The April Forex volume is not surprising. Markets at slower speeds.

Since the beginning of the year, we have been able to observe a significant improvement in market sentiment. Monthly results are not bad, although comparing them to those from last year does not look so optimistic. When reviewing publications presenting the volume from currency exchanges, a slight recession was recorded on a monthly basis. You can see that the saying about the stock market, regarding sales in May and the proverbial runoff also applies to the forex market and starts a month before. The results are not alarming or drastic lower (m / m). Nevertheless, the volatility in the market may be slightly smaller.

Be sure to read: The volume on the Forex market in March 2019

Fall on Euronext by 20%

According to the published Euronext data, in April the total volume was USD 352,5 billion. On a monthly basis, a decrease by 20,2% was recorded. Comparing the published data to the year 2018 from the same period, they are also not very optimistic. The total volume was 406,7 billion USD. Therefore, this translates into a drop of over 13%.

By converting the turnover achieved to average daily volume, it does not look good. The result that comes out of these calculations is less than 16 billion dollars. Comparing them with the same period in 2018 year, where daily turnover was at the level of 21 billion USD. We quickly count that in reality, in y / y terms, it decreased by 17,3%.

Interestingly, the lowest and highest turnover was recorded in Euronext exactly on the same days as for Cboe, the American Stock Exchange. The best April day turned out to be 24 April, where currency exchange took place at 22,2 billion USD. The worst one was 19.04 with the result of only 2,5 billion USD.

Be sure to read: Volatility on the Forex market is getting closer to the 5-year minimum

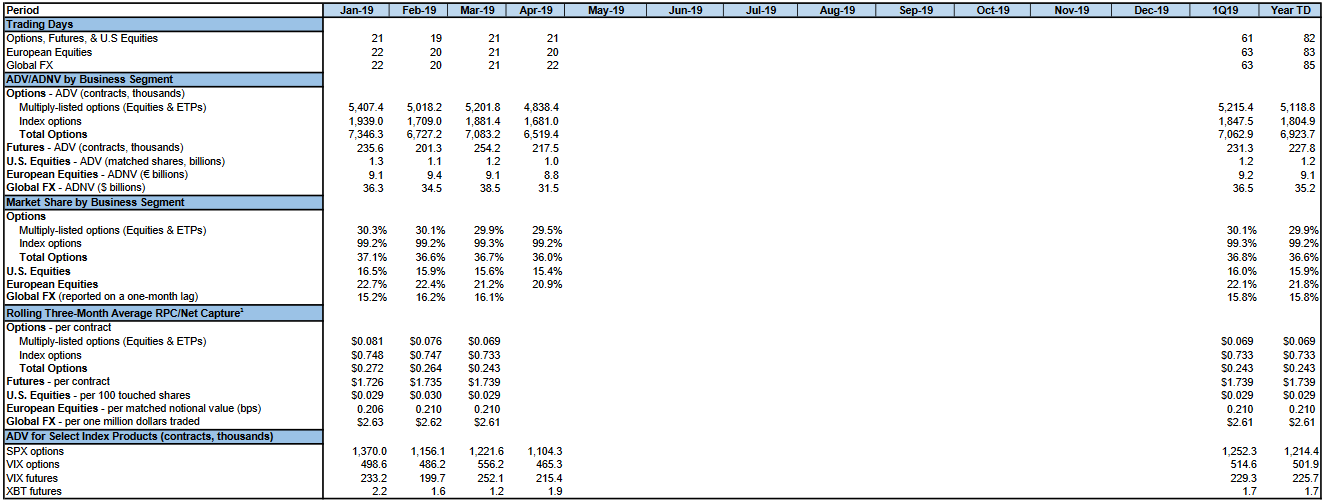

CBOE - Worst since August 2017

After good results in March this year, Cboe (the American stock exchange) published volumes of forex currency trading. Along with the April results, it revealed the lowest, monthly average daily volume (ADV). It has not been so bad since August 2017 year. Last month in the United States exchanges were made for the amount of 693,2 billion USD. In comparison to March, where the result was announced at 809,5 billion USD, the current is lower by 14,4%. In annual terms, however, regress was recorded around 9%. The bank was a very strong month in terms of turnover on the currency market. The best result was achieved then from October last year.

In April ADV (average daily volume) was 31,5 billion USD. Although this may seem like a solid number, it is actually the lowest monthly ADV since August 2017. Compared to the previous month, the average turnover from April is lower by 18,3 percent.

Big account activity

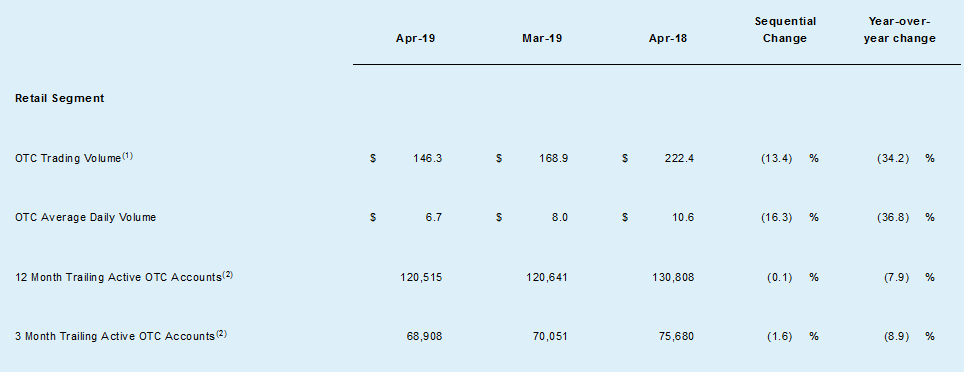

Finally, data from the GAIN Capital Holdings group. GAIN Capital retail customers have traded at 146 billion dollars in April 2019, It is 13% percentage drop compared to last month. The average daily group volume (ADV) was 6,7 billion USD. This means a fall of 16,3% on a monthly basis from 8 billion USD a day in March 2019. Compared to the same period in 2018, the turnover on the foreign exchange market decreased by 37%.

Despite the worse results, the number of active accounts has not changed drastically. Considering only the retail segment, the investors systematically trading on the forex market was 120 515. Compared to March, the drop was very small (from 120 641).

Summation

Weaker results related to currency exchange on the forex market may seem quite high in percentage terms. However, one must take into account the fact that March was a strong month in terms of volume. He noted the highest turnover since October. Therefore, their April "return to normal" could turn out to be a considerable and at the same time a negative surprise in light of volatility in the forex market. May in the light of the published data is to be a kind of stabilizer of current results and according to the forecasts of the majority of analysts, it should keep them at a similar level as we observed in April.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

Leave a Response