Nasdaq high, bonds low

US inflation for May 23 will be published on Tuesday at 14:30 CET XNUMX:XNUMX and it is believed that it will have a large impact on the behavior of investors. These data take on special importance because they are published the day before the decision Federal Reserve on interest rates (Wednesday 20:00) and the market is unsure whether they will remain unchanged (73,6% probability discounted from Fed Funds futures) or whether interest rates will be raised by 25 basis points ( probability 26,4%).

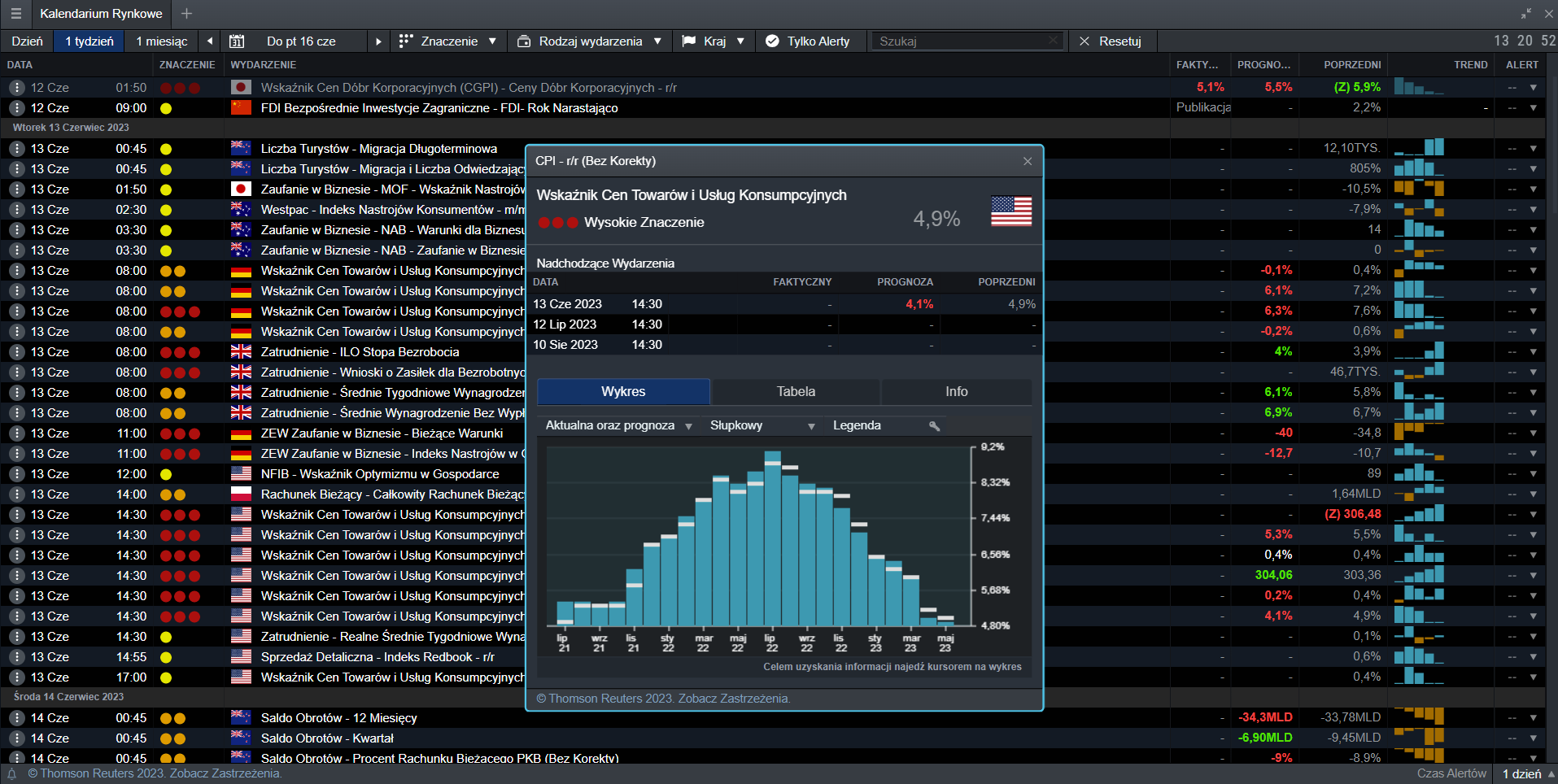

Thomson Reuters market consensus as of June 12, 23 predicts headline inflation to increase by +0,4% month-on-month (m) and +4,1% year-on-year (yoy), or eight-tenths of a percentage point less than +4,9% yoy in the previous month. As for the core index, the consensus expects +0,2%MoM and +5,3%YoY, which is two tenths of a percentage point lower than +5,5%YoY in the previous month.

The expected level of CPI inflation in the US. Source: CMC Markets platform Next Generation.

The rate of decline in inflation has stabilized, but there are still fears of an inflationary spiral.

Although inflation has slowed and is moving away from last year's highs, the rate of decline has slowed, despite a sharp fall in energy prices (West Texas barrel decreased by almost 40 percentage points on an annual basis). The fear of an inflationary spiral remains present due to the strength of the US labor market, forcing the Fed to raise and/or keep interest rates high for an extended period of time.

Possible impact on the stock, bond and USD markets

In stock markets, a lower than expected inflation reading would be positive as it would reduce uncertainty but could raise fears of a recession. Conversely, higher than expected inflation would signal that inflation is still out of control and could have a negative impact on the stock market if interest rates rise sharply.

Bonds could gain if lower-than-market inflation figures come out (<+4,1% y/y for core and <5,3% y/y for core) as it would mean Fed rate hikes are working to control inflation. Conversely, higher-than-expected data could put pressure on prices that are close to support.

CFDs on 10-year US bonds. CMC Markets platform Next Generation.

The main factor affecting the currency market is the difference in interest rates. If this momentum continues, higher than expected inflation will encourage interest rates in the US to stay higher relative to other currencies and may facilitate the appreciation of the USD. Conversely, lower inflation would allow for lower interest rates in the US and narrowing the spread as the USD depreciates.

EUR/USD CFDs. CMC Markets platform Next Generation.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response