The ECB meeting is the main event of the day on the EURUSD market

Thursday's event on the financial markets, including primarily on the currency market, is the meeting European Central Bank (ECB). Traditionally, investors will know the decision on monetary policy at 13:45, and at The press conference of ECB head Christine Lagarde will start at 14:30 and the latest macroeconomic forecasts will be published.

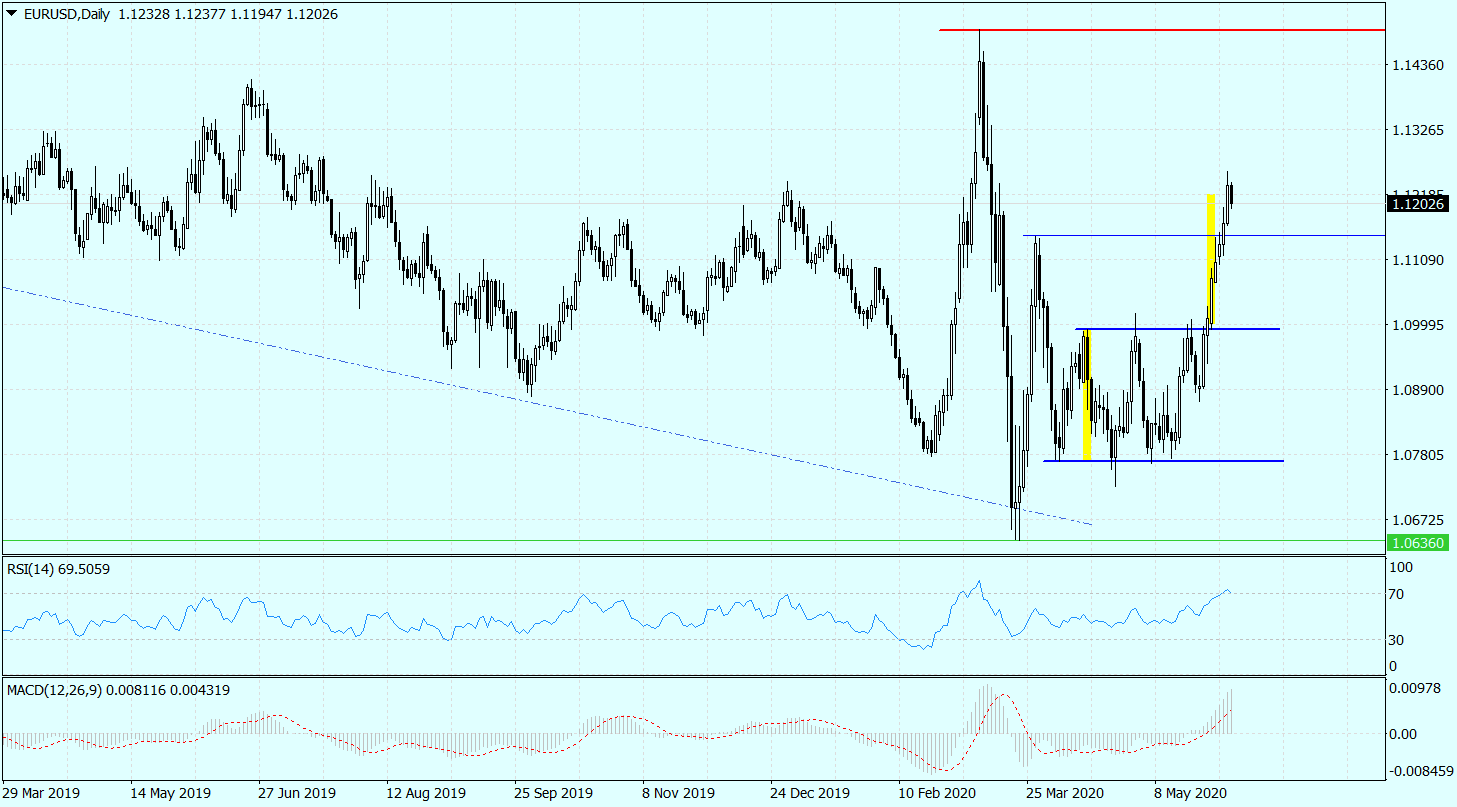

EURUSD situation

On Thursday, the EUR / USD, which climbed up for seven consecutive sessions, testing the highest levels until March 12 yesterday, goes back to around 1,12 from 1,1236 on Wednesday at the end of the day. This drop in prices is mainly a reaction to the deterioration of moods in global markets and the associated increase in risk aversion, supported by considerable redemption on the EUR / USD chart, and to a lesser extent by waiting for the results of the ECB meeting.

On the basis of technical analysis, the decrease of EUR / USD to 1,12 does not change anything. As long as the course is not permanently below the support created by the local summit from the end of March (1,1147), the falls are only of a corrective nature. Thus, the technical scenario still remains valid, which assumes that after breaking at the end of May with a 1,5-month consolidation in the range of 1,0770-1,0990, and then after breaking above the peak from the second half of March, the demand side has open road even to around 1,15.

EURUSD chart, D1 interval. Source: MT4 Tickmill.

ECB in focus

However, the ECB meeting can have a significant impact on what levels EUR / USD will close today. There are three main issues to decide on which to look out for. It is:

- scale of asset purchase program;

- new ECB macroeconomic forecasts;

- references to the last judgment of the German Constitutional Court.

There are no interest rates in the above list because no one expects them to change. This means that the deposit rate will remain at -0,50 percent and refinancing rate at 0,0 percent. The market expects, however, that the ECB may increase its pandemic asset purchase program (PEPP) by EUR 500 billion from the current level of EUR 750 billion, while considering purchasing bonds of companies that have lost their investment rating.

The ECB today will present new GDP and inflation forecasts for the euro area. They will constitute an important reference point not only for assessing the situation in Europe, but also for expectations regarding the further shape of monetary policy.

The last element is the issue of the recent "controversial" decision of the German Constitutional Court on the purchasing program, which the head of the ECB will surely be asked about at a press conference. It will be important whether the bank is upset by this judgment and what it will do if the German Bundesbank is forced to stop buying bonds under the PEPP program.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response