SyncTrading - Double profit of our suppliers [TEST # 5]

Another week of testing the SyncTrading platform from TeleTrade is behind us. The volatility in the markets was great. Although the moods did not spoil (no clear trend), our traders felt quite comfortable in such an environment. This is evidenced by the results we will present today.

In fact, the presidential election in the United States was the main topic, absorbing all the attention of the markets recently. The result was ambiguous and so obvious, so no one is surprised that the stock markets reacted with mixed moods and the lack of a specific trend. The direction of the markets (extremely optimistic) was imposed by the news of the vaccine. "Pfizer's Invention" - because that is what it can now be called, it is not synonymous with getting rid of COVID-19 from the economic situation. Nevertheless, this information gives a clear signal that all news regarding the development of methods / drugs for the coronavirus will be very enthusiastically received by the market. With this analytical reflection, we will finish the discussion of the market situation and come directly to the observation of our traders' games recently.

Check it out: What is SyncTrading TeleTrade and copy trading

Making up for losses

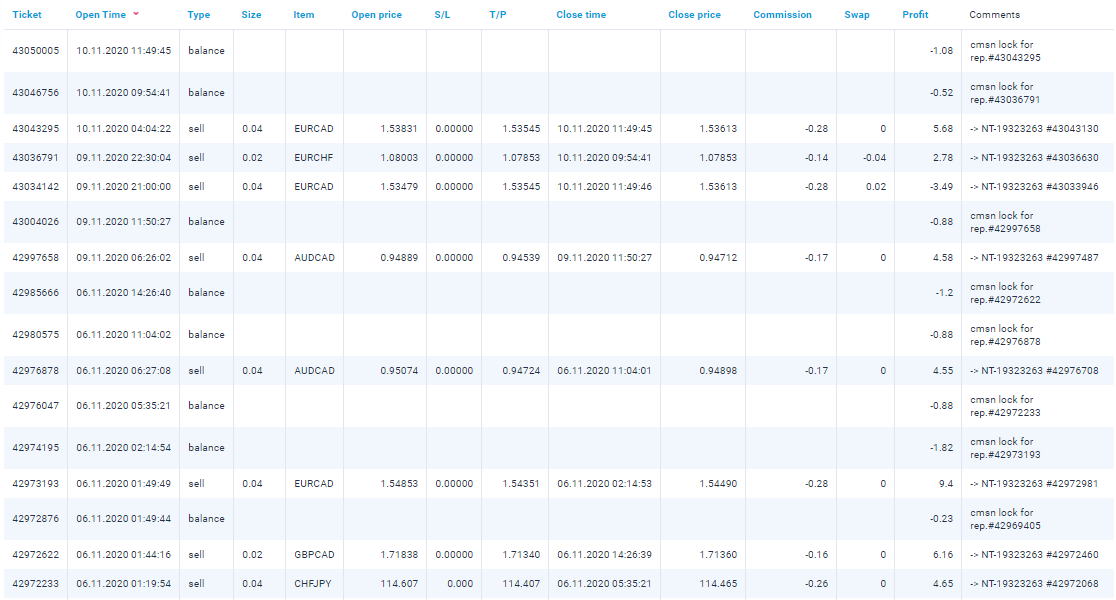

Our safe trader, whose copying level we decided to increase in one of the weeks, turned out to be the most risky “asset” in our portfolio. Nevertheless, observing his trading recently (the last two weeks), it can be said that it returns to form and, importantly, trades in a similar way, in which we decided to copy it.

Is that a good sign? On the one hand, yes. We hope that it will make up for at least some of the generated losses. On the other hand, however, we must bear in mind a possible repetition. However, based on the assumptions of our test, we will not change the trader yet. Our plan is to test the potential of social trading in the long term. Below is a list of the trades that the trader made last.

Comparing them to the first, our summaries, we can see that the strategy for the trading instruments themselves has not changed. ASProfiway he trades the same currency pairs all the time and the size of his positions (including double copying) remains at the normal level.

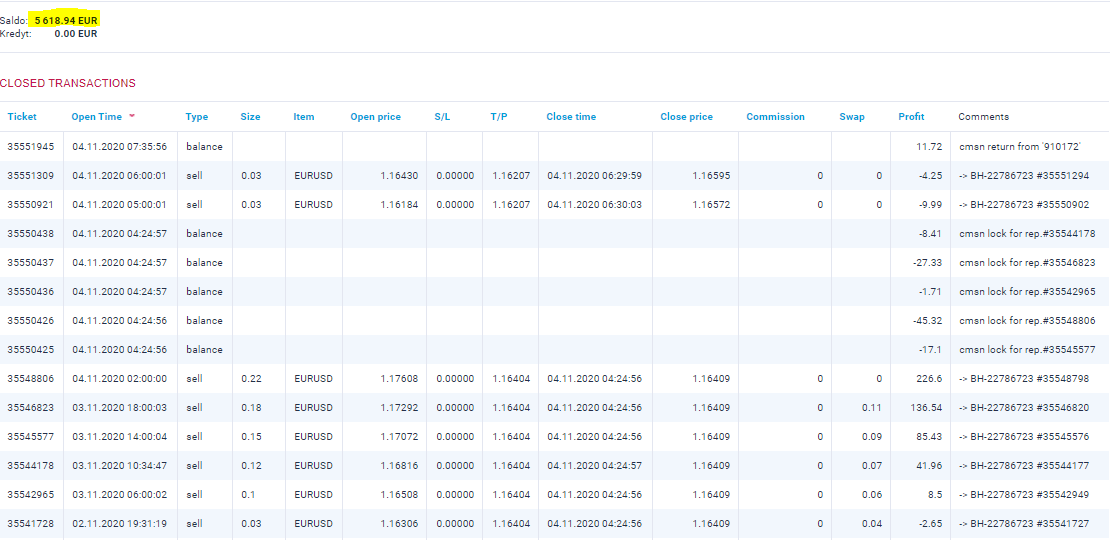

Quick profit and… vacation

Now let's move on to a quick overview of the medium risk trader. The result that we can present is pretty good. Thanks copying PipFX we earned over 600 EUR. According to the first entry, we know that it uses minimalist the grid strategy. Let's see what the positions he concluded last week look like.

Interestingly, after earning a few percent of the account, the trader decided not to place any more positions. This, of course, has its logical justification. Some traders, after obtaining a satisfactory rate of return, simply withdraw from the market in order not to get carried away by greed.

Does the risk pay off?

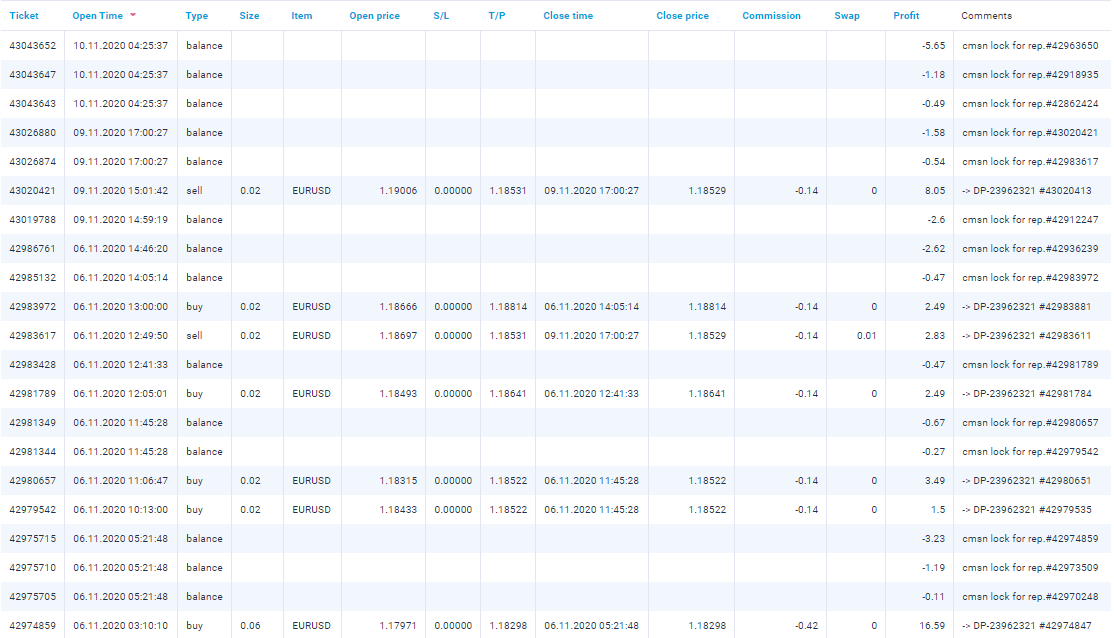

We waited for a very long time for the movements of the risky trader. In the first summary of our test, it didn't close a single trade, which made us a little bit hopeless about seeing a risky trade. Our “employee” with the most risky profile did not disappoint and in the last summary he turned to a very high rate of return, thus covering the loss generated by a safe trader.

Above are both open and closed transactions. Importantly, he did not rest on his laurels and decided to continue to be active in trade. So far, he has not made "strange" transactions on his account that deviated from a certain commercial standard FXC40he worked out. It continues to trade in a similar fashion to the test start.

Summation

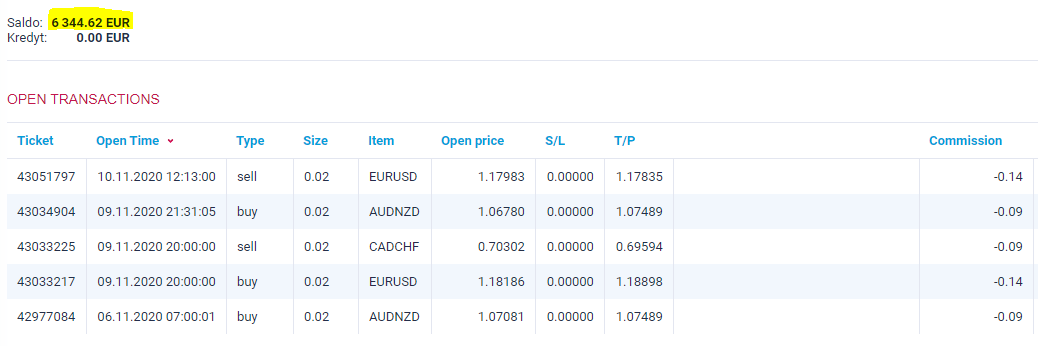

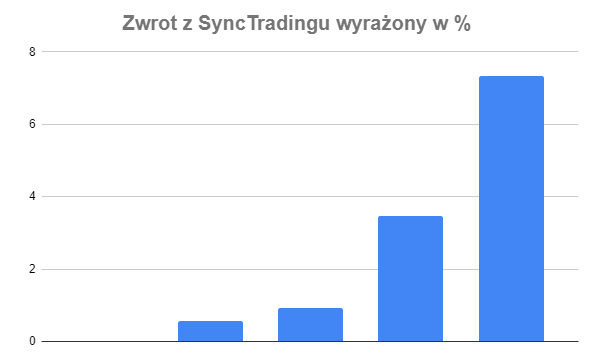

Currently, the situation on our accounts is as follows:

- Safe trader: 4136,23 €

- Moderate trader: 5618,94 €

- Aggressive trader: 6344,62

- Rate of return since test start: + 7,33 %

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![SyncTrading - Double profit of our suppliers [TEST # 5] synctrading teletrade test 6](https://forexclub.pl/wp-content/uploads/2020/11/synctrading-teletrade-test-6.jpg?v=1605086705)

![SyncTrading - Double profit of our suppliers [TEST # 5] macd oscillator](https://forexclub.pl/wp-content/uploads/2020/11/macd-oscillator-102x65.jpg?v=1605023367)

![SyncTrading - Double profit of our suppliers [TEST # 5] REIT - real estate investment trust](https://forexclub.pl/wp-content/uploads/2020/11/REIT-real-estate-investment-trust-102x65.jpg?v=1605255279)

Leave a Response