Irregular correction - a "trap" for traders

Each trend, regardless of whether it is in equity markets, or currency markets, consists of impulses and adjustments. Corrections are extremely important, because after correcting, it is best to join the currently prevailing movement. While adjustments such as straightforward or speed correction are relatively easy to identify, the irregular correction very often causes problems in everyday trading and is called a kind of "trap".

In this article, we will take a closer look at this type of correction, and ways to identify it in everyday commerce.

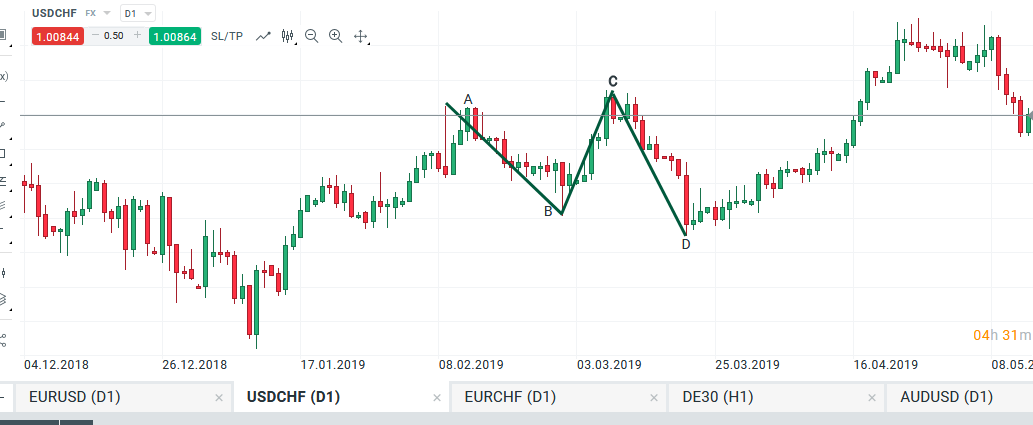

Irregular correction - definition

At the outset, it is worth defining in general what the correction really is. Well, it's nothing like price movement in the opposite direction to the currently prevailing trend, after which the price returns to the main trend again. It does not matter if we are dealing with a downward, upward or lateral trend, in each of these variants adjustments will take place. The structure of an irregular adjustment is difficult to recognize due to its specific specificity. This type of correction consists of three sections:

- section AB - which price creates in the opposite direction to the last impulse,

- episode BC - it strikes the A point,

- episode of CD - it makes a punk.

An example of an irregular adjustment, USDCHF D1. Source: xNUMX XTB xStation

Identification of irregular adjustment in everyday trade

Very often the irregular correction is referred to as a "trap" for investors. This return is justified because a very large number of traders assume that the current trend will be reversed when this type of correction occurs. It is very confusing for the price to go below point B - when it does, traders automatically assume a reversal.

The next step is the return of the price to the current trend and the breaking of the previous summit in the upward trend or the bottom in the downward trend, which results in the fact that people playing the position on the new trend are minted from the market on stop-loss orders. Thus, they can be caught in the mentioned trap.

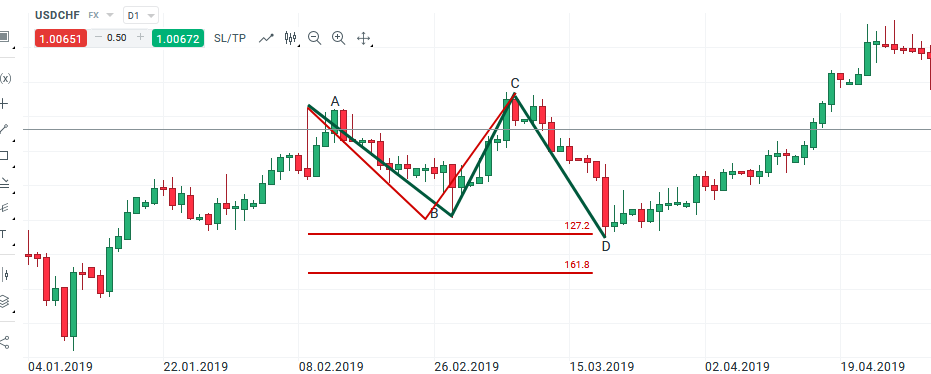

How to forecast such corrections in advance? Very important is paying attention to the structure of the BC section. Of course, not always, but very often with an irregular correction, this episode consists of three waves. Another very important issue is the relationship between AB and CD sections. In a non-regular correction, the lengths cannot be equal to each other because there is no 100% geometry. Some Fibonacci measurements are worth using when determining potential turning points. The two ratios most frequently respected by the market are the levels of 127,2% and 161,8%.

The use of Fibonacci measurements in an irregular correction, USDCHF D1. Source: xNUMX XTB xStation

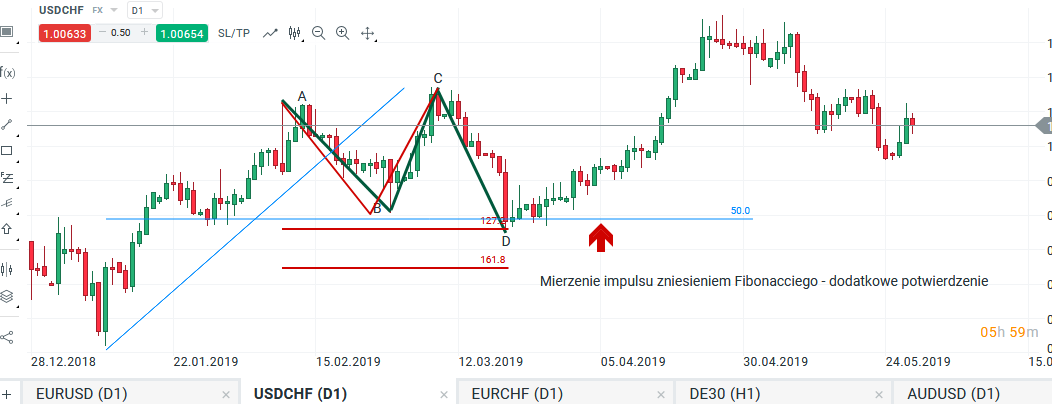

It is also always worth looking for additional confirmations. The best confluence is provided by levels of support and resistance, candles with long shadows, or supply / demand levels. It is also worth to measure individual impulses, because often the turning points coincide with some internal abolition.

Measuring the Fibonacci mesh pulse, USDCHF D1. Source: xNUMX XTB xStation

Summation

Corrections, including an irregular adjustment, can be a very important part of the investment strategy. Corrections usually occur before impulses, which makes them a very good opportunity to join strong and dynamic movements and, as a consequence, obtain a very favorable profit-to-risk ratio. In the case of an irregular adjustment, the most important are:

- paying attention to the structure of the BC section,

- use of external summons, mainly 127,2%, and 161,8%

- searching for additional confirmations in the form of support / resistance, Japanese candles, internal measurements.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Wyckoff's three laws on current charts - Mieczysław Siudek [Video] Wyckoff's three laws on current graphs](https://forexclub.pl/wp-content/uploads/2023/05/Trzy-prawa-Wyckoffa-na-aktualnych-wykresach-300x200.jpg?v=1684310083)

![Grzegorz Moscow - Ichimoku is not everything. On trader evolution and market analysis [Interview] gregory moscow ichimoku interview](https://forexclub.pl/wp-content/uploads/2022/12/grzegorz-moskwa-ichimoku-wywiad-300x200.jpg?v=1671102708)

Leave a Response