Silver and gold gain as the economic outlook deteriorates

Silver and gold they gain as the economic outlook deteriorates. As some parts of the world begin to open their economies after the isolation caused by Covid-19, financial markets try to raise investors' optimism, backed by money injections and zero interest rates. As in the case of hurricanes or other natural disasters, long-term effects can be observed first after the occurrence of a given event. Over the past few weeks, we have begun to notice the enormous damage caused to the global economy by the inactivity that has persisted for many weeks.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

In the coming months, there will most likely be a wave of bankruptcy, significant revisions of negative corporate profits, and with it the risk of persistently high unemployment. For many months, social distance will stop people from traveling and participating in fairs, eating in restaurants and going to the cinema. The need to keep a distance from others will at the same time strengthen gasoline demand - commuters and travelers will choose a car instead of public transport.

Gold and silver and the second wave of the virus (in autumn?)

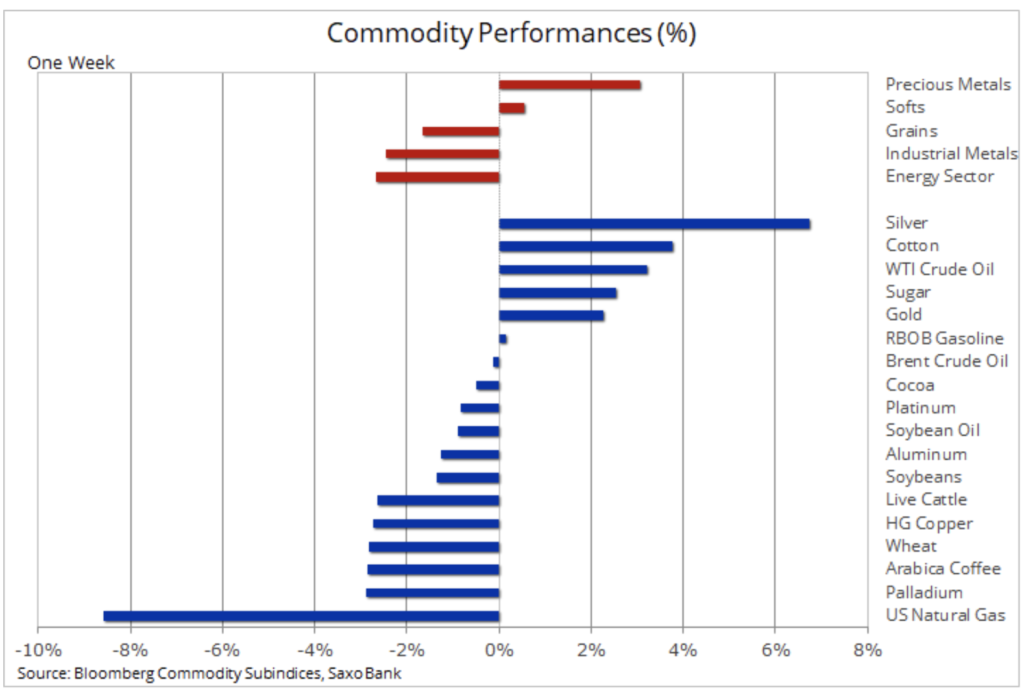

In addition to the above threats, one should take into account the risk of the second wave of the virus in the second half of the year and the growing game of blaming the virus between Trump and China. Therefore, we see the risk of further weakening on the stock market, strengthening of the dollar and increase in demand for the Japanese yen as a safe investment. Market oil, after a strong bull market as a result of cuts in extraction and recovery of demand, stabilization will take place relatively quickly, and precious metals seem to continue to increase due to the demand for safe investments and diversification, while food products will generally remain unchanged due to the forecast high supply.

At a lateral exchange rate of more than a month, gold finally managed to break free from the level of 1 USD / oz. Further weakening on the stock market, American warning Federal Reserve forecasts and the continued increase in the number of unemployed are just a few of the last factors.

Covid-19 pandemic is still a difficult problem to solve and involves the risk of recurrence in places where the virus has been eliminated. Although the situation is still not under control in many countries, the United States and other countries are risking a prolonged pandemic due to the fact that some states or regions are striving to open up the economy before the spread of the virus is even reduced.

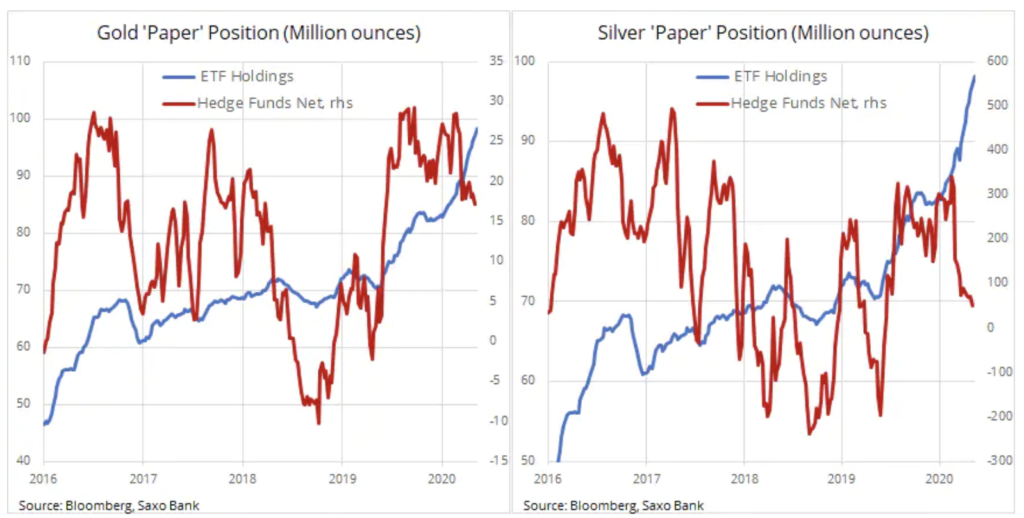

Additional spice was added by breaking gold above USD 1 720 / oz, as a result of which the ratio of gold to silver fell to 107 (ounces of silver relative to one ounce of gold), which is the lowest level since mid-March. The next key levels are 16,5 USD / oz, followed by 17,50 USD / oz. At the same time, gold will have to beat the April maximum of USD 1 / oz to stimulate hedge funds, which - as in the case of silver - have reduced the number of upward orders in recent months.

In the context of so-called "on paper" for precious metals shows a significant discrepancy between tactical trading companies, such as most hedge funds, and long-term investors, both retail and institutional, using silver and gold-based listed funds. The Commitments of Traders report for the week ending May 5 showed that hedge funds, concerned about a decline of almost 40% in the period from February to mid-March, reduced their upward positions on silver by 85% compared to February, reaching an eleven-month minimum. Apart from a slight fall in March, investing in ETF since January, they have been consistently buying silver-based funds. The current overall volume owned by investors has reached a record level of 98 million ounces. The same phenomenon can be seen in the gold market: the ETF volume records another record highs, while hedge funds reduce the long position in net futures to the lowest level in 11 months.

Also favorable from metals are reports from Chinese research centers that investors in raw materials massively accumulate fixed assets. Metal companies have received cheap bank loans because of Covid-19 and apparently place these resources in raw materials in the hope of a recovery that would be more favorable than their production activities. This may also partly explain the recent strengthening of copper and the decline in inventory levels monitored by the Shanghai futures exchange.

Current rates

Copper market

Copper HG reached an eight-week high of 2,43 USD / lb, after which it lost momentum. Although information and better economic data from China - the world's largest consumer - are still promising, we believe that caution should be exercised with regard to the forecast. The increase in supply after the resumption of production, which was affected by the virus, forces us to ask ourselves whether the increase in demand, in particular from Chinese producers, is enough to generate a surplus of stocks this year.

Therefore, we remain skeptical about the ability of HG copper to permanently strengthen above the key resistance at 2,50 USD / lb, an area that has been providing support for three years until the March break and fall to 2 USD / lb.

Crude oil market

Oil is still rising; In retrospect, it can be seen that the short-term collapse of the WTI oil price to negative values last month could have saved the market and ushered in the current recovery. Major global producers, in the face of the increased risk of widespread tank overflow and collapse in prices, have doubled their efforts to reduce production. Along with the increase in demand, this was the main reason for the recovery last month in the opinion of the International Energy Agency expressed in the latest report on the situation on the oil market.

HOW TO BUY CRUDE OIL

However, the strengthening also caused a breakdown in time spreads, as a result of which the issue of oil storage may return in the coming months. In addition to changes in Brent oil prices this month, the charts below also show a narrowing of the six-month spread between futures contracts for July 2020 and January 2021.

Given this, and in the context of estimates that demand may not fully return to its previous level at least in the coming year, we suspect that the current recovery may eventually lose momentum. The risk that US shale oil producers, some desperately struggling to survive, will also be able to restart production suspended after reaching economically justified prices above USD 30 / b.

We maintain our long-term upward forecast for crude oil, but we prefer to invest in large mining companies with solid capitalization instead of products such as ETFs that follow the price of the underlying futures contract.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response