Fears of a recession are driving commodity prices down sharply

Last week, the commodities market, fearing the specter of a recession, plunged sharply in all three sectors: energy, metals and agricultural products. At this point, it is not known what the level of potential demand destruction will be, but we doubt that the final effect will overcome the long-term cause of the cyclical commodity bull market. In today's analysis, we cover crude oil, copper, gold, and wheat in detail.

Clear drops in raw materials

The commodities sector is increasingly concerned about the specter of a recession. As a result of last week's sales, there were significant drops in all three sectors: energy, metals and agricultural products. At this point, it is not known what the level of potential demand destruction will be. There is no doubt, however, that some of the last purchases are currently being removed from the market. This is in part due to the actions of macroeconomic funds, which purchased commodities during a boom period, but are now beginning to have doubts as the risk of an economic slowdown is increasing.

However, the current concerns will not take shape until the coming months and quarters. At this point, we doubt that the final effect will counter the long-term cause of the cyclical bullish commodity. Structural issues, such as doubts about the long-term investment appetite for new energy exploration and production ventures, remain a key reason why limited supply will continue to be a price driver in the coming years. In part, this is due to the green transition making it increasingly difficult to forecast fossil energy demand.

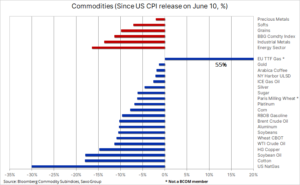

Key commodities' performance since June 10, when higher-than-expected inflation in the United States contributed to the aggressive reaction of the US Federal Reserve in the form of an interest rate hike, which in turn sparked fears of recession. Note: The most important exceptions are the EU's TTF (Title Transfer Facility) gas and US gas contracts, given the persistent opposing factors of European concerns about supplies from Russia and the protracted restriction on US exports following the recent explosion at the Freeport export terminal LNG in Texas.

What about energy?

The unpredictability of future demand has recently been highlighted by several energy producers who are now the target of criticism from governments - notably the Biden administration, which is fighting for votes in the face of record high fuel prices at gas stations ahead of the supplementary elections this fall. The majority of energy producers, defending themselves against increasing expenditure on increasing oil production and production reserves in refineries, say that increasing sales of electric vehicles will reduce the market share of gasoline in the next few years, thus reducing the attractiveness of new long-term drilling and refining ventures.

In fact, June saw a sharp turn in the markets, starting with a higher-than-expected US inflation reading on June 10, leading to the first hike in decades. interest rates by 75 basis points. Due to further planned Fed rate hikes, the market is becoming increasingly concerned that central banks around the world will continue to raise interest rates. This will continue until inflation is brought under control or something goes wrong - in the latter case, there is a risk that economies will buckle under pressure with a consequent recession. For now, at least one component of inflation, ie rising production costs due to high commodity prices, has started to decline.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Last week, the market focused even more on the recession as bond yields plunged sharply after Fed chairman Powell in his speech to the US Senate admitted that large interest rate hikes could trigger a recession in the United States and make it soft an economic landing will be "very difficult". This was followed by another series of weak economic data from the United States and Europe pointing to a decline in activity in the manufacturing and services sectors. In Europe, two-year German bond yields fell the most since 2008, and the region is increasingly threatened by a sharp slowdown as gas and electricity costs have risen sharply after Gazprom cut supplies to Germany.

These concerns about global economic growth last week pushed the Bloomberg Commodity Index down to its lowest level in four months, with all sectors, including cereals, dropping. The index has plunged around 9% since it reached its record high on June 12, but is still gaining around 21% annually, with crude oil and fuel products accounting for the greater part of these gains. As the table above shows, all sectors have weakened since that date, with the EU natural gas market being the only market supported by the risk of shortages in the coming months.

Black gold market

Crude oil on Friday showed signs of stabilization after an overall correction of nearly 15% in the past ten days amid rising concerns that aggressive interest rate hikes by central banks around the world will eventually harm economic growth and, consequently, demand for key commodities ranging from energy to metals industrial. Prices have fallen despite persistent signals that supply in the crude oil and fuel products markets remains very limited - illustrated by near-record refining margins, which would have fallen if demand had decreased. In the short term, there will be a battle between macro-economic traders selling "paper" oil through futures and other financial products as hedges against recession, and the physical market, which is still limited in supply to support prices.

Copper in retreat

Copper headed for its biggest weekly loss in a year due to rising fears of a global recession and the fact that lockdowns in China continue to hold back economic growth and demand in the world's largest consumer of industrial metals. While the Bloomberg Industrial Metals Index is down 6% yoy, the price of copper is now down 15% - with about half of that loss realized last week when Fed chairman Powell re-emphasized his commitment to bring down inflation, boosting it hence the risk of a hard landing. In addition, Codelco, a large Chilean mining company, reached an agreement with workers to end a strike that could lead to a price-saving reduction in supply.

Our long-standing positive outlook on copper and industrial metals has not changed, but rapidly growing concerns about a recession, coupled with China's ongoing and protracted fight against the Covid-19 pandemic, could delay the inevitable rebalancing of the market and ultimately cause a supply shortage. In addition, we are seeing a constant mismatch between rapidly falling prices and stock levels in warehouses monitored by the London and Shanghai stock exchanges. Last week, stocks of all four major metals fell to a cumulative record low of 1,1 million tonnes, down 60% compared to last year.

After falling below $ 3,95 per pound - the level that has supported the support since early 2021 - the next key support level is $ 3,50 per pound, retaining 50% from the 2020-2022 bull market.

Wheat

Wheat, along with cooking oils, was at the forefront of March increases in agricultural prices after Russia's attack on Ukraine raised concerns over supplies from a key supplier of these two food products. After hitting a record high of $ 13,63 per bushel last month, the Chicago wheat price has since suffered a clear weakness, turning to a decline last week after falling below key support triggered a wave of technical selling and long liquidation .

READ ALSO: Wheat - How to invest in wheat? [Guide]

Despite the prospect of record production in Russia and a better outlook in the United States, everything points to a further reduction in post-harvest supply, particularly given the drought and heatwaves in Europe and the unresolved issue of restoring wheat exports from Ukraine by sea. The most important event this week, aside from weather conditions, will be the US Department of Agriculture's monthly report on crop acreage and inventory.

The December Chicago Listed Wheat Futures (New Harvest) saw accelerated sales after breaking the support, which became resistance at $ 10,50 per bushel, the neckline of the head and shoulder pattern, which could indicate further short-term technical weakness.

Precious metals

Gold remains broadly in the range of $ 1- $ 780, with the prospect of sharp interest rate hikes being counterbalanced by fears of a recession and, at worst, the risk of stagflation that has historically been favorable for the price of gold. However, as silver was dragged down by sharply falling industrial metals prices and the relative return of risk appetite in the equity market, gold ended the week at a lower level as these events more than offset the positive impact of US Treasury yields and the weaker dollar.

Our long-term positive outlook on gold has been strengthened by the events of the past few weeks, and we continue to see the potential for gold to reach a new record high in the second half of 2022 when economic growth slows down and inflation remains high. For now, however, calm must return to the market for silver and other semi-industrial metals such as platinum before investors turn their attention back to gold.

More analyzes of commodity markets are available here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response