On Thursday, the focus will be on inflation data in Europe and the USA

The highlight of Thursday in the financial markets will be inflation data from the largest European economies and the USA. They should absorb investors' attention to the greatest extent, and at the same time constitute an incentive to stimulate market volatility. Including the currency pair EUR / USD.

The market is waiting for inflation data in Europe and the USA

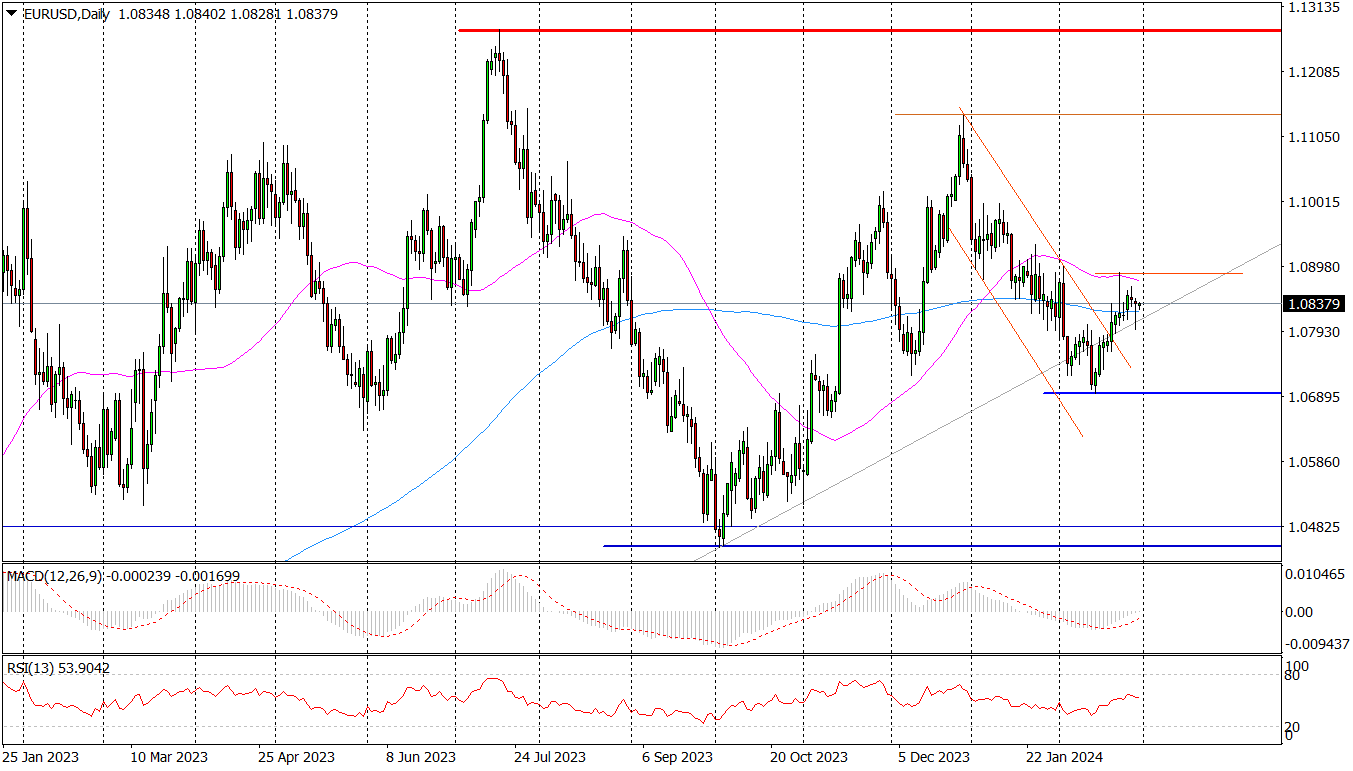

At 08:45, preliminary data on February inflation in France will be published. CPI inflation is expected to decline to 2,7 percent this month. from the level of 3,1 percent Y/Y in January and compared to 3,7%. in December 2023. The lower the inflation rate, the closer the first interest rate cut will be European Central Bank (ECB). This will support stock markets in Europe, reduce bond yields and at the same time weaken the common currency. Especially against the US dollar. On Thursday morning, the EUR/USD rate remained stable at $1,0838. The same interpretation will also apply to other inflation data from Europe.

Daily chart EUR / USD. Source: Tickmill

A quarter of an hour after the data from France, data from Spain will arrive. According to forecasts, CPI inflation dropped there to 2,7% in February. with 3,4 percent Y/Y in the first month of this year.

A decline in inflation is also forecast in Germany. It is estimated that this month CPI inflation decreased to 2,6%. from 2,9 percent Y/Y in February. These data will be released at 14:00 p.m.

At 14:30 p.m., a report on Americans' income and expenses will arrive from the US, which includes PCE (Personal Consumption Expenditures) indices, the favorite measure of inflation by the US Federal Reserve (Fed). The PCE index is an indicator representing the average increase in prices of domestic consumer goods in the United States. In its base form, this indicator excludes food and energy prices.

The index is expected to decline in January PCE up to 2,4 percent with 2,6 percent Y/Y in December 2023, and the PCE core index to 2,8%. from 2,9 percent R/R. These data, similarly to reports from Europe, will also be analyzed primarily in the context of the first interest rate cut in the US.

The inflation data described dominated Thursday's macroeconomic calendar, pushing many other reports published today into the background. In the first half of the day, investors included: they will learn data on retail sales in Germany, consumer spending in France and GDP dynamics in Switzerland. In the afternoon, Canadian GDP data, a report on unemployment benefits claims in the US, and the Chicago PMI will be released.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)