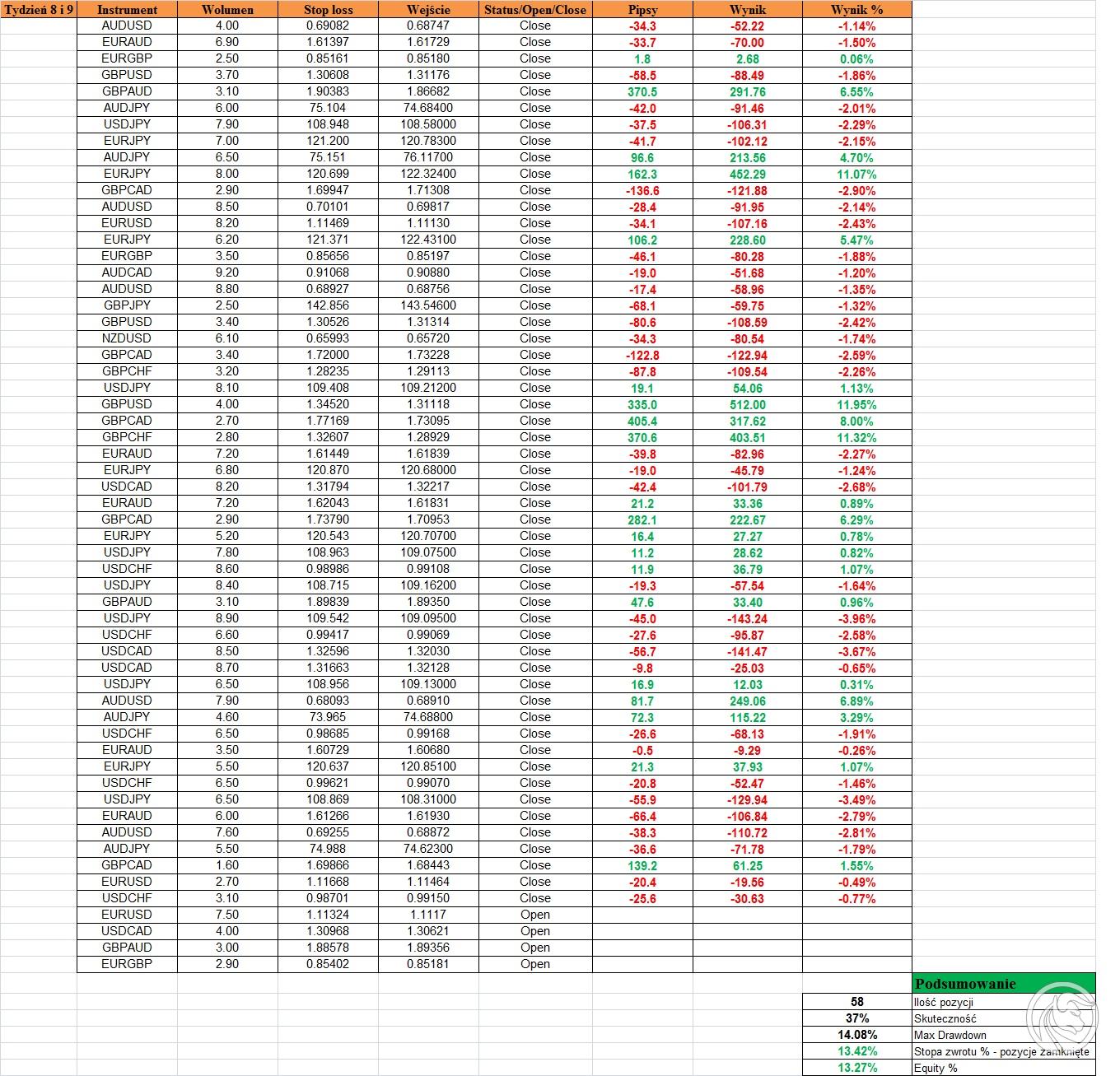

Forex Strategy "At the End of the Day". Summary - weeks 8 and 9

Behind us another two good weeks for the "Na Koniec Dnia" strategy. It can be said that after the holiday season there is no trace and more volatility has returned to the markets in most cases. In general, as far as transactions are concerned, the past two weeks have been quite "rich". Below I will discuss the items that had the most important impact on the account balance in weeks 8 and 9.

Be sure to read: End of the day strategy - Summary of the 6th and 7th weeks

The best setups - long GBP / AUD, short EUR / JPY

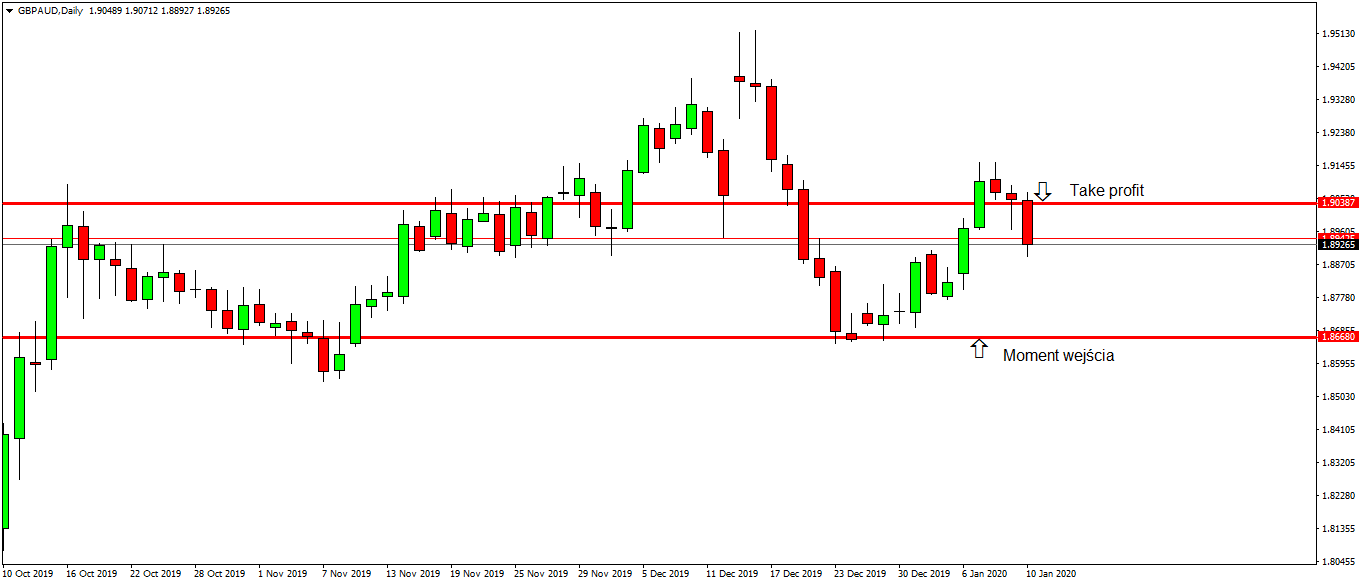

Position on the GBP / AUD pair - you can see an uptrend on the chart for some time. Additionally, a very important aspect for me was the fact that the price respected the important level of support in the regions of 1.86700. It was around this level, exactly at 1.86680, that the long position was opened. The price went up very nicely and dynamically. I secured the items by moving them stop lossa each time you close another candle from the daily. Take profit was achieved around 1.90387.

Long position. GBP / AUD chart, D1 interval. Source: MT4 XM

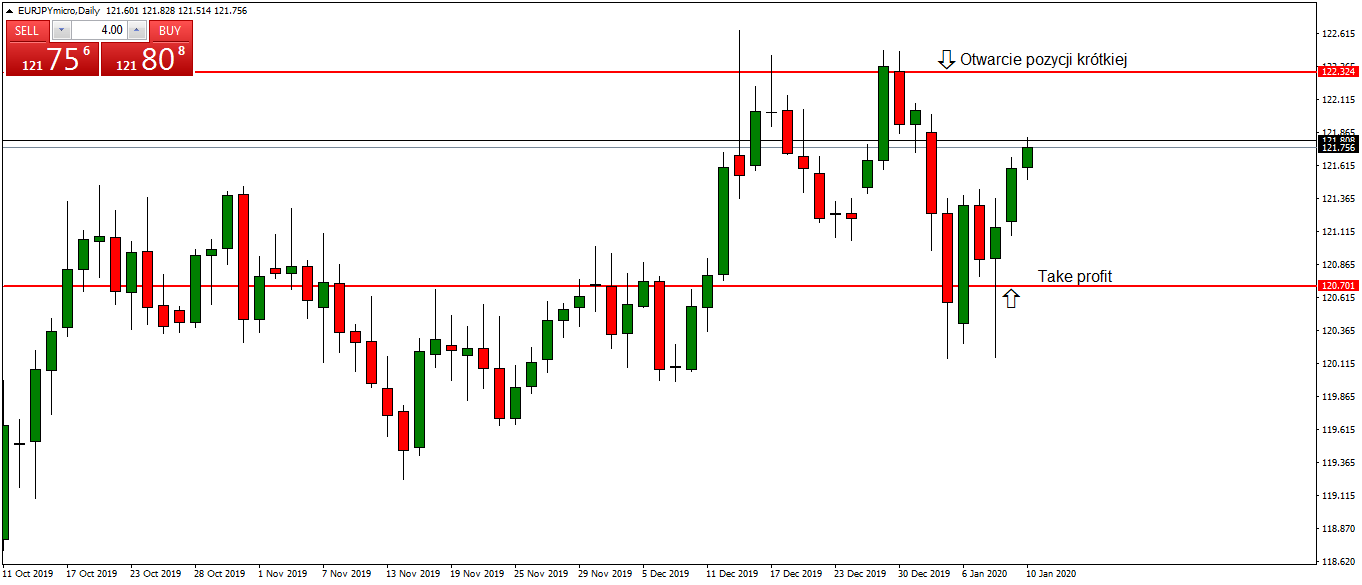

Another good transaction was short on EUR / JPY. Whoever follows the summary knows that I played this position also in weeks 7 and 8. Generally, as far as I am concerned, the main valid direction for this pair is noon, at least as long as the price fails beat the area of 122.400. Once again there was a test of this level and once again I opened the short, exactly at 122.324. The price dropped strongly by around 120.700, but the next candle was in strong demand, which resulted in the take profit closing.

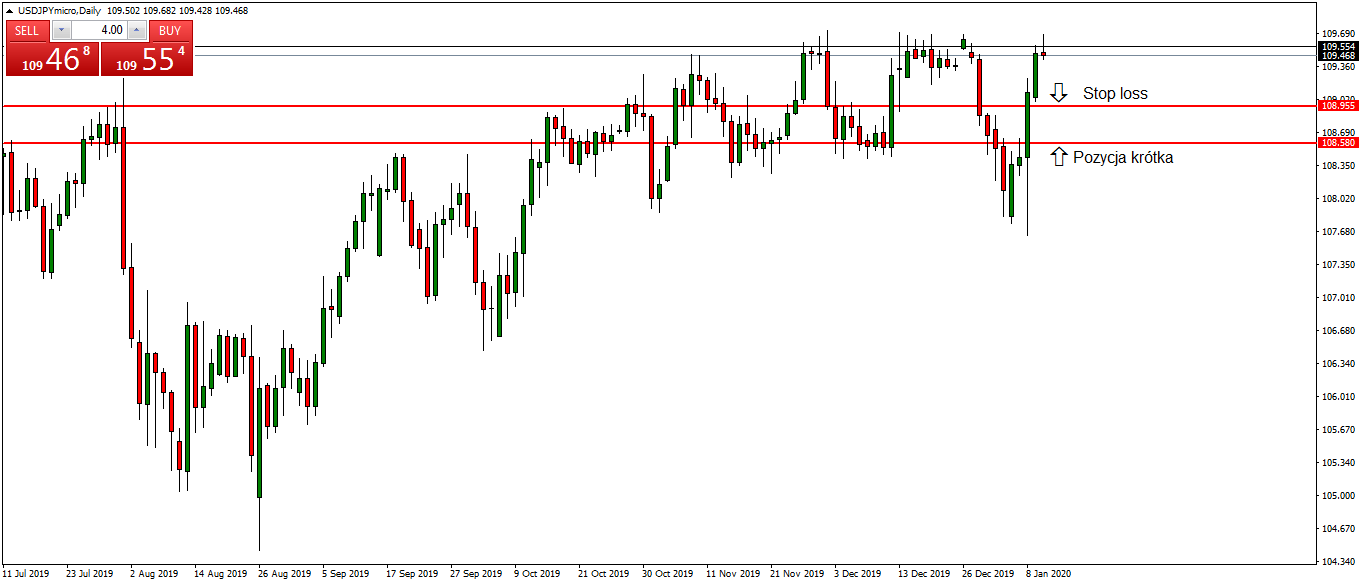

The worst setups - USD / JPY, AUD / JPY

In general, the scenario was the same in both cases, I assumed a descent. On USD / JPY you could observe strong downward swings, I wanted to join this move. I had an order in areas of 108.580. Activation took place, unfortunately the candle was so strong that the transaction immediately set a rate.

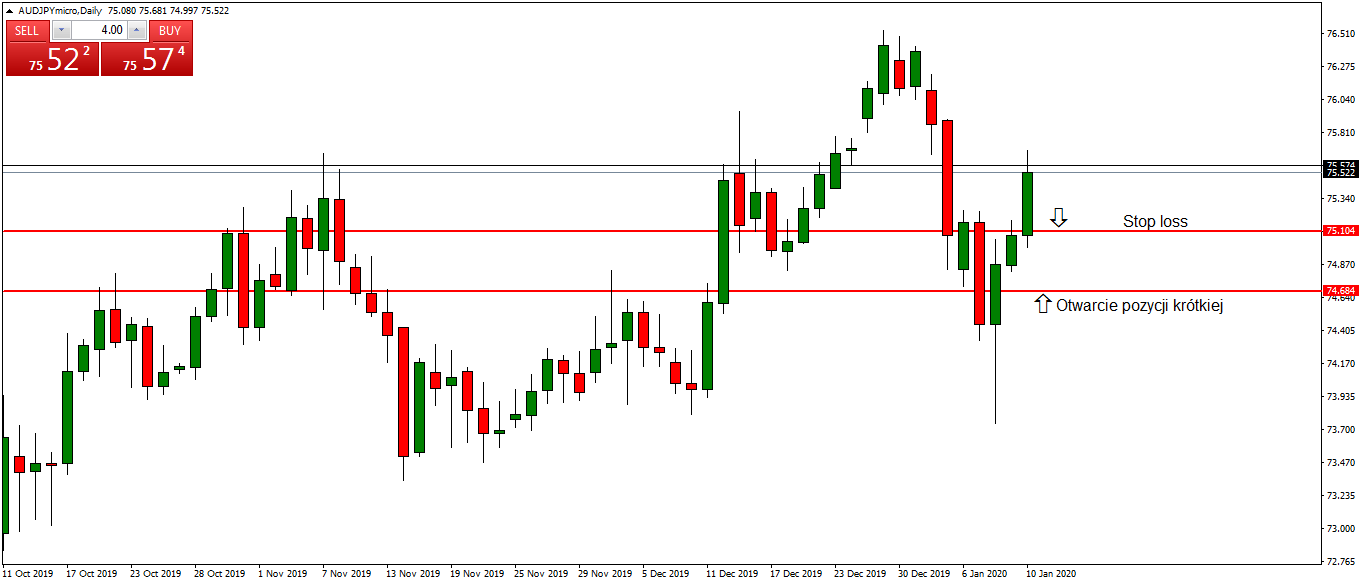

A similar situation took place at AUDJPY. The pair beat an important level in the region of 74.700. It was a clear signal for me to look for a place for a short position. I set the order at the broken level, counting on retesting again. I was not mistaken that the puncture turned out to be a fake and the price got stronger.

Short position. AUD / JPY chart, D1 interval. Source: MT4 XM

To sum up, at the moment the profit compared to the last two weeks has been increased by another several percent. In addition, I have open orders for EURGBP, GBPAUD, EURUSD and USDCAD. The next days promise to be equally interesting.

You can follow the results in real time on my profile on MyFxBook HERE.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response