Polish individual investors are shaking off the crisis

According to the latest study "Puls Investors Individual" conducted by eToro platform, most Polish individual investors are not concerned about the downturn that has been present on the financial markets for over a year.

In a nutshell:

- 66 percent of Polish individual investors have a positive and neutral attitude to the ongoing slump,

- Many are betting on defensive assets such as financial services and real estate stocks,

- As much as 75 percent of respondents have cash products in their portfolio (up from 55% in Q2022 XNUMX)

- Inflation remains the biggest threat to investment (33%)

Poles were not discouraged from investing

Two-thirds of investors (66%), when asked about the impact of the slump on their moods, are positive or neutral, while the rest (34%) say that their investment appetite has been somewhat weakened.

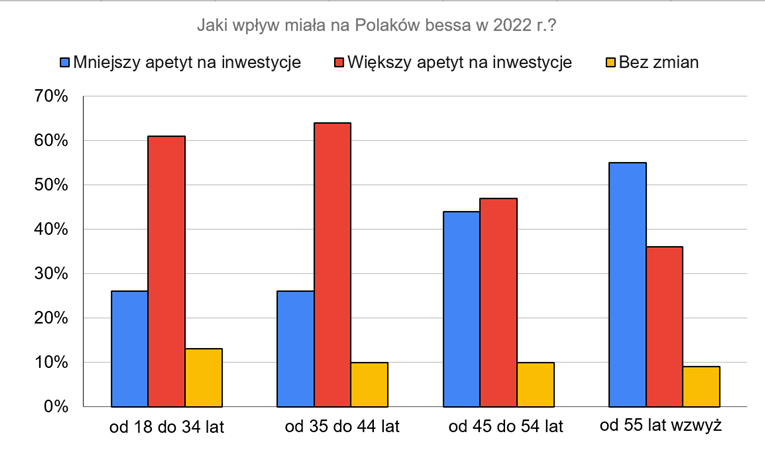

The year 2022 will be the first serious bear market experience for many less experienced individual investors in Poland, but the data shows that it is older investors, closer to retirement, who will feel its effects the most.

Source: eToro, Individual Investor Pulse study, Q4 2022

Three out of four people (74%) aged 18-34 positively or indifferently assess the economic downturn, while among people over 55 this percentage drops to 55%. (see chart). Across all age groups, the younger the investor, the more calm he was about the 2022 slump – challenging the notion that younger investors are more short-term oriented.

Commenting on the results of the study, eToro Markets Analyst Paweł Majtkowski said:

The fact that after such a difficult year on the stock market, 2/3 of investors retained a positive or neutral attitude towards the market may seem strange. However, this is only a confirmation of what the results of eToro's Investor Pulse in previous quarters have already shown. Namely, that most Polish investors think long-term (in terms of years and decades). In such a situation, the bear market, which in 2022 overestimated S & P500 and WIG20 by about 20 percent, is seen as an opportunity to buy assets at much lower prices. And this, in the longer term, serves to improve investment results.

There was also a slight improvement in moods - 56 percent. of respondents feel confident about their current investment portfolio. Although this is still a relatively low result compared to the previous results of Puls Investor Individual, it represents an increase of 2 percentage points on a quarterly basis. At the same time, respondents' confidence in maintaining their income level increased (51% vs. 47% quarter on quarter). Respondents, however, are more afraid of losing their jobs than in the previous quarter - a drop in the level of security from 58 percent to 54 percent. to 2022 percent (in QXNUMX XNUMX).

Inflation remains the dominant bogeyman

The threat of inflation (ranked as the biggest investment risk in six of the last seven quarterly surveys) remains the biggest risk. At the end of the third quarter, 37 percent. perceived inflation as the greatest individual threat to their portfolio over a three-month period, with this figure dropping to 33% at the end of Q2023. When asked about the greatest risk in 27, the percentage of people pointing to inflation dropped to 17%, then 12%. pointed to global conflict, and XNUMX percent potential recession in Poland.

As a safeguard against recession risk, many people are adjusting their portfolios defensively while preparing for future opportunities. The percentage of people with cash assets (e.g. savings account) increased from 55%. in the third quarter to 75 percent. at the end of the fourth quarter. Meanwhile, the most popular industry among Polish investors investing independently is financial services (61% vs. 67% in Q60), followed by real estate (49% vs. 58% in Q41). The technology sector recorded a decline from XNUMX percent. in the third quarter to XNUMX percent. currently.

Paweł Majtkowski adds:

Although inflation still remains the greatest fear of investors, it can be seen that with its decrease (in November and December) the fear decreases. On the other hand, concerns about the international conflict and the war in Ukraine have increased for the first time in two quarters. This is due to the lack of any real chance for its termination or de-escalation at present. Cash has also settled in investors' portfolios for good, which is not surprising when the best deposits on the market have reached the level of 10%, which has not been recorded for years. annually. It is also a preparation for upcoming market opportunities and shopping.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response