Gold is the most expensive since Russia's attack on Ukraine

Gold prices have broken the $2000 per ounce barrier and are at a 13-month high. This is probably not the end of the growth yet. What will the near future bring us?

Gold is the most expensive in over a year

Wednesday morning an ounce gold USD 2023,23 was paid, after gold prices surged yesterday and definitely broke the barrier of USD 2000. As a result, gold is currently the most expensive since the peak in early March 2022, which was set on the wave of market panic after Russia's attack on Ukraine. And this is probably not the end of his growth. At least that's what technical analysis suggests.

XAU/USD daily chart. Source: Tickmill

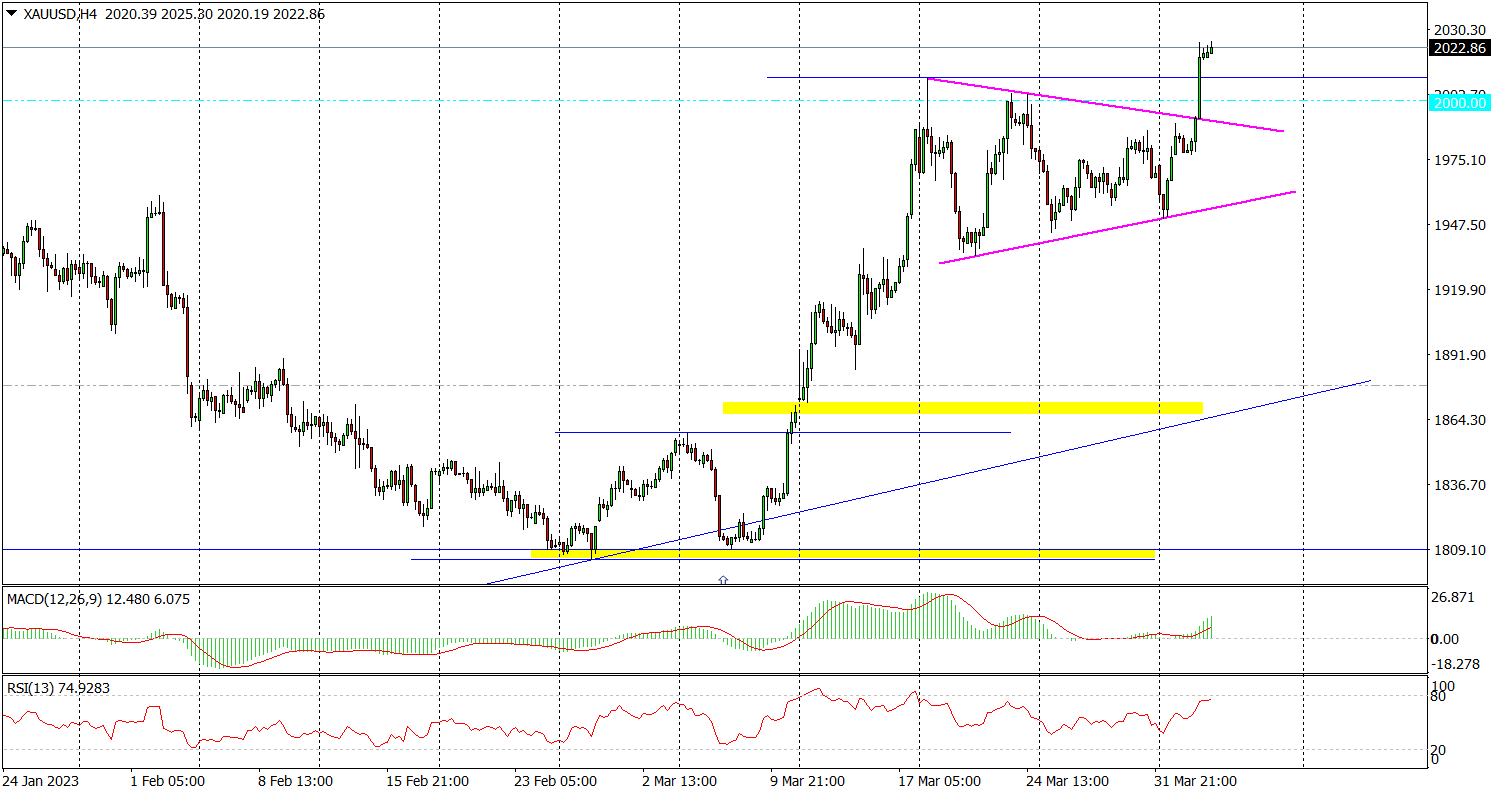

On Tuesday, gold broke out above 2 weeks yesterday. triangle formation in the H4 chart, which was drawn during the consolidation phase that took place in this market after a strong upward rally in the first half of March. Recall that at that time the increase in the exchange rate was driven, among others, by concerns about the condition of the banking sector in the US and Europe. The triangle formation itself was plotted at the level of the local peak from the first days of February, which further strengthens the significance of yesterday's breakout from it.

XAU/USD, chart H4. Source: Tickmill

The current balance of power on both the daily gold chart indicates an advantage of the demand side and suggests a future attack on the highs of March 8, 2022, i.e. USD 2070,57 per ounce. This scenario will remain valid until gold returns below $1983,89, below Tuesday's opening.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response