Realization of tasks - Monthly macroeconomic forecast

The COVID-19 pandemic has dealt a hard blow to the market. Among the world's most important indices, only the US indices are positive year-on-day (+ 0,65% in the case of S & P 500 and + 20,62% for the Nasdaq). Pre-crisis trends have intensified: investors are becoming more and more involved in monopolistic industries. In an era of growth in market power, the stocks of just six well-known technology companies now account for 49% of the Nasdaq index. In recent months, we have seen a shift towards "momentum" stocks (ie consumer staples that tend to be more resilient in periods of recession) and "growth" stocks linked to listed companies whose profits are rising. This phenomenon is particularly visible in the United States and emerging markets.

While in the US stocks are consistently green, the bond market continues to show a red alert for the economy. History teaches us that smart money tends to be more right than stock investors. In other words, the balance of risk in the second half of the year for the equity market is down, as we believe the V-recovery scenario will not materialize.

About the Author

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

China: A Model in Fighting Coronavirus

In Asia, one of the highlights this month was stronger-than-predicted Chinese real GDP reading: 3,2% compared with -6,8% in Q19. This encouraging outcome mainly reflects the positive impact on the economy of supply-side incentives (clearly visible from increased bond issuance by local authorities), increased investment by state-owned companies and the effective management of the COVID-XNUMX pandemic, enabling the reopening of the economy.

Some may see this rebound as a signal of a V-shaped recovery, but this assumption is incorrect. If we look closely, we will see that the Chinese economy is not yet completely secure. Structural inequalities are rising, the private sector is focusing on cost cutting through layoffs and wage cuts, the risk of deflation is rising, confirmed by the weak core CPI reading at its lowest level since the global financial crisis, and China's consumption forecast remains disappointing - in June retail sales continued to decline.

As we have warned many times in recent months, the pandemic-related hysteresis effects are likely to delay the recovery of the economy and will certainly have profound negative effects in terms of consumer behavior. The greater propensity to save among Chinese households, which still do not spend large amounts on discretionary spending, is a phenomenon that is likely to become apparent in other countries as well as isolation is lifted and direct injections of liquidity into households are stopped (e.g. in United States, unless the federal government extends generous unemployment benefits at the end of July).

Rest of the world: only contrasts

The forecast for the rest of the world remains unfavorable. Global trade is hibernating and is likely to stay there until the end of this year. Global freight rates, as well as the cost of freight and trade in consumer goods indicators, confirm that the recovery is slow and the pace varies from country to country depending on the management of the epidemiological situation.

In the short term, we are more optimistic about the situation in the euro area than in the United States. Our COVID-19 mobility table shows that the euro area has managed to open up the economy more successfully than the US, where states with more than three-quarters of the country's population are now reversing or holding back the re-opening process. Moreover, the market reaction to the last European Council meeting was overwhelmingly positive. Although we had reservations in many respects (e.g. with regard to cuts in key innovative programs or the unclear definition of the rule of law and democracy), for the EU it is still a huge step in the right direction - the EU will spend from EUR 1 trillion to EUR 1,8 trillion - and to confirm that in the end solidarity between Member States will always prevail.

In the days to come, the market will focus on the United States, where Congress is currently discussing a new bailout package, and the Board of Governors will meet next week Federal Reserve. We do not anticipate any significant announcements on this occasion. The latest minutes of the FOMC meeting showed that several members support the yield curve control policy, while others argue that reliable guidance will most likely be sufficient. Further analysis is needed to make a final decision on this issue, in particular based on the Australian experience with short-term rates, which reduces the likelihood of a yield curve control being implemented as early as September.

Calendar for July and August 2020:

- 29 July: FOMC meeting. No material announcement is foreseen. With regard to the yield curve control policy (which the Fed calls YCT), further analysis and debate is needed.

- the end of July: Completion of additional payments of $ 600 per week for US unemployment benefits.

- beginning of August: break in the deliberations of the Congress. Last chance to extend your benefits period.

- 1 August: Biden should announce the name of the candidate for vice president.

- 7 August: report on wages in the non-agricultural sector.

- 8 August: Small US Small Business Application Deadline for $ 659 billion Wage Protection Program Loans.

- 17 August: Milwaukee Democratic Party national convention.

- 17 August: another round of negotiations between the EU and the UK on Brexit (a date considered to be the new "soft" deadline for reaching a compromise).

- 24 August: Jacksonville Republican Party national convention.

- 27 August: symposium in Jackson Hole - "Strategy for the next decade: consequences for monetary policy"

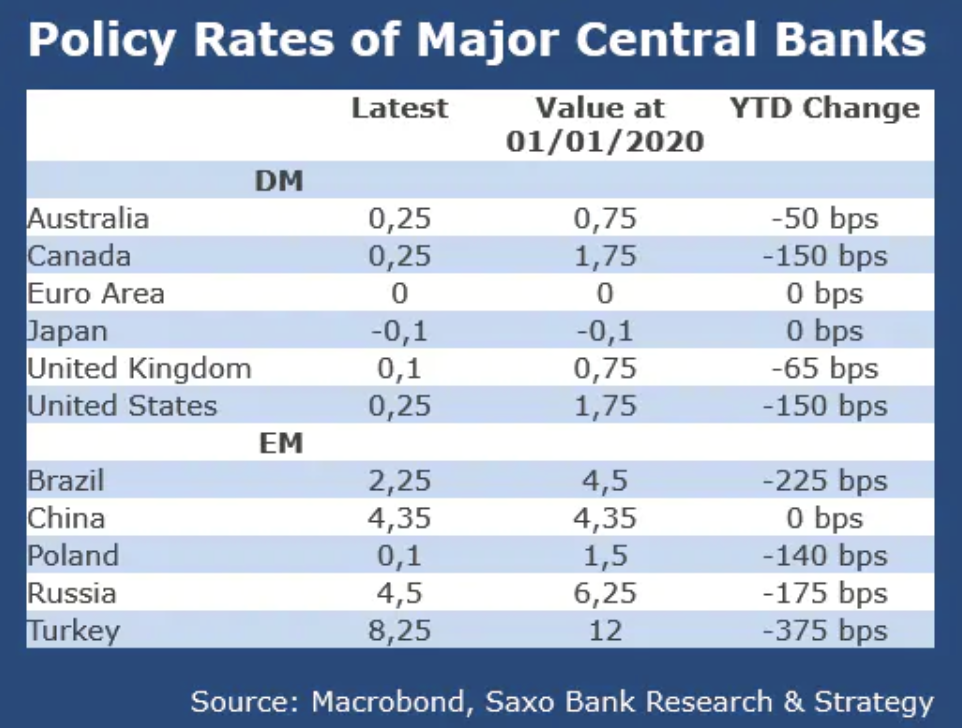

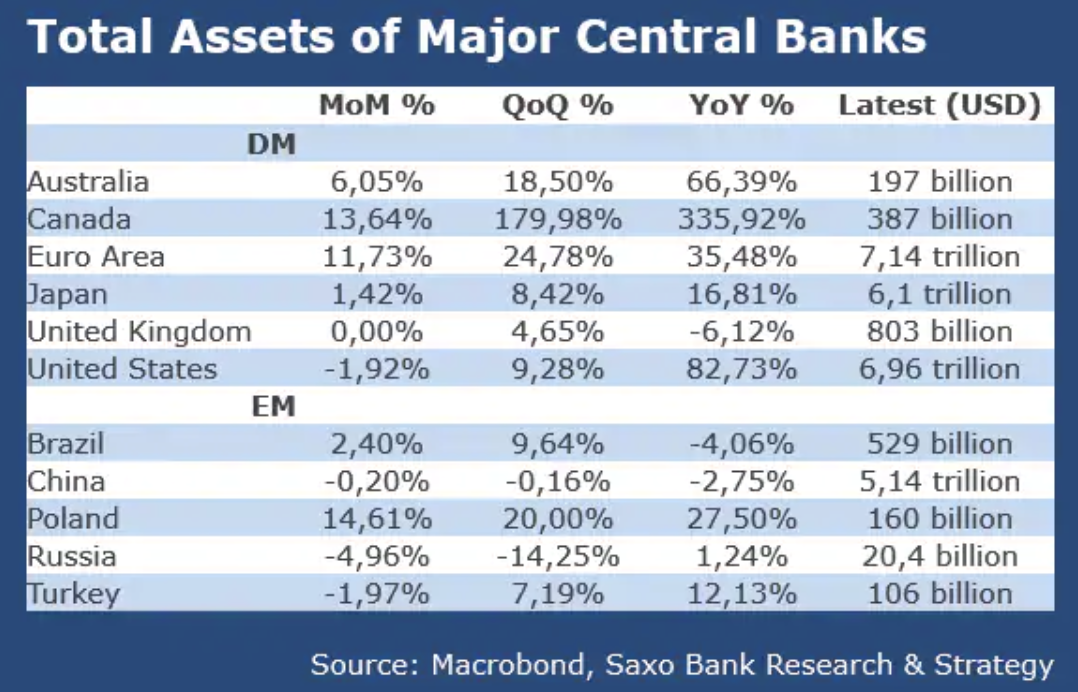

Central bank tables

Interest rates at major central banks.

Total assets at major central banks.

World market results.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response