An epidemic threatens the economy. Tourism, transport, trade and gastronomy suffer

The coronavirus epidemic affects the dynamics of both Chinese and global growth. The effects are felt by tourism, transport, trade and gastronomy. This can be seen, among others after global companies limit their operations in China, airlines cancel flights and countries evacuate their citizens. The worst-case scenario presents a spiral of fear, causing a slowdown so great that it will turn into a global crisis.

Fear of infection causes that consumers give up their trip to China and stop using the services offered by China. The authorities are choosing additional trade restrictions and extending the closure of offices.

14 cities and provinces announce that the difficulties will last at least a week, and according to Bloomberg they are responsible for 69 percent. Chinese GDP. The slowdown of this huge economy (which is still developing at a relatively low level of around 6%) will affect other countries. The most severe effects of the epidemic will be felt by brands that have factories in this area. Some do not produce, others do not export, and their links with global giants can - according to Moody's agency - cause a series of events leading to global recession. Estimates show that the decline in China's GDP growth due to coronavirus may even be in the first three months of the year 1-2 percent

The indices were booming, the yuan weakened

Panic around the epidemic has contributed, among others to declines in the Chinese stock market - closing of the trading floor for the Christmas break has been extended, and Shanghai Composite index fell by almost 9 percent at the opening. They are also losing raw materials - oil demand in China has fallen by around 20 percent, the highest since the global crisis.

- The decline in oil prices associated with the coronavirus epidemic suggests that changes in fuel prices may soon act on inflation cooling - evaluates Chief Economist TMS Brokers Konrad Białas.

The Chinese government announced a whole range of stimulus measures, and the People's Bank of China injected CNY 1,2 trillion into the market by reducing loan rates by 10 bp.

- This will rather prove insufficient to prevent a strong slowdown in the recovery in QXNUMX and the authorities will have to do more, but for now it shows that the markets will not be left to themselves - evaluates Białas.

Despite the support of the economy by the Central Bank of China, slower consumption of raw materials can cause a negative impact on prices. Especially since investors' sensitivity remains high, both for bad and good information.

Calming the mood is not influenced by the fact that the number of infected has risen to over 17, with cases of patients reported in over 20 countries. We have not yet reached the peak of virus spread, so more shocking information is possible.

- It is still easy to ignite risk aversion, but investors also want to believe that there will be a "cure" that will save the prospects for economic growth, and with it the boom. The Fed was looking for such a remedy on Friday, as the market raised expectations for interest rate cuts. to 50 bp by the end of this year. This confirms the risk we attributed to the US dollar as the Fed has room to ease policy, in the face of strong risk aversion this will undermine the dollar's safe harbor status. JPY and CHF don't have this problem - assesses the economist.

Stock market decreases

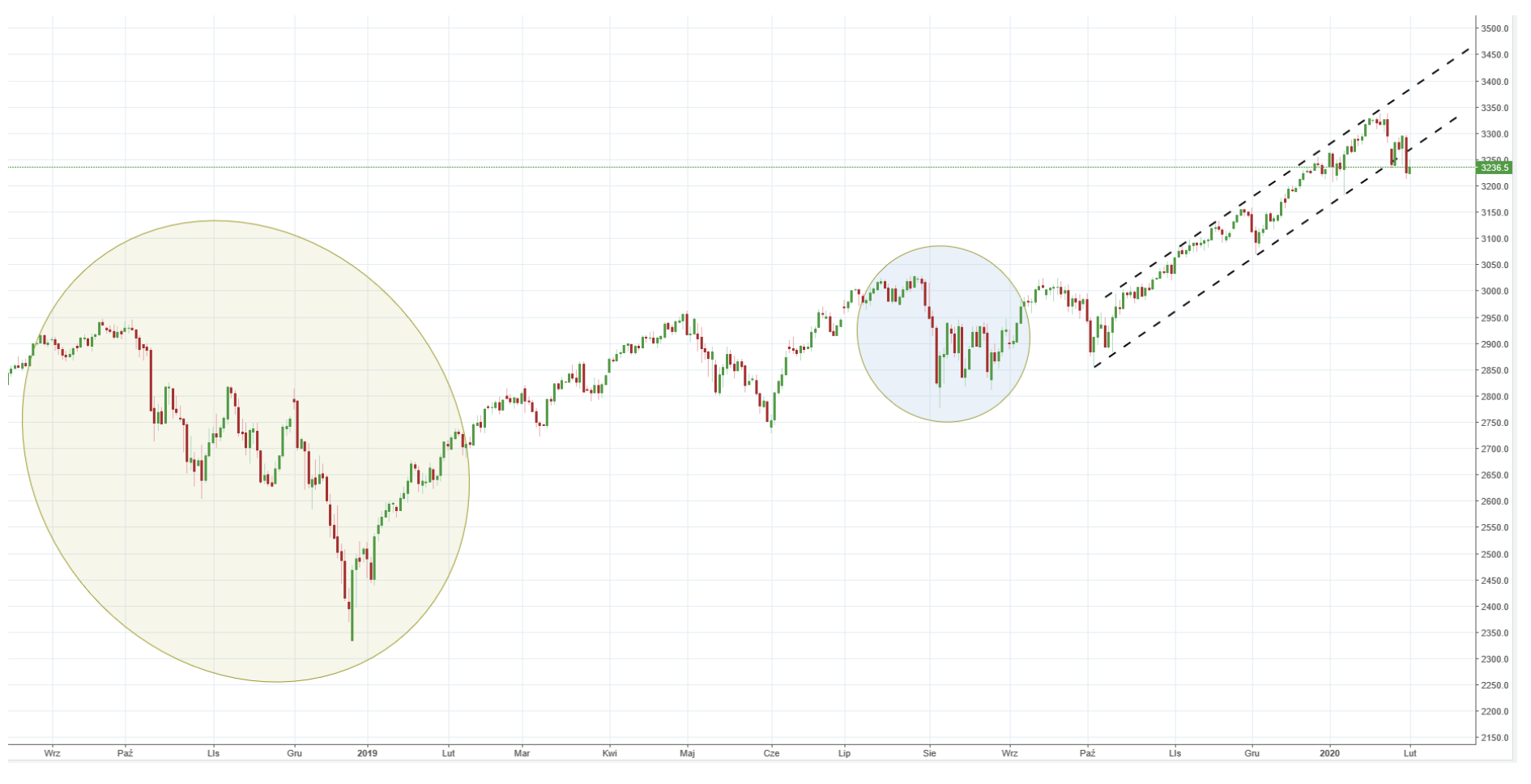

The US stock market was at historic peaks a week ago, and fell sharply during one session. SP500 index prices fell from around 3337 points. by over 3% Although this does not immediately mean the beginning of the bear market, anxiety is visible among investors.

Will the epidemic become a trigger to change the 10-year trend? According to OTC market expert Łukasz Zembik - such a scenario is "unlikely".

The CFD contract on SP500 only made a correction, which is natural after such strong increases. The rate broke the medium-term upward trend line, which may support a scenario of slightly deeper declines than those we observed at the beginning of December 2019 and January this year. The current discounts are currently small, especially when we compare them to those from last year's holidays or to a breakdown at the end of 2018 Therefore, the strong upward trend is still more likely to be maintained.

- Let's not forget, however, that the risk of negative news from China on mortality and disease will still somehow limit further increases. Only positive information may induce investors to return to risky assets - warns Zembik.

Add to this that other benchmarks of the US stock market, such as the Dow Jones Industrial index or Nasdaq 100 behave similarly, and we can find similar relationships on the price charts of these items.

Holes in Asia

Asian stock exchanges are also on the reverse. In mid-January, Nikkei lost more than 3,4 percent and the Thai stock exchange, represented by the Taiex index, fell by less than 6 percent. Today, the Chinese parquet hit 9% after the break we had in connection with the Lunar New Year celebrations.

In such conditions, gold and currencies classified as safe (franc and yen) returned to the growth path. Gold, which 2 weeks ago was the most expensive in 7 years, still has great growth potential.

Graph 1: Gold again on a growth path. Recently, the quotations have been at most for seven years. Source: TMS Brokers.

source: DM TMS Brokers press material

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response