Record volatility and record turnover. The currency market is teeming with life.

Despite the fact that the virus deprived markets (in particular equity) of successive increases and new historical peaks, volatility has significantly improved since the beginning of this year. We can, of course, argue about the "healthy" turnover that is currently on the market. The increased volume on equity securities has been used spectacularly by brokerage houses. Brokers were not in debt. Volatility was also favorable for the currency market. In a moment we will look at the newly published reports to summarize what March looked like on the global stock exchanges.

The record is chasing a record

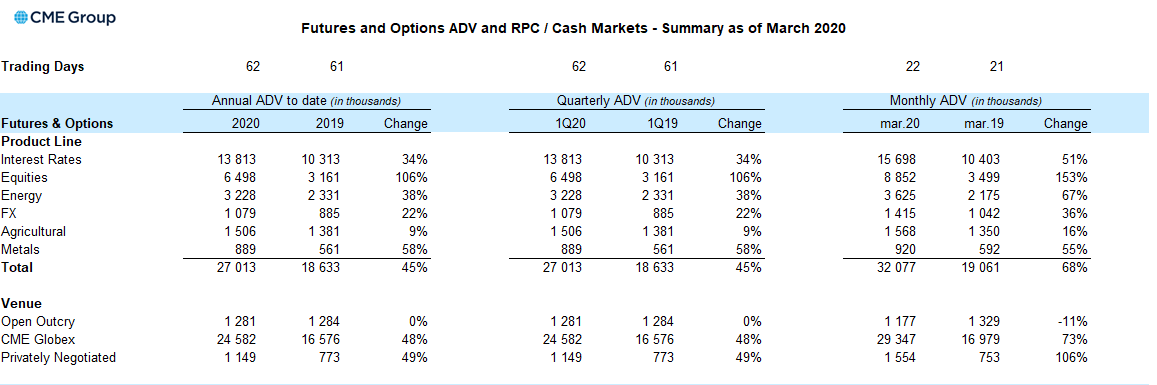

We talked about good results for February, which cast some optimism and freshness on the currency markets. Turnover increased not only on a monthly but also on an annual basis. March turned out to be more favorable to traders than its predecessor. The first company that we analyzed is CME Group. The company can boast of an increase in turnover by 54% compared to the same month of 2019. We know that last year did not belong to a good period for stock exchanges. However, this does not change the fact that the annual increase is really spectacular. In addition to wording, let's also take some numerical data under the microscope. The CME Group operates internationally. Therefore, in her reports we will find a division into relevant regions.

The above table and the data it contains provide a general summary of the turnover generated by the CME group. Looking at individual areas - Europe, the Middle East and Africa - the average daily volume reached a record 5,4 million contracts. Compared to the same period last year, it increased by a substantial 54%. This result broke the region of the Pacific and Asia, where in terms of y / y an increase of 73% was recorded. In each of the regions, the significant improvement in results was largely due to equity products and hedging with forward (currency) contracts. The increase in global risk led to an increase in the willingness to hedge it, and thus to acquire instruments, which largely shaped the March publications.

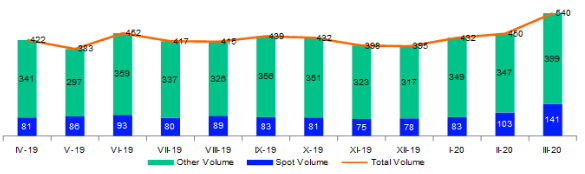

USD 540 billion in Refinitiv

group Refinitiv we rarely consider when preparing analyzes of turnover in the broad market. Calm exchanges reflected in the weakest publications of the company. Now, however, it is difficult to omit her in the March statement and not mention in a word whether she can boast. The reason for pride may be, among others, that such volumes on the currency market have not been visible practically since 2014. Moving on to specific numbers, March 2020 was 20% better than March 2019. In particular, currency trading had a good impact on this result. The average daily volume (ADV) of currency trading was $ 540 billion last month. It was generated primarily on trading services directly related to the forex market. The ADV value includes spot, forward and swap options.

To a large extent, Refinitiv reflects the general market trend that has been observed on many trading platforms. An important aspect in taking this enterprise into account is the service they provide to the wholesale market. The company provides transactions on a large scale, therefore the improvement of trade results is a good indication for a wide market to maintain a good run in the coming months.

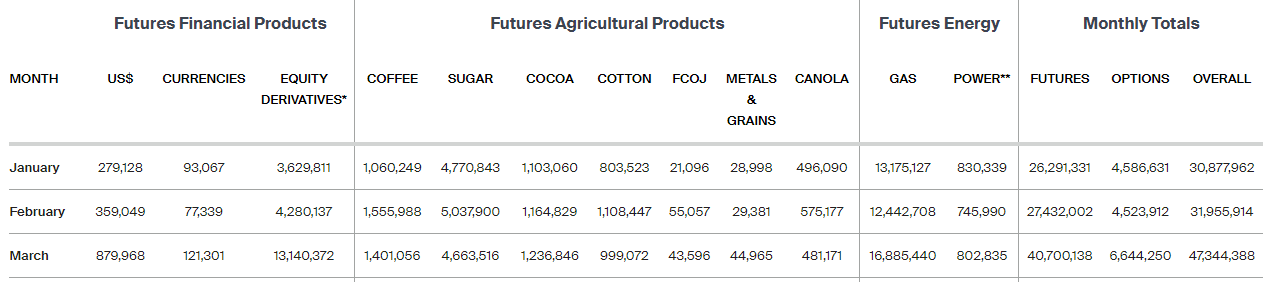

ICE took the opportunity

In this combination with the proverbial candle we can look for financial companies that have not improved or have not recorded new records in terms of turnover. ICE was also favorable to market volatility. The company dominates the New York Stock Exchange, and therefore will be a good reference point for assessing the situation in the United States.

The best volatility has been "traded" on transactions futures and options. Together, they raised 9,4 million flights, an increase of 56% on an annual basis. The stock exchange also recorded a record, daily, average increase in the above-mentioned interest rate futures. The exchange results are even better. According to the ICE report, in March the average daily volume of cash shares on the NYSE was 3,9 billion, an annual increase of 96%. By converting this result to ADV, we get a result improvement of more than half.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

Leave a Response