Breakout of gold and silver due to the interaction of many factors

The six-week gold raid continues; in recent days, the metal managed to break several key levels, in particular, the two-hundred-day moving average and the downtrend line from the high of August 2020. It is also worth noting, however, that since March, when the monthly decline in the form of a double bottom at 1 $ 677 / oz, gold owed the ability to penetrate key resistance levels many times over to silver. The breakout above $ 1 and the last rally above the aforementioned downtrend were critical.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Since the low in early April, silver outperformed gold by 7%, and the ratio of gold to silver fell from over 70 ounces of silver to one ounce of gold to 65,50. This additional support for silver is due in part to the link with recovering industrial metals such as copper and zinc.

The current strengthening was influenced by numerous factors, the most important of which was the weakening of the dollar and stable yields US treasury bonds. The latter factor is hidden by the fact that concerns about an increase in inflation caused the ten-year yields above the break-even point to reach an eight-year maximum of 2,56%, while real yields, which often show a strong inverse correlation to gold, have returned to -1%. In addition, fear of the Asian variant of the virus emerged, tensions in the Middle East and very high volatility in the cryptocurrency marketas a result of which this new sector has lost its attractiveness as a method of storing value.

For this rally to go beyond current levels, US economic data should continue to follow a downward trajectory. Although this would not reduce the inflationary pressures favorable to gold, a longer period of correction of the US data would keep the yields on US government bonds stable and at the same time put downward pressure on the dollar.

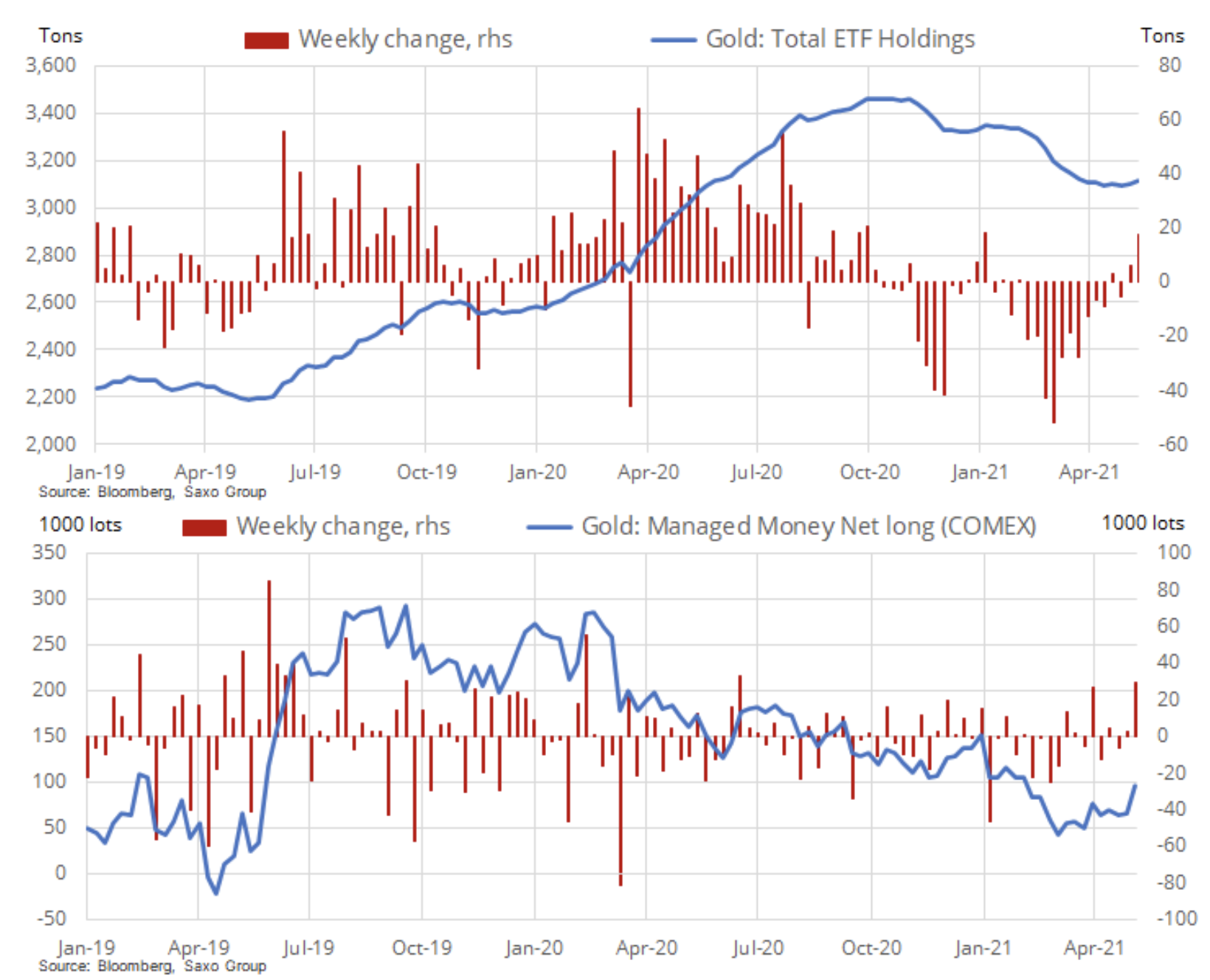

Although the current recovery in the precious metals market started more than six weeks ago, investment flows through gold-backed stock exchange funds only turned positive this month: a total of 24 tonnes of investment inflows in the past few weeks, according to Bloomberg reports. From the peak in October to the last low, the total amount of gold held by investors fell by 377 tonnes to 3 tonnes. Cash managers, who are usually the first to act, also hesitated to then start accelerated purchases. From March 090, for eight weeks, they increased their net long position by PLN 9. lots (24 million ounces), and in the last reporting week ending on May 2,4, they reacted to the improvement of the technical forecast by purchasing 11 thousand. flights, an increase of 29,5% to the highest level in 45 weeks.

Gold market (XAUUSD)

Gold it has shown an uptrend since early April, and the accelerated rally since last week's release of strong inflation data and weak US retail trade data pushed above the two-hundred-day moving average ($ 1) and retreated 845% from the the period from January to April. Another key level of growth will be the resistance of the corridor, and above all a 61,8% retraction from the August-April markdown line, ie $ 50. After breaking above, gold could threaten the $ 1 level, with support in the above-mentioned region of $ 876 and the corridor support at $ 1.

Silver market (XAGUSD)

Silver it shows an uptrend since early April, supported by the 26,80-day moving average ($ 30); There has been an acceleration in the last few sessions and the metal briefly breached the corridor, which may indicate that a re-test of the $ 28,90 level is becoming increasingly likely. In the short term, some resistance may emerge at $ 28,30 when trying to establish support, potentially in the regions of $ XNUMX.

HG copper market (COPPERUSJUL21)

Copper gained value and is only 2,5% below the record price from last week; continues to find strong support from the prospect of a dynamic recovery in global growth and demand coupled with an emphasis on a green transition. As a result of increasing demand and inelastic supply, the price of this metal has almost doubled in the last 12 months, and with recent events in South America, potential supply problems could provide an even greater source of support in the months and years to come.

This is due to the fact that the recent elections in Chile largely ended with a victory for the left. It proposed a progressive taxation of Chilean copper sales, with a maximum rate of 75% - a similar step could be taken by the Peruvian presidential candidate in the polls. Both of these countries account for around 40% of global supply, and the mining companies have already announced that such a transfer to the treasury would mean problems with meeting future expectations for an increase in supply.

After recently reaching 200% of the triangle formed in March / April, last week, copper looked for support, which it eventually found at $ 2,65, the previous record high of 2011. After a slight adjustment, copper prices could reach new highs, potentially reaching up to $ 5,10.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)