Thomas Rowe Price – the father of growth investing

Thomas Rowe Price Jr. is one of the most famous investors in the history of the United States. Over 80 years ago, he founded a well-known investment company listed in the United States - T. Rowe Price. He is also considered the father of investing in growth companies. In today's article, we will briefly introduce the story of this investor and his company. We invite you to read.

Youth

Thomas Rowe Price was born on March 16, 1898 in Glyndon, Maryland. The village was located near Baltimore, which was the main industrial and service center in the area. The Price family was quite wealthy. The father of the hero of the article was a surgeon who graduated in medicine from the University of Maryland School of Medicine. His knowledge made him the most respected surgeon in Glyndon and the surrounding area. This ensured high profits that allowed the family to maintain a high standard of living. Thomas Rowe Proce Jr.'s mum she was the daughter of a well-known construction company owner, Samuel Black, who operated in Baltimore. The mother was also related to S. Duncan Black, who was one of the founders of the Black & Decer factory. Young Thomas was therefore provided with the conditions for development.

Chemist on Wall Street

Price attended Glyndon School before continuing his education at Faranklin High School in Reisterstown. He graduated in chemistry from Swarthmore College in 1919. While studying for college was a member of the Delta Upsilon Society (6th oldest organization of this type in the US). This is one of the associations whose members often find careers on Wall Street. However, our hero was initially not interested in the financial market. He wanted to find an interesting job in the profession.

1927 our hero married Eleanor Baily Gherky, whose father was William D. Gherky. He was an inventor who worked for Thomas Alva Edison for many years. He was responsible for the electrification of major cities in the United States

Thomas Rowe Price. Source: trowprice.com

Initially, as an adept of chemistry, Thomas Rowe Proce Jr. tried his hand at the DuPont chemical company. Very quickly he realized that he was more interested in finance than in scientific research. He decided to try his hand at it "WallStreet". It was hard for him to break through at first. The most famous companies preferred to employ people with the appropriate education instead of "chemist", but eventually he managed to find a job with less significant brokers. Thomas Rowe Price was initially a salesman for several brokerage firms. He recommended stocks to his clients. Over time, he preferred to focus on investment management. Over time, Thomas gained experience in trading. After 10 years of working in three different companies, he shaped his investment vision.

In the mid-30s, Thomas was head of investment at MacKubin Legg and Co. (predecessor of Legg Mason). It was then that an altercation with his teammates took place. The more conservative part of the team preferred to invest based on value investing. Price, on the other hand, preferred to invest in growth companies. Finally, Thomas Rowe Price Jr. decided to leave the company. Together with three employees of MacKubin Legg and Co, he founded T. Rowe Price and Associates. The company was established in 1937. T Rowe Price Jr. he was 39 at the time.

Views on investment and asset management

Price wanted to create a company that would invest in growing companies. At the same time, he tried to come up with a bonus system that would be fair for the client on the one hand, and profitable for the company on the other. Thomas decided that charging a commission on sales was unethical. This was due to the fact that customers paid for the purchase of an investment product regardless of the investment horizon and the fund's performance. Price opted for the so-called compensation system. It was based on an anniversary fee which depends on the size of the assets.

His company was small at first. It employed 5 people and focused on providing investment advice to individual investors. The investment strategy was based on looking for growth companies with very good prospects. For this reason, it is considered "father of investing in growth". As you can see, the concept of investing in growth companies is nothing new.

However, height alone is not everything. TR Price himself believed that an investor could earn very good money by investing in very well managed companies. It was also important that a competent management board be found in companies that can grow faster than inflation. The increase in the scale of business, combined with good returns on invested capital, were to provide the investor with very good profits.

That meant it was important to Price as well the business model was good and the micro and macro environment was favourable. Another significant factor was in-depth analysis of companies and making a selection of potential investments. Only then should a diversified portfolio be constructed. According to Price, diversification was to ensure that losses were minimized in the event of a mistake. So it was a different approach from the case Buffett or Munger.

Additional issues related to the approach to investment

Currently, Price's views on investing are not shocking. However, it is worth looking at what it looked like several decades ago. Back then it was very fashionable to invest in value the way he saw it Benjamin Graham. At that time, they were looking for "butts", i.e. companies valued significantly below their book value. Sometimes companies were worth more "dead" than their market capitalization (i.e. the value of liquid net assets was higher than the company's market capitalization).

Investing in value was treated as buying cheap companies. Investing in growth has not been very popular. It was therefore a niche approach that flourished many years later. Price's investment philosophy was significantly different from its time. At that time, thinking about companies as “cyclical assets”.

His search for growth companies and search for companies in the category "dividend growth" later found many imitators. Thomas Rowe Price Jr. was one of the characters in John Train's book "The Money Masters". He was praised for his consistency and common sense approach to investment. He was not an investor who blindly followed fashion. Instead, he was looking for companies with great prospects and competent boards that could take advantage of it.

T. Rowe Price was able to adapt to the changing reality. In 1969, the New Era fund debuted, which was one of the first funds investing in gold and companies from the energy and petrochemical industriesj. The fund was to prepare investors for the coming era of inflation. Our hero could not have foreseen that the Bretton Woods System would collapse soon after. Instead, he saw that high inflation was inevitable because of the large supply of dollars.

Thomas Rowe Price Jr. managed client funds for almost 30 years. He sold his interest in the company in 1966 and retired in 1971. In 1970, Price decided to sell the company and focus on managing the portfolio of his family and closest friends. He believed that in the coming times he would not have enough time to keep an eye on both the company and the assets of those closest to him. He was right. There was stagflation in the 70s. One of the most difficult periods for many investors on the American market. Although T. Rowe Price finished managing investments in the company he founded in 1971, he continued to invest until his death. He died at the age of 85.

Sample Transactions by T. Rowe Price

Over time, the company's activities have expanded significantly. In 1950, the first fund was established: the T. Rowe Proce Growth Stock Fund. It was an investment vehicle that allowed for long-term investment. The introduction of this investment product to the offer coincided with the great boom that began in 1949. One of the first companies T. Rowe Price acquired was stocks IBM (International Business Machines). $1000 invested in the company in 1950 would generate a profit of $22,8. $ until 1972.

In 1960, the New Horizons Fund debuted. His goal was long-term investing in small companies with high growth potential. One of the fund's first transactions was an acquisition Xerox Corp.which then changed its name from Haloid Corporation. Xerox also turned out to be a great investment. It was a company that dynamically increased its scale of operations. This translated into higher revenues and profits. In the long term, this translated into a higher valuation of the company. Another company Price acquired during this time was Boeing. The company benefited from the development of air passenger transport and the increase in orders from the military. Price's story is an example that you can also earn money on already large companies that have a dominant position in prospective markets.

However, it is worth remembering that not all transactions were successful. As I mentioned:

"I've made more mistakes than anyone else."

Price, however, was a person who was able to admit mistakes and make appropriate adjustments in the investment strategy. This allowed us to avoid even greater losses in the future. His favorite sayings were the following:

“I cannot predict how the market will behave”

and

“Change is the investor's only certainty.”

T Rowe Price – the history of one of the most famous investment companies

Although the protagonist of the articles sold his shares in the company more than 50 years ago, it is the philosophy of the company that still operates according to the principles of the founder. The company continues to actively manage assets and tries to introduce funds to its offer that are to meet the expectations of even the most demanding customers.

Today, T. Rowe Price is one of the best-known asset management firms. In addition, the company also offers investment advisory services, wealth management and pension management.

From 1970 to 1990: first steps in foreign markets

After the departure of the founder, the company did not stop growing. T Rowe Price in the 70s opened a department dealing with investing in bonds and other debt securities. This was to diversify the company's activities.

Despite the period stagflation, the company has not stopped thinking about expansion. At that time, she opened her first overseas office to help increase assets under management. In 1979, T. Rowe Price formed a Joint Venture with a British asset management company Robert Fleming & Co. This joint venture was called Rowe Proce - Fleming International. Over the past 20 years, this company has significantly increased its scale of operations. In 2000, assets under the joint venture's management totaled $39 billion.

1986 was a very important date. Then T. Rowe Price went public on the stock exchange. The company was then valued at around $200 million. After its debut, the company returned to expansion, also geographically. Shortly after the IPO, an office was opened in Hong Kong, which was to develop operations in Asia and be “gateway to China”. Even then, the Middle Kingdom appeared to be one of the most promising places to invest in the world.

Since the 90s: one of the beneficiaries of globalization

In the 90s, T. Rowe Price entered the RPS (Retirement Plan Services) market. Further customer acquisition and the acquisition of promising companies (including USF&G) allowed for an increase in the value of assets under management to the level of USD 100 billion. The engine of development was abroad. In 1999, the investment company together with Sumitomo and Daiwa Securities established a partnership on the Japanese market. In the same year, the company bought back the shares in Rowe Price-Fleming International. The acquired company was renamed T. Rowe Price International. The dynamic development of the form meant that in 1999 T. Rowe Price joined the S&P 500 index.

The company gained fame in 2000. Back then, the company's funds had low exposure to technology companies. As a result, during the March 2000 crash, T. Rowe Price walked relatively dry.

Currently, T.Rowe Price continues to focus on active investing. This is against the current trend. At present, the market is developing dynamically passive investingwhere they lead ETFs. Despite this, the company introduced ETFs to its offer that imitate selected active strategies created by T. Rowe Price.

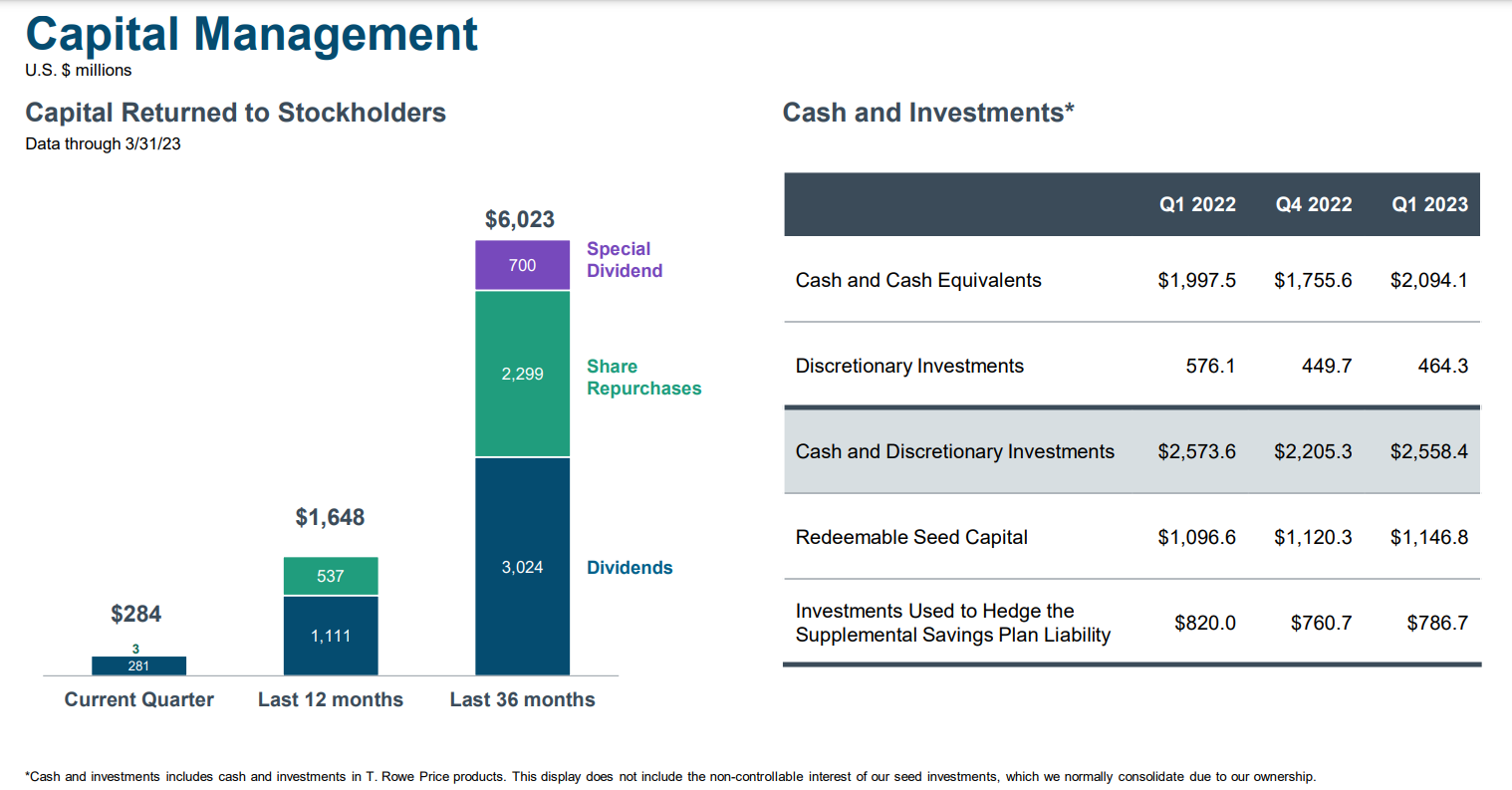

T. Rowe Price is a company that generates a lot of cash, which it spends on dividend payments and share buybacks. Over the past three years, they have returned over $3 billion to shareholders. For comparison, today's capitalization of the company is $ 6 billion.

Summation

Certainly T. Rowe Price Jr. is one of the most prominent figures in the history of the American capital market. He is the first known person to consistently invest in growth companies. It was an innovative approach that guaranteed a high rate of return for participants of funds managed by Price. Importantly, Price did not focus only on dry numbers, but tried to get to know the board in detail. He always wanted to know how the management board sees the future of the company and how it intends to realize its forecasts. According to today's hero, competent management is one of the most valuable assets of any enterprise.

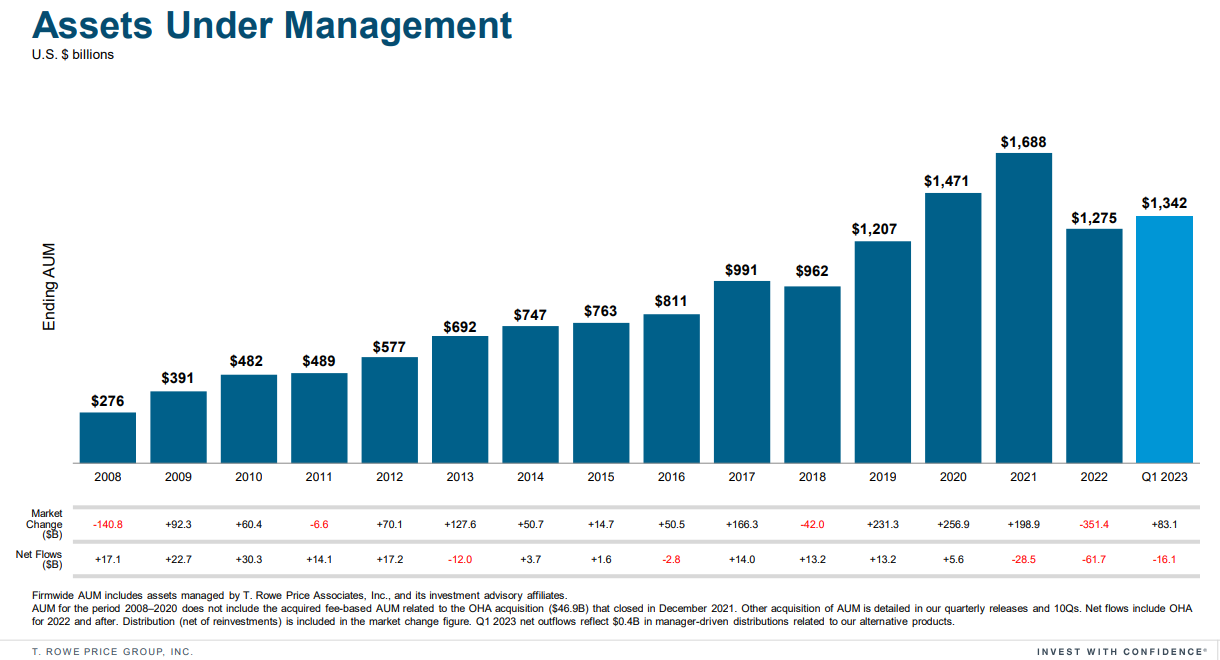

Although the company was sold by TR Price a long time ago, it still focuses on active management. Currently, assets under management amount to over $1 billion.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-300x200.jpg?v=1713870578)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-300x200.jpg?v=1709558918)

Leave a Response