Gold (XAUUSD) may still increase

This is a good week for gold (XAUUSD). His quotations broke through the consolidation, setting new 8-year records. However, this is not all. The balance of power on the chart suggests further price increases. Large investment banks also expect this.

XAUUSD with a chance for growth

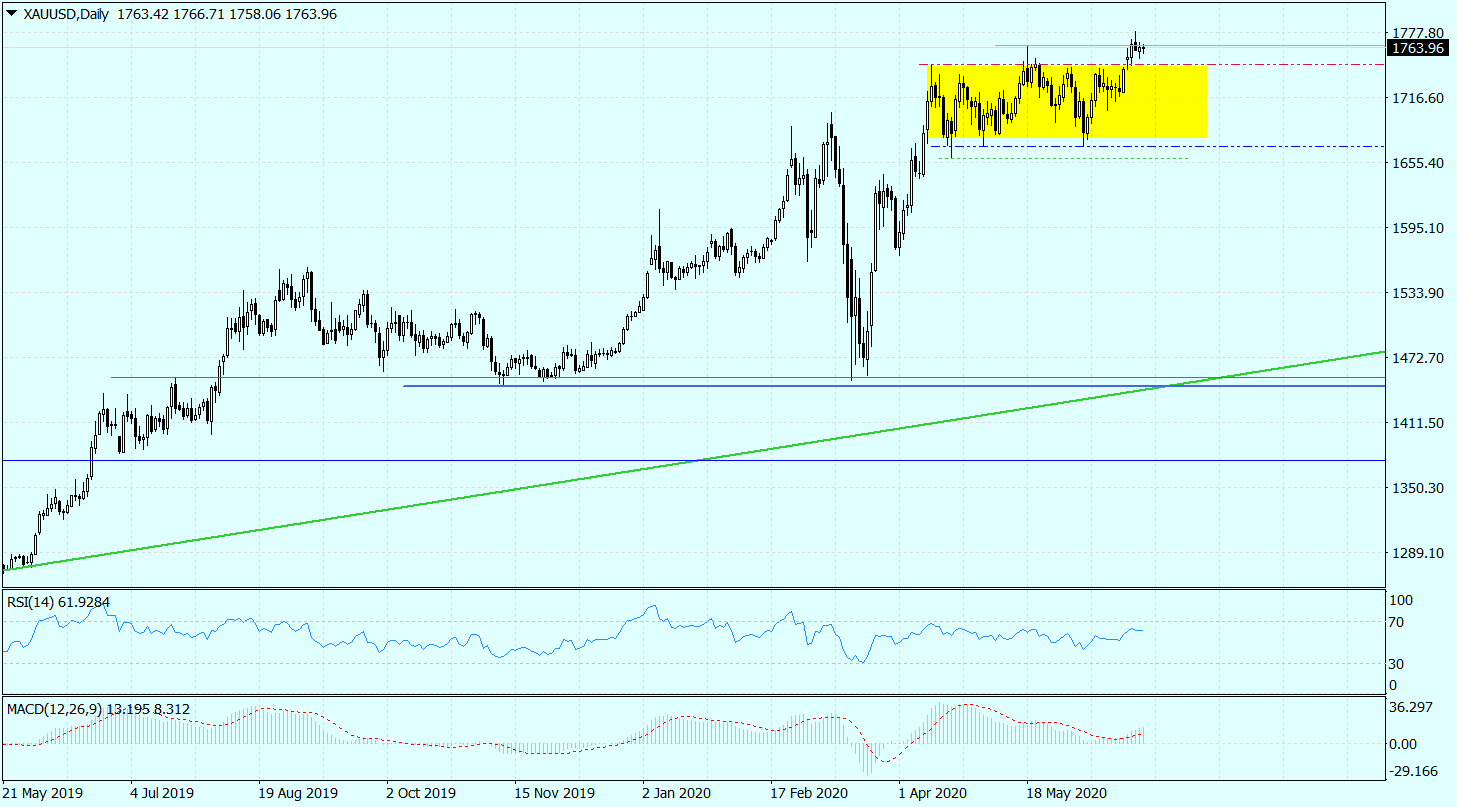

The week began with breaking gold prices above the 2,5-month consolidation. On the daily chart, it can be closed from the bottom with 1679,32, and from the top with 1747,79. In technical analysis, this paved the way for the 1815 level. So far, the course has climbed to 1779,29, testing unseen levels since 2012.

XAUUSD chart, interval D1. Source: MT4 Tickmill.

Breaking out of consolidation, lack of close resistance levels (those from 8 years ago are of little importance), but also no major correction on gold, in a situation where the risk appetite has been steadily rising in the markets over the past 3 months, leads to higher increases than mentioned above 1815. Perhaps up to 1920,50, which is the maximum from September 2011.

Investment banks are also optimistic about the gold market. For example, Goldman Sachs analysts raised their 12-month forecast for gold prices to $ 2000 per ounce from previously estimated $ 1800.

Credit Suisse analysts are equally optimistic. They are currently looking for a peak above $ 1921, but are already seeing more at levels of $ 2000, and then even $ 2075.

On the basis of technical analysis, all these optimistic predictions about the price of gold will lose their relevance when the bullion price goes below 1670,73-1679,32.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response