Currency summary of the week. The US wipes China out of its investment portfolio

The dollar's stability and strengthening in the market is not only the result of poor data from countries whose currencies are quoted in USD. Trump reliably supports quotations "secure" politics to secure his victory in the upcoming campaign. In fact, data from the Old Continent, published on Monday, do not improve sentiment on EUR or PLN. The worst situation (mainly on the PMI index of industry) concerns Germany and France. According to some analysts, the industry and services sector is beginning to experience recession. In relation to the above, what will the next quotations of key currencies on Forex look like?

ECB and no response

Immediately after the publication of Monday data course EUR / USD has significantly dropped to a key level of support. The forecasts expected stabilization of the PMI indicator for the German industry, within 44 points Previous readings indicated 43,5, and those on Monday were far from expected. 41,4 is one of the worst results recently. On Monday, the Dax index dived 150 points.

What does all this mean? European Central Bank? In general, Mario Draghi's speech did not cause much response on the market. In fact, the speech briefly repeated the last ECB meeting without adding anything new.

EUR / USD seems to be reaching a new record hole. The base currency of this pair successfully crossed the last (red) supply zone, stopping around 1,09240. This support is not the strongest, and the slight demand rebound quickly lost strength, which is additionally reported by large wicks of green candles.

Chart EUR / USD, H4 interval. Source: xNUMX XTB xStation

The period of economic problems in Germany is certainly not coming to an end. However, the indicator design allows for a quick assessment that the situation will not change in the near future. Since PMI is a kind of survey among entrepreneurs regarding orders, sales, etc., it's hard to expect that something will change drastically from month to month. Where to look "Collapse" German economy? Contrary to appearances, it is difficult to find the sector guilty of weak moods in the economy. The only industry that stands out is the pharmaceutical industry.

The poor situation of the neighbor will not have a positive impact on the Polish economy. August data were worrying. Part of the banking community announced on their basis "First alarms" slowdowns in the country.

Chinese soy duties

On the introduction of exemptions for companies buying American soy (in appropriate quantities) we have already written in the previous currency summary of the week. The Chinese government in recent communications confirmed initial reports on these solutions. The effects of these changes will certainly affect October trade talks. Tuesday's upbeat mood on Wall Street dropped slightly. On this day, Trump emphasized dissatisfaction with the actions of the other party to the conflict, while he did not foresee any exacerbation or pressure on China.

Pre-election fever

On Wednesday, the president of the US House of Representatives officially motioned to remove Trump from the presidency. This procedure provides for such a possibility as long as votes support the demand. The chances are therefore slim. In fact, the hype surrounding the candidacy of the current US head of state was already considered at the beginning of his presidency. This type of game is certainly not going to make his campaign any easier and will bring some confusion to the markets. The whole thing was about family ties in American politics with the mobilization of aid funds for Ukraine, in which one of the most important companies was the son of Joe Biden (former US vice president). What's the dollar for all this? It is gradually gaining strength, and Wall Street recorded a decline that day.

Chart USD / PLN, D1 interval. Source: xNUMX XTB xStation

Fluctuations in American politics weigh heavily on indexes, while the dollar is doing very well in the light of recent events. To buy this currency last week, we had to pay 4,00 PLN. For the time being, nothing indicates that its appreciation against the zloty should change. Writing about the poor situation of the zloty against the basket of leading global currencies, we marked the key resistance (currently support), which is at the 3.9965 level. It was broken last week and so far the course is above it.

Important data from Poland, potentially supporting the zloty exchange rate will be announced on Tuesday at 10: 00. Readings will relate to CPI inflation. The current forecasts do not predict large fluctuations, and the published data are generally expected to remain at readings similar to July.

Trade agreement signed

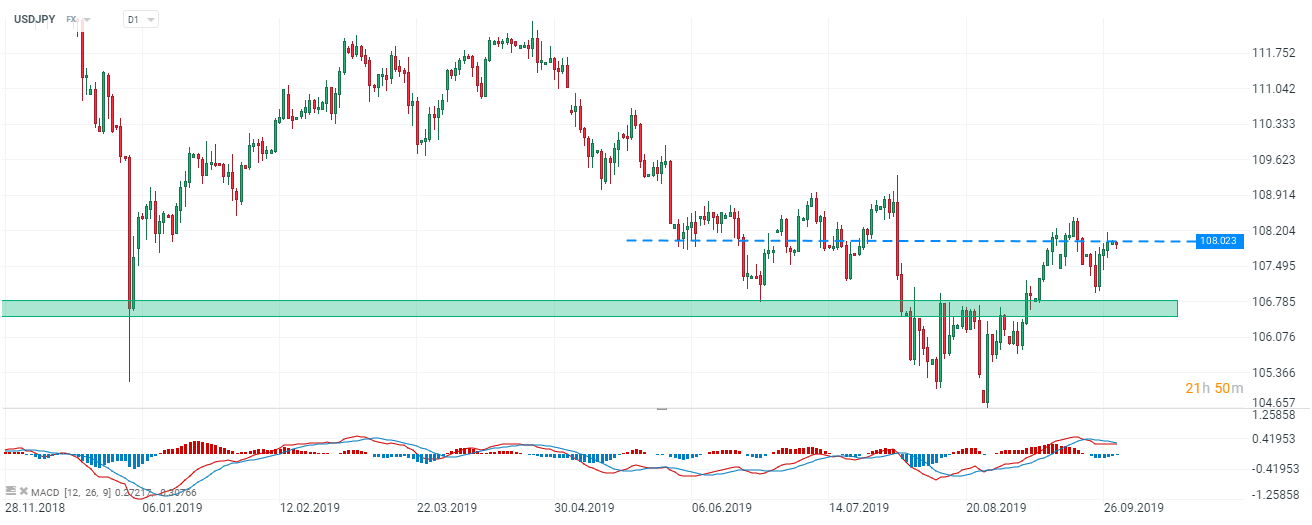

It is worth adding that one of the key events of last week was the signing of a trade agreement between the US and Japan. Strategically, Donald Trump's move was well received by a new partner who has been fighting stagnation in the economy for several months. Under the agreement, Japan undertook to abolish or significantly reduce tariffs on US agricultural goods. In return, the US is expected to reduce taxes on imports of machinery and equipment, for which orders according to recent eastern data fell by nearly 37% on an annual basis. However, the agreement does not cover the automotive industry in the United States. The Eastern partner is a significant recipient of goods in this branch of industry, but so far no reduction of tariffs in this category can be seen on the horizon.

Chart USD / JPY, D1 interval. Source: xNUMX XTB xStation

The rebuilt confidence in a favorable and peaceful settlement to the trade war (important talks ahead in October) has been shaken by Friday's speculation in the White House. Information was released to the media about alleged cuts in investment in China. More specifically, it refers to funds from US pension funds, which have a large exposure to eastern equity markets. For now, this information is treated briefly. If this turns out to be the actual Trump plan, we can see significant drops not only in the Emerging Markets indices, but also on the S & P500.

We are currently at key resistance on USD / JPY. Macroeconomic data from Japan regarding retail sales should appear soon. On Wednesday, however, we will know the readings of the consumer sentiment index.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

Leave a Response