2021 has been an amazing year for action

The past year has been a fantastic year for equities: after extraordinary gains in 2020, this market returned 21%. This seems nearly impossible given galloping inflation unheard of since the early 80s, but low nominal yields created the environment under which equities proved to be the only viable choice. Equity earnings as a whole were the result of technical aspects such as low nominal yields, but an important factor was also the enormous corporate earnings, which rose by 28% compared to 2019, demonstrating the significant impact of public fiscal stimulus on the private sector. Looking back, we also look to the future in terms of what to expect in 2022 and how investors should shape their equity portfolios to take into account areas that may turn out to be profitable in an inflationary period.

Negative real yields mean TINA

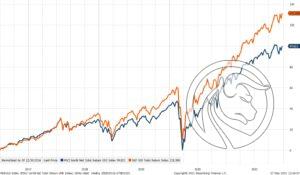

While investors are getting ready to close their books for this year, it is worth analyzing what the market situation was like in the past year. If we had informed you a year ago that S&P 500 index will go up by 28%, and MSCI World - by 21% in annual terms, and at the same time the core inflation in the United States will amount to almost 5%, which is the highest level since the early 80s, our readers would certainly not believe us. Key to understanding why stocks are gaining in spite of inflationary pressures is the bond market's response to rising inflation.

The bond market agreed with the Fed's opinion that inflation was temporary, but even after that Federal Reserve dropped the concept and admitted that the causes of inflation were deeper and more persistent than initially thought, and the bond market continued to forecast inflation to remain low. This was based on high debt-to-income ratios in many parts of the world, an aging population, and technological advances, all of which counteracted inflationary forces over the long term. Persistently low nominal yields amid rising inflation - both realized and projected - put significant pressure on real yields to decline, triggering a wide-ranging swing towards equities.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

Why would anyone invest in bonds when their capital real estate is dwindling? You might as well switch to stocks despite historically high prices and valuations, as perhaps it would at least save capital from the devastating effects of inflation. In other words, the TINA (there is no alternative) approach is still alive in financial markets as we approach 2022 because, as both John Maynard Keynes and Warren Buffett have noted, although in different context - inflation is the enemy of the capitalist economy and investors.

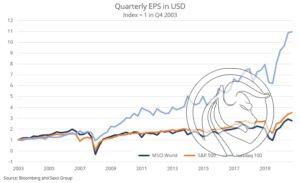

Huge gains on record fiscal stimulus

While low nominal yields have played a significant role in the stock market boom this year due to their impact on the cost of capital used to discount future free cash flows, investors should not ignore the fact that MSCI World gains in the first three quarters of 2021 increased by 104% compared to the corresponding period of 2020. This can only be considered a rebound effect, but it should be noted that profits in the first three quarters of 2021 were 28% higher than the profits in the corresponding period of 2019. In other words, the dynamics of profits generated by companies emerging from the pandemic was extraordinary and resulted from enormous loose monetary and fiscal stimuli implemented on a scale not seen in the post-war years, i.e. from the end of World War II. Deficits in many of the world's largest economies have pushed the surplus in the private sector into a corresponding jump.

Sensitivity to interest rates

The irony of 2021's high returns and excellent returns on stocks is that 2022 could turn out to be 'bad' for equities due to projected inflation as a bond market response of 100bp on the long end of the US the yield curve (ten-year government bonds) could push stocks down regardless of the increase in earnings. We recently estimated that growth stocks such as Pinterest and Adobe have an interest rate sensitivity of 18% and 26%, respectively, which means that the valuation of these stocks will fall by as much as the 100-year US bond yield changes by XNUMX basis points, assuming that that all other aspects will remain the same.

Overall, the US stock market most likely has a stock duration of around 15-18%, which means that an increase in nominal yields alone could offset next year's earnings growth. The chart below is from our recent stock market analysis, The Return of Interest Rate Sensitivity is the terror of tech stocks and shows that indices Nasdaq 100 and STOXX 600 move in opposite directions in response to significant changes in US ten-year bond yields. US tech equities exhibit a negative excess return compared to global equities on days when long-term yields go up, while European equities show a positive excess return due to financial, energy and mining companies being dominant.

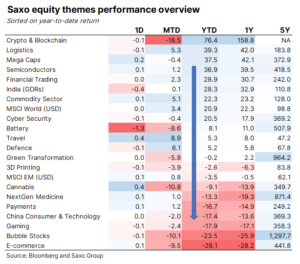

We continue to believe that investors should continue to adjust their equity holdings to better absorb higher interest rates and inflation in 2022. This includes increasing exposure to commodities, finance, semiconductor, logistics, and financial trading companies that will benefit from the volatility and can also serve as a hedge against losses in the tail of stock portfolios.

Green transformation, India, China and urbanization

Our green transition basket has gone down 6% this year, losing part of the huge gains of 2020, when investors ensured a massive capital flow into the area. As next year will be a breakthrough for electric vehicles, the Green Transition deals will see a spectacular comeback. Vale is clearly stating that it intends to become the preferred supplier of electric vehicle essential metals in North America, and Rio Tinto is also investing heavily in lithium carbonate projects, including a massive project in Serbia that could potentially supply nearly 10% of Europe's future demand in the context of the production of electric cars. The green transition in terms of electric vehicles, solar and wind energy, energy storage and hydrogen production will continue due to the upward pressure on the prices of many key metals, and in the long term we are convinced that it will make a significant contribution to increasing long-term inflation rates.

In terms of economic growth, infrastructure investment, market reforms, tech debuts and related shareholder returns, and urbanization, India appears to be the new China. Indian stocks have been one of the best stock markets in the last 20 years, generating 10% yoy profit growth and we believe that this trend will continue for the next decade, delivering extraordinary returns for investors. However, alongside India's tremendous economic growth and urbanization, there will be a green transition, which will also drive global inflation up as a result of inflation in commodity markets.

China has found itself on the defensive this year, uncharacteristically diverging from the rest of the world. The crisis on the housing market is having a negative impact on the economy, credit markets and consumer confidence. While this industry needs to find a solution, it must embrace the "shared prosperity" narrative and we are already seeing signs that the government and the central bank are beginning to seek to minimize the economic impact of this crisis. Fiscal stimulus will return in 2022, but the key question is where profitability will go, as the introduction of stringent technology regulation and other reforms, including a new data privacy law, negatively impacts analysts' estimates of growth. We do not have a clear view of the future of Chinese equities, except for a constructive outlook for consumer goods companies as they are by their nature not data dependent.

More stock market analysis is available here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)