Gold loses, oil gains in connection with hopes for recovery

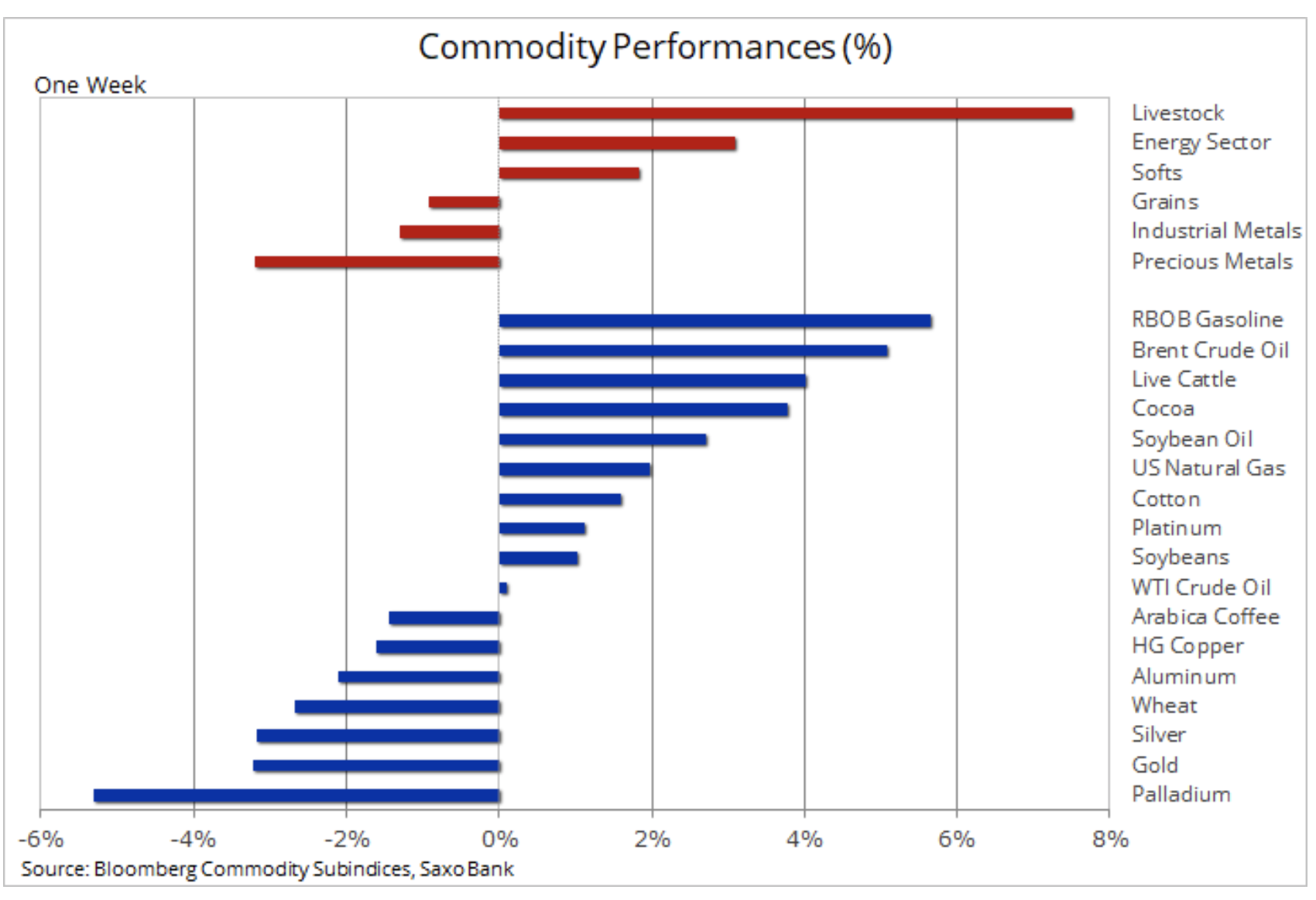

Last week, the world situation unexpectedly began to look better - at least on paper - after the publication of a number of articles related to Covid-19, which are a stimulus for recovery. Key raw materials, such as oil and gasoline, have found buyers after the recent breakdown and chaos, while gold - safe investment - recorded the largest weekly decline in seven weeks.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Gold and silver in focus

The change in mood was the result of the first light at the end of a very long coronavirus tunnel. It was the fact that a number of European countries began preparations for the partial opening of the economy, as well as the prospect or hope for the emergence of a cure for Covid-19. These events at least temporarily diverted attention from soaring global unemployment and equally rapidly falling consumer confidence. They also gave arguments to supporters of the V-shaped recovery that would minimize the consequences of the worst slump since the Great Depression.

Unfortunately, in our opinion, the road to economic recovery will by no means take the shape of the letter V. Although a short-term technical forecast for gold deteriorated, long-term foundations remained unchanged. On this basis, we maintain an optimistic position with regard to the medium and long-term forecast for gold, but we acknowledge that the current positive and negative factors are equally intensified. In our opinion, the following types of risk will affect current and future price changes:

growth:

- Protection against central monetization of the financial market;

- Control of the yield curve to reduce real yields - a key factor shaping gold prices;

- Increase in global savings with very low and negative interest rates at the same time;

- Demand for investment in developed markets will offset the weak consumer demand in emerging markets (China and India);

- Increased geopolitical risk related to shifting blame for the Covid-19 pandemic (China versus the rest of the world).

succession:

- Loose restrictions and potential medicine;

- Hopes for a V-shaped recovery will further distance Wall Street from ordinary citizens (rising unemployment and collapsing consumer confidence);

- A sharp decline in jewelry demand in China and India;

- Risk of selling gold by central banks as deficits increase and currency depreciation.

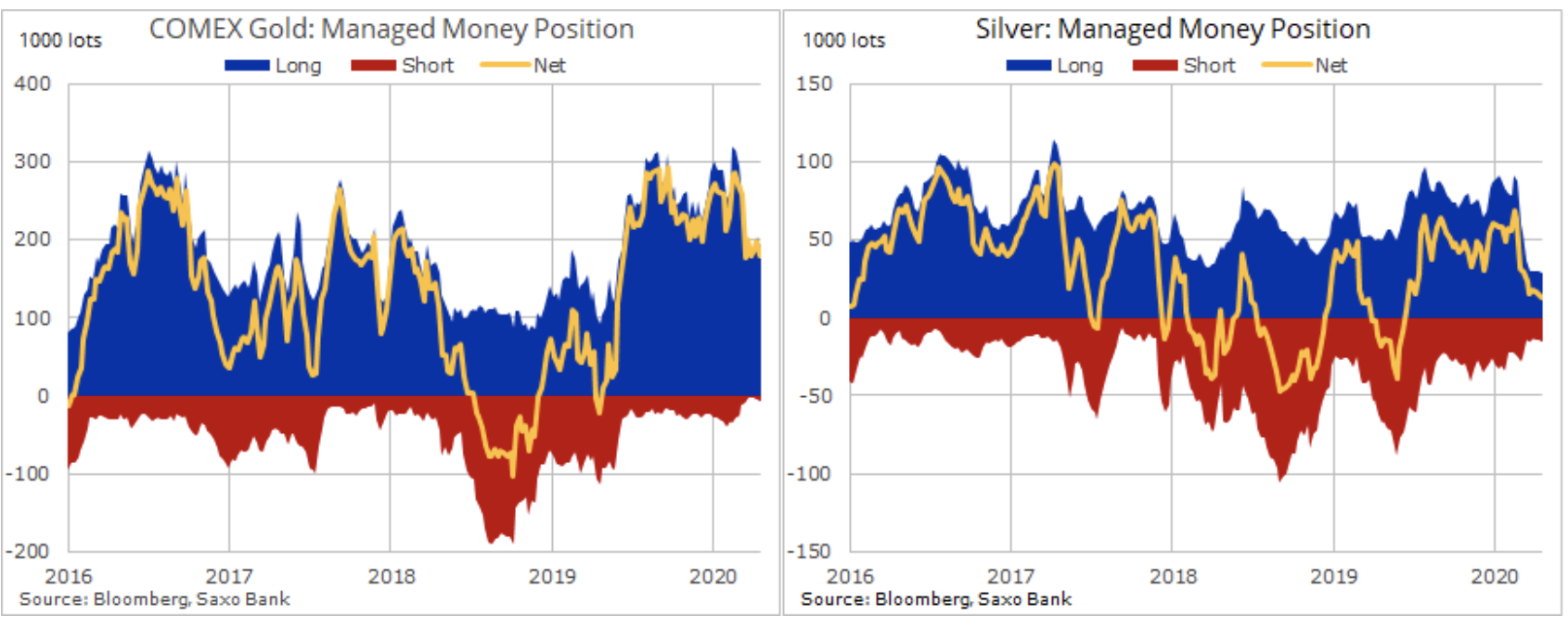

Despite the record high demand for gold-based funds, this metal still has a problem finding resistance below the level of USD 1 / oz. Due to the zero growth rate of prices, hedge funds have already begun to reduce their bullish positions in gold. In the week ending April 750, the long speculative net position fell to its lowest level in almost ten months after a 21% reduction compared to February. No results silver due to his links with industry led to the escape of speculative investors. In the last week of the report, ending April 21, the long net position dropped to just 13 flights, i.e. 500% compared to the maximum in February.

The ratio of silver to gold, which seems to remain at the highest level of 110 ounces of silver to one ounce of gold in several decades, will most likely remain at this level with the possibility of even greater growth in the short term. It is a reaction to the weaker global economic growth, contributing to a decrease in demand for industrial applications of this metal. However, the new gold bull market in conjunction with the abovementioned decline in long net position may provide support from investors preferring a relatively low price as a replacement for gold investment.

Hedge funds, including so-called CTAs implement models that are often not based on foundations but on signals of a technical and price nature. They usually increase their position after establishing a profitable position (buying strong assets while selling weak assets) until they reverse the market. While in our view the gold market is not approaching a reversal, the current lack of growth has led to the liquidation of long positions among these funds.

Taking this into account, the short-term forecast may deteriorate due to the risk of a deeper correction towards USD 1 / oz, and maybe even USD 655 / oz, before the above-mentioned growth factors start to manifest.

Petroleum throughout the week it was aiming for recovery after the last pogrom, as a result of which the currently expired WTI futures contracts in May turned very negative. In order to avoid a repetition of this situation before the July contract expired on May 19, a number of changes were made. CME increased margins on holding positions while imposing an upper limit on positions for funds based on futures prices. Major commodity funds such as S&P GSCI have already rolled their exposure further down the curve, while a number of banks and brokers have introduced a cut only rule for positions held by their clients in the July contract.

BROKERS OFFERING OIL

The fundamental factors of the first increase on a weekly basis for a month were the prospect of increased demand as more countries began to loosen restrictions, as well as producers' efforts, both with OPEC + and others, to reduce production in order to avoid forced shutdowns due to the inability to store this raw materials.

If the world fails to store unsold crude oil, production should be adjusted in terms of demand. This can only be achieved through significant cuts in output, not necessarily from high-cost producers but primarily from those who do not find buyers. The Norwegian concern Rystad Energy in the latest report predicts that this month demand will drop by 28 million barrels a day, next month - by 21 million, and in June by 16 million. In another report, Goldman Sachs predicts the world's warehouse spaces will be full in May.

While prices used to settle physical transactions remain low, speculative demand over the past week has strengthened futures prices. The saga of the USO oil fund, which is under pressure, is not over yet, however, after regulators have forced the rollover of exposure to a further section of the curve, the systemic risk for this fund has decreased. Lack of results related to the end of the month with the highest volatility eventually - although too late for many new investors - began to bear fruit in the form of reduced demand. An example is the US trading platform, which last month, when the value of the fund dropped by half, recorded an almost tenfold increase in the number of customers holding positions in USO, and then on Thursday, in just one day, this number dropped by more than a third .

As we have already mentioned, oil recorded its first weekly profit in a month in response to production cuts announced by producers other than just OPEC + and signals that a collapse in demand due to coronavirus is coming to an end. However, the resistance of USD 23,5 / b for WTI oil and USD 28 / b for Brent crude may for now constitute the upper limit of growth. The short-term forecast remains problematic due to tank filling up. The key risk is still an attempt to avoid tank fullness and the associated possibility of forced closures, and the futures market may be at risk of rising to levels not yet supported by changes in the cash market.

Commodity price changes

Futures contracts for natural gas for the first time since February, they rose to $ 2 / MMBtu after the prospect of a drop in production due to the shale oil industry has contributed to rising prices. According to Bloomberg, natural gas production in 48 continental US states dropped to 85,6 bcf / d - the lowest level since July, i.e. by 10% compared to the record level recorded in December.

RBOB gasoline peaked six weeks after the EIA reported the first drop in stocks in five weeks, and consumption in the United States for the third time in a row increased to 5,86 million barrels per day, although it is still around 35% below average year.

HG copper depreciated this week after reaching resistance at 2,38 USD / lb, which is a 618% abatement on sale from February to March. The main factors are large inventories, reclosing production and an increase in the risk of a deep recession detrimental to demand - they can keep prices unchanged or cause them to fall in the coming weeks.

Prices livestock, especially for pigs, increased rapidly after the outbreak of the meat crisis in the United States. Sixteen large plants processing poultry, pork and beef meat were closed after detecting Covid-19 infectious outbreaks. Pork production recorded the largest losses - almost half of all plants are currently closed. After reaching the lowest level in 18 years, two weeks ago futures contracts for lean pork went up by 60%.

Cocoa continues to show signs of recovery after rebounding above USD 2 / MT. The risk to demand in connection with the pandemic resulted in a 400% drop in prices followed by stabilization and growth. Apart from better technical forecasts, bad weather conditions and isolation of employees in fear of the virus can harm production in West Africa - the main region of crops.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response