Will the dollar benefit from State of the Union?

Will the dollar benefit from State of the Union?

We are facing a hotter time in the United States. Despite the fact that the markets are now emotionally absorbed in the fight against coronavirus, their attention is effectively attracted by Donald Trump, reminding them about the pre-election reality. This year he will apply for re-election, which is hardly surprising for any investors. The key issue is his opponents who are not yet fully known. Let's take a brief look at the actual chances for the dollar to keep gaining against major currencies and whether the current head of the White House has real chances for the next term.

Night election rally

Tonight there was a speech by US President Donald Trump in front of the joint congressional assembly. It takes place only once a year and it is a kind of summary of work, setting political goals and sketching the vision for the coming months. This time it was mostly devoted to the policy that the current head of the White House intends to pursue after re-election, as well as plans and promises related to the upcoming campaign. As you can easily guess, the speech was more like a political rally than what it really was. They were called informally State of the Union.

In addition, the situation was fueled by mistakes in the organization of primaries, which Donald Trump attributed in his favor. This "profit", of course, was to point out to the opponents the ineptitude regarding such a prosaic (in the understanding of the current US president) issue, which was the organization itself. Of course, everything focused on adding that they are not capable of exercising actual power in the state.

Nobody will threaten Trump?

When we look at the real opponents of the current president, there is no one who could actually threaten him in the upcoming elections. This is not synonymous with the fact that his re-election is obvious. The campaigns have not started yet and therefore the candidates are still quite "blurred" and it is hard to distinguish them from the leader. A very early favorite (with relatively high chances) was Joe Biden, who in Trump's political game in Ukraine became a big loser. The electorate that sailed away with this incident can be difficult to make up for.

Two candidates at the forefront

Currently, one of the most frequently mentioned names is Bernie Sanders, who is currently leading Democrats in the primaries. He is only ahead of Pete Buttigieg, who until recently was called the "ineligible" candidate in the media. Without going too much into the details and biographies of both men it is worth emphasizing that the current leader of the primaries Buttigieg is largely the opposite of Trump. He doesn't have much political experience (the mayor of about 100 cities), he runs the campaign with his husband, while declaring attachment to Christian traditions. His (currently not very numerous speeches) shows that he is a "moderate" candidate who advocates evolutionary and gradual socio-economic changes.

Trump dollar

Especially the last 2,5 years have shown the strength of the dollar, which is supported by the unpredictable policy of the current president. Its appreciation is so strong that it is slowly beginning to be embarrassing for exporters. American goods are becoming more and more expensive abroad, which may adversely affect price dynamics, which will necessarily start to fall, so that foreign markets will still see the potential in purchasing products from the USA.

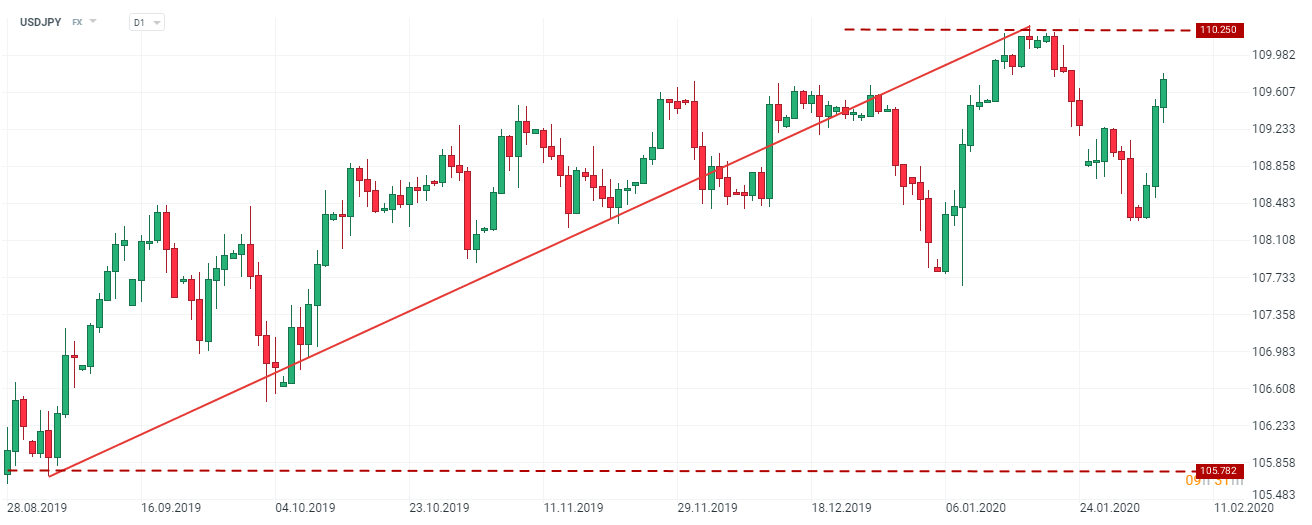

Chart USD / JPY, D1 interval. Source: xNUMX XTB xStation

The increase in uncertainty in the markets is mainly determined by the president himself. The strength of the dollar, as recent years have shown, lies in economic and commercial tensions that attract capital to the US market like a magnet. Considering the USD / JPY chart above, the dollar has virtually strengthened from 2019 to the level (max in 105,782) 2020 since the beginning of September 110.250 and it does not seem to be the end of the further journey north.

The first phase of the trade agreement was a kind of "collateral" of the market. Thanks to it, soybean exports to China are not only preserved, but increased to the heavy "demand boundaries" for this country. Given the strong dollar, this will be a difficult venture. However, investors are counting on the fact that the strong USD will weigh heavily on the United States itself, that they will want to let some depreciation of the domestic currency into the market through fiscal and monetary policy.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response