Crude oil - the risk of tankers being full remains high

While the US stock market, dominated by technology, healthcare and the media, is still sending signals that everything is all right, one glance below the surface is enough to convince you that this is by no means true. Numerous incentives have been delivered to the stock markets, but they have not reached ordinary people in a situation where unemployment is rising and consumer confidence is peaking. These events have put many governments and healthcare institutions under significant pressure to end isolation.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Waiting for the end of the pandemic

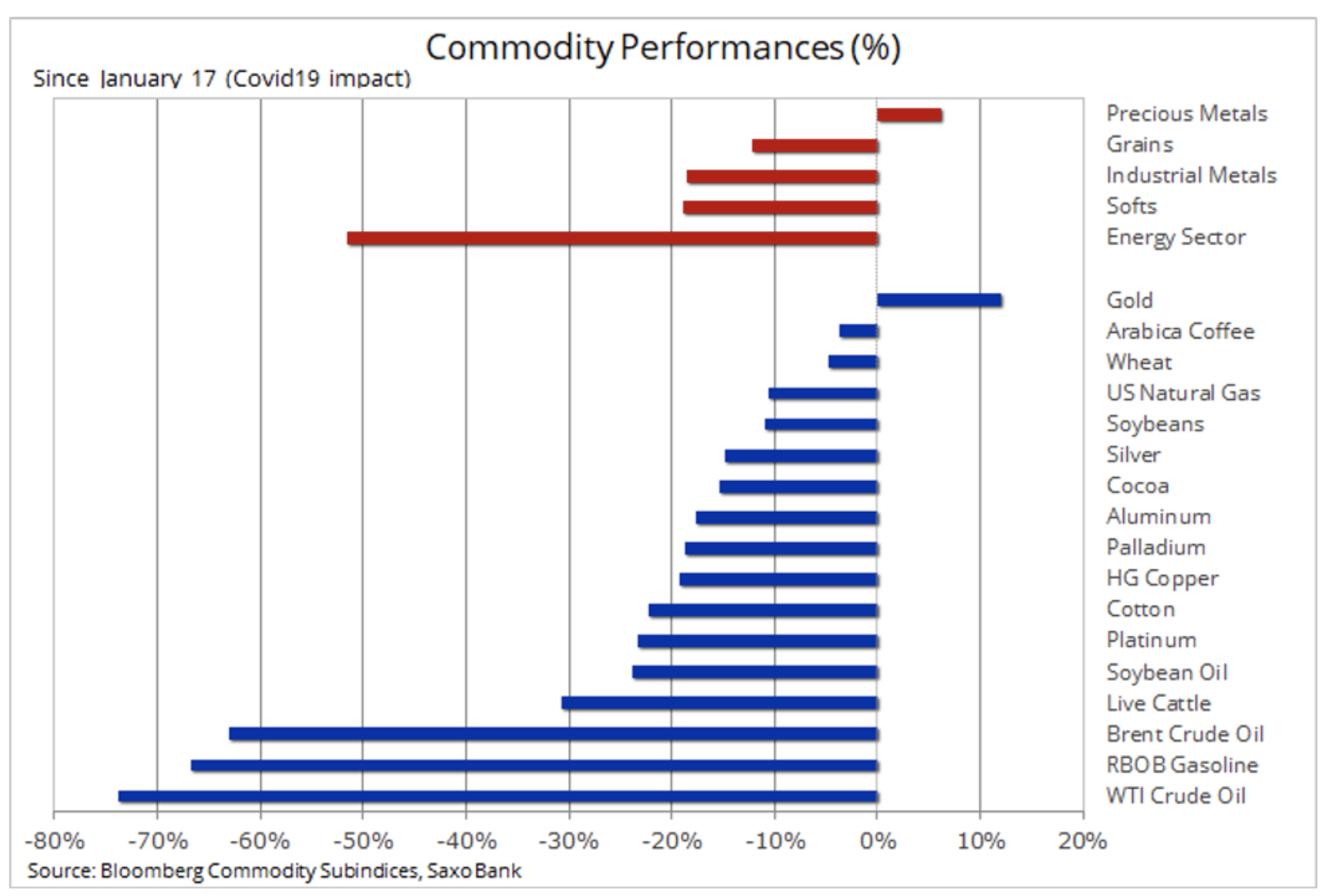

Although some are already seeing success in defrosting the economy, many are not yet ready for this step, and the consequences for economic growth and demand will be more and more serious. This is most visible on the market of key raw materials because they respond to demand more than other sectors. The table below presents the consequences for key raw materials since the Covid-19 pandemic spread outside China. Raw materials dependent on growth and demand have gone down considerably, while few winnings include selected key agricultural markets, and above all gold.

Crude oil has recently seen a historic change, falling into previously unreachable regions, while natural gas has gained in anticipation of a drop in oil-related supply as a result of drilling wells. Gold reached almost a seven-year maximum as investors continued to diversify investments at the expense of shares and cash. China's purchases of food products have grown in intensity, while industrial metals have remained unchanged, as the supply disruptions caused by the virus have somewhat offset the risk of slowing demand with the coming recession.

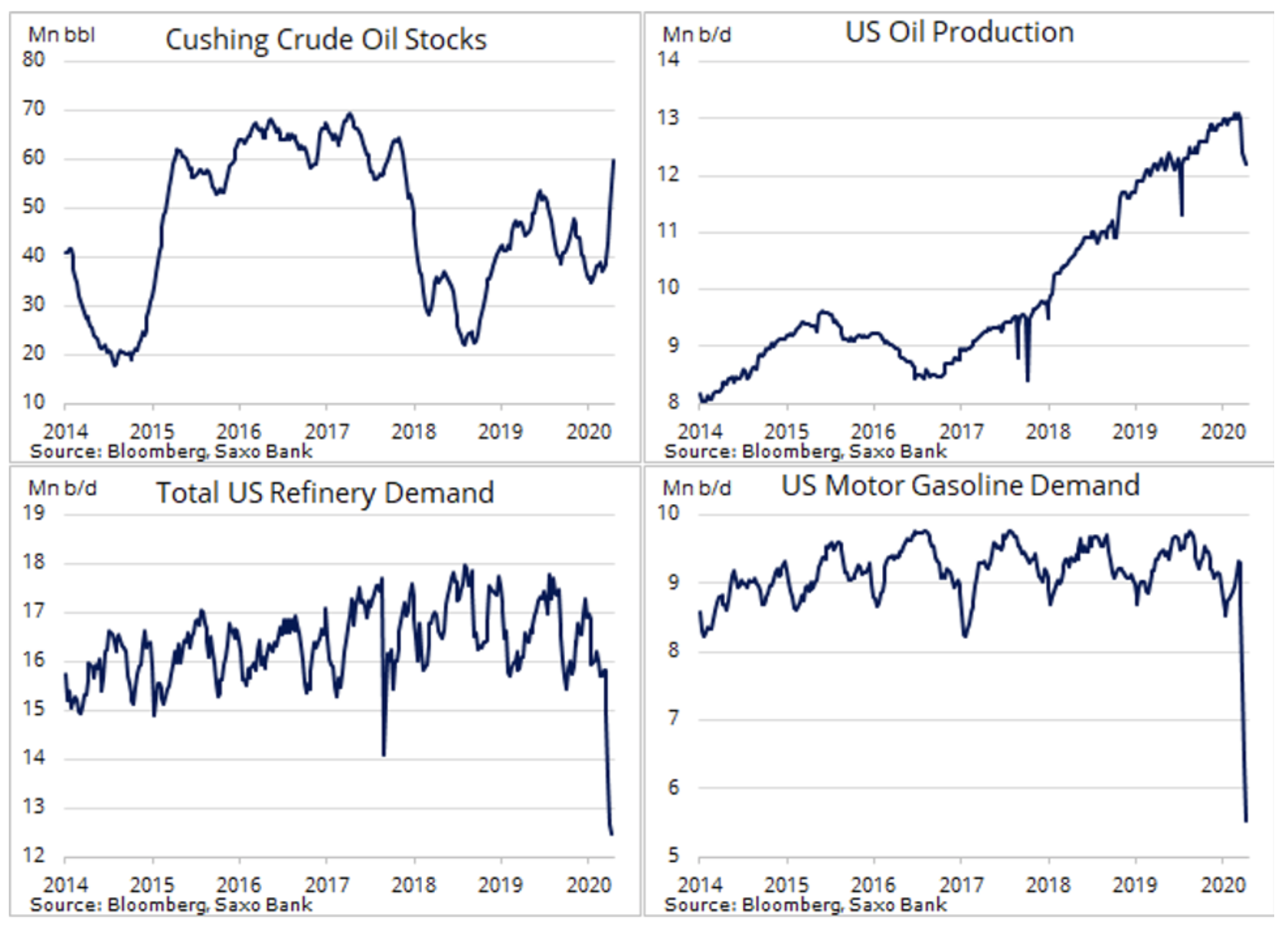

In recent days, one message outshined all other commodity market news. Monday's historic decline in the contract expiring in May oil WTI below zero has highlighted the current tension on the global oil market. The decline in global demand in connection with Covid-19, estimated by the International Energy Agency at 29 million barrels a day this month, has caused millions of barrels of oil to go to storage.

BROKERS OFFERING OIL

After extraction, crude oil must be used by refineries or stored in tanks, pipelines or at sea in VLCC (Very Large Crude Carriers). If the tanks are full, oil producers can only extract as much as they can sell. The risk of such a turn of events is currently the biggest challenge in this industry. An event of this kind could result in millions of barrels per day falling, ultimately leading to bankruptcies and a government debt crisis. Oil producers have been surprised and are trying to reduce production in response. Saudi Arabia's decision at the worst possible moment to increase production in just a few weeks had to be canceled after the OPEC + group agreed around Easter reducing production by 9,7 million barrels a day, starting from May. Other countries are slowly lifting the restrictions related to isolation, however, it may take many months to return to earlier levels of demand. In turn, the time to fill the tankers in the world is currently counted in weeks, not months. One area where the tanks have already been filled is warehouses in Cushing, Oklahoma. With a capacity of 76 million barrels, this is a key oil trading center and the settlement / implementation of WTI oil futures contracts traded on the New York Stock Exchange.

Although the current level of stored oil is 60 million barrels, the price action regarding the contract expiring in May clearly indicated that the remaining 16 million was no longer available because it was already leased for the needs of May supplies. Without a place to store oil, necessary in the event of maintaining long May positions to expire, traders began to massively seek to liquidate their position in an increasingly illiquid market.

The pressure on oil was strengthened by the inflow of retail money to oil-based funds. I totally understand why an investor could consider current cheap oil as an excellent investment opportunity. However, this would require the assumption that the effects of the pandemic on demand will be temporary, and the final recovery will be supported by cuts in OPEC + production and a strong reduction in investment in future oil production.

While the idea itself makes sense, its execution leaves much to be desired. Oil funds tend to invest first, currently in the cheapest part of the oil curve. The fund provider holds a long position in such a futures contract and, unless there is an oversupply in the market, will make a loss each month when selling the expiring contract in order to buy another one at a higher price. This phenomenon is called "contango" and it is a significant problem for investors. At the time of writing this article, the spread between the June and September contract (three months) is 60% - that's how much oil needs to strengthen in just three months for the fund to break even. The oil-based fund (USO: arcx) unexpectedly became an elephant in the porcelain warehouse when it turned out to have a disproportionately large market share. As the market collapsed, the risk of bankruptcy increased. Therefore, the June futures contract, which expires only on May 19, on Tuesday unexpectedly fell below USD 10 / b, and with it Brent crude to a minimum of USD 16 / b.

Since then, however, the market has been recovering to some extent. Only one of the following four reasons could positively affect the price in the long term:

- The CME exchange, servicing the WTI oil futures contract, increased the margin for maintaining the contract (1 barrels) to USD 000.

- Several banks and brokers have introduced trade restrictions in relation to the June contract: existing positions may have been closed, but it was not possible to open new positions.

- The USO Fund faced the risk of a potential collapse, which resulted in its exposure to the June contract from 80% to just 20% after rolling contracts for July, August and even September.

- President Trump threatened to destroy Iran's ships if they continued to attack the US navy in the Persian Gulf.

While the last of these events means a risk to security of supply through the Strait of Hormuz, the other causes are rather technical. On this basis, we still believe that the potential for strengthening oil will be limited until the restrictions are eased, which will lead to an increase in global demand or - which is unfortunately more likely - to limit the production of many high-cost producers, both voluntary and forced.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Maybe they will refuel for free 🙂