Everything about pending orders

Trading on the currency market takes place 24 hours a day, 5 days a week. With these parameters, it is unrealistic to follow the quotes all the time to catch the best time to trade or close. Pending orders come to our aid, thanks to which the problem is largely solved. Just enter the appropriate parameters on the platform and it's ready - you can turn off the computer, and then just "drink cream". Nevertheless, effective use of pending orders requires a certain amount of skill and experience, and above all, knowledge of how they work.

What types of pending orders are distinguished and how they are executed - this is what the article below is about.

How are pending orders executed?

Very often you can meet with the surprise of traders whose pending orders came to completion at courses other than they planned. What does this mean and why does it happen?

Well, the price entered in the order does not mean execution at the indicated rate. This is the activation level, i.e. the moment at which it is transferred for execution. When the order is activated, it is sent to the liquidity provider, where it is associated with the other party, and then we receive confirmation of execution - this is the case with ECN and STP brokers, with MM brokers, orders remain with the broker, but this does not exclude a slippage. In the event that the market experiences a sharp price movement and the liquidity is dispersed, it may happen that the trigger level of our order is automatically jumped or there is no other side for our position at the indicated price. Then the brokers make efforts to execute the transaction at the first possible and most favorable price for the client.

What are the price slips resulting from?

It looks a bit different in the case of Offer Bid and Offer Ask orders, which are available at the Dukascopy broker, however, more at the end of the article.

Bid price, Ask price

There are two types of prices on the Forex market - Bid is the lower price at which we sell. Ask is the higher price followed by the opening of long positions. These prices may change independently of each other depending on the orders flowing to the market. It means that even if the Bid is 1.3500 and Ask is 1.3502, even if the Bid does not change, the Ask may increase or decrease slightly due to orders flowing to the market.

Curiosity! It is true that very sporadically, but it happens that the Ask price is lower than the Bid price - then we deal with a negative spread (if they are only present at ECN brokers). A negative spread is due to the fact that liquidity is diffuse and. Unfortunately, I have to worry people who have already got the idea to make money on it. Negative spreads are so rare and so short that it is difficult to trade in such conditions, and when we add the broker's commission, unfortunately it will no longer be profitable.

Platforms and types of prices

Chart

On the MetaTrader 4 platform, the chart is drawn based on the Bid price, which is lower. If you want to see the current Ask price you should. Unfortunately, you can not see the historical Ask price.

On the JForex Dukascopy platform, you can choose at what price the graph should be displayed.

Activation level

On the MetaTrader 4 platform, the level of activation of pending orders is indicated only at the Bid price, so depending on the type of order, the spread value should be added here. This will be the case for every short position, i.e. sale.

READ NECESSARY: Review of the JForex 3 trading platform

On the JForex Dukascopy platform it is more comfortable and there is a possibility of choosing after exceeding the type of price the order will be activated.

Are there brokers guaranteeing the execution of orders?

Almost all brokers guarantee the execution of pending orders. However, another issue is to make it at the indicated price. Unfortunately, it is impossible, or rather possible, but not profitable. Imagine a situation where we place a pending order to buy at 1.35 while the market price is 1.3450. When the rate changes dynamically and a price gap arises, i.e. there is no transaction at the price from 1.3490 to 1.3510, our order can be executed only at the rate of 1.3510. If the broker would carry out the transaction at the price indicated by us, it would mean that he must contribute to the difference out of his own pocket.

Curiosity! Some brokers offer a performance guarantee service at a specified price for an additional fee. If we hear about something like that, it should immediately sharpen our vigilance and make us interested in exactly what conditions this guarantee is provided. It is often the case that it applies only in normal market conditions, i.e. in the case of price gaps, nothing will happen to us. Needless to say, such a solution approaches a robbery in broad daylight. In the end, it is mainly price gaps that cause slippage in the execution of orders.

Buy orders

We distinguish two main types of orders pending purchase. These are:

- Buy Limit,

- Buy Stop.

A limit order is used to buy a given stock after its price drops. For example, if the current market rate is 1.3500, and we believe that the price will go down to 1.3400 first and only then rise, then we set the Buy Limit at 1.3400.

We use the Stop order in a similar situation. When we want to buy a given instrument at a price higher than it is currently on the market. For example, the market price is 1.3500, and we believe that the rate will increase dynamically if it exceeds 1.3600. Therefore, we can set the Buy Stop to 1.3600 (or 1.3601 if you prefer) and wait.

Sales orders

We distinguish two main types of orders awaiting sales. These are:

- Sell Limit,

- Sell Stop.

In terms of sell orders, everything is the same as in the case of Buy Limit and Buy Stop. However, to consolidate it, it is worth writing about it again and supporting it with examples.

The Sell Limit order is used to sell (open a short position) a given security after its price increases. For example, if the current market rate is 1.3500, and we believe that the price will go up first, e.g. to 1.3600, and then it will drop, we set the Sell Limit at 1.3600.

We use the Stop Order when we want to sell (open a short position) a given instrument at a price lower than it is currently on the market. For example, the market price is 1.3500 and we believe the price will go down if it exceeds 1.3400. Therefore, we can set the Sell Stop to 1.3400 (or 1.3399 if you prefer) and wait.

Defense and profit orders

Stop Loss and Take Profit - surely each of you knows these terms. They are also types of pending orders that are executed in the same way. You can say that these are Buy and Sell Limit orders, but balancing with another position immediately after opening (more professionally speaking, a'la hedging + "Close by").

Trailing Stop this is not a pending order, but a mechanism based on a Stop Loss order, but in this article it will be explained immediately. In order for Trailing Stop to work, an enabled platform is most often required, because it moves on a regular basis after changing the course. The Stop Loss modifying order itself is active only on a given application and is not on the broker's server. Unlike the rest of the pending orders where the computer does not have to be turned on.

Other orders

Place Bid i Place Offer

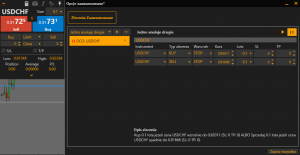

On some ECN platforms you can come across more unusual types of orders. This is the case, for example, on JForex Dukascopywhere jobs are available Place Bid and Place Offer. The pending orders discussed earlier, such as Buy / Sell Stop and Buy / Sell Limit, are not included in the order book. They are sent for execution only when the activation level is exceeded. Only then is the margin for these items blocked on our account. This is not the case for Place Bid and Place Offer orders. By placing such orders, we ourselves become liquidity providers, and the margin is blocked when Place Bid / Offer is set. The position can be opened only at the indicated price or not at all (then it is deleted). For some, this may be a great advantage, for others, this type of engagement will be less beneficial.

On some ECN platforms you can come across more unusual types of orders. This is the case, for example, on JForex Dukascopywhere jobs are available Place Bid and Place Offer. The pending orders discussed earlier, such as Buy / Sell Stop and Buy / Sell Limit, are not included in the order book. They are sent for execution only when the activation level is exceeded. Only then is the margin for these items blocked on our account. This is not the case for Place Bid and Place Offer orders. By placing such orders, we ourselves become liquidity providers, and the margin is blocked when Place Bid / Offer is set. The position can be opened only at the indicated price or not at all (then it is deleted). For some, this may be a great advantage, for others, this type of engagement will be less beneficial.

Advanced orders at MT4

MetaTrader 4 from the beginning focused on simplicity and the necessary minimum in terms of pending orders. Therefore, we have access to basic orders as standard. However, there are tools that add some functionality to us. A great example is the Smart Orders tool provided to mForex ECN clients. Smart Orders is equipped with a module called advanced orders. We can close positions in it depending on the time, the value of funds on the account or the profit or loss from the position. In addition, there are so-called OCO orders, i.e. One Cancels Other (one cancels the other).

This allows us to create various combinations and thoughtful distribution of pending orders. Depending on what happens on the market, we can react exactly as we would like. In other words, you can create many combinations of OCO orders that will respond correctly to many scenarios.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![New features on the xStation 5 platform from XTB [September 2020] xstation 5 xtb](https://forexclub.pl/wp-content/uploads/2018/12/xstation-5-xtb-300x200.jpg)

Leave a Response