A week marked by central banks: Fed, BoJ, BoE and SNB

The third week of March, which begins, will be dominated by central banks on financial markets. In particular, the decisions of the Bank of Japan will be in the spotlight, as it is forecast to increase interest rates and the American interest rate Federal Reserve (Fed), which will probably refrain from cutting rates in the US until June.

A week marked by central banks

Last week brought new records on the stock exchanges in Frankfurt and Paris, stabilization at record levels on the Wall Street trading floor and consolidation after earlier profit-taking on the Tokyo stock exchange. The dollar strengthened slightly against the main currencies. Bitcoin he first corrected the records and later began the correction. A downward correction also hit the gold market. However, there was greater demand on the oil and copper markets.

The week starting today on financial markets will be focused primarily on central banks. Decisions on monetary policy will be made by as many as 6 large banks. Naturally, the US Fed will focus on attention, but the most important event of the week should be the meeting Bank of Japan.

The Bank of Japan will announce its decision on rates on the night from Monday to Tuesday. The market forecasts that the bank will end the period of ultra-loose monetary policy at the March meeting and will decide to increase interest rates. The bank is expected to increase the main rate from the current level of -0,10%. to zero.

He will decide on rates on Tuesday Reserve Bank of Australia. They are expected to remain unchanged, which means maintaining the main rate at 4,35%.

The second important event of the week will be the Fed meeting. The decision will be announced on Wednesday, March 20 at 19:00 p.m. Polish time, and the press conference of Fed Chairman Jerome Powell will begin at 19:30 p.m. Analysts assume that the Fed will not change interest rates in March, leaving the fluctuation range for the federal funds rate at 5,25-5,50 percent, and the first cuts will take place in June at the earliest. It can be expected that after the meeting these beliefs will be even stronger.

He will also decide on interest rates on Wednesday People's Bank of China. It will probably leave the one-year loan rate at 3,45% and the five-year loan rate at 5%.

He will decide on interest rates on Thursday Bank of England (the main rate is now 5,25%), the Swiss National Bank (1,75%) and the Bank of Norway (4,50%). In all three cases, no change in interest rates is expected. However, the method of communication regarding monetary policy may change ahead of the expected rate cuts in the future, and this may already have an impact on financial markets.

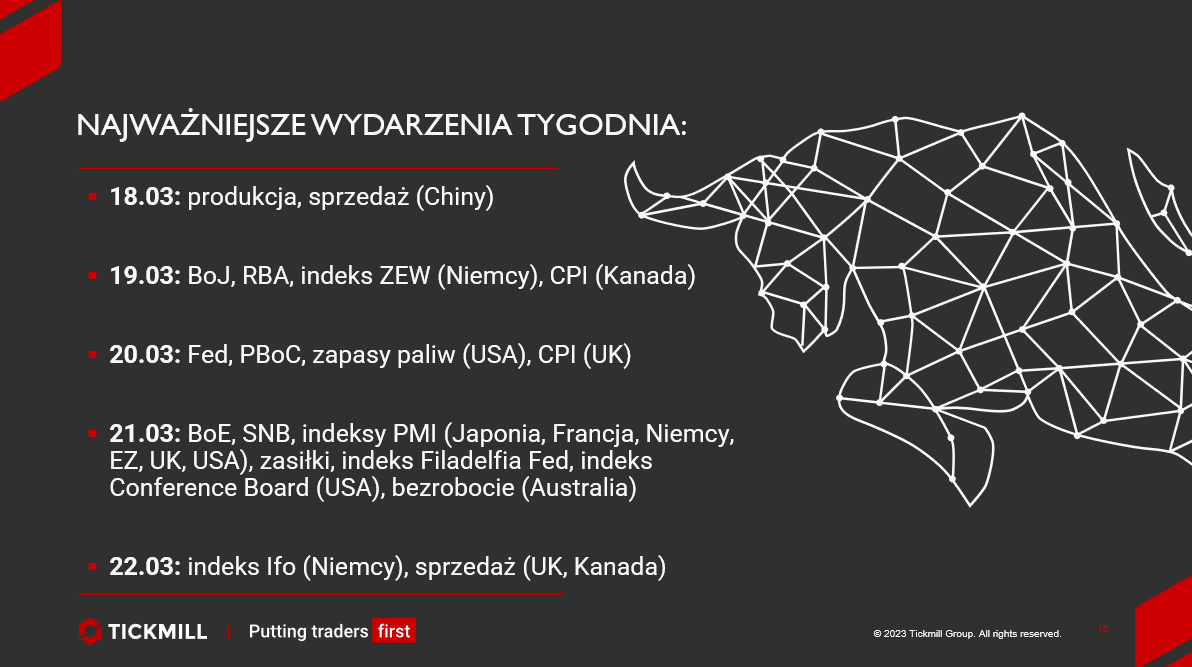

Key events March 18-22, 2024 Source: Tickmill

In the calendar, in addition to the previously mentioned central bank meetings, which will focus most of the market's attention, you can also find, among others: publication of preliminary readings of March PMI indices for the world's largest economies, ZEW and Ifo indices for Germany, Philadelphia Fed and Conference Board indices for the USA, inflation data in Great Britain and Canada, as well as production reports published on the night from Sunday to Monday industrial and retail in China.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response