Summer break does not exist - Monthly macro forecast

August is considered a quiet month in the markets. However, this opinion is incorrect. In August 2011, the markets experienced chaos in connection with increasing the debt ceiling, i.e. the statutory limit on the amount of national debt in the United States. In August 2015, China surprised investors with an unexpected devaluation of the yuan. This year we see a number of risk factors that could cause a sudden increase in market volatility: the date of the increase in the debt ceiling in the United States (August 2), meetings of many central banks (Australian, British, Hungarian), the reading of the US CPI for July and the inevitable annual symposium Jackson Hole.

About the Author

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

China: Peak growth has already been achieved

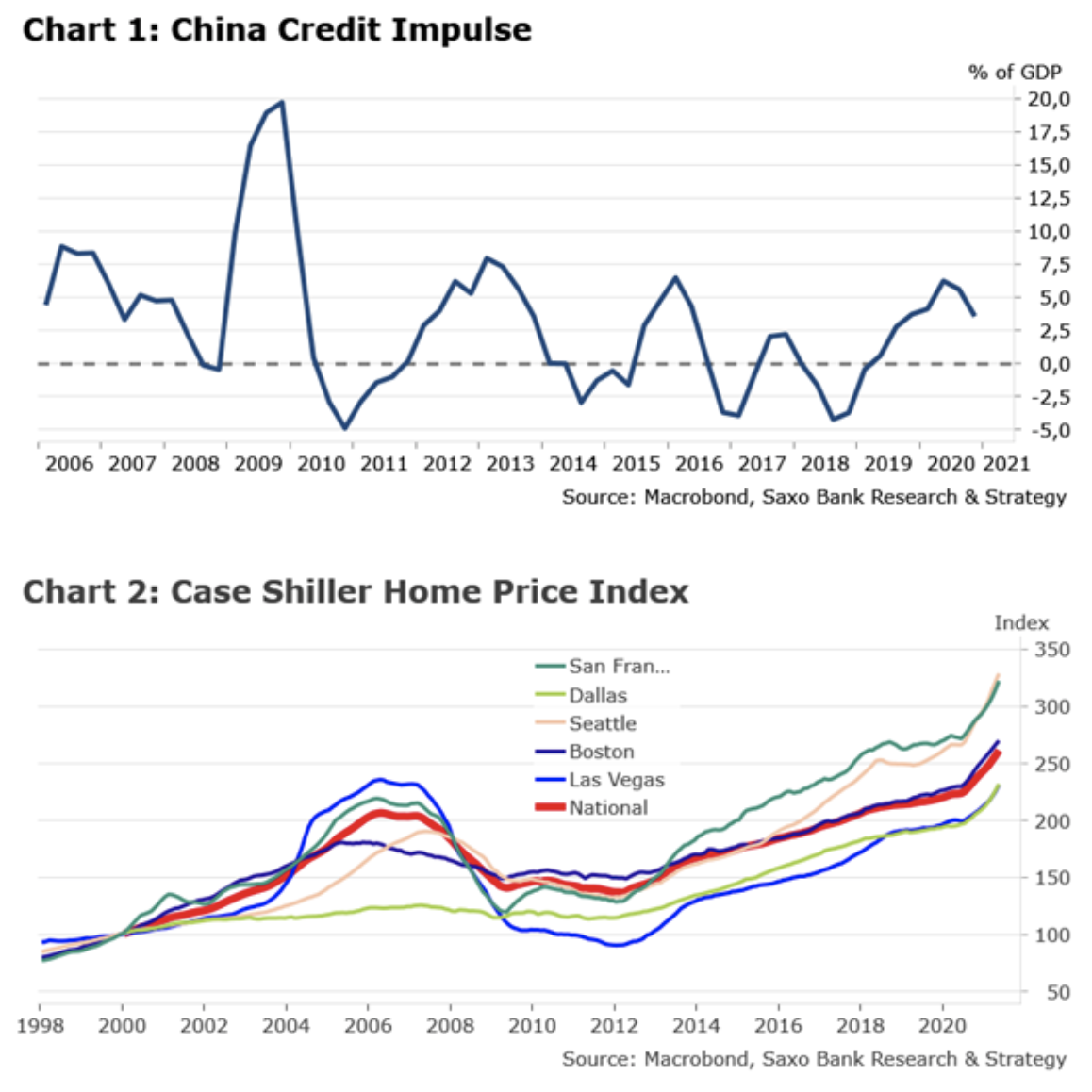

China's credit impulse peaked some time ago, and the economy is now slowing down (see chart 1). However, the macroeconomic picture of the situation is slightly worse than the Chinese authorities are willing to admit. This explains the growing trend towards an upward revision of the historical data. The main drivers of the slowdown are weak growth in consumer spending and a decline in investment in equipment. In our opinion, the most important factor negatively affecting consumption is the increase in wages. Unless a centralized policy is implemented to promote higher wage growth, we do not expect consumption to return to pre-pandemic levels this year. Two key drivers of the decline in hardware investment are the semiconductor shortage, which is likely to last at least until the end of the year, and the reduction in investment due to concerns over the economic outlook. In our opinion, China will primarily continue to seek to support the manufacturing sector, in particular investments in equipment. This should translate into real political action and at least one reduction in the reserve requirement level by the end of this year.

Rest of the World: Everyone watches the US economy closely

After deliberately vague and unclear comments at the FOMC meeting on July 27-28, this summer investors will most likely continue to follow the situation in the United States in terms of hints about future monetary policy Federal Reserve. With regard to the US economy, we are concerned about two things. First, there is more and more evidence that we are entering a cycle characterized by higher inflation than before. In our opinion, the "temporary" inflation will be of a permanent nature. At this point, it relies on four factors: 1) bottlenecks and disruptions in supply chains (cyclical); 2) price increases in the enterprise sector (cyclical); 3) leftist policies promoting greater wage growth; and 4) green inflation related to, inter alia, with tariffs regarding carbon dioxide emissions. Factors 3 and 4 are structural and potentially sustainable. Overall, these factors may lead to a lasting change in the inflation regime.

Second, politicians seem to be ignoring the soaring house prices; a similar situation took place in 2005-2007. This led to the crisis of 2008. According to information published last Tuesday, S & P / Case Shiller index The monitor of single-family house price developments in twenty key urban markets in the twelve-month period ending in May rose by 17,0% (Figure 2). This is the highest rate of growth in history. The US housing market is approaching the stratosphere and, with a few exceptions, a rapid return to pre-pandemic levels does not seem very likely. Given that the housing market is the most interest rate-sensitive segment of the US economy, investors should exercise extreme caution as changes in monetary policy may burst the current speculative bubble in this market.

Calendar of events for August 2021.

August 2 - US debt ceiling decision deadline

If the US Congress does not take appropriate action by August 2, the Treasury Department will be forced to resort to emergency measures to prevent it from reaching the debt ceiling. As late as 2019, Congress quietly suspended the debt ceiling until August 2021. An agreement between the two parties will force the Biden administration to make political concessions to the Republicans. If the parties do not reach an agreement by this date, it means real damage to the US bond market.

August 3 - Australian central bank meeting on monetary policy

As the recent wave of lockdowns in Australia and high-frequency data point to a significant real decline in activity in QXNUMX, we predict that Reserve Bank of Australia The (Reserve Bank of Australia, RBA) will make a 180-degree return on its recent asset restraint decision. In the present circumstances, there are strong indications to keep the weekly asset purchases at AUD 5 billion, at least in the short term. Talks on limiting asset purchases can only be resumed after the restrictions are lifted and economic activity is revived. Regarding the cash rate, we expect the RBA to postpone its decision until early 2024.

5 August - British central bank meeting on monetary policy

Gertjan Vlieghe - external member of the Monetary Policy Committee Bank of England The (Bank of England, BoE) with the right to vote and his associate Michael Saunders have made comments in recent weeks suggesting a shift towards more aggressive policies. However, there are no indications of a decision to end the asset purchase program early or to future rate hikes at the next monetary policy meeting on August 5, given the increasing risk to the economic outlook from a third wave of the pandemic. For now, the BoE is likely to stick to the existing, effective rules, signaling that the condition for lifting the monetary stimulus against Covid-19 is to make "significant" progress.

August 11 - July CPI reading in the United States

In June, the US CPI exceeded all expectations and amounted to 5,4% y / y. This was the largest increase since August 2008. More than 55% of the June CPI increase occurred in six areas directly affected by the economic opening (in particular hotel, flight and used car prices). However, as more and more companies raise prices in response to rising wages and transportation costs, the market seriously challenges the Fed's concept of "transitional" inflation. The consensus assumes that in July CPI in the United States will amount to 4,9%. If the headline inflation reading is likely higher, then be prepared for a real rollercoaster in the market.

August 24 - Hungarian central bank meeting on monetary policy

On July 27, the National Bank of Hungary (Magyar Nemzeti Bank, MNB) raised the base rate more than expected, ie by 30 basis points to 1,20%. It was a strong message for the market that the central bank was projecting a proactive tightening cycle with an emphasis on early-cycle measures. Given that inflation is most likely to remain above the upper tolerance (4%) until the end of this year, there is room for maneuver in raising rates. We predict that the decision on the next rate hike will be made at the meeting on September 21, during the update of economic projections.

August 30 - French Finance Minister Bruno Le Maire will meet representatives of entrepreneurs from sectors hardest hit by the introduction of covid passports July 21

Soon thereafter, we will most likely learn about further actions to financially support selected sectors.

August 26-28 - annual symposium in Jackson Hole

This year, the symposium in Jackson Hole, hosted by the Federal Reserve Bank of Kansas City, will be held on-site, unlike last year. The full list of speakers is not yet known. However, the main topic will be "Macroeconomic policy in the conditions of unequal economy". In our opinion, Jerome Powell's speech should slightly brighten the situation regarding the reduction of asset purchases. We predict that the Federal Reserve will wait until the end of this year, possibly a meeting in December, to announce future policy guidelines.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response