Forex risk management. Tools helpful in trading

Risk management is one of the most important (and perhaps even the most important) elements in trading. Operating capital on various instruments, with the dynamic situation and the changing state of the deposit is a real art that requires self-discipline, analytical thinking and often also a quick response. Various tools that can help us facilitate this process come with help.

Risk management

The technique of managing capital, and therefore the risk, is many. In this article, we will not discuss them in detail and we will focus more on tools that can help us.

By far the most popular, and in my opinion, the most effective method is to determine the percentage of the deposit that we are willing to lose per transaction. Thanks to this, along with the changing account balance, using the dynamic Stop Loss, we do not lose control over the exposure to risk.

The management itself is about choosing such a transaction volume for the instrument we are interested in, so as not to lose more than the X% deposit we set. Our X% is a constant defined by us.

We also have a number of variables such as:

- account balance,

- size SL (unless we use a fixed SL),

- the pip value depends on the instrument (unless we only trade on one market).

The currency of our account, which must be included in the calculations, will also be significant.

Tools supporting risk management

If we already have some experience, all we need is a card and a pen to quite efficiently calculate the volume we can afford. But one is that it is not very convenient, and two that it is worth following the times :-). Additionally, with many positions and day-trading, this solution will be extremely onerous and too slow. In order to be able to manage risk more effectively and faster, we have several additional options to choose from.

We can use:

- on-line calculators or indicators,

- tools built into the platform,

- position management machines.

On-line calculators / indicator calculators

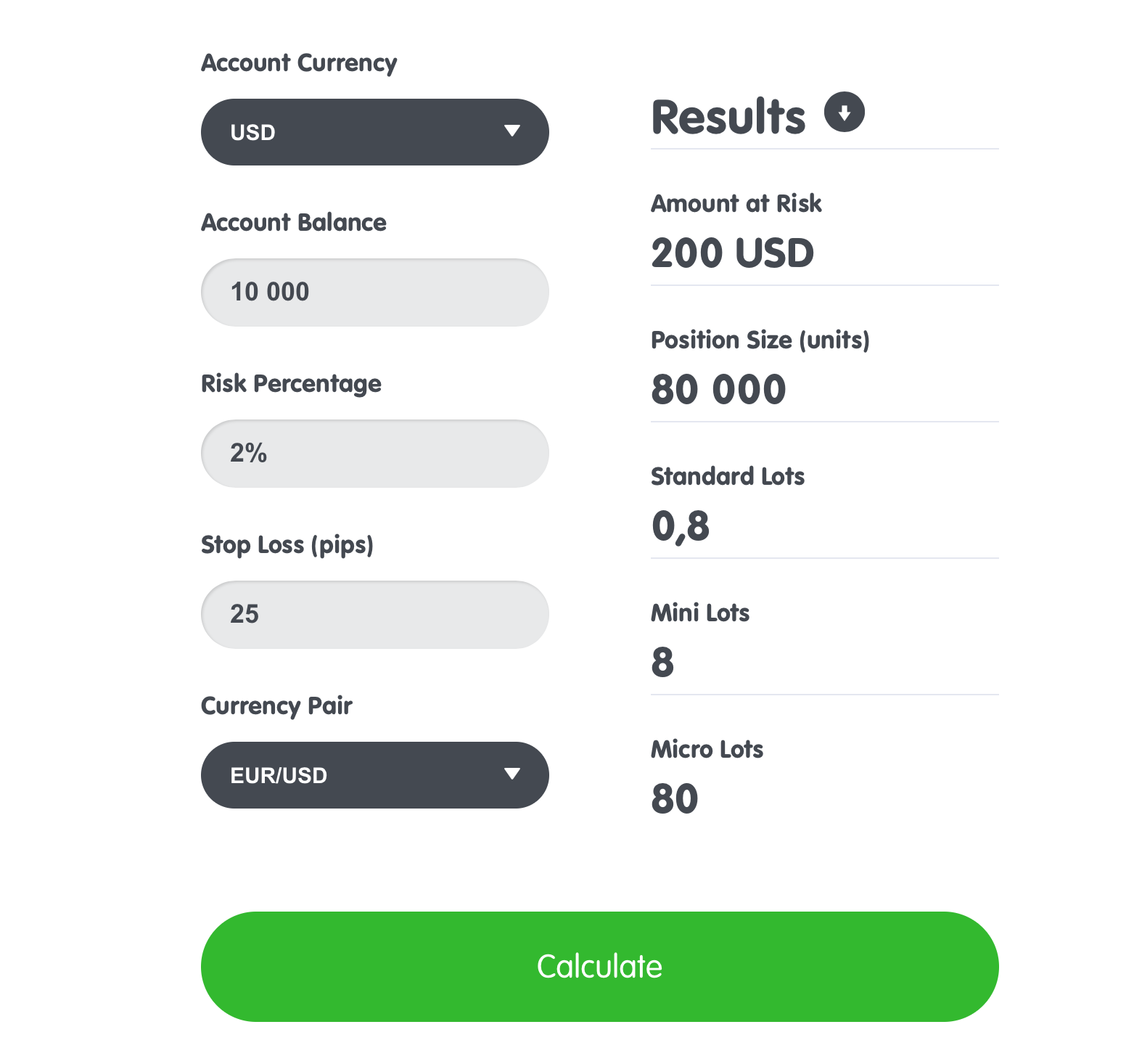

Online calculators they are very popular due to their simplicity and availability. There is virtually no lack of them in the network (under the phrase "Risk calculator forex" we have almost 4 million results on Google). Just enter your account balance, account currency, SL size, risk and choose an instrument. The result is the flight we should use.

Example:

However, this type of tool has its distinct drawbacks. You have to go to the website, enter everything manually each time and in addition - we have a limited number of instruments at our disposal. But there is one major plus - they work regardless of the platform we use.

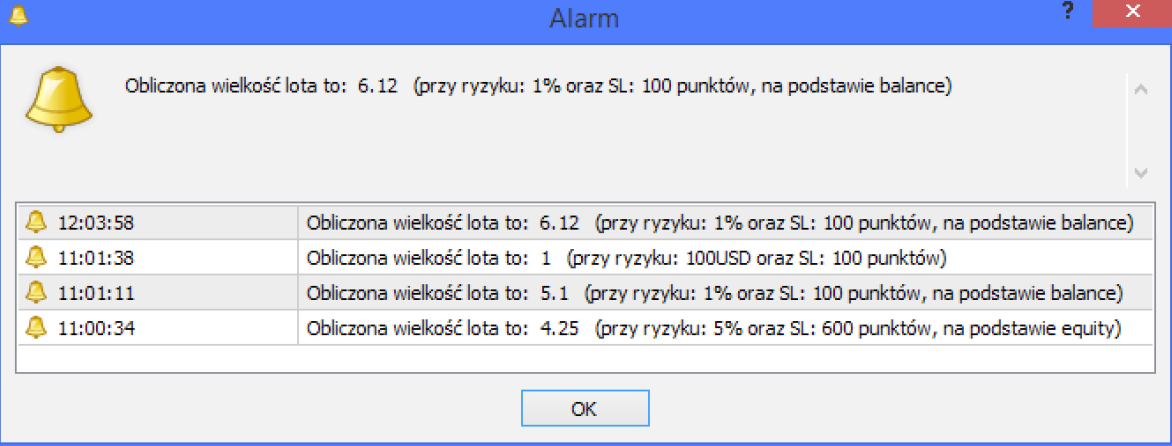

Calculators in the form of indicators or scripts for trading platforms solve the problems of on-line calculators. Due to the fact that they work on our platform, most of the variables are downloaded automatically (account balance, pip value, account currency) - just enter the constant, which is our X% and the variable in the form of the size of our SL. In the case of the indicator on the chart, or in the case of a script in a separate window, the value of the volume that should be applied will be displayed.

Examples:

- Risk Calculator for MT4 - included in the Forex Club Tools package

- Position Size Calculator for MT4

- Position Size for Balance's% for cTrader

There is only one problem - their availability. Not every platform offers the possibility of using non-standard tools. Popular MT4, MT5 or cTrader have such an option. In other cases, we are doomed to on-line calculators or… what the broker offers us.

Tools built into the platform

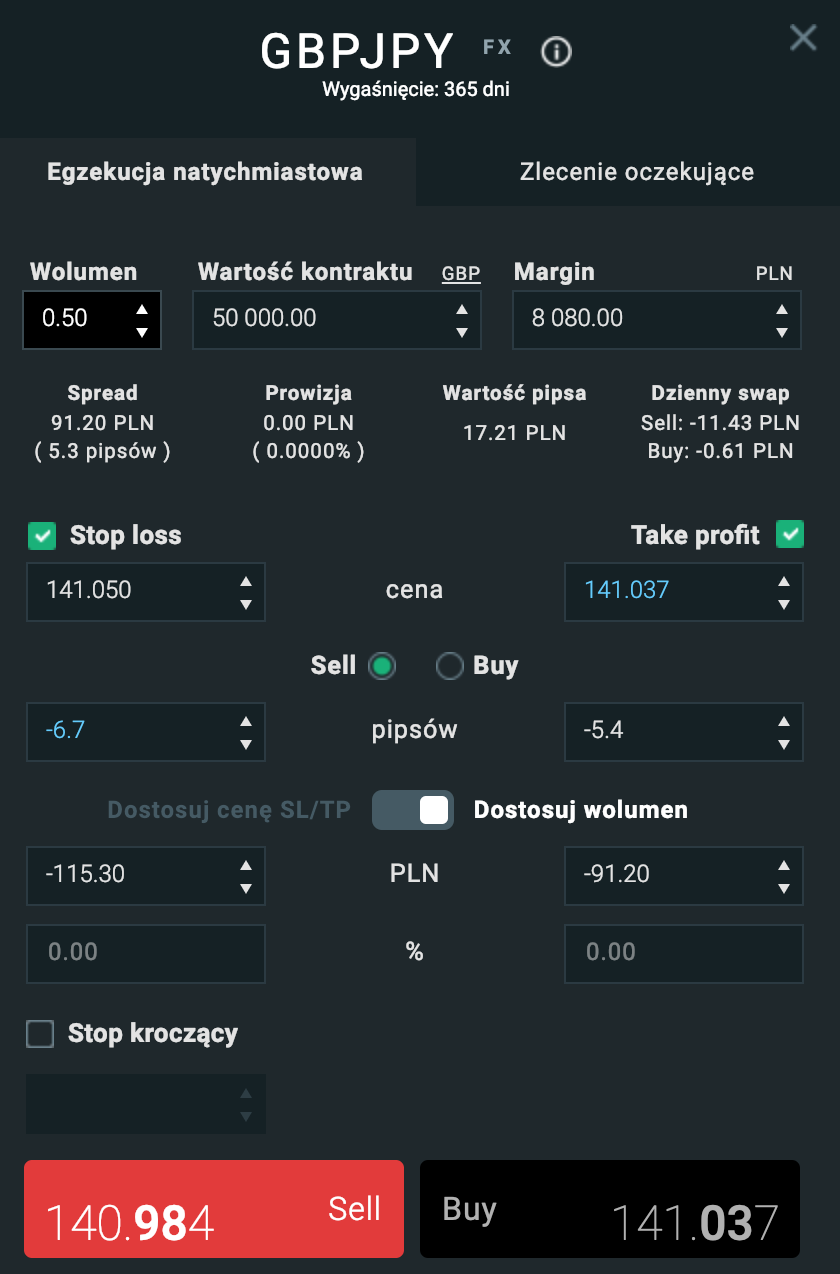

Selected platforms, most often those created by Forex brokersbased on web browsers do not allow the use of external tools. But more and more often they are equipped with tools to help manage risk. The solutions vary. Some only indicate the degree of risk, others allow you to automatically adjust and enter the appropriate volume into the transaction window. This solution is available on the platform xStation from XTB (option "Adjust the volume").

This is an extraordinary convenience and a tailor-made solution for beginner traders. We do not have to worry about the correctness of the tools, learn how to install or operate (it is very simple).

The less convenient solution described earlier has cTrader platform and NextGeneration from CMC Markets. In the case of cTrader, we see the risk scale in currency and percentage, but we have to adjust the volume ourselves. At Next Generation, you must additionally calculate the theoretical loss per% of capital.

Position management machines

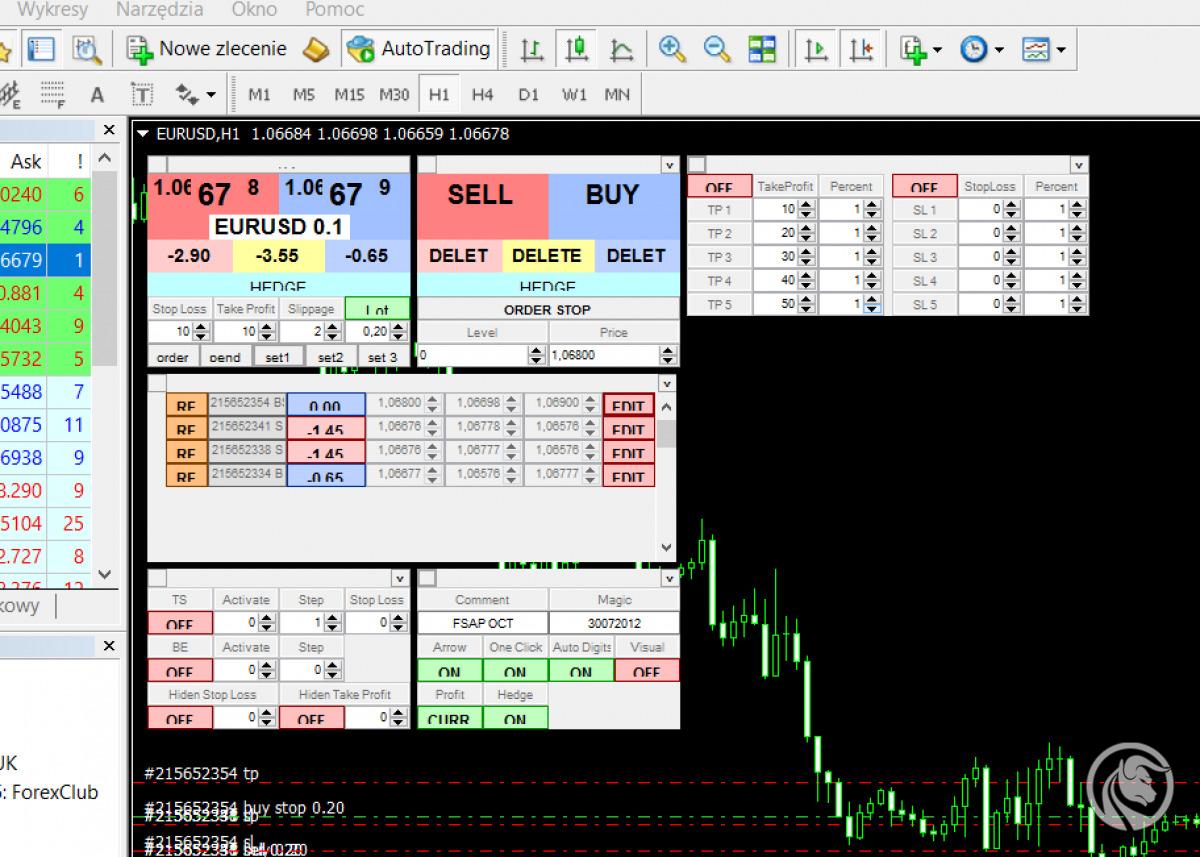

The most effective and comprehensive solution that automates the entire or almost the whole process associated with risk management. Automata, often referred to as trading combines, allow you to place orders with specific parameters that are calculated instantly. How does it work in practice?

After configuring elements such as percentage risk and Stop Loss, all you have to do is click "buy" and/ or "Sell". The transaction volume will be selected and entered automatically. That's all! In addition, these combines are usually equipped with a number of additional functions, such as: calculation of risk from the account balance with or without taking into account the balance of open transactions; inverting / doubling transactions with one click; inclusion of commission costs; and many, many other options.

Examples:

- One Click Trader for MT4,

- FxCraft Manual Trader for JForex,

- FxCraft Manual Trader for MT4,

- Risk / Reward Charting Tool for cTrader.

- FxCraft Trade Manager for MT4,

There are no perfect solutions. Smaller and larger disadvantages also have this kind of tools:

- often only commercial tools are available,

- they work only on selected platforms,

- we must contain orders through a given tool, not through buttons built into the platform,

- they occupy an additional place on the chart.

Risk management: Trust but check

Increasingly, platforms show what the effect of our order will be Stop Loss / Take Profit. It's a solution post factumbecause it concerns an already concluded transaction, but in this way we can quickly make sure that it is the way we wanted it. It is worth controlling the actual level of risk, especially when we use on-line calculators - even the best people make mistakes when entering data.

If you have not provided information about the assumed loss or profit in the trading window (such a function is e.g. in cTrader), then check whether this information pops up after placing the order by hovering the cursor over the position or SL / TP. If not, measure the distance range with the crosshair and check if everything looks okay.

Summation

Which option should you choose? You have to decide for yourself by matching the chosen solution to your own needs and capabilities. By using day-trading or scalping, definitely automation works best. But on the other hand, if your capital is 2000 PLN, and you have to pay several dozen zlotys for the transaction tool, this idea is pointless. Savings can then be found in indicators and scripts. If you trade positional, you definitely have time to prepare yourself for each trade. Then even a piece of paper will be written :-).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response