Artificial intelligence warms up investors. Worse results of American companies

In the past week, there was a lot of nervousness among global investors. Growth sessions on global stock exchanges were intertwined with falls, but the overall balance of the whole week should be described as negative.

The market is beginning to favor members' attitudes Federal Reserve and he estimates the end of the cycle of interest rate increases in the second quarter of this year as the baseline scenario. at a level exceeding 5.00%. The hawkish statements of policy makers in the US last week confirm the high probability of such a development.

In recent days, investors have been warming up about artificial intelligence, which has become the subject of press conferences of giants from the technology industry. The attention of financial market participants was also focused on the publication by American companies of subsequent financial reports for the fourth quarter of last year.

Investor nervousness

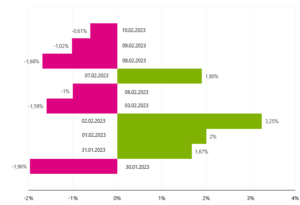

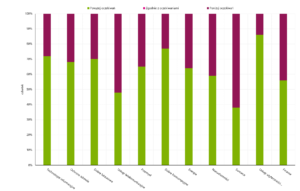

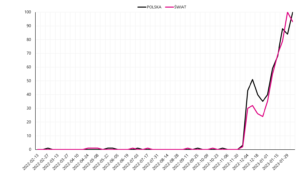

The volatility of global stock indices in the last week shows that investors are very nervous. The best reflection of the current sentiment is the streak recorded by the American Nasdaq Composite index. During 9 consecutive sessions, the daily rate of return each time exceeded the level of +/- 1%, and the series was broken only on Friday, when the index lost 0.61%.

W.1 Index return rates Nasdaq Composite during the last 10 trading sessions. Source: own study, Stooq.pl

Last week, the Tuesday session poured the most hope into the hearts of investors, but as it turned out later, these were "good beginnings of bad things". The Nasdaq Composite index recorded a loss of 5% over 2.41 sessions. The S&P 500 index fared slightly better, with a rate of return of -1.11%. However, there was no lack of positive accents on the global stock exchanges. Behavior is definitely one of them 100 FTSE, which climbed to an all-time high, improving last week's record.

All of a sudden, European stock exchanges have become one of the driving forces behind the growth of indices in the world. Limiting the basic threats to the economy became a catalyst for a rebound in stock prices on European stock exchanges. During the winter, the main risk for Europe was the escalation of the energy crisis. The mild winter as well as the securing and replacement of gas supplies from Russia helped to avoid the most negative scenario and ensured a return to relative balance. This is reflected in the relative strength of European indices, which, however, cannot count the last week as successful.

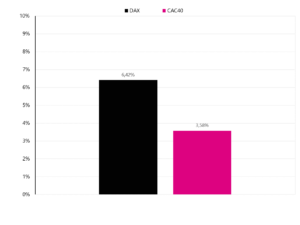

Apart from the FTSE 100, which recorded a cosmetic increase (0.13%), the other major European indices ended the week in the red. The losses incurred were not significant and amounted to 40% for the French CAC1.44 and 1.09% for the German DAX, respectively. Underlining the strength of both European stock exchanges in recent weeks is the fact that historical index records are within reach.

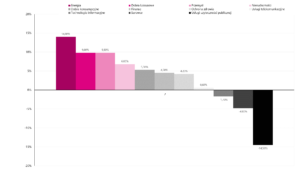

W.3 The scale of growth necessary for the indices to reach record values CAC40 i DAX. Source: own study, Stooq.pl

In other parts of the globe, sentiment has also deteriorated. The reversal of the short-term trend in currency pairs linked to the US dollar translated into a downturn in emerging markets. Last week, the Chinese Shanghai Composite index fell by 0.08%, Hang Seng down by 2.17%, India's Sensex down 0.26%, and Brazil's Bovespa down 0.41% Optimism has also "evaporated" from the local market. among others amid concerns about the escalation of the war in Ukraine, the index of the 20 largest companies recorded a decrease of 3.05%. Slightly better were the indices of small and medium caps, which lost 1.06% and 0.99%, respectively.

The cycle of increases will last longer

The market attitude regarding the cycle of interest rate increases in the US is evolving in the direction of Fed members' indications. During Tuesday's speech, Jerome Powell once again emphasized that the road to the inflation target will be long and bumpy. At the same time, the Fed chairman confirmed that further interest rate hikes and maintaining restrictive monetary policy in the longer term would be appropriate. Powell said that if the labor market remains strong and inflation remains high, the Fed will be forced to react and increase interest rates more than expected. Powell's tone was softened by words about the already started process of disinflation, which was positively interpreted by the financial market.

The somewhat hawkish overtones of Powell's words are also in line with the statements of other members of the Federal Reserve. John Williams stated that the Fed still has some work to do until interest rates are at the right level. Christopher Waller spoke in the same spirit, emphasizing that a strong labor market can provide fuel that will prevent inflation from falling at the pace that everyone expects. In turn, Neel Kashkari noted that the actions of the central bank so far have not had a major impact on the labor market and although there is evidence that the steps taken bring the expected results, the Fed should raise the target interest rate to 5.40%.

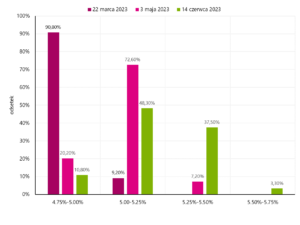

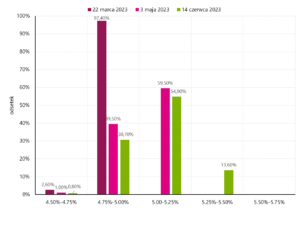

The futures interest rate market indicates a gradual adjustment to the direction set by the Federal Reserve. Immediately after the last Fed meeting, the market was pricing in only one interest rate hike and the end of the cycle in March. Currently, expectations are changing and the baseline scenario assumes that interest rates will be above 5.00%, and the date of the last increase will be delayed. Just a week ago, the probability of an increase in rates in June to 5.25%-5.50% was negligible (13.60%), and now the chances of such a move have increased to 37.50%.

Artificial intelligence warms up investors

In recent days, investors have been hot on the subject of artificial intelligence. Companies from this segment have become known to many people due to the extraordinary popularity of ChatGPT. ChatGPT is an artificial intelligence system created by OpenAI, the purpose of which is to create answers to received questions. The solution uses artificial intelligence and machine learning to process and generate text in a human-like language.

The scale of popularity Chat GPT best reflect searches by users around the world. Browsing through social media, you can come across test use of the system and verification of possibilities in a variety of topics, ranging from writing poems, essays to inquiries about forecasts for the economy or prospects for financial markets in the world.

There was a fever of searching for companies involved in this area on the stock exchanges, and the shares of companies related to the subject of artificial intelligence were characterized by above-average price movements. Last week we had to deal with several important events in this area, in which the largest American technology concerns were involved. Microsoft has been developing its cooperation with OpenAI for many months in order to accelerate the development of artificial intelligence and its use in general use.

At a press conference, the technology company announced that the Bing search engine and Edge browser will soon be integrated with the improved version of ChatGPT, which will significantly improve the functionality of both solutions. The update will enable a new type of search, and in addition, a chat mode will be available that will allow for advanced interaction. The excitement of investors translated into increased interest in Microsoft shares, which closed the session after the press conference at the highest level in several months, noting an increase of over 4%.

Google has also joined the battle for primacy in the field of artificial intelligence. The global search engine leader with a market share of more than 80% unveiled an artificial intelligence service called Bard on Wednesday. The system is to use real-time information to provide high-quality answers based on the latest news in the search engine. The company, presenting the possibilities of its new solution, has made a video available. As it turned out, Bard gave the wrong answer to a question about new discoveries from the James Webb Space Telescope. This situation raises questions about the scale of imperfections of the presented solutions. Sensitivity to published information shows the behavior of Alphabet shares. The company recorded a decrease of over 7% in one session, which allows for the interpretation that this week Microsoft emerged unscathed from the fight in the field of artificial intelligence.

The topic of artificial intelligence will indisputably be one of the elements driving the development of technology in the world. The involvement of the largest global technology companies shows the importance of this topic, while at the same time being a signal to investors that it is worth observing achievements in this area. The use of artificial intelligence will be widespread in many industries, and the number of companies intermediating in its development will grow. Suffice it to say that the Chinese giant Baidu also informed about the approaching end of tests of an artificial intelligence project similar to ChatGPT.

Worse results of American companies

The earnings season of American companies for the fourth quarter of 2022 is already halfway through, and the reports published so far allow us to draw the first conclusions. Last week, such companies as Walt Disney, Uber Technologies, PayPal Holdings, Philip Morris International and Philip Morris International published their financial statements for the previous quarter. PepsiCo.

Most signals indicate that the current earnings season will be somewhat disappointing. For the first time since Q2020 500, companies from the S&P 70 index will be characterized by negative profit dynamics year on year. Data from nearly 4.90% of the companies included in the index signal a 2022% decrease in profit. There are very large disproportions in the results among the sectors identified in the index. At the top of the list are energy companies, which in 57.70 benefited from a very good economic situation, which translated into an increase in profits in the last quarter by as much as 36.80%. Undoubtedly, the dynamics of improving the results of industrial companies (XNUMX%) should also satisfy the biggest malcontents.

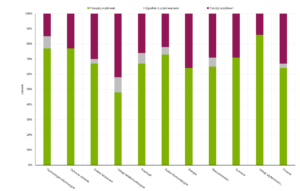

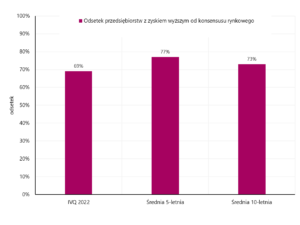

At the end of the ranking, there are three industries for which the decline in profits exceeded the level of 20%. The weakest sector in Q2022 23.80 was the telecommunications industry (-23.60%). Companies from the commodities segment (-22.00%) and luxury goods (-1%) did not much better. Another negative symptom during the current earnings season is the percentage of companies that beat expectations in terms of earnings per share. So far, 69% of companies boast profits above market consensus, while the 5-year average is 77% and the 10-year figure is 73%.

The telecommunications sector is characterized by the highest level of negative surprises, where nearly 50% of companies generated a profit lower than market expectations. Compared to the entire index, the energy sector (36% of companies posted a profit below the market consensus) and the financial sector (33%) perform relatively poorly. On the other hand, the situation in the utility sector looks very positive, where 86% of enterprises have so far achieved a result exceeding expectations. A high percentage of positive surprises is also found in the health care sector (77%) and information technology (77%).

W.10 Percentage of companies in individual industries with a result exceeding expectations. Source: own study, FactSet

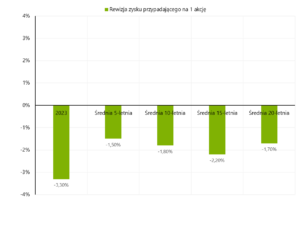

Market fears, however, may primarily arise from expectations regarding the future. The high probability of an economic slowdown or even a recession in the American economy means that the current estimates of profits for the coming quarters are subject to revision. In January, analysts revised their earnings expectations for S&P 3.30 companies down by 500% from their predictions a month ago. Taking into account the scale of historical revisions in the first months of the quarter, these data may raise concerns. The earnings per share adjustment exceeds the average over the horizon, 5, 10, 15 and 20 years.

W.11 Profit revision scale for companies included in the index S & P 500. Source: own study, FactSet

The leader of the ranking of negative revisions are the sectors: industrial and energy, for which the estimates of profits were lowered by 6.90% and 6.70%, respectively. At the opposite extreme were utility companies, where forecasts improved (increase by 2.30%). The reduction of profit in the horizon of the entire 2023 may also be worrying. For the current year, analysts assume that corporate profits will increase by 2.50%, and according to predictions, the situation will improve from quarter to quarter. In the first half of 2023, a continuation of the negative trend and a further decrease in profits by 5.10% and 3.30% should be expected. In the second half of the year, the financial situation of the companies will be better, which will cause the companies' profits to start accelerating and will be characterized by dynamics of 3.40% and 10.10% in the XNUMXrd and XNUMXth quarter.

The situation is slightly different in the case of revenues, which are still in an upward trend. The dynamics in the fourth quarter was at the level of 4.60%. However, many companies disappointed analysts, as evidenced by the percentage of positive surprises (5%) lower than the 69-year average (63%). Among the industries characterized by the highest level of positive surprises, there is primarily the utility sector (86%) and the consumer goods industry (77%). The biggest disappointment in terms of revenues turned out to be the results of commodity companies (62% of companies published results below expectations).

W.12 Percentage of companies in individual industries with revenues exceeding expectations. Source: own study, FactSet

Expectations often differ from reality, but the measure that better highlights the situation in individual sectors is the dynamics of revenues. Compared to last year, out of the 11 industries included in the S&P 500 index, 8 can boast an increase in revenues.

W.13 Dynamics of revenues of companies in individual industries in the fourth quarter of 2022. Source: own study, FactSet

A two-digit scale of revenue growth was achieved only by companies from the energy sector (14.00%). On the podium, and at the same time nearly 10% of the threshold, were also companies from the luxury goods sector (9.80%) and industrial companies (9.80%). A definite outsider in the ranking are companies from the utility industry, which recorded a decrease in revenues in the fourth quarter of 2022 of up to 14.50%.

Summation

Last week did not contribute to a radical change in market sentiment. Most of the indices oscillated around the levels of the previous days, however, with the passage of time, the moods deteriorated. The British FTSE 100 deserves a special mention, as it climbed to an all-time high on Thursday. Further increases in indices were hampered by the adjustment of market expectations to a slightly more restrictive view on monetary policy by the Federal Reserve. On the stock exchanges, one can see the symptoms of a new trend and investors placing high hopes in sectors related to artificial intelligence. The growing popularity of companies involved in this area is related to the success and development of the ChatGPT system.

You also can't go past the ongoing results season. So far, the published reports are disappointing in holistic terms, but analysts assume that the situation in companies will improve in the second half of the year. To a large extent, the economic situation on the global stock exchanges will depend on whether expectations are met in reality.

Source: Piotr Langner, WealthSeed Investment Advisor

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response