Agricultural products driving through the problems of the weather

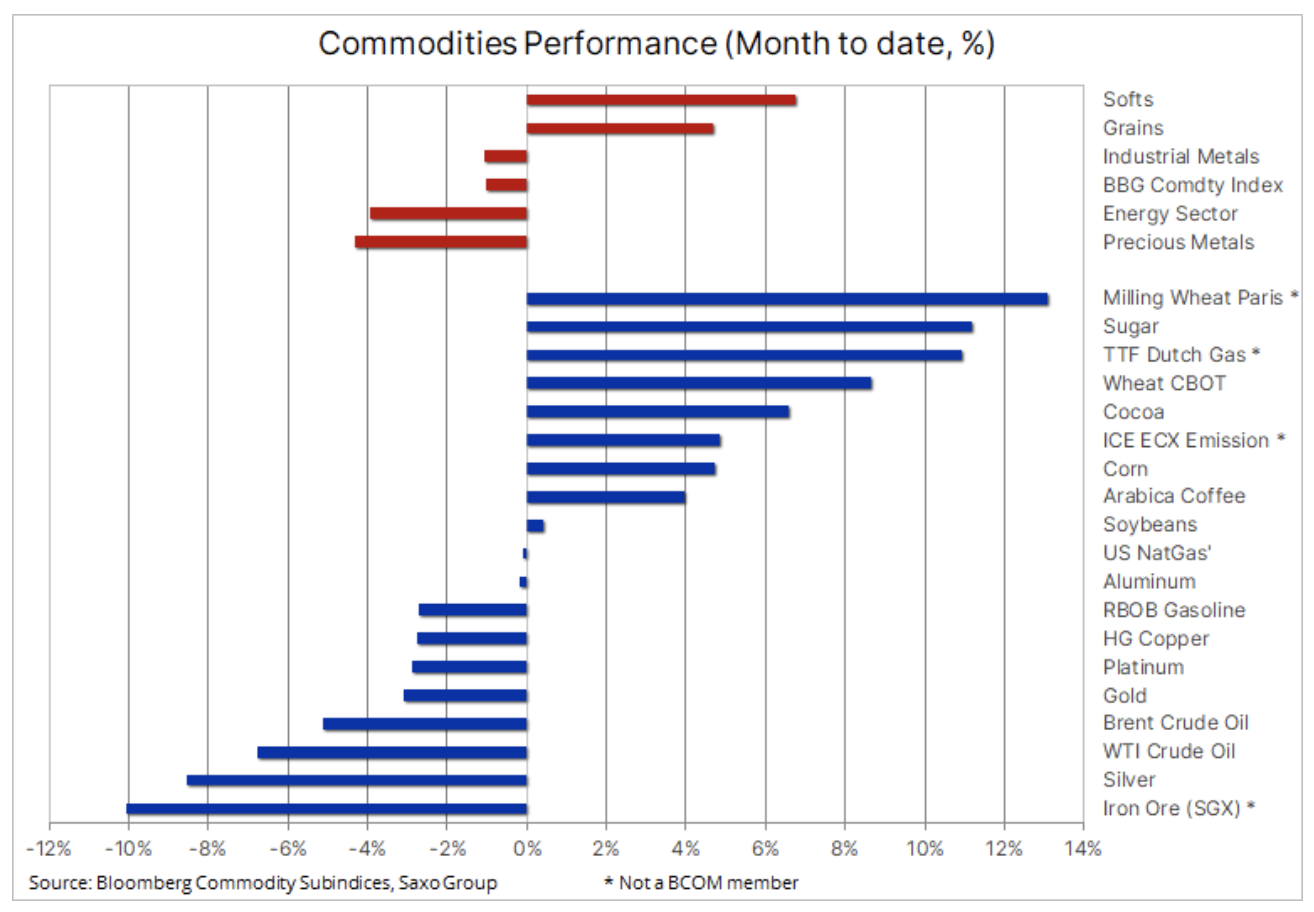

Commodity markets, with the exception of some key food items, remain on the defensive this month as the current spike in infections in major economies worsens the short-term outlook for growth and demand. Moreover, the prospects of an earlier than expected return to US policy tightening Federal Reserve put additional pressure on the rise in bond yields and the strengthening of the dollar, thereby reducing the attractiveness of investment metals such as gold and silver.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The macroeconomic outlook is negatively affected by the current third wave of Covid-19, which continues to spread across Asia and parts of the United States, putting into question the short-term demand for key commodities dependent on growth and demand, from crude oil and gasoline to copper and iron ore. . In this context, the Federal Reserve, which is increasingly willing to curb its wide-ranging asset purchase program, is unlikely to be followed by other central banks, which could lead to an increase in US Treasury yields and a strengthening of the dollar.

As in the past week, the high price lower has persisted: a number of key agricultural commodities continue to seek support from the current season of extremely volatile weather conditions in selected key global growing regions. The cooling in parts of Brazil has dealt a blow to sugarcane crops and has also caused significant losses to local coffee crops. In other regions, extreme heat led to droughts, which reduced the forecast levels of cereal production, particularly maize and wheat.

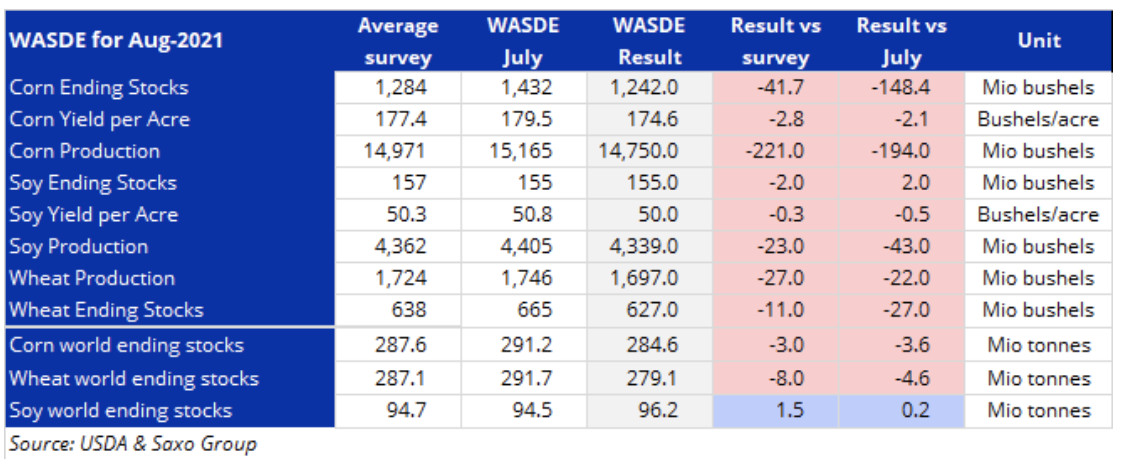

In its latest World Agricultural Supply and Demand Estimated Report (WASDE), the US Department of Agriculture forecasts that the US wheat harvest will be at its lowest in 19 years, and global supply will be further revised downwards in response to significant reductions in the grappling estimate. drought to farmlands in Canada and Russia. The prospects for a reduction in supplies from Russia, the world's largest exporter, saw the Paris-based regrind high-protein wheat futures contract hit a three-month high, exceeding 255 per ton, around 35% above the five-year average.

Natural gas (natgas)

Gas prices in Europe, they reached record highs once again, before falling as concerns about supply were somewhat offset by deteriorating sentiment in the broader energy market in the wake of the latest Covid-19 wave. In the US, gas prices recorded the largest weekly loss following a greater-than-expected weekly increase in inventories, but forecasts for the next heatwave are likely to limit the scale of the correction due to low winter inventories, similar to Europe; this risk may support prices throughout the fall.

In Europe, the unexplained restriction of supplies from Russia, coupled with increasing competition from Asia for LNG supplies, has made it difficult to replenish heavily damaged stocks for the coming winter. This has led to an increase in demand for coal, forcing industrial users and utility providers to buy more pollution permits, the price of which has already reached record levels. This has resulted in a sharp rise in electricity prices, which will ultimately be covered by consumers, which will further drive up the already rising costs of all kinds of goods and services.

Gold

Gold for the better part of the week, it sought to recover from the collapse in prices triggered by the stronger-than-expected US employment report, released on August 6. The sell-off culminated in the early hours of the Asian session last Monday, when gold fell by more than $ 70 in a short time. At the beginning of August, investors' sentiment was negatively affected by the inability of gold to strengthen in reaction to the July decline in US government bond yields. Just days after this decline, US 1,22-year inflation-adjusted yields hit a record low of -XNUMX%.

Having failed to strengthen despite favorable profitability levels, gold immediately plunged on the first signs of an increase in profitability, and after hitting key technical levels in the area of $ 1-750, a wave of orders sell stop During the extremely illiquid period of the day, it briefly brought the price to a double March level below $ 1, with new buy orders from Asian physical gold buyers.

The short-term forecast is still negatively affected by the risk of rising yields and the dollar ahead of the Jackson Hole central bankers' meeting scheduled for late August. Traditionally, there are signals to the market at this annual symposium about changes in central bank policy or priorities.

A week's close above $ 1 can help create an uptrend on the chart and send a positive signal to the market, which is still struggling to recover from the recent price swing. For real strengthening, however, the support of silver is also necessary; so far, it has experienced problems, with XAUXAG's ratio exceeding 765 ounces of gold to one ounce of silver - the highest level and the greatest weakness of silver against gold since last December.

Copper

The last one is favorable for the prices copper the turnaround of potential supply disruptions from Chile has somewhat lost relevance after safety workers from the Escondida mine, which accounts for 5% of the world's mining of the metal, voted to adopt the final rates offered. In recent weeks, the risk of a supply disruption has been offset by an increase in Covid-19 infections and fears that the economic slowdown in China will negatively affect demand. A decrease in the risk of disruptions could mean that the market, as with oil, will have a side course until the current pandemic is under control. While the resistance has stabilized above $ 4,4 / lb, the support below $ 4,20 / lb is just as solid. Overall, however, we see further growth potential and the price of HG copper may eventually reach $ 5 / lb, but this may not be until 2022, when market supply may turn out to be insufficient due to increasing demand for copper in the context of green transformation and infrastructure projects.

Petroleum

Clothing remains one of the biggest losers this month; only iron ore and silver are ahead of it in this respect. After many months of focusing on OPEC + and the organisation's ability to support prices by maintaining a relatively limited supply, the market turned back to the uncertain outlook for demand as a result of the rapid spread of the Delta variant, particularly in China, a key importer of this commodity. This caused the forecasts for economic growth to be lowered and put into question the short-term forecast for the demand for crude oil and fuel products from the world's largest buyer.

While some major Wall Street bulls believe the delays with the Delta Variant are temporary with a negative impact on demand for a few months at most, both the IEA and OPEC have downgraded their demand forecasts in their latest monthly oil reports by the end of this year. The latest wave of the pandemic will result in further restrictions on mobility around the world; the greatest concern relates to the situation in China, where the continued low number of infections has resulted in the implementation of aggressive restrictions.

Flexibility OPEC + however, last year is likely to prevent a deeper correction should the rise in demand suffer more than predicted from the current increase in infections. Taking this into account, and taking into account the lack of reaction from US producers despite high prices, we maintain a constructive outlook for oil prices until the end of the year.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response