A resilient gold market defies forecasts of smaller interest rate cuts

Gold continues to climb higher - the current price of around $2 reduces the monthly loss to just 035%, an impressive result in a month in which the expected number of US interest rate cuts dropped from six to around three, with the first cut by July is not yet fully reflected in valuations. As a result, the yield on 1-year US bonds increased by over 35 basis points to 4,28%, while the yield on two-year bonds increased by as much as 51 basis points to 4,72%, thus significantly increasing the opportunity cost of maintaining a non-interest-bearing gold position.

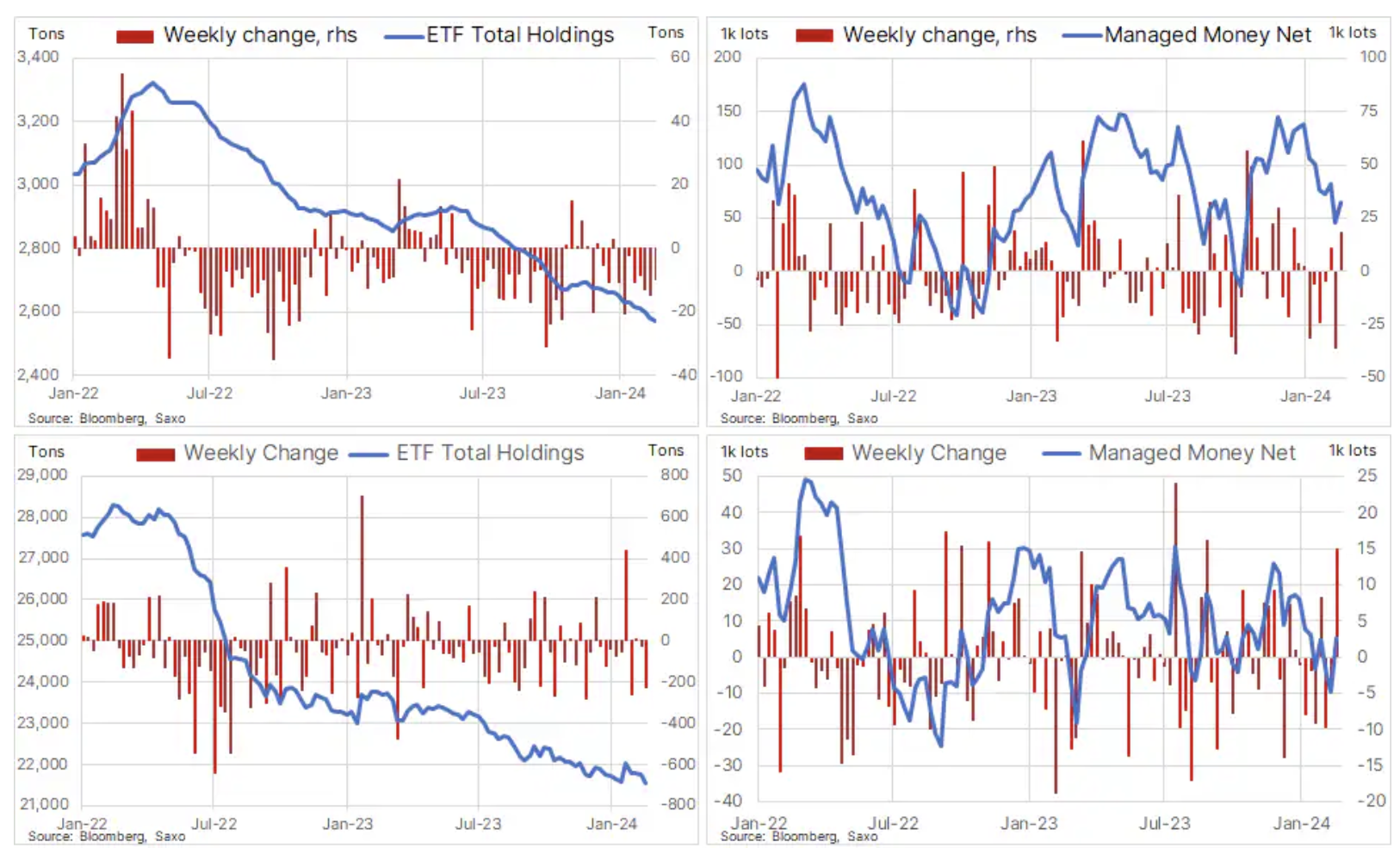

The rising cost of holding assets, coupled with the market's obsession with AI stocks, potentially creating a false sense of stability in markets, has seen demand for 'paper' gold investments continue to fall and the total position in gold ETFs has declined in this month by 44 tons, and so far this year by 95 tons. Against these odds, support was provided by a weaker dollar and short covering by speculative investors, initiated earlier this month when gold briefly fell below $2.

U.S. Commodity Futures Trading Commission (CFTC) in its latest report Commitments of Traders covering the week ending February 20 showed that speculative investors increased their net long position in gold futures contracts listed on the COMEX by PLN 18. contracts (1,8 million ounces or 51 tons) to the level of 64 thousand contracts, the vast majority of which resulted from the reduction of the gross short position by PLN 17. contracts by short sellers based on incorrect premises. This repeated action by speculative investors - selling on weakening and buying on strengthening - has been the dominant market behavior since December, when the price of gold remained within an increasingly narrow range.

Gold and silver market

When observing investor positions in silver, a similar pattern can be seen: overall position in ETF has fallen by 437 tonnes so far this month to 21 tonnes, the biggest monthly decline since July last year. Meanwhile, money management funds remain much more open to short-term price movements and, like gold, have recently struggled with a lack of momentum, leading to buying at highs and selling at lows. Weakness earlier in the month caused funds to become net short in COMEX silver futures, but they were forced to return to net long positions in the week ending February 407 as a rebound in gold and industrial metals supported higher prices.

Positions and weekly changes in investments in gold (top) and silver (bottom) ETFs and futures held by money managers such as hedge funds and CTAs.

The fact that gold dropped "only" to the extent mentioned above despite a significant increase in bond yields and reduced expectations for a rate cut, was likely the result of geopolitical concerns related to tensions in the Middle East and, above all, continued strong demand for physical gold from central banks and China middle class trying to protect their fortunes, which are shrinking as a result of the real estate crisis and the prolonged decline in the stock market.

We maintain optimistic forecasts for gold, and therefore also for... silver, however, as we have highlighted repeatedly in recent months, both metals are likely to remain flat until we have more knowledge about future interest rate cuts in the United States. Until the first cut, the market may be a bit too optimistic, increasing expectations regarding a rate cut to levels that expose prices to a correction. In this context, the near-term direction of gold and silver prices will continue to be dictated by incoming economic data and their impact on the dollar, yields, as well as expectations of interest rate cuts. This applies primarily to the PCE deflator, the Fed's preferred inflation indicator, the reading of which will be published on Thursday.

The spot gold price, trending down since December, continues to recover after a recent failed attempt to break below $2 triggered a wave of new buy orders from long position holders based on erroneous premises, as well as momentum-driven traders waiting for another attempt to move towards the upper channel, currently at USD 000 and then USD 2048, the February 2 high.

Meanwhile, the silver spot price is also range-bound with solid support around $22 and equally solid resistance around $23,50. The current weakening, which has brought the gold/silver ratio back to 86 ounces from a mid-month low of about 90 ounces of silver per ounce of gold, is the result of the latest wave of silver futures selling by funds that in the week ending March 20 February, they changed their position in silver futures contracts listed on the COMEX exchange from nearly PLN 10. short position contracts for PLN 5. contracts net long position.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response