BlackRock's Q1 Results - Falling Margin During Uncertain Times

BlackRock is one of the world's largest asset management companies. The company is also one of the leaders of the passive revolution. It also belongs to the Big Three of the index fund market (together with Vanguard and State Street). The flagship product of the company are ETFs from the iShares group. The company is also a component of such indices as the S&P 100 or S & P 500. It is therefore one of the companies that can boast of a stable business model and a large moatwhich is the reputation on the financial market. This allows you to protect your market share and benefit from the enrichment of humanity and the escape from active to passive solutions. The Company generates most of its revenue from fees for asset management and fund performance. In the case of passive solutions, the company only generates fees for the amount of assets. For active solutions, the company charges both a management fee and a fund performance fee. On April 14, 2023, the company published the results for IQ 2023. How did the company cope during the turmoil on the stock and bond market?

Assets under management - slow growth despite adversity

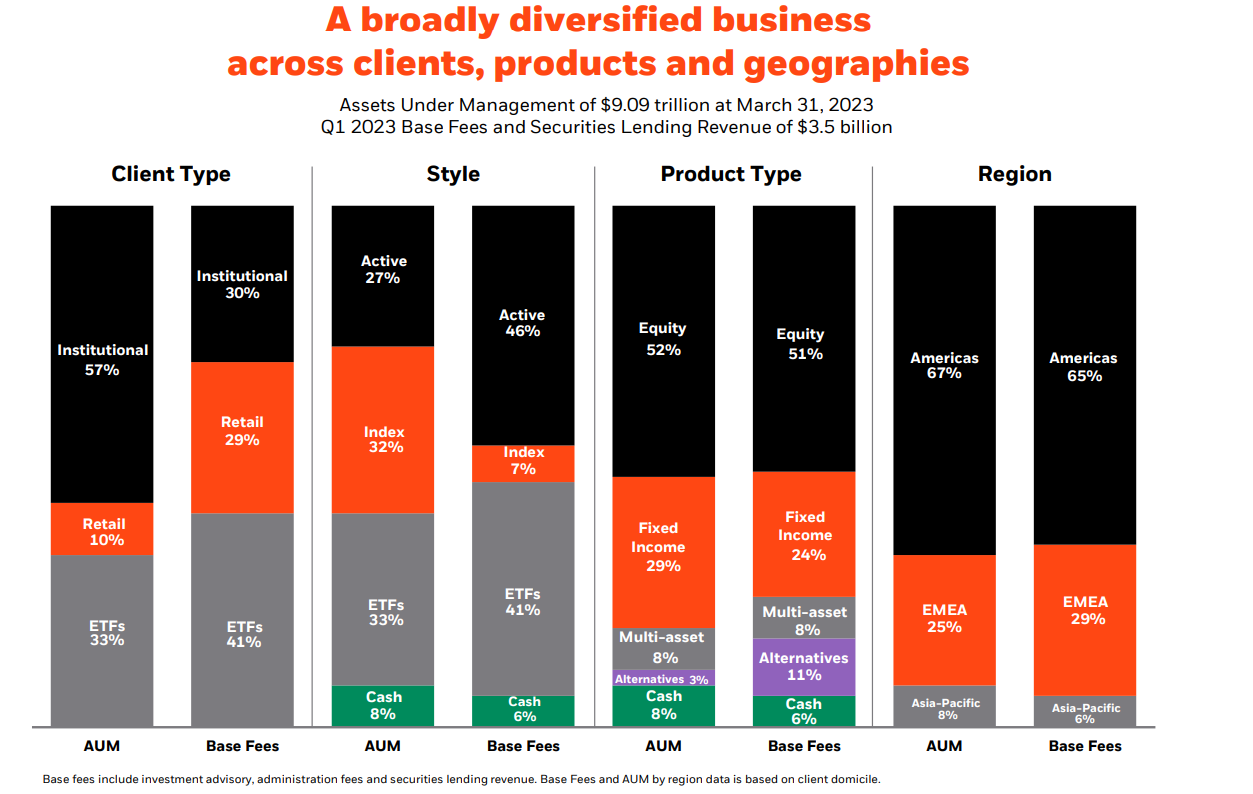

At the very beginning, let's look at the main source of income, i.e. the size of assets. On March 31, 2023, BlackRock managed just under $9 billion AuM (Assets under Management). Detailed information can be found in the chart below.

source: BlackRock

In terms of assets under management, more than half belong to institutional clients. However, in terms of collected base fees, institutional clients generate only 30% of revenues. This is because this type of customer has more bargaining power than a retail customer. This allows them to demand higher discounts on management fees.

Looking at the style of investing, active solutions are the most important in terms of revenue. These are strategies that try to beat the rate of return of the market. Fees for these types of solutions are higher, which is not unusual. The group of active products accounts for 27% of AuM, but generates as much as 46% of revenues. It is worth remembering, however, that the current trend prefers passive solutions that generate lower fees.

Let's also look at assets and revenues broken down by product categories. Alternative solutions are the most profitable. This is a group of investments, which consists, for example, in investing in a similar way as some funds belonging to KKR, BAM or Apollo Global Management. They are strategies “tailor-made”mainly used by institutional clients. Alternative strategies have only 3% AuM, but generate as much as 11% of revenue. This is because special strategies mean higher fees.

Geographically, the US market is dominant. No wonder. BlackRock is an American company and it is on this market that it enjoys great prestige. The Asian market, which has the greatest future, deserves attention. This is because the region Asia will be the fastest growing region in the world. For now this geographic area accounts for 8% of assets under management and approximately 6% of revenues. Therefore, there is considerable potential for development in this market.

ETFs still liked by investors

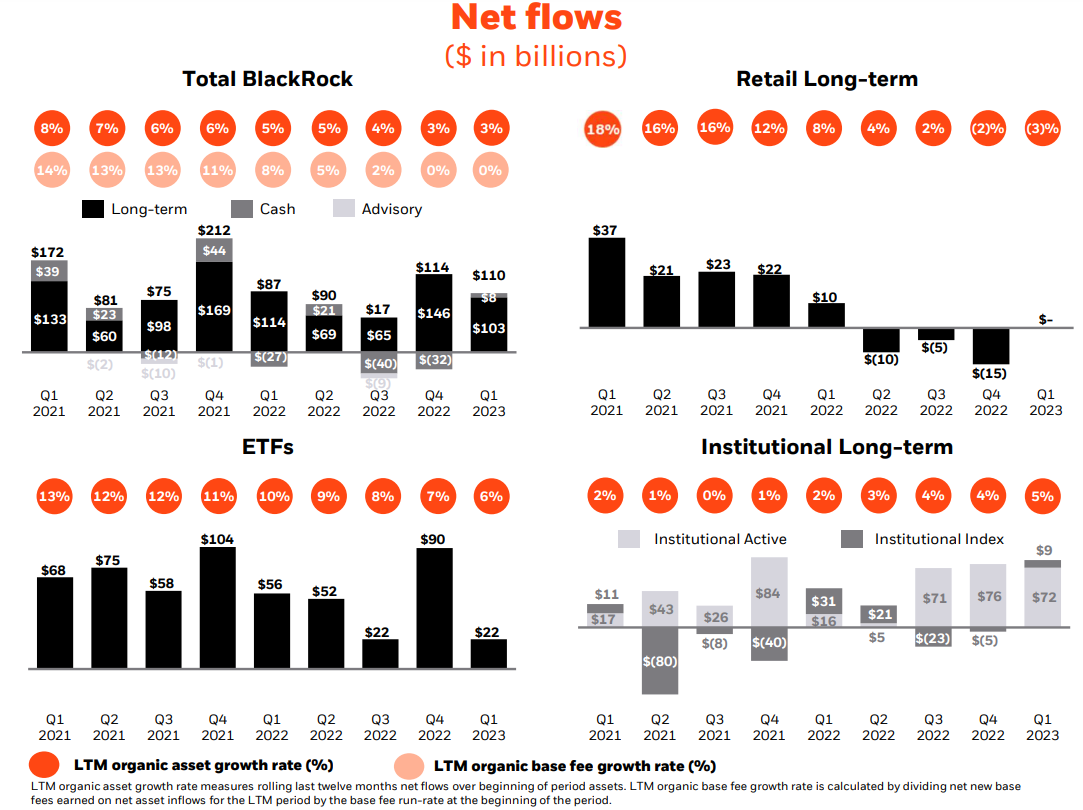

From an asset size standpoint, there is nothing worse than a bear market for asset managers. This hits AuM from two sides. First, the value of held financial instruments decreases. Secondly, impatient investors who see stock market declines may be willing to reduce their exposure. Therefore, simply comparing the change in the size of assets is not enough to check whether the business is sound. Net inflows are an important measure. It is the result of the difference between inflows (client deposits) and outflows (client withdrawals) of assets. Detailed information on inflows can be seen in the chart below.

source: BlackRock

The graph associated with is very interesting ETFs. In each quarter (including those with large declines), investors paid in more than they took out of the funds. It is worth looking at Q2022 XNUMX. Inflows to ETFs were slightly lower than a year earlier. Despite high inflation, turbulent geopolitical environment and high interest rates.

Inflows to long-term strategies whose recipients are retail clients look much worse. No net inflows have been recorded since Q2022 2023. IQ XNUMX was roughly zero.

It is worth noting that BlackRock recorded positive net inflows in each quarter of 2022. This is a very good signal, which proves that BlackRock is able to win customers even in an unfavorable market environment.

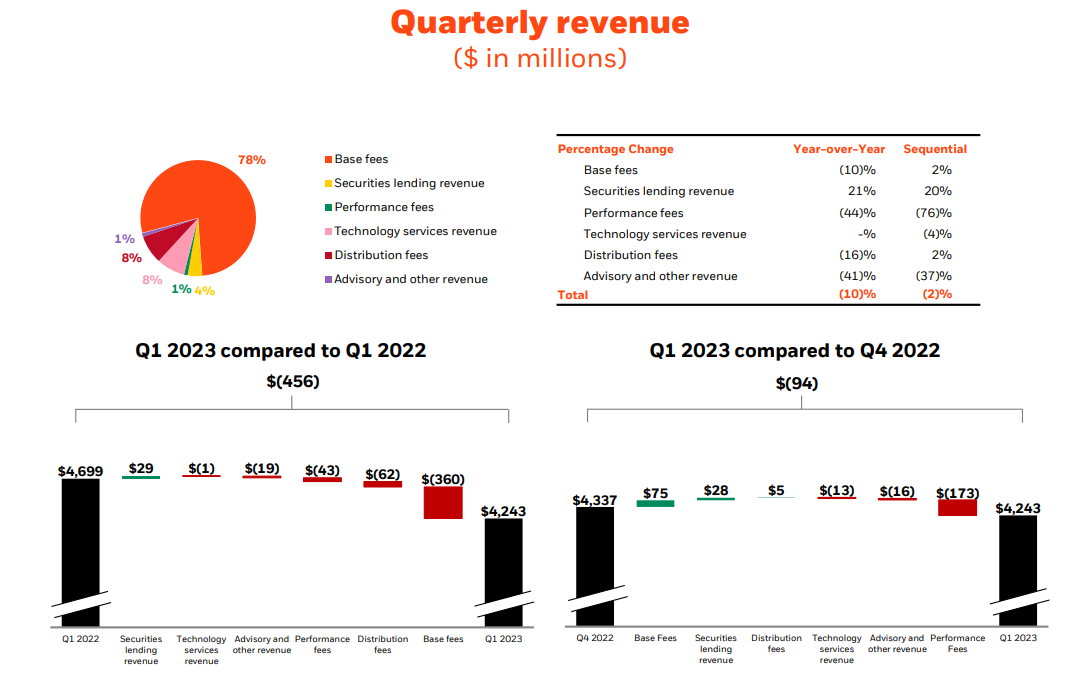

Revenue under pressure

From the components of revenue, only those related to the lending of shares to other companies increased. It is worth noting that even revenues related to technology services decreased year on year (-$1 million y/y). Management fees (base fee) had the greatest impact on the decrease in revenues. Revenues on this account decreased by 10% y/y, i.e. by USD 360 million. Revenue related to distribution fees also decreased by 16% y/y (-$62 million y/y). Revenues from performance fees are also very weak. No wonder. The poor stock market situation meant that the results of actively managed funds were not very good. Of course, the drop in performance fees is temporary. In the long term, an improvement in the revenues generated from this segment should be expected. This will result from an increase in assets under management and better performance of actively managed funds.

source: BlackRock

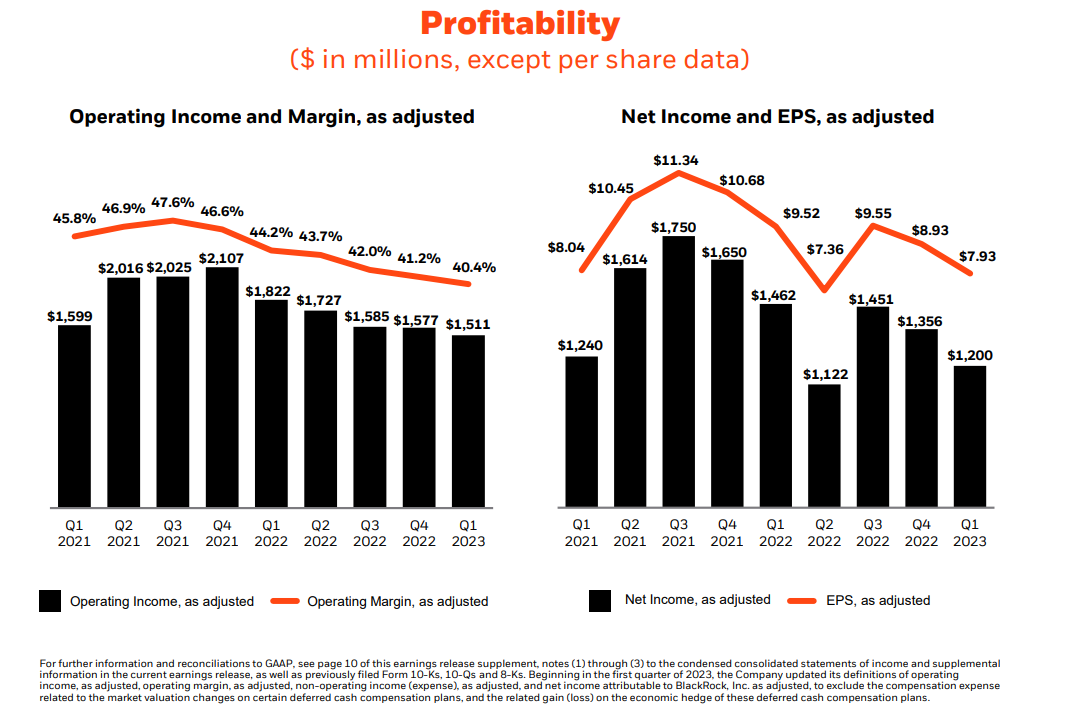

Declining margins a challenge for Blackrock

As you can see in the chart below, Blackrock is under pressure from falling margins. For the time being, it does not appear that Blackrock will quickly return to the record margins from Q2021 and Q2023 2022. EPS (earnings per share) is also falling along with the falling operating margin. In Q2021 XNUMX, EPS was lower both compared to the corresponding quarter of XNUMX and XNUMX. Earnings per share fell despite the declining number of shares. The reason is the decrease in nominal net profit. This does not mean that the company has lost its market advantages. On the contrary. Assets under management continue to grow. It is worth remembering that AuM is the basis for future profits.

source: BlackRock

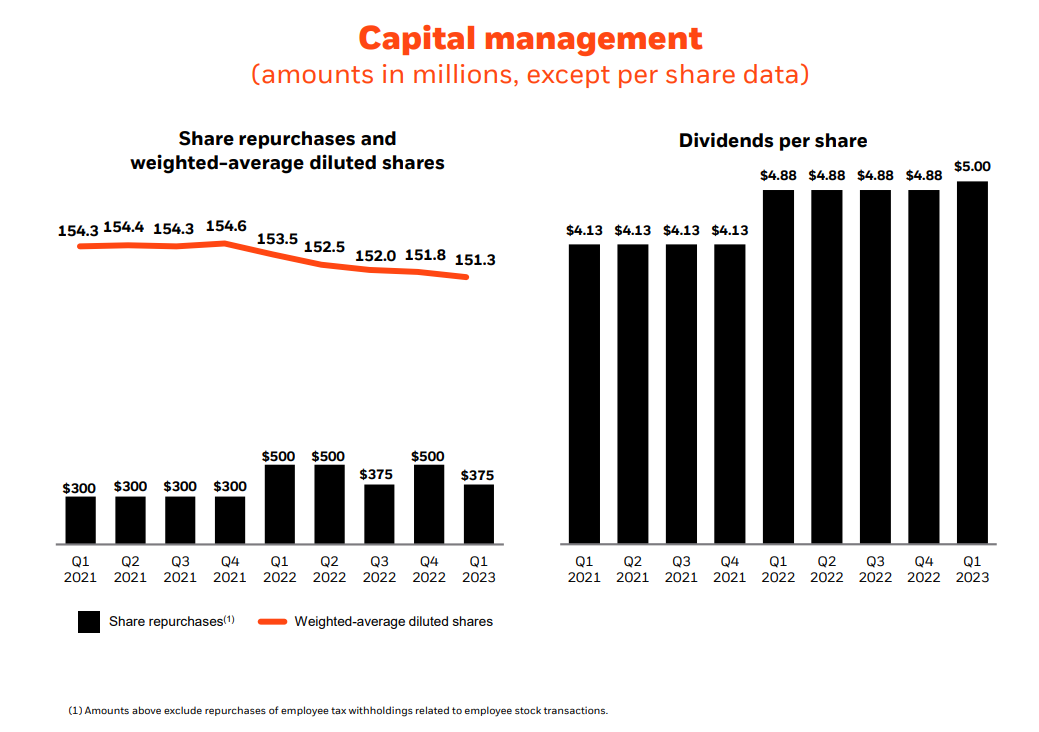

Smart capital management

BlackRock is a cash generating machine. Its high margin and low capital expenditures needed for development mean that the company has a surplus of cash. It spends in two ways:

- dividend payment

- share buyback

The dividend per share increases regularly. In the chart below, you can see that BlackRock raised its quarterly dividend to $5 per share. Just two years earlier, the dividend amount was $4,13. This means an increase in the dividend per share by 21,1% over two years. The increase in the dividend was possible due to the increase in the payout ratio.

BlackRock has been buying shares regularly for years. Over the last 9 quarters, the company has bought shares worth $ 3,45 billion. As a result, the number of shares decreased from 153,4 million shares (IQ 2021) to 151,3 million shares (IQ 2023). Thanks to this, the company can increase the amount of profit and dividend per share even if the company does not increase the nominal level of net profit.

source: BlackRock

Results submit

BlackRock reported decent results for IQ 2023. Of course, skeptical investors may say that revenues and profits are falling. However, in the perspective of 5-10 years, the episode of falling revenues will be one of the exceptions. It is enough to look at the last 10 years of the company's operation and analysts' forecasts for the coming years.

BlackRock is a cash generating machine. The company will continue to allocate capital surpluses to share buybacks and dividend payments. However, before you decide to buy stocks, it is worth looking at the stock valuation. Currently, the company is valued at 20 times its net profits. So this is a normal valuation. BlackRock is a typical dividend growth company. It has a stable business, a large moat ahead of smaller competitors and a further opportunity to scale up (especially in Asia). Of course, there are also risks. One of them is one of the products that are a sales success - ETF. The Passive Revolution sees investors move from actively managed funds to passively managed funds. ETFs generate a much lower management commission than active solutions. This will cause the average value of the management commission to decrease. On the other hand, BlackRock will “steal” clients from active asset management firms.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)