Crude oil rises after the OPEC agreement, demand for all metals is growing

The strong increase in risk appetite, which started on November 9, amid optimism about the vaccine, continues in December. Stock markets, mainly in Asia, continue to gain, while the Bloomberg dollar index, which monitors the performance of ten major global currencies against the US dollar, fell to its lowest level in 32 months. Combined with the current discussion of additional fiscal stimulus in the US and Europe, and with OPEC + reaching a sensible agreement to increase post-pandemic production, this has helped to strengthen oil and metal prices, both industrial and precious.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Agricultural commodities

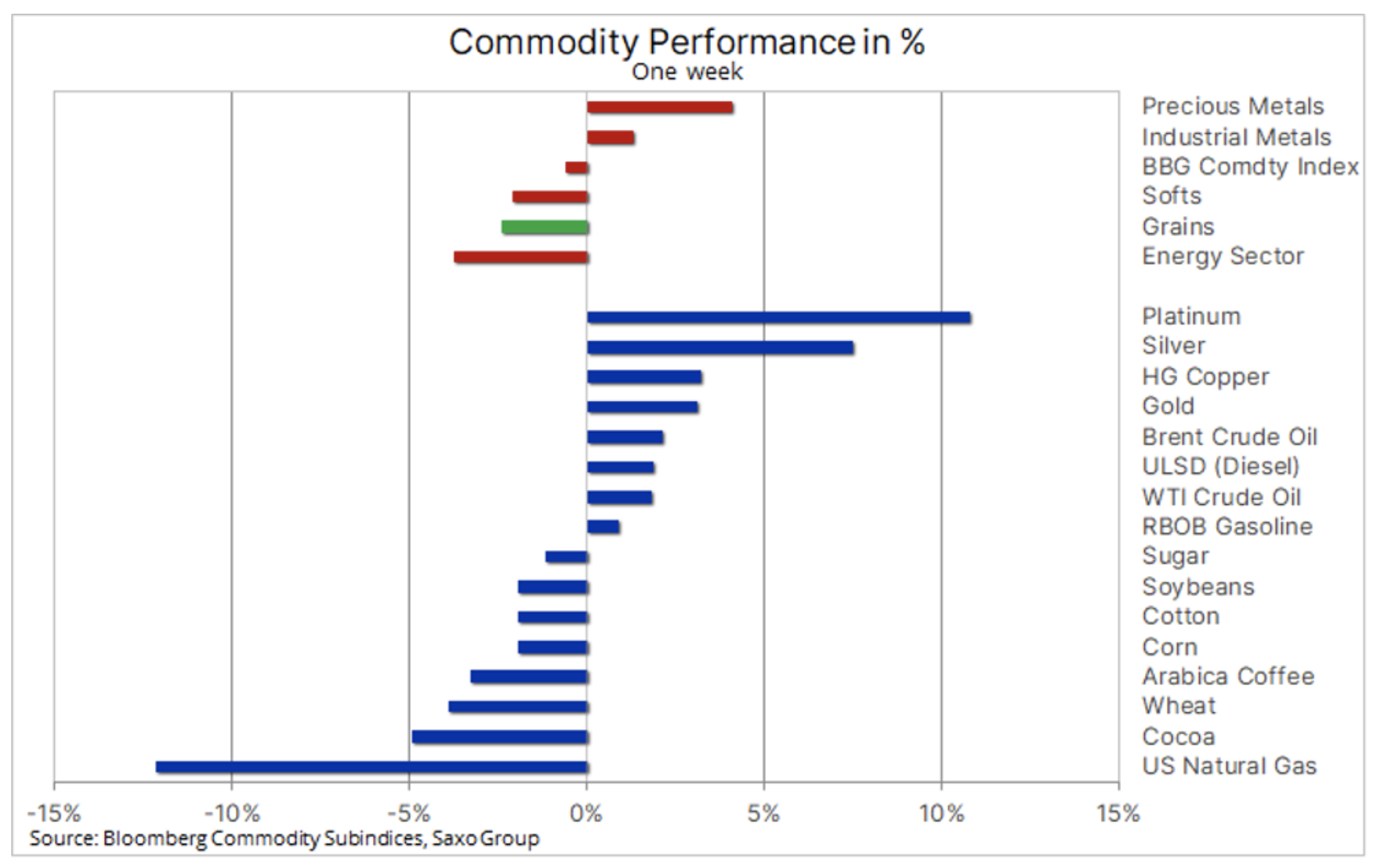

The agricultural sector stalled after a boom since June, which gained 25%, with cocoa, wheat and coffee being the main losers. He was at the bottom again natural gaswhich lost more than 10% due to a milder-than-usual winter in the United States, raising concerns about demand during periods of intense production.

As a result, the Bloomberg commodity index closed almost unchanged during the week, which - following the publication of the monthly US employment report - usually signals the beginning of a slowdown in turnover ahead of Christmas and New Years Eve. Although the index continues to show a loss on an annualized basis following the lockdown slump in QXNUMX, it has seen a marked recovery since then.

This trend was strengthened by optimism about the vaccine last month and is likely to extend to 2021. We assume that after the pandemic there will be a significant increase, the dollar may continue to depreciate, and there will be increased concerns about inflation and weather conditions. As a result, for this index it may be the best year in more than a decade, and if such a scenario materializes, key commodities such as copper, crude oil, soybeans and gold will perform well.

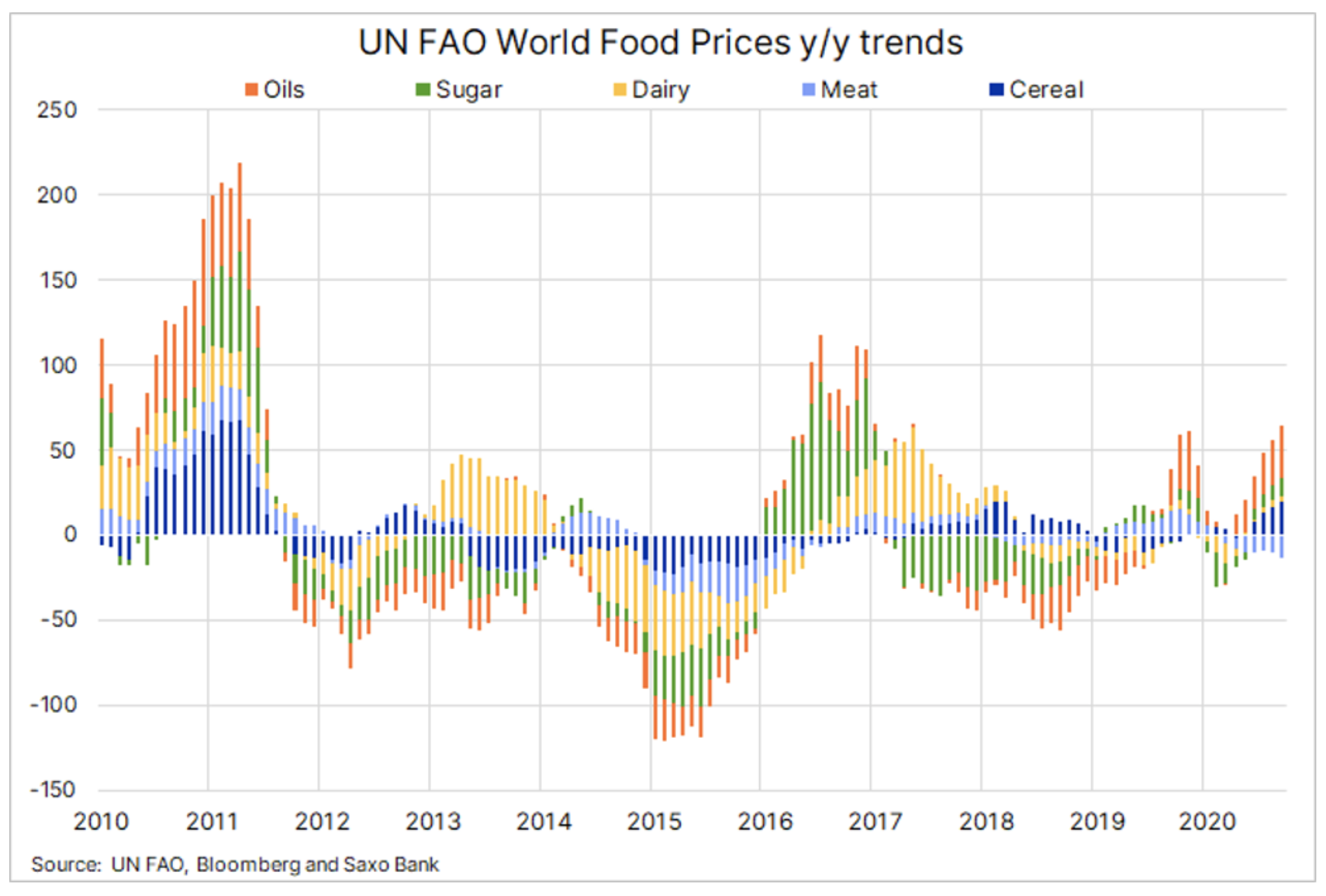

The rise in food prices continues to fuel the emotions around inflation, which may only get worse in 2021, as underlined by the Food and Agriculture Organization of the United Nations (FAO) in the monthly report on the food price index for November. This index, which monitors the average value of 95 food prices broken down into five product groups, reached the highest value in six years and recorded an increase of 6,5% year on year. All sub-indices in November recorded gains, with the vegetable oils sub-index gaining as much as 14,5% compared to October and 31% compared to the same period last year.

Petroleum

Clothing reached its nine-month high after OPEC + producers reached a compromise after another nervous week of talks. As a result, production will gradually increase in the coming months, starting with 500 barrels per day in January. Given the projected recovery in global fuel demand over the course of the vaccine, this deal will support oil prices until it can take shape on its own.

The fact that the market had boomed despite the delay in the previously agreed increase in production by 1,9 million barrels per day in the valuations was due to the flexible nature of the agreement. In other words, production can be increased but also reduced if the recovery turns out to be slower than expected. Overall, analysts now believe that the path to rebalancing the market has been significantly shortened, giving rise to forecasts for oil and fuel price increases in 2021.

In addition, this year's reduction in long-term capital expenditure by the largest oil companies by USD 80 billion is likely to translate into higher oil prices in 2022 and beyond. Only time will show whether the current year has not drastically changed the way global consumers work and travel, and thus their fuel consumption.

The price of Brent crude oil will sooner or later reach $ 50 / b as others will join the already solid Asian demand after the Covid-19 problem is solved. The scale of further growth in the short term depends on how Europe, and in particular the United States, manage the current and not yet fully contained second wave of the Covid-19 pandemic.

Gold

Gold has risen sharply since the US Thanksgiving, when the price fell to the key support level - though not above it, to $ 1 / oz, a 763% retracement from the March-August boom line. While equity funds continue to cut their positions - now by 50% or 3,7 ounces after the Nov. 411 vaccine news - support from a weaker dollar, rising inflation expectations and talks on fiscal stimulus in the United States contributed to trajectory reversal.

Copper, silver, platinum

By then, gold had already gained some support from the copper-related silver bull market. Copper prices reached their highest level in more than seven years amid mounting concerns that mining companies will not be able to meet the demand from recovering economies apart from a strong increase in demand in China. In addition, an ecological transition will contribute to increased demand as the wave of electrification intensifies.

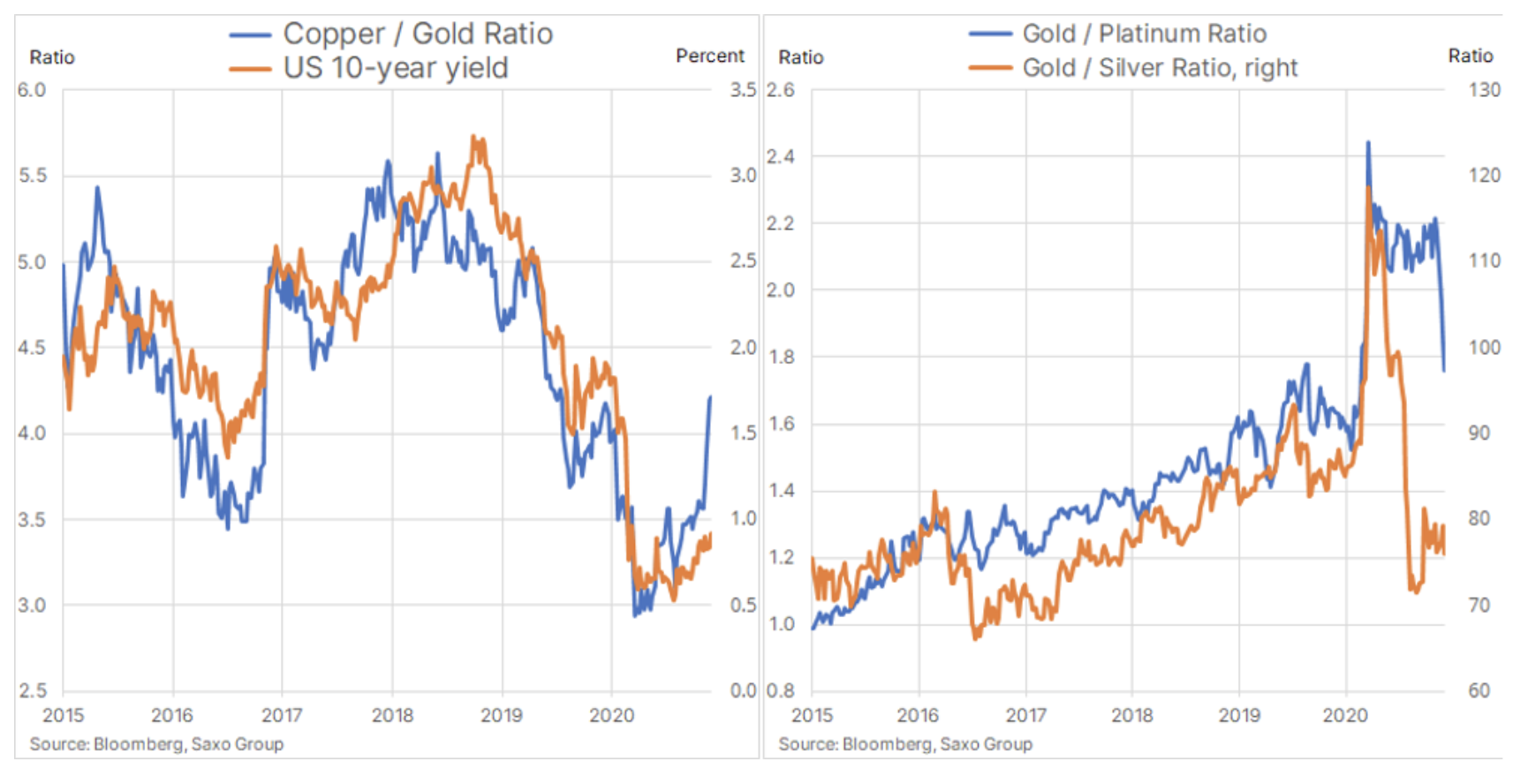

Along with the copper, it definitely went up silver i platinumthereby enabling gold to gain support until it can rebound on its own. Silver strengthened against gold in August; the gold-to-silver ratio then returned to a long-term average of about 70 ounces of silver per ounce of gold. At the same time, platinum needed an impulse in the form of information about the vaccine and a strong revival in the demand for cars. Since these two factors materialized in early November, platinum has surpassed gold by 20%, and the gold-to-platinum ratio has dropped from 2,15 to its current 1,75.

Finally, it is worth taking a closer look at the relation of copper (LME) to gold and its relatively close correlation with changes in US bond yields. In the chart below, we can see that this ratio has plummeted over the past month. The strong strengthening of copper with the waning interest in gold is a picture of a world where growth is at the center of attention. Under normal circumstances, this would lead to an increase in bond yields, and the fact that this has not happened makes us ask ourselves whether this is the new normal or whether there may be a correction. We are inclined to the latter, assuming an increase in gold prices, which will lower the relationship to copper, and a slight increase in bond yields.

We see a risk of an increase in nominal bond yields with a potential breakout of US ten-year treasuries above 1%, which will raise the above-mentioned ratio to around 1,5%. However, we maintain the view that the growing nominal yields are mainly driven by increasingly higher yields above the break-even point (inflation expectations), and not by real yields, which will most likely remain around the current level of -1%.

As for the sources of gold demand, investment demand may slow down somewhat in the short term, but at the same time, along with the recovery in economic and social activity, there will be an increase in interest in jewelry, especially in China and India, which are the largest consumers of such products in the world. We can cautiously assume increased demand from the sector, which in the last five years accounted for 50% of total demand (source: World Gold Council) after a 40% y / y decline in the first three quarters of this year.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response