Types of orders in Dukascopy Bank (JForex platform)

Na JForex platform at Dukascopy we distinguish different types of orders specific to ECN market. They have their own specificity when it comes to their application as well as their method of implementation.

- Market Order;

- Closing the order (Close Order);

- Market order with slippage;

- Conditional Close;

- Pending order Stop Entry (Stop Entry Order);

- Pending orders Limit Entry;

- MIT entry order (MIT Entry Order);

- Take Profit Orders;

- Stop Loss Order (Stop Loss Order);

- Orders Place Bid / Offer (Place BID / OFFER).

Market order

It is an unconditional order, the execution of which depends on the market situation at the time of its sending. At the time of sending the order, the market price is the so-called a reference price to check whether the conditions for its implementation are still satisfactory and can be approved. The term "unconditional" does not mean that the order will be executed under all conditions. Unconditional orders are executed immediately or canceled at the same time. The order may also be executed only partially, in which case the “remainder” is automatically canceled.

It is an unconditional order, the execution of which depends on the market situation at the time of its sending. At the time of sending the order, the market price is the so-called a reference price to check whether the conditions for its implementation are still satisfactory and can be approved. The term "unconditional" does not mean that the order will be executed under all conditions. Unconditional orders are executed immediately or canceled at the same time. The order may also be executed only partially, in which case the “remainder” is automatically canceled.

In market orders, we can only define the transaction amount, you cannot define your own price slippage. It is "hidden" and fixed at 5.0 pips.

Market orders can be concluded by clicking in the transaction window on Buy xxx / Sell xxx.

The way of implementation

An unconditional market order is sent to the marketplace and directly directed to the source of liquidity, obtaining the best market price available at the moment. Then, in this place, it can be implemented in full, made partially or discarded. The reason for rejection may be the fact that the price on the market has changed and no longer meets the terms of the order. An unconditional order does not mean that it will be executed at any price. The system also assumes maximum negative price slippage for market orders. Each such order is accompanied by a slip defined in advance in the application. This is to prevent the execution of orders at a price that is much different from the one set by the investor as well as at a price significantly different from the one on the market. To avoid execution of the order several times for a given amount, the query is sent to one source of liquidity with the best price, but only once.

Capital protection requirements

The margin deposit is blocked to the position opening when the order is sent. If the account does not have sufficient funds, only part of the transaction is allowed, which is allowed by the deposit.

Closing the order (Close Order)

Closing an order is a market order that is sent to close one or more positions. Depending on the open position you have, a market close order can be both a buy and a sell (opposite position). As with the Market orders, the Close order is unconditional and the investor's slippage control is disabled. Here also the so-called slippage is "hidden" and set to 5.0 pips. This order may also be executed in full, in part or rejected.

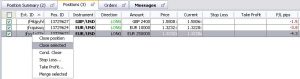

By ordering a closure in the Position Summary tab, all transactions on a given currency pair will be closed, while doing this in the Positions tab we can select a specific item and close it separately.

In addition, it is possible to close open positions on various currency pairs with one click. To do this, select them in the square and then select Close Selected.

The way of implementation

The unconditional closing order is sent to the server (SWFX Swiss FX Market Place) and directed to a liquidity source, obtaining the best available market price at the moment. The order may be executed in full, in part or rejected. The reason for rejection may be an outdated, satisfactory price on the market or not meeting the terms of the transaction at the time of sending the inquiry, due to the fact that there is a slight delay between sending the order and its execution. Of course, it is ensured that this time is as short as possible. In the event of rejection, further attempts to execute the order follow. In addition, the closing order has a "hidden" price slippage, which is to help in its execution, but also to prevent the transaction from being executed at a price much different from the market price or the one selected by the client. In the case of positions with a very large volume of transactions, it may happen that the closing transaction is carried out in several parts.

Capital protection requirements

Executing the Close order will immediately "release" the deposit used to open the transaction.

Market order with Slippage

Compared to unconditional orders, conditional orders have additional conditions to be executed immediately or are executed later than they were created and approved, usually not at the current market price. These conditions are most often the price limits for the execution of the order. In this type of orders, we have the option of defining our own price slippage for each transaction, which is different than in the case of outright orders, where the slip is stiff and "hidden". This order is executed immediately or canceled. In the case of partial execution of the order, the remaining part that has not been executed is immediately canceled.

Compared to unconditional orders, conditional orders have additional conditions to be executed immediately or are executed later than they were created and approved, usually not at the current market price. These conditions are most often the price limits for the execution of the order. In this type of orders, we have the option of defining our own price slippage for each transaction, which is different than in the case of outright orders, where the slip is stiff and "hidden". This order is executed immediately or canceled. In the case of partial execution of the order, the remaining part that has not been executed is immediately canceled.

To use a market order with slippage, just use the main transaction panel, the Market Overview window or the extended Conditional Orders panel. Default value price slip can be set in JForex options (Preferences -> General -> Slippage -> Apply default Slippage at All Market Orders).

The way of implementation

A conditional market order with price slippage is sent to the server (market place) and directly directed to the source of liquidity, obtaining the best market price available at the moment. Then, in this place, it can be implemented in full, made partially or discarded. The reason for rejection may be failure to meet the order conditions by the market at a given time when the order was sent. If the attempt to execute the order at the best price (market price) fails, then further attempts are made to implement it at the level of the price slippage set by the investor.

The value of deviation (slip) may be helpful in order to increase the probability of execution of the order at the expense of the strike price, but also to increase the probability of carrying out very large transactions at once. It should be remembered that there is no optimal (ideal) value of price slip due to the fact that it depends on the future behavior of market conditions.

Capital protection requirements

The margin deposit is calculated and blocked when the order is sent for execution. If the account does not have sufficient funds to perform a given order, it is implemented only in the amount allowed by the deposit, and the rest is canceled.

Conditional Close (Conditional Close)

Conditional closure is a conditional market order that closes one position. The volume of closing transaction and price slippage contained in it are defined by the investor. This order can be used to close only a part of the item.

Conditional closure is a conditional market order that closes one position. The volume of closing transaction and price slippage contained in it are defined by the investor. This order can be used to close only a part of the item.

Conditional closure is performed immediately or canceled. Unlike an unconditional closure order, there will be no further attempts to implement it if it is rejected or only partially implemented in the first attempt.

Conditional closure is available in the Positions tab. After selecting the item, the option Cond. Appears. close. This option is not available in the Position Summary window and it is not possible to conditionally close several different items due to the possible difference in their volume. An unconditional shutdown can be used to close several positions with a single command thanks to the default slippage values for all market orders in Preferences.

The way of implementation

Conditional closure is sent to the server (market place) and directed to the source of liquidity in order to get the best available price at a given time. The order may be executed in whole, in part or rejected. The reason for rejection may be the same as in the case of the orders described above. If the implementation at the best price fails, another attempt is made to implement it in the price slip limit determined by the investor. The investor fixing the given price slip agrees to the execution of the order within the deviations he defined. If the price slippage is set to 0, it means that the investor will not accept the order at a price different from the one indicated by him.

Capital protection requirements

Execution of a conditional closeout results in an immediate "release" of the margin used to open a given transaction or its part in the event of a partial execution.

Pending order Stop Entry (Stop Entry Order)

Pending Entry Stop orders are sent to the market at the moment of reaching the price indicated by the investor in order to try to implement them. For this type of stop and limit orders, an indication of the price at which the execution will take place is required. If the pending order is sent when the market meets its assumptions at a given moment, it may happen that it will be executed immediately.

If the price indicated in the order is reached, the order may be executed or rejected, in whole or in part. However, rejected orders are not canceled and are renewed if they are likely to be executed immediately or later, depending on the order's parameters.

Pending Stop Entry orders are designed to open the position according to the trend / traffic direction, i.e. in the case of the Buy item, the entry rate determined in the Stop Entry order must be higher than the market price. For Sell, this rate must be lower than the current market price.

We distinguish four types of Entry Stop Entry orders:

- Stop Entry Buy when the Bid price is greater than or equal to the price indicated;

- Stop Entry Buy when the Ask price is greater than or equal to the price indicated;

- Stop Entry Sell when the Bid price is less than or equal to the price indicated;

- Stop Entry Sell when the Ask price is less than or equal to the price indicated.

Note:

If the One-click option (the option visible next to the account balance) is enabled, by starting a pending order, it is immediately approved and no additional confirmation of the wish to submit it is needed.

Stop Entry orders are valid until they are executed or canceled. They remain in progress, unless they have been fully implemented or canceled either by the investor or due to failure to meet the margin requirements.

The exercise price may or may not be limited. The execution constraint may occur through a price slippage in relation to the strike price. In Stop Entry orders, it is possible to define orders Stop Loss, Take Profit and Trailing Step, i.e. Rolling Loss Stop at a market price at a certain distance. The trader has the option to change any parameter of the Stop Entry order until it is filled.

If the Stop Entry pending order is sent:

- without price slippage, this is carried out at the market price when the market reaches the rate set in the order;

- with price slippage, this is carried out at a price within the limit set by the entry price and accepted price slippage;

- with the price slippage fixed on 0, attempts are made to execute the order only at the indicated price in the order.

The way of implementation

When a Stop Entry order is created, usually the conditions for its implementation are not met, then the order has a pending status. After its creation, all parameters are stored on the broker's server. When the market meets the criteria set in the order, it is sent for execution at the market price or the indicated limit.

Note:

The price indicated in the order is not always the price of implementation (see points above).

Capital protection requirements

A security deposit for the opening of a position by ordering Stop Entry is blocked only when the order is sent to the market for its implementation. The deposit is not blocked when the pending order is established. If the account has too little funds to carry out the entire order, only the part of the deposit allowed is opened.

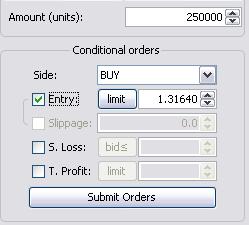

Pending Limit Entry (Limit Entry Order)

Pending Order Limit Entry is a conditional order with a limit opening the position after reaching or exceeding the limit price by the market rate. In this type of orders, it is not possible to define a price slip. However, we have the option of setting additional orders waiting for Stop Loss, Take Profit and Trailing Step (Stop Loss following the course).

Pending Order Limit Entry is a conditional order with a limit opening the position after reaching or exceeding the limit price by the market rate. In this type of orders, it is not possible to define a price slip. However, we have the option of setting additional orders waiting for Stop Loss, Take Profit and Trailing Step (Stop Loss following the course).

Pending order Limit Entry is used to open the position in the opposite direction than the last market movement, that is:

- The Limit Entry Buy must have a price set below the current market rate and when the price goes down to the indicated level, a purchase transaction is carried out;

- Limit Entry Sell must have a price set above the current market rate and when the exchange rate increases to the indicated level, a sales transaction is executed.

Capital protection requirements

The margin deposit for opening the position by ordering the Limit Entry is blocked only when the order is sent to the market for its implementation. The deposit is not blocked when the pending order is established. If the account has too little funds to carry out the entire order, only the part of the deposit allowed is opened.

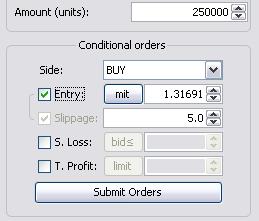

MIT entry order (MIT Entry order)

The MIT entry order can be both a conditional market order and a limit order to open a position. It is subject to the setting of a trigger price, the purpose of which is to 'ease' the constraints on the strike price, once it has been reached by the market. You can set a cap on the strike price by setting the slippage to zero. In this case, the execution of the MIT order may only take place at the agreed limit price. The value of the price slippage can be set in the platform settings (Preferences -> General) and this default value is always used to execute the order.

The MIT entry order can be both a conditional market order and a limit order to open a position. It is subject to the setting of a trigger price, the purpose of which is to 'ease' the constraints on the strike price, once it has been reached by the market. You can set a cap on the strike price by setting the slippage to zero. In this case, the execution of the MIT order may only take place at the agreed limit price. The value of the price slippage can be set in the platform settings (Preferences -> General) and this default value is always used to execute the order.

Take Profit (Take Profit Order) order

The Take Profit order is a conditional limit order related to a specific position. As the name implies, the order is to realize the profit from the position. However, there is a possibility that it will also perform a loss in order to minimize it (in a situation where the position is highly lossy, TP can be set at a lower loss level). The Take Profit order is a good-till-canceled order, i.e. valid for cancellation. You can cancel them at any time until they are executed.

TP's order may be defined at the time of concluding the transaction or added later. It can be set automatically by defining the appropriate value in the JForex options (Preferences -> General -> Take Profit pips -> Apply default Take Profit to all Market Orders) - thanks to this, the TP value will be automatically sent with an order to open a position.

The way of implementation

The Take Profit order is sent to the market for execution so quickly and until it is completed if the price of the market offer is equal to or exceeds the set Take Profit limit. Negative price slippage is not allowed here. Enforcement takes place at a price in the limit or better. The TP order may be rejected or executed in several batches. It may happen that the Ask or Bid price set in the TP order may not be available on the market (eg a price gap) or the market liquidity will not allow the execution of a given order (no other party to the transaction). In this case, attempts to execute the Take Profit order will be continued as long as the position is open and the investor does not cancel or modify the TP order.

Stop Loss Order (Stop Loss Order)

A Stop Loss Order is an unconditional market order to close a position at a specified price. As the name suggests, this order is designed to stop the loss (or rather its increase) in the position. It is also possible for the Stop Loss to take profit - when the position is profitable, the SL order may take a value between the trade opening level and the current market rate.

The way of implementation

Stop Loss is aimed at closing the transaction when the set price assumptions are met, in every market situation, especially during high volatility. However, it is not possible to define a slippage for Stop Loss orders. When the price set in Stop Loss is reached, the order is sent as an unconditional order and attempts are made to achieve the best available price. Depending on the scale of fluctuations on the market, the likelihood of Stop Loss during a very volatile market with price slippage increases. After fulfilling the order assignment, Stop Loss is executed immediately.

Orders Place Bid / Offer (Place BID / OFFER)

These are limit orders visible on the market to its other internal participants, and the security deposit is blocked immediately at the time of their creation. Place orders are able to capture potential market orders sent to the market by other internal participants.

Bid and Offer orders are limit orders, visible in the so-called Market Depth (depth of the market) by other internal market participants. To expand internal liquidity, these orders have the ability to capture internal market orders and enable clients to create their own market and to conclude orders with each other (their own market-making).

In this type of orders, it is possible to define the validity period of the order for a specific amount of time (Good For) or until a specific date (Good Till). The default option is Good-till-canceled (GTC), which means that when an offer is fulfilled, it disappears at the same time.

It should be remembered that in the case of the Good Till condition, where we define the time of expiry of the order, the applicable time zone is GMT (broker server time), which is the time moved back in relation to Polish time (GMT + 1).

The way of implementation

Bid and Offer orders are placed in the so-called Market Depth (depth of the market) and are visible to their internal participants. Due to the fact that they are limit orders, there is no negative price slippage. They can be made only at the indicated price or better. Orders are executed in whole or in part if the price limit is reached. However, there is a possibility of catching an order from a given internal market participant. If the price of the Bid order is set above the current market price, it is possible that it will be executed immediately. If the price of the Offer order is set below the current market price, it can be executed immediately.

Capital protection requirements

The margin deposit is blocked for Bid / Offer orders at the time of their creation and reserved in order to maintain a reserve of funds for their execution. In the event of a decrease in the account balance and the inability to meet the margin requirements, the Bid and Offer orders are automatically canceled.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)