What are the price slips resulting from?

Where do price slippages come from in the Forex market? Anyone who invests longer time on the market has certainly encountered a situation in which his order "did not enter" as he wanted. It was executed at a different price than planned and introduced on the trading platform. This applies to both orders where we wanted to enter the market and those where we wanted to leave it. Often, novice investors who encounter this phenomenon for the first time are confused and upset. They thought it would be different and lost more (or earned less) than planned. At this point, accusations by the broker of theft and manipulation usually begin. Take it easy - this is a market phenomenon that must be accepted and included in the financial result.

Where and when do price slips occur?

There are several different situations in which slippage can occur and this varies depending on the type of order.

At the moment when we click the BUY or SELL button, the platform first checks if we are able to open a given position, if so, such an instruction is forwarded to the broker server and the order is forwarded to the liquidity provider (in the case of the model ECN) or platform quotes are checked (Market Maker model). Then the message is returned and the order is concluded. Of course, the whole operation takes a maximum of several seconds (usually less than a second). However, what happens when at the moment of clicking BUY / SELL the price of a given instrument changes very dynamically? Although the whole procedure of opening a position is short and takes place relatively quickly, with a very volatile market it can be a problem to conclude a transaction at the price we indicate. Then we encounter price slippage when opening. This may also be the case when there is low liquidity on the market

Such events can also occur with the MM broker, although it is more difficult for him to explain it because the broker is a party to the transaction (here, in fact, there may be a suspicion of abuse), hence there is usually a re-quoting, i.e. a re-inquiry about the price - if we confirm, another attempt is made opening a position, if we cancel, there is no topic and we do not enter into a transaction.

READ NECESSARY: Dirty plays by brokers - TOP 5

How to minimize the effects?

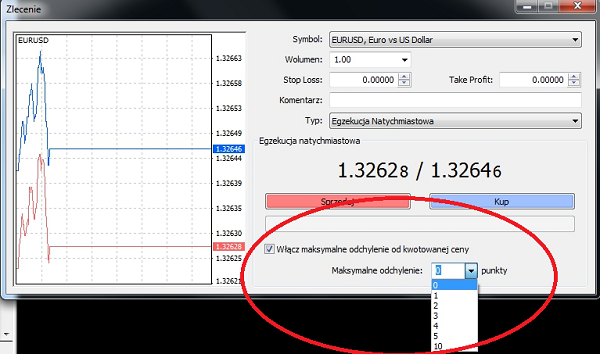

Brokers Market Maker on the MetaTrader 4, 5 platform (and some ECN on other platforms) give the option of setting a price slip for opening a position (the so-called maximum acceptable deviation from the price). This option is only used to enter the market during a dynamic price change and tells the broker about how much worse price we agree to open a position for us anyway.

We are at the mercy of the market for pending orders. By setting orders of type Buy / Sell Stop, Buy / Sell Limit or related, as well as Stop Loss i take Profit we cannot choose the maximum deviation from the price, regardless of the platform. Price level set for the above orders does not mean the level at which the transaction will always and nonetheless be carried out. This is the level at which the order is activated and forwarded for execution. This means that when the market rate equals or surpasses the price set by us, the server transfers them for execution and does so after the first possible (best) price at a given moment. In the case of the ECN model, the other side of the transaction (so-called opposite order) is needed, with which our order will be paired. If the liquidity is limited and / or the rate is changing dynamically, here also we include slippage and we will enter at a lower price.

It is not as bad as it looks

All this can sound quite dramatic, but you don't have to be afraid of slips. First of all, Forex is a very liquid market with a huge number of participants who trade with each other around the clock, so slippage usually occurs only in extreme moments such as the second after the publication of very important macroeconomic data (due to the large number of orders at different prices, liquidity is dissipated), in the case of central bank interventions, when a very large order enters the market (imbalance), in the area of long-term support and resistance, where many orders are placed in the same direction, during public holidays (e.g. period Christmas) and periods of low liquidity when the main financial markets of the world are not working (e.g. 23:00 every day).

READ ALSO: Price gaps, types and characteristics

In addition, the slip works in two directions, that is also in our favor. When using a Take Profit order at the time of strong market traffic, we can also note a slip in such a transaction, on which we will eventually earn more than we planned.

The gaps are not visible, and the slip is

The first thing a surprised investor usually does after observing that his order has been completed at a different price than he wanted is to include the instrument's chart and see if there is a gap in the chart. Unfortunately, going even to the lowest time interval a 1-minute or even 10-second type (if offered) will not make us see everything on it. This requires tick analysis. This is due to the fact that the tick chart is not dependent on time, only on the amount of price change. If the price has not changed at that moment, then there is no tick. However, if in the minute candle the first tick occurred in its first second of its duration, and the second 5 seconds later and then 10 points below, we will see a candle with a size of 10 pips, although there was no other price on the way.

The first thing a surprised investor usually does after observing that his order has been completed at a different price than he wanted is to include the instrument's chart and see if there is a gap in the chart. Unfortunately, going even to the lowest time interval a 1-minute or even 10-second type (if offered) will not make us see everything on it. This requires tick analysis. This is due to the fact that the tick chart is not dependent on time, only on the amount of price change. If the price has not changed at that moment, then there is no tick. However, if in the minute candle the first tick occurred in its first second of its duration, and the second 5 seconds later and then 10 points below, we will see a candle with a size of 10 pips, although there was no other price on the way.

Unfortunately, hardly any broker provides tick charts (offers them, for example, Dukascopy). Hence, it will be difficult for us to verify the occurrence of slips, but generally brokers (especially ECN) do not interfere in the orders of their clients. They always try to implement them at the best price by collecting only a commission for each transaction carried out.

What can you do about it?

There are not many options. This is just how market mechanisms work and if a given price did not occur on a given instrument or there was no opposite transaction to ours, so that it would be possible to implement this slippage is inevitable.

Brokers may try to acquire an increasing number of liquidity providers who will ensure even more efficient execution of orders, however usually they connect the largest players at the start so you can not expect extraordinary improvement from them.

On the other hand, investors who do not want to record slips at all costs should skip the game when publishing important macro data and during low liquidity on the market. Also, leaving the position on the weekend will prevent us from slipping off on the weekend's opening gap. Just remember that the same we will take the opportunity to earn extra money with a dynamic price change. Something at the expense of something.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)