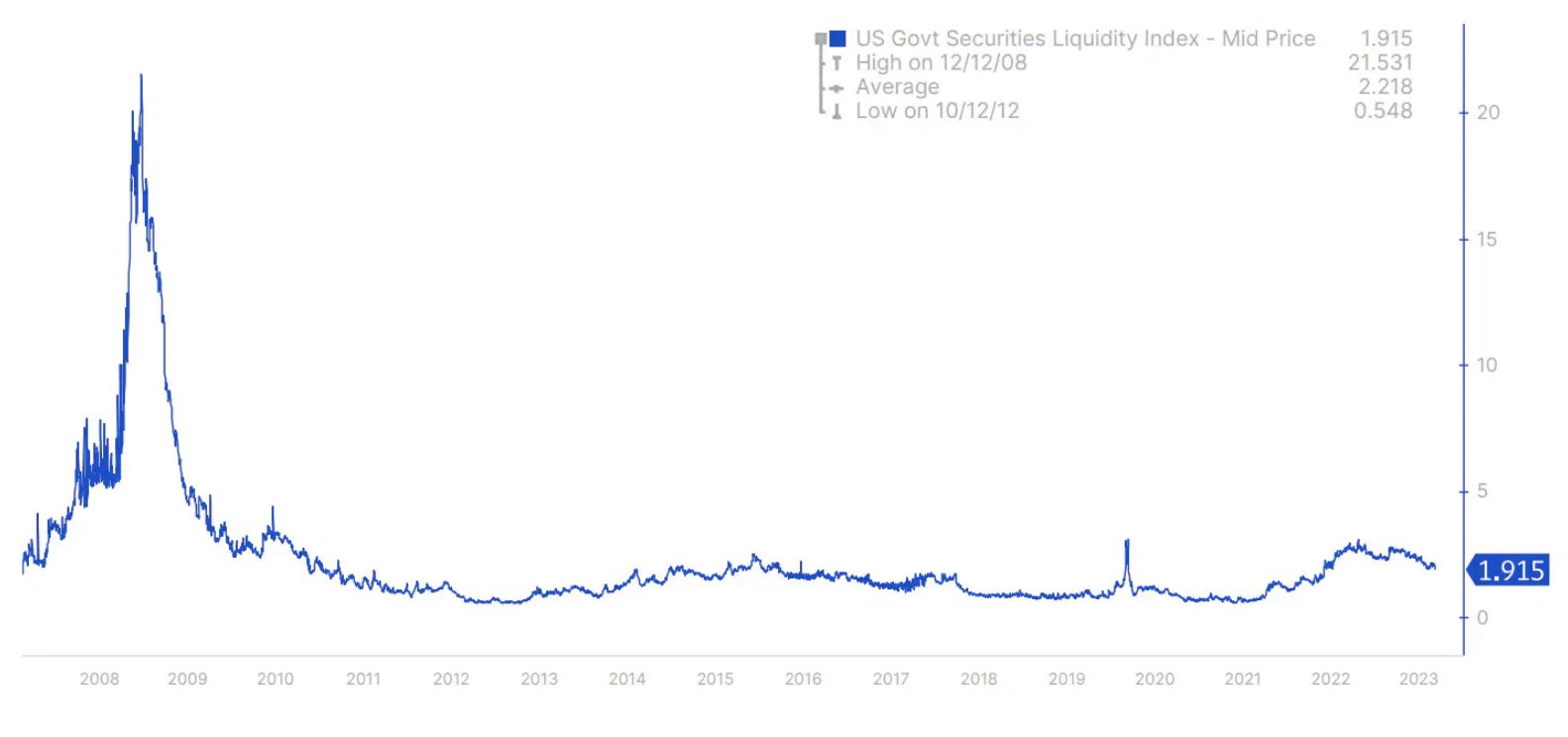

To avoid a repeat of the chaos seen in March 2020 and September 2022, when the British Treasury bond market experienced spikes in yields and liquidity problems, the U.S. Treasury has introduced a bond repurchase program for 2024. Bloomberg U.S. Treasury Liquidity Index , which measures market liquidity, remained at high levels similar to those observed during the crises of March 2020 and September/October 2022 (Figure 1).

Another indicator of the risk of a sudden market decline is the average daily volume of the U.S. Treasury bond market as a percentage of the total amount of U.S. Treasury bonds outstanding. This percentage decreased from over 12% to the current level of around 3% (Chart 2).

A less frequently mentioned mandate: the role of the Federal Reserve

The Federal Reserve routinely reports on its dual mandates of achieving maximum employment and maintaining stable prices; however, it also plays a vital, if less publicized, role under Section 2A of the Federal Reserve Act. This mandate commits the Fed to promoting the goal of "moderate long-term interest rates."

In the latest study Duffy et al. (2023) emphasize the key role that capital restrictions on dealers of Treasury securities play in shaping liquidity in the Treasury bond market. When these restrictions exceed 40%, market liquidity begins to deteriorate. As this number increases from 40% to 80%, illiquidity becomes more than just an anomaly, going beyond the scope of a phenomenon typical of increasing yield volatility as such. The importance of the Fed's willingness to conduct asset purchases to maintain market functionality Duffie (2023) he emphasized during his presentation at the 2023 Jackson Hole Economic Policy Symposium. According to his estimates between 2007 and 2022, the exponential growth in the amount of Treasury bonds in circulation almost quadrupled the capital expansion of Treasury securities dealers.

The huge cost of quantitative easing: interest on reserves

The Federal Reserve Act of 1913 was intended to provide a "flexible" monetary system that allowed funds to be transferred smoothly between bank deposits and currency without affecting the money supply. Under Section 2A of the Federal Reserve Act, the Fed's mandate is to achieve three goals with a single policy tool: maintaining money and credit supply growth in line with the potential of the economy. In the past, this involved the purchase of government bonds primarily to increase bank reserves during currency withdrawal periods. However, since 2008, quantitative easing has shifted the focus towards large reserves and interest payments on reserves, culminating in the abolition of reserve requirements in 2020. A more detailed analysis is available here Saxo article.

The Federal Reserve Financial Landscape

This raises an important question: As dealers in Treasury securities struggle with these capital restrictions, can the Federal Reserve continue to operate without restrictions? In the first half of 2023, the Fed reported interest income of $88,4 billion, but also incurred interest expense of $141,8 billion. After accounting for $4,4 billion in operating costs, the Federal Reserve reported a whopping loss of $57,4 billion. The bulk of the Fed's interest-bearing assets were 1,96% Treasury bonds, worth $5,5 trillion, and 2,20% mortgage-backed securities, worth $2,7 trillion. At the same time, the Federal Reserve paid about 4,9% on $3 trillion in bank reserve balances and 4,8% on $2,4 trillion in conditional sale agreements (reverse repurchase agreements).

The Fed's capital balance was just $42,4 billion. A six-month loss could completely wipe out the central bank's capital. However, the Federal Reserve recorded the accumulated loss differently, showing it as a deferred asset marked as "transfer of profits due to the State Treasury". This item has seen a significant increase, from USD 16,6 billion as of December 31, 2022 to USD 74,7 billion as of June 30, 2023 and as much as USD 100,1 billion by September 13, 2023.

Under its transfer policy, the Federal Reserve remits all net income to the U.S. Treasury after covering expenses and allocating a 6% dividend to commercial banks that are members of one of the 12 district Federal Reserve Banks. If profits do not cover these costs, they are not transferred until their value exceeds this deficit. The accumulated loss is recognized as an asset because it represents a reduction in future liabilities to the State Treasury.

The complex structure of the Federal Reserve

Commercial banks that are members of district Federal Reserve Banks are required by law to contribute capital equivalent to 6% of their capital plus surplus, of which 3% is payable in advance and the remaining 3% is payable upon request by the Federal Reserve Bank. Under a scenario in which a district Federal Reserve Bank faces a capital shortfall, it has the authority to force its member banks to contribute the remaining 3% and an additional 6% of their capital and surplus to make up the shortfall. This is a risk that investors often overlook when it comes to banks.

Portfolio breakdown: unrealized losses

As of June 30, 2023, the Federal Reserve's System of Open Market Account (SOMA) portfolio had an unrealized market settlement loss (mark-to-market) amounting to USD 1,1 trillion. At the same time, the yields on five- and ten-year treasury bonds were 4,15% and 3,84%, respectively. These yields then increased to 4,46% and 4,3%, respectively. Notably, approximately 47% of SOMA's portfolio had maturities greater than five years, suggesting that the market settlement loss could potentially exceed the original estimate of $1,1 trillion. If long-term bond yields continue to rise as a result of interest rate increases or increased Fed issuance of Treasury bonds, the Fed's unrealized market settlement loss could increase further.

Motivations and outcomes: The Federal Reserve's dilemma

Timeless wisdom applies when it comes to making financial decisions Charles Munger:

“Show me motivation and I will show you the result.”

Within the Federal Reserve's complex role in the Treasury bond market, its actions are driven by multiple incentives, each potentially offering a different outcome.

One important motivation relates to the Fed's role in ensuring the proper functioning of the Treasury bond market. While the scope of this role may be up for debate, it is clear that in crises like the one in March 2020, the Fed will intervene.

Another factor on the Fed's radar is the need to prevent further accumulation of losses. Resolving the unrealized loss in market settlement and restoring the health of the SOMA portfolio is essential. Therefore, there is a clear motivation to lower short-term interest rates, which could result in the so-called a bullish swell in the yield curve, potentially having a profound impact on the market.

Potential courses of action

In such a dynamic environment, the likelihood of lower short-term interest rates in the United States is significant. When positioning for a bullish rally, it is worth considering taking a long position from the front end to the middle of the Treasury yield curve.

Additionally, another potential course of action for the Federal Reserve could be to stop paying interest on reserves. This change could translate into billions of dollars in savings in interest costs. However, such action should be considered in parallel with the idea of restoring minimum capital requirements for banks. Restoring non-zero capital requirements would be necessary to regain control of the rate overnight Fed funds. Such a move would represent a significant departure from the current approach and a return to the pre-2008 system, when the Federal Reserve managed interbank liquidity by influencing the availability of excess reserves through open market operations in the form of transactions repo i reverse repos.

Author Redmond Wong, market strategist, Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response