Trader of the month, Mohammed, made a turn over in February for over 460% [Tickmill Contest]

Trader of the month - February 2018

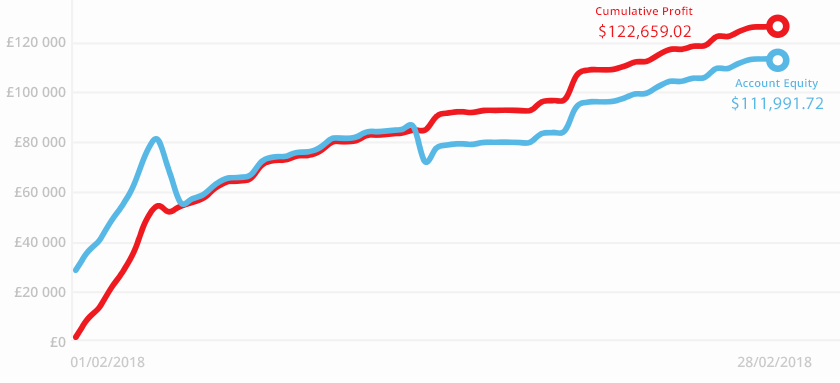

The best trader of the month February 2018 turned out to be Mohammed, generating a rate of return of 59% on 466 transactions. The surprisingly high effectiveness translated into the effect of £ 122,659.02 profit in the shortest month of the year. How did he do it? The trader tells about it in the interview below.

From September 2017, the broker will be able to select not one and two traders of the month, where each of them will receive an award of 1000 $

94,92% performance

There weren't many transactions, but it was the percentage of closed positions in the black that contributed to the spectacular result. 56 out of 59 transactions ended at a profit - an incredible precision. There were actually only two losing trades: 1) at -2293 GBP, 2) at -158 GBP. The third, missing transaction was closed in the black, but the final result was determined by the transaction costs, which exceeded the profit.

How did you deal with Mohammed? Looking at the account history, you can see that in his trading he used Limit pending orders and focused exclusively on currency pairs. The list includes majors such as EUR / USD, AUD / USD, USD / CAD or GBP / USD. The dominating group are the cross-pairs: NZD / CAD, AUD / NZD, AUD / CAD or AUD / JPY, despite the fact that it was the Eurodollar who recorded the biggest profit in the position that exceeded the 11 500 GBP.

It is difficult to estimate the risk taken by Mohammed due to the fact that the vast majority of items is not equipped with the Stop Loss parameter. Meanwhile, about half of them have a Take Profit set. Volume? From 1.0 flight to 10.0 flights, although the entire list is dominated by the value of 5.0 flights. Comparing this to the actions taken by the previous Traders of the Month and the capital held, Mohammed prefers the conservative use of financial leverage :-).

Transaction history in numbers:

- Profit: £ 122,659.02

- Return: 465.80%

- Total number of transactions: 59

- Profitable transactions: 94.92%

Statement trader (PDF)

Interview with a trader

How long have you been involved in trade?

I have been trading on the Forex market since 5 for years.

How did your adventure with Forex trading begin?

I started trading shares and options. After two years, I developed a non-directional, volatility-based strategy that was better suited to the Forex market.

What is your trading style?

I apply styles and strategies: medium-term swings, short-term scales, quant trading, fundamental and technical analysis, purely technical analysis and non-directional strategies based on volatility.

Do you have any risk management policies?

Risk management is essential for success. Bad Risk Management (RM) it will ruin even the best strategies while good RM can change medium strategies into ones that will generate impressive profits. If you do not learn to manage your risk, the margin call will do it for you (you can, of course, combine them together and divide the capital in such a way that the Margin Call level is the amount of risk and the rest of your capital is waiting for another account).

What good habits should investors be fooled about?

In addition to the general good habits necessary to succeed in every field (patience, perseverance and dedication), clever traders need to develop a good plan and the right way of thinking.

Plan: they understand the nature of the market, identify the advantage on which they can focus, record their results (very important) and create a plan that they can do without departures and bending the rules.

Mindset: They take losses as part of the game, have confidence in their trading strategy and adhere to its rules flawlessly. They do not allow missing opportunities (normal with all strategies) to affect them, nor do they allow winning trades to make them feel euphoric and reckless (losing the sense of risk present).

Instead of focusing on earning a reward at every position, the wise trader is based on long-term, consistent action.

First of all, they know themselves (strengths and weaknesses, and use them to their advantage).

Describe your best / most-remembered transaction (How much did you earn? What strategy did you use? On which pair?)

I recorded my best transactions with GBP / USD immediately after a sudden drop in the rate caused by the Brexit referendum. I was expecting a large amplitude of fluctuations on this pair, deposited on the MT4 account the amount that I was willing to lose, and aggressively traded. The market confirmed my expectations for volatility and ended 3-trading with profit at 900 +% on the account.

What advice would you give to novice investors?

- Do not look for saints (EA),

- Learn the typical mistakes that new traders make (otherwise you will learn about them on your own skin).

- Only risk what you can lose.

- Trading on a small real account is better than trading a demo.

- Try to find something that will give you an advantage in the market, and at the same time fits your character.

- Work on your attitude - this is more important than your strategy.

- Instead of emotionally trying to win every trade, focus on consistency.

- Treat it like a business.

- Try to find a good mentor who can speed up your learning (look only for those with credible history and achievements, watch out for cheats).

Considering the current market situation, do you think that traders trading in macro / news trading data should keep an eye on it?

Anticipation of interest rate hikes in the United States may be taken into account by the market before the event in the price (buy a gossip, sell facts). I would suggest looking for good technical setups that complement fundamental foundations.

What is the most important thing you expect from a Broker?

Regulations, execution of orders, cost effectiveness, spreads, flexibility, customer service, payment / withdrawal rates, transparency and stability.

competition rules

The trader is selected by the Tickmill Jury. The win is not only determined by the rate of return - it is the total that matters. Overall, i.e. the factors such as earned profit, position management, risk and trading skills are taken into account. There is also one more necessary condition - interviewing the broker and consent to make the account history public. Only then does the prize of $ 1 go to the trader's investment account.

The principles introduced are aimed not only at showing that you can make money on the Forex market, but also consciously educate and encourage sharing experience with other traders.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Trader of the month, Mohammed, made a turn over in February for over 460% [Tickmill Contest] trader month tickmill](https://forexclub.pl/wp-content/uploads/2017/06/Zrzut-ekranu-2017-06-16-o-21.34.51-1000x654.png)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

![Trader of the month, Mohammed, made a turn over in February for over 460% [Tickmill Contest] xtb-cashback](https://forexclub.pl/wp-content/uploads/2018/03/xtbrabat-102x65.jpg)

![Trader of the month, Mohammed, made a turn over in February for over 460% [Tickmill Contest] steve ward forex](https://forexclub.pl/wp-content/uploads/2018/03/wardtrade-102x65.jpg)

Leave a Response