Resources count on support in the form of a fiscal bazooka

The coronavirus pandemic triggered three significant macroeconomic impulses. All three in the coming months will significantly affect commodity markets, in particular the energy sector. The global economy is currently experiencing the largest demand shock since the global financial crisis, as well as a global supply shock and a price war on the oil market that has a devastating effect on capital. The closure of workplaces and institutions in China at the beginning of the pandemic is now becoming commonplace in other parts of the world, in particular in Europe and the United States. The effect in the short and medium term will be a sharp decline in global economic growth, an increase in unemployment and mortgage rates, and a decrease in consumer confidence.

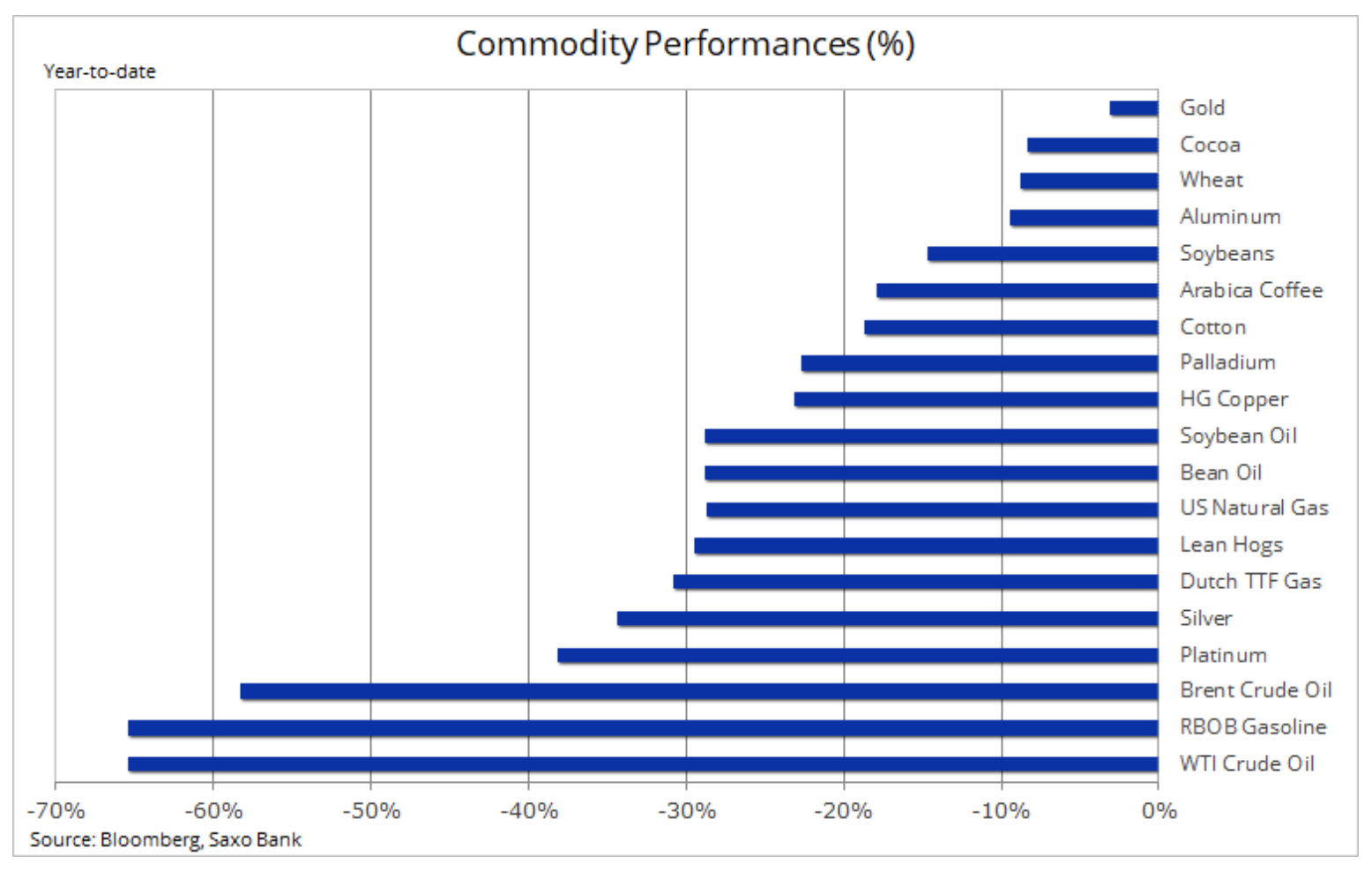

At the beginning of the second quarter, the most likely topic will be a destructive decline in demand for many key raw materials, from crude oil and industrial metals to some agricultural products. However, as coronavirus spreads, it is likely that forecast supply will also become a problem. Miners and producers may begin to feel the effects of labor shortages and supply chain breakdowns. The impact of falling prices is noticeable in both the agricultural and mining sectors, as production costs go down. However, the potential risk for supply can cause many markets to find support faster than demand forecasts.

We don't make any price forecasts, but we looked at some of the raw materials that could potentially benefit from current disturbing events.

The impact on global economic growth and demand will be significant. Due to the fact that millions of people around the world were ordered to work from home and travel was banned, the demand for fuel for transport decreased. At the same time, a decrease in consumer confidence will affect consumer demand.

Up to now the most serious effects have been observed in the energy sector. As a result of a strong increase in supply from outside OPEC and a worse forecast for global demand, OPEC + cooperation inevitably ended on March 6.

Saudi Arabia started an open price war, lowering the price while increasing production. Regardless of whether the target was Russia or high-cost producers from the American shale industry, the consequences of this decision for the oil itself were devastating. If the goal was a strategy of "shock and terror," this decision was made at the perfect moment - global demand fell sharply after the global community surrendered to the fight against COVID-19.

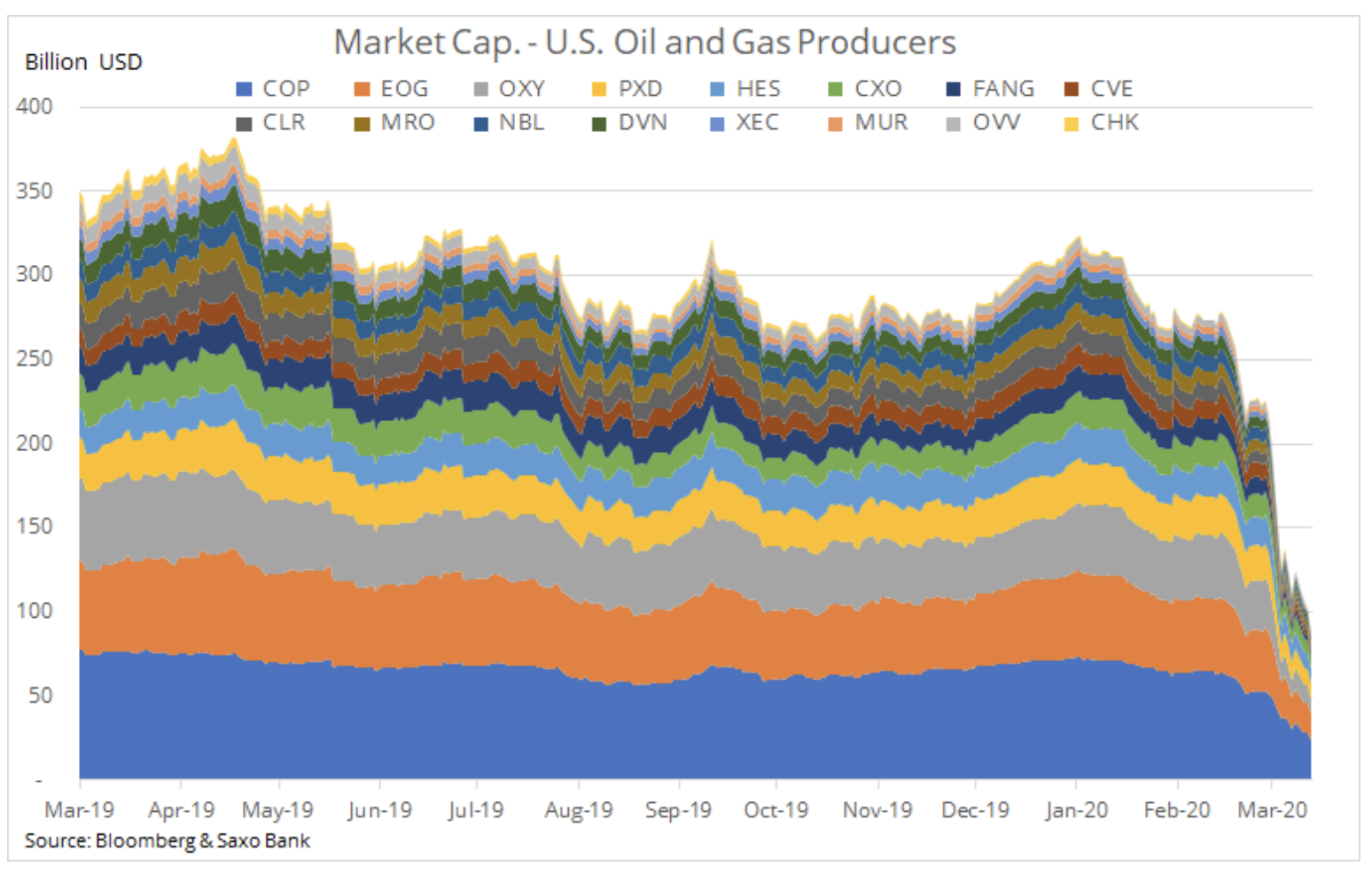

Price Brent oil has fallen to its lowest level in 18 years. The SPDR Energy Select (XLE) fund covering the largest US oil companies has depreciated over half since December. At the same time, a group of 12 largest independent oil and gas producers in the United States reported a decrease in market capitalization below USD 90 billion compared to December USD 300 billion.

Due to the fact that most oil producers (including Russia and Saudi Arabia) currently sell at prices well below the budget break-even points, the market will eventually recover. However, before this happens, the pandemic must begin to show signs of extinction, or high-cost manufacturing companies from countries such as the United States and Brazil must begin a significant and long-awaited reduction. In addition, the long path to recovery in the Brent oil market towards the USD 50-60 range will be hampered by a sharp increase in world oil stocks. It will therefore be necessary to reduce them.

Regarding the energy market, we are convinced that a significant reduction in US oil production from shale in the coming months may lead to the long-awaited reduction in related natural gas production. An increase in production, mild winter in the northern hemisphere, and a decline in activity due to the virus have contributed to a strong reduction in world gas prices. In March in the United States they fell to the lowest level in 25 years. Depending on the speed of stopping production, gas prices may rise above the levels currently presented on the forward contracts market.

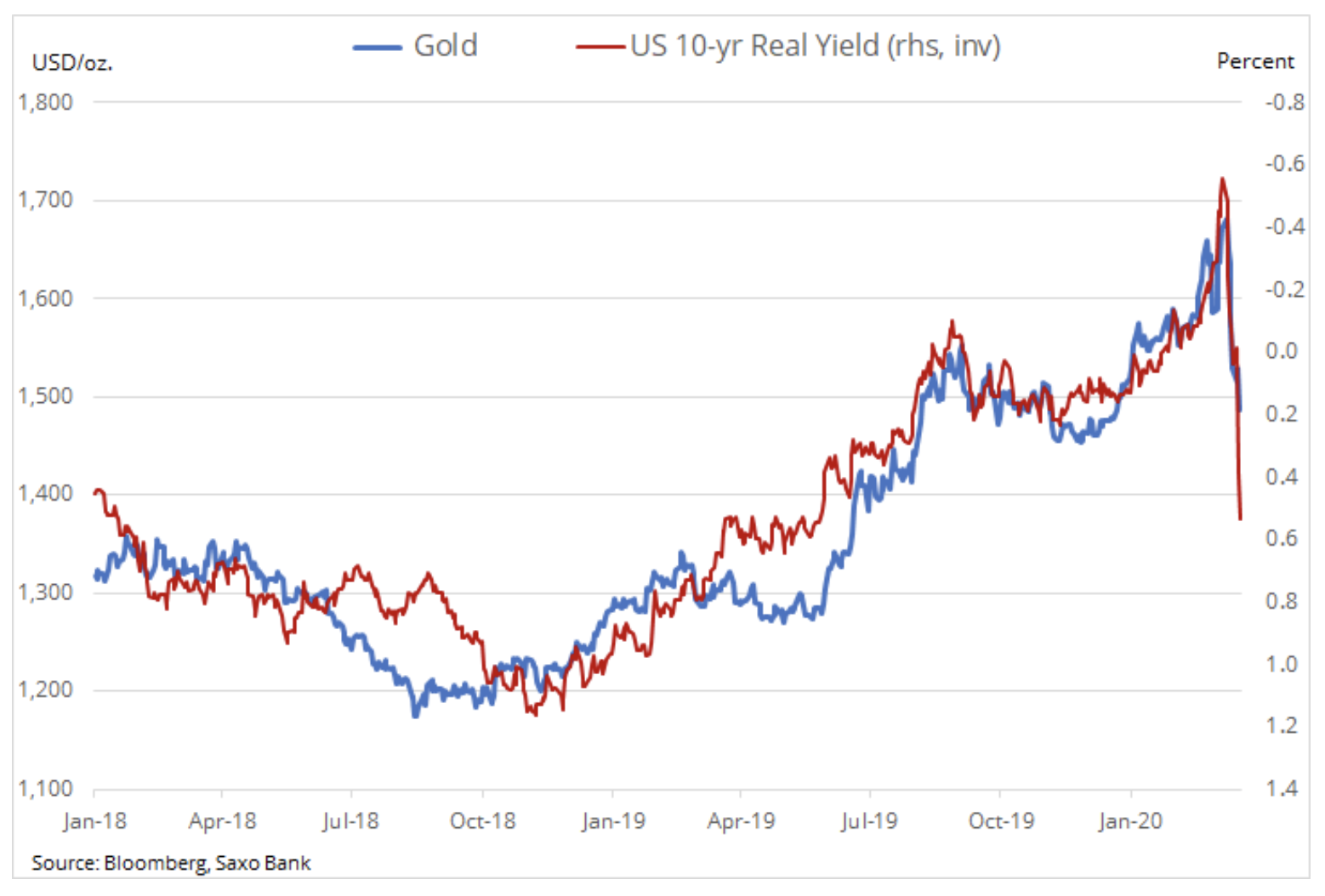

Inability gold to take on the bull market as COVID-19 spreads and economic uncertainty increases, it resembles the 2008 situation. In the early phase of the global financial crisis, all assets were sold out, as investors carried out deleveraging to withdraw cash or cover other losses. In the initial weeks of the crisis, there was a sell-off of gold by 27% to the level of 725 USD / oz, after which the growth finally ended at the level of 1 920 USD / oz.

The bull market began in the mining stock market before reaching the gold itself, and by the time the stock market finally bounced back, the next few months passed. Therefore, we are closely observing gold mining companies through the Vaneck Major Gold Miners fund (ticker: GDX: arcx). You should also remember about the sharp decrease in the cost of fuel, which is responsible for 20% of the cost of extraction. Therefore, at least for now, gold mining companies have not suffered as much as a drop in the price of gold would suggest.

We believe that long-term reasons for maintaining gold have even strengthened after recent events. Although official interest rates have gone down, corporate bond yields are rising. The collapse of transmission between central bank operations and global events may result in a significant fiscal and potentially inflationary response from world governments. The real yields of XNUMX-year US bonds - another important factor shaping gold prices - have gone up strongly in response to a significant reduction in inflation expectations. We believe that this move is not long-term and that real yields will eventually return to negative regions.

The aggressive sell-off of crude oil did not help gold. The Russian central bank has been buying in gold intensively in recent years. It is now over, and depending on when the oil market revives, Russia may become a net seller. Ultimately, it will have to cover oil shortages, which fell below the budget break-even point around USD 40 / b.

The fall in the price of silver in March to the lowest level in 11 years meant that the value of this metal relative to gold decreased by over 50% compared to the five-year average. Insufficient liquidity contributes to a significant loss to survive the aggressive pursuit of cash and its correlation with economic growth. When the market stabilizes, we see the potential for strong recovery due to the fact that traders will focus on the relatively low price of this metal in relation to gold.

Copper HG, which started this year with a small supply deficit forecast, finally beat the key support of 2,50 USD / lb. However, given the projected aggressive fiscal measures and the potential risk for supply caused by virus-related interference, in our opinion the risk is upward in the second quarter.

All Saxo Bank forecasts for download at this address

source: Ole Hansen, head of department of commodity markets strategy, Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response