Key company results for the Wall Street bull market

American indexes are steadily climbing higher and higher, every time improving historical records. The financial results of Wall Street companies will now determine whether this trend will continue.

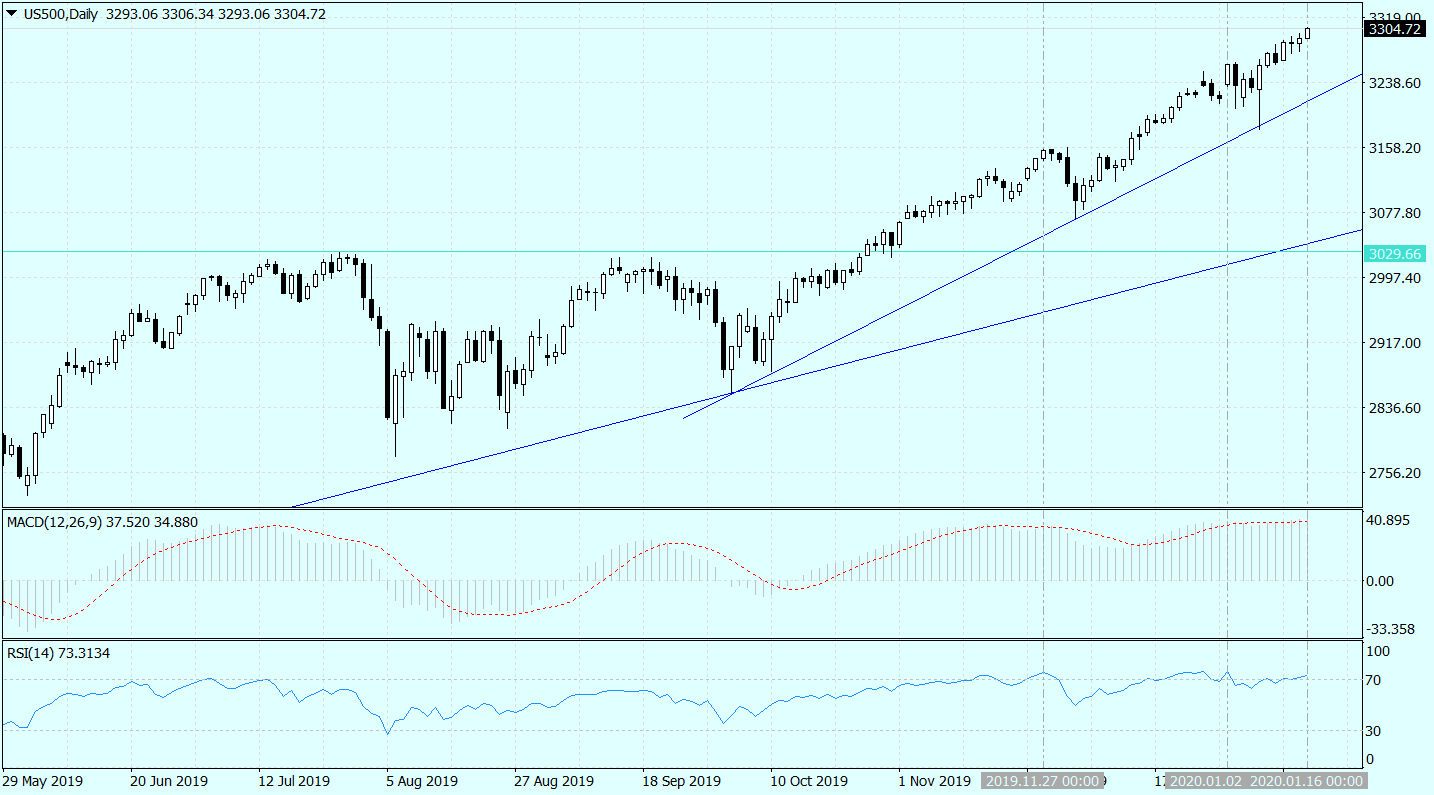

On Tuesday, after many months of negotiations, The US and China have finally signed a preliminary trade agreement (the so-called first-phase contract). As this agreement had been discounted for weeks, it clearly did not provoke an outburst of euphoria. Yes, the American indices broke new historical records, but there were no sudden purchases of shares. On the contrary. Now investors there seem to be considering 'selling the facts' rather than continuing to buy stocks. Especially since they have big profits to make. Just take a look at the S & P500 chart. The index has been increasing practically since autumn without any major correction. Its considerable redemption is already visible.

US500 chart (S&P 500 index), D1 interval. Source: MT4 Tickmill.

Results of Wall Street companies

Profit taking on Wall Street is real, but will require excuses. Otherwise, each withdrawal will be used by investors to buy shares and the indices will slowly climb higher.

What excuse can this be? In principle, everyone will be good. It's just that it's very difficult to point to it right now. However, it is much easier to indicate what will be in the center of attention in the near future. These will be the quarterly results of Wall Street companies.

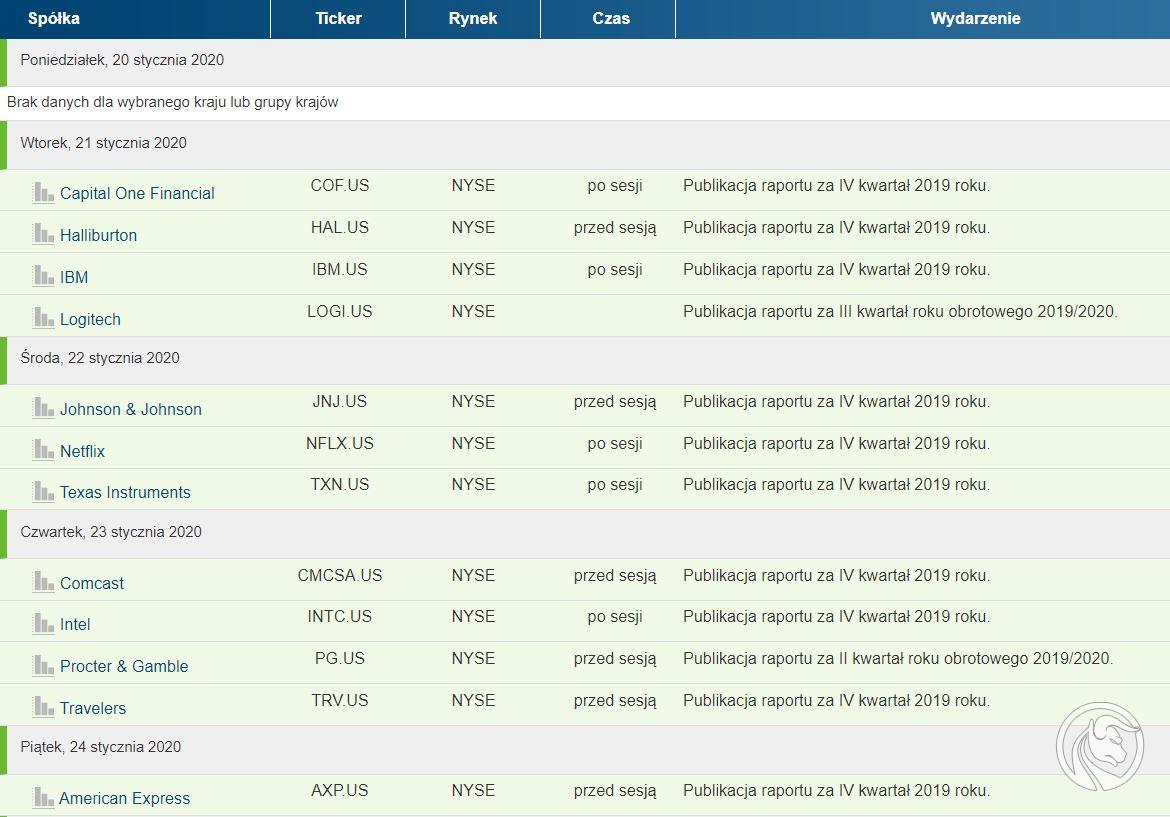

The performance season started this Tuesday. Traditionally, it was opened by American banks. Next week, quarterly reports will be published, among others Halliburton, IBM, J&J, Netflix, Comcast, Intel, P&G, and American Express.

Stock exchange calendar. Source: macroNEXT

The fact that the banks opened the earnings season was just perfect for the Wall Street bulls. This is because the financial sector as a whole has had a good fourth quarter of 2019. The entire market, however, not necessarily. It is estimated that the companies included in the S & P500 index recorded a decline in the annual dynamics of net profits in the last quarter by approximately 2%. It is worth noting, however, that it may be difficult to find a potential disappointment, as these forecasts have been significantly lowered. Even three months ago, it was believed that profits would increase by 2,5 percent. in the fourth quarter of 2019. Therefore, theoretically, there is now more room for positive surprises. Theoretically.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response