Chinese electric cars want to conquer the global EV market. Will they make it?

Cars were a segment that developed well in Europe and the United States in the 20th century. When it seemed like that “Euro-Atlantic” will dominate the entire world, strong competition has emerged from Japan and South Korea. At first, Asian companies competed on price, but over time they developed their own solutions. For example, Toyota introduced the JIT system, i.e “Just in Time”, which has been introduced by many over time "western" concerns. Chinese companies also tried their hand at the combustion car market. However, for many years, the successes of producers from the Middle Kingdom were small. The Chinese car market was “colonized” by Western companies. Volkswagen had a particularly strong position and held the leading position for many years. Brands such as Toyota and Honda also performed well. However, in recent years the Chinese have gained enormous popularity. They are particularly good in the electric car (EV) segment. What was the reason for such a reshuffle? Do Chinese companies have a chance to conquer the global EV market? We invite you to read!

Why has the Chinese EV market developed so dynamically?

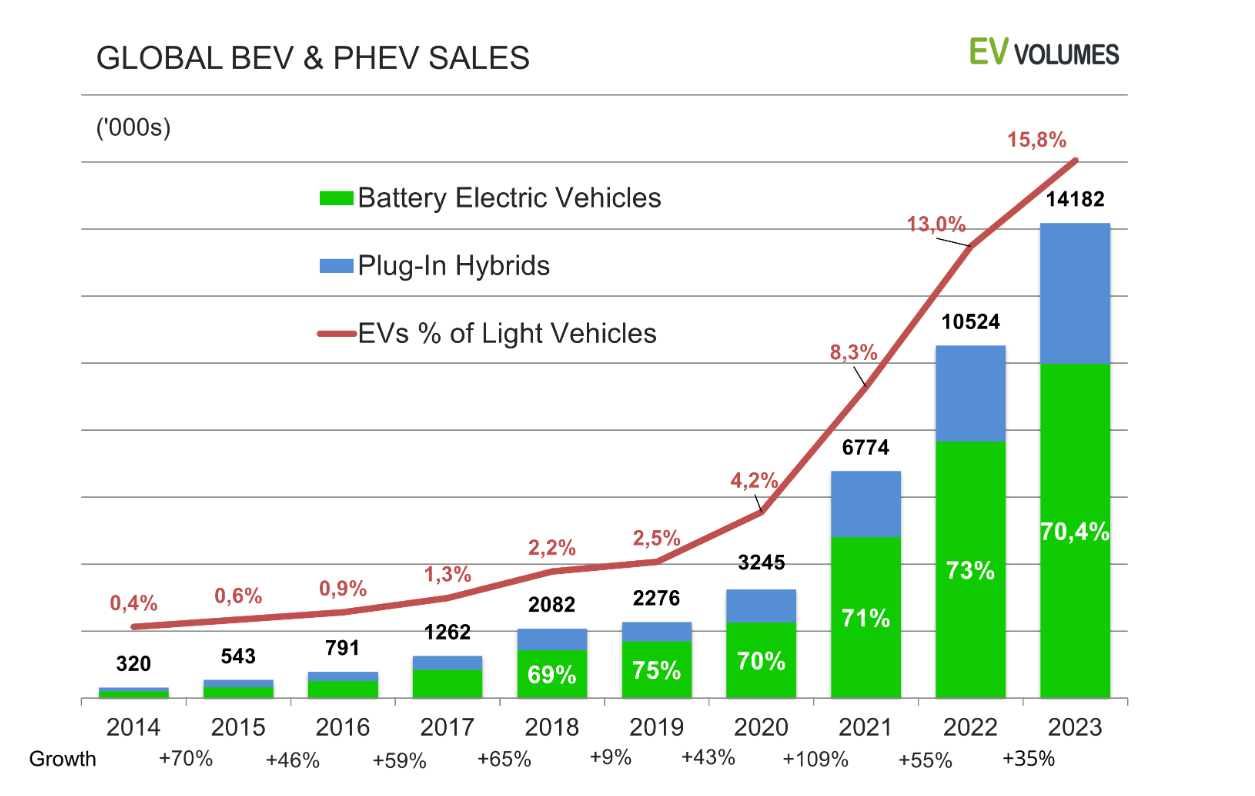

At the very beginning, it is worth explaining what the electric car market looks like. The most popular solutions are PHEV (Plug-in Hybrid Electric Vehicles) and BEV (Battery Electric Vehicles). PHEV cars are so-called hybrids that combine combustion and electric drive. This reduces fuel consumption. In the case of BEVs, they are fully electric cars that need a different charging infrastructure than classic cars. The chart below shows the dynamic growth of the electric car market. In 2014, they accounted for only 0,4% of cars sold “electrics”. In 2023, the share of electricians was 15,8%. Therefore, it is clear that EVs are not a curiosity, but an increasingly important segment. The most important market for this type of cars is China. According to the Global EV Outlook 2023, in 2030, the Middle Kingdom will have a 40% share in the global EV market.

Increase in the number of electric cars sold. Source: EV Volumes

The CCP chose electric cars

In China, the Chinese Communist Party (CCP) has been looking for ideas for many years advancement in the international division of labor. At the beginning, the Middle Kingdom specialized in the production of simple things, because low labor costs were a huge advantage. However, over time, more and more advanced production processes came to China. Chinese companies also appeared, most of which competed on the local market on price. Over time, companies emerged that successfully challenged Western competitors. Examples include: Alibaba, Tencent or Xiaomi. However, in the automotive market, Chinese companies had trouble gaining market share. The Chinese still held the opinion that foreign car manufacturers offered better quality products, and Chinese ones were associated with shoddy and unreliable. Another problem was that the existing leaders had operational advantages. They knew how to produce cheaply and optimize costs. Another problem for Chinese companies were numerous patents from foreign car manufacturers. In such conditions, it was difficult to “grab” market shares. A window of opportunity has emerged as electric cars have become more popular. The Communist Party of China has decided to support the development of EV manufacturers. Companies that challenged the existing leaders began to appear like mushrooms after the rain.

The Chinese government used the approach “carrot and stick”. The CCP's incentives included:

- Consumer subsidies – a program that offered subsidies for a decade for the purchase of an electric car. The subsidies lasted until 2022 and last year the subsidies amounted to 60 yuan (approx. PLN 000). Currently, government support is no longer available, but some local governments decide to introduce subsidies themselves. An example is Shanghai, where in 33 subsidies amounted to RMB 000 thousand for BEV cars and PLN 2023 thousand for BEV cars. RMB for PHEVs.

- RThe government abolished the 10% tax on the purchase of a new car. This relief applies only to EV cars. In 2026-2027, the tax for electricians will be 5%. The reliefs are scheduled to expire by the end of 2027. It is estimated that the cost of this program in the years 2014-2027 will amount to approximately RMB 835 billion (approx. PLN 472 billion).

- Subsidies for electric car manufacturers. The ease of obtaining subsidies meant that, just a few years ago, there were many companies involved in the design or production of EVs. Of course, most of them were unable to gain recognition from consumers or lacked financing. Ultimately, several national leaders emerged on the market. Among them is BYD, SAIC or Changan. In addition, there are other companies with significant market shares Li car or NIO.

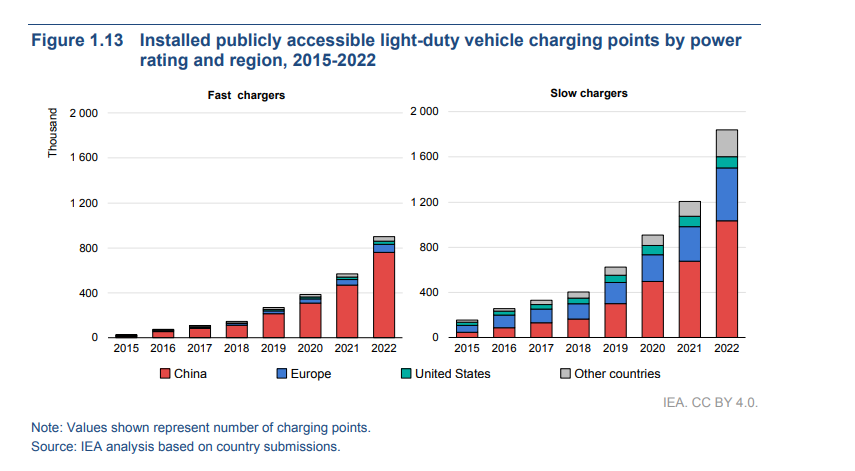

- The Chinese government did not just think point-wise, but holistically. In effect vehicle charging infrastructure has developed dynamically. An important step was the unification of charging standards, which makes using an electric car easier. Fast charging stations were also developing dynamically, which significantly improved the comfort of electric driving. China is unrivaled in the world in terms of the number of charging stations and fast charging. The West has been left far behind and it will take a long time before a similar density of charging stations appears throughout the EU or USA.

Number of electric car charging stations. Source: Global EV Outlook 2023: Catching up with climate ambitions

It is also worth noting that governments and local governments began to "electrify" their transport. Electric bus manufacturers in particular benefited from this.

Many years of improving the offer meant that in 2022, for the first time on the Chinese market, domestic producers had a total of more than half of the market in the Middle Kingdom.

China is thinking about foreign expansion

After years of product development, Chinese electric car manufacturers decided it was time to try their hand at foreign markets. The United States and the European Union seemed to be the natural destinations. In the case of the USA, expansion was hampered by the actions of the American government, which introduced a tariff on Chinese cars (it was as much as 27,5%). This made exporting cars from China to the United States unprofitable. However, the European Union was more liberal as the tariff was only 10%. So there was an increase in shares “Chinese food” on the European EV market. In 2021, Chinese electric cars had about 4% share in the EU EV market, while in 2023 it was already 8%. Reuters reported that Chinese brands are to take over 15% of the European EV market by the end of 2025. The introduction of approximately 11 mass car models will help achieve this goal.

The big advantage of Chinese manufacturers is that they produce cars very cheaply, which makes them competitively priced. This is due to lower labor and energy costs and good production optimization. China is currently one of the largest R&D centers in the automotive industry. This means that there are models that can surprise with avant-garde solutions and an interesting silhouette. It's also worth noting that the quality of some Chinese models is not inferior to European or Japanese competition. Some Chinese electric cars have received five-star safety ratings.

Another important factor is the trend of increasing automation, which means that car users have to focus less and less on the driving process itself. This means that the time spent driving can be used for entertainment, office work or communication with the world. Interestingly, Technology companies are also investing in EVs. This is due to the fact that cars are increasingly packed with electronics. An example is Xiaomi, yes, there is no mistake in the text. A smartphone manufacturer is entering the electric car market. It is supposed to be a flagship project Xiaomi SU7. Ultimately, the monthly production of the new car is to amount to 10 units per month. The average price for the car is expected to be comparable to the Tesla Model 000.

Chinese electric car Xiaomi SU7. Source: mi-home.pl

The pressure from BYD and other Chinese manufacturers worries managers of Western companies. Carlos Tavares, who is the CEO of Stellantis (owner of Peugeot, Citroën, Chrysler, Opel, Fiat, among others) fears the invasion of Chinese electricians in the next few years. Of course, not everything is that simple. Firstly, profits are reduced by tariffs on Chinese products. Sales costs in Europe are higher than in China because, in addition to taxes, there are also transport costs and adapting cars to EU standards (safety, ecological aspects, etc.). Another problem is overcrowded ports, which extend the delivery time of EVs to European showrooms.

The largest Chinese car manufacturers listed on the stock exchange

The Chinese capital market, despite the fact that it is little known to investors in Europe, is an attractive place to raise capital, which is why many car manufacturers decided to debut on the stock exchanges in Hong Kong, Shenzen, Shanghai or Beijing. Why do car manufacturers decide to debut on the stock exchange? The reason is that selling cars is a capital-intensive business with low margins. It is important to remember that the operating profit of most car manufacturers oscillates around a few percent. The exception are owners of luxury brands (e.g. Ferrari), which can achieve EBIT margins of over 30%.

BYD – a synonym for the success of the Chinese automotive sector

BYD is short for Build Your Dreams. It is a leading manufacturer of EV cars that successfully competes with the largest players on this market. Interestingly, an investment vehicle invested in the company in 2008 Berkshire Hathaway. This means that it was already a dozen or so years ago Warren Buffett i Charlie Munger they saw potential in this company and in the person of the company's president. Berkshire paid $10 million for 230% of the company's shares. In the following years, Warren Buffett decided to increase his exposure to the company. In 2021, the share increased to 21%. BYD initially focused on producing batteries, but over time it was decided to try its hand at the automotive market.

The change in the business model itself was not very well received by investors. This was due to the fact that in June 2002, the company debuted on the stock exchange and collected PLN 1,6 billion. Hong Kong dollars. Less than a few months after the IPO, the company decided to acquire the car manufacturer Xi'an Qinchuan Automobile. BYD paid HK$77 million for 269% of the shares. The seller was a state-owned defense company - Norinco. Some investors complained that information about acquisition plans was not included in the prospectus.. Xi'an Qinchuan Automobile itself has been operating in the car market since the 80s. So it had experience in production and work organization. BYD initially focused on the production of cars with an internal combustion engine (BYD Flyer).

However, initially everything did not go according to the plans of the main shareholders. Sales were not impressive, and R&D left much to be desired. The new model 316 (working name) was rejected by dealers, among others. due to “poor design”. This resulted in a write-off of the project of over RMB 100 million. The second attempt turned out to be better. The BYD F3 model challenged the Toyota Corolla. Ultimately, less than two years after the car's debut, sales exceeded 100 units. Nowadays, such numbers are not jaw-dropping, but China was much poorer 20 years ago than it is today. Many Chinese could not yet afford a new car, while the middle class looked closely at the price-quality ratio. In turn, the less wealthy believed in CCC (Price Works Miracles). The first model was intended to be addressed to followers of this view. However, at that time the car business generated only a dozen or so percent of revenues. As BYD Auto developed, the share of this segment also increased. In the first half of 2009, for the first time, car sales generated higher revenues than the core business.

The beginnings were stereotypically Chinese. For the first models, reverse engineering reigned supreme. This meant that BYD's products were based on competitors' solutions. For example, the BYD F3 was modeled on the Toyota Corolla, while the F0 was confusingly similar to the Toyota Aygo.

BYD F3. Source: wikipedia.org

Cost control allowed the final price of cars to be reduced, which helped attract price-conscious customers. The increase in demand made it necessary to increase production capacity. In 2008, BYD had two factories with a total production capacity of 300 units. Importantly, the management board knew that in the long run, only imitating competitors is the path to failure. For this reason, an R&D center in Shanghai operated already in the first decade of the 2008st century. The funds invested in the work of engineers and designers meant that BYD ultimately stopped using Mitshubishi engines, but developed its own engine based on the previously used one. The Chinese company's product was simply an improved version of a previously licensed product. In 3, the FXNUMXDM was launched, which was the world's first plug-in hybrid car. Just a year later, BYD started selling electric buses, which allowed it to win government contracts. Thanks to this, the Chinese manufacturer benefited from government and local government support. Support for the EV production sector resulted from government purchases, subsidies for buyers, tax reductions and preferential loans granted for business development.

Interestingly, EV development has not been without problems. For example, at the Beijing Auto Show, the company showed a BEV (battery electric vehicle) version with a range of up to 300 km. It was planned to start selling this car around 2010. However, the plans were suspended due to poor vehicle charging infrastructure. Managers then concluded that the market was not yet ripe for the electric revolution.

The company was the beneficiary of huge government subsidies for many years. Government subsidization of car purchases has resulted in a surge in EV sales. As a result, the company quickly boasted high profits from the sale of electric vehicles. However, when subsidies for the purchase of electric cars were reduced, revenue growth from this market slowed down between 2017 and 2019.

Since 2020, there has been a sharp increase in electric car sales. This was due to both the increasing popularity of EVs in the most important car markets in China (including Shanghai, Guangzhou, Beijing) and the company's increasingly better reputation among the Chinese. It is worth remembering that the new generation is not ashamed to buy domestic products. This is a big difference than at the turn of the 20th and 21st centuries, when this opinion prevailed “better, because imported”. The last three years have been a real boom for BYD cars. In 2023, sales amounted to 3 million cars, which is more than a 7-fold increase compared to the already good 2020 (taking into account COVID-19). Approximately 13,6 million EVs (BEV and PHEV) have been sold worldwide. In 2022, the company withdrew from the production of cars with combustion engines.

In 2024, the Chinese market will account for approximately half of the company's revenues. The goal is therefore foreign expansion, mainly to Europe, Southeast Asia and South America. For logistical and tax reasons, BYD intends to expand production on Hungary, Brazil and Thailand.

It is worth remembering that BYD is also a battery manufacturer. In recent years, the company has focused heavily on development LFP battery (LiFePO4), i.e. a lithium-iron-phosphate battery. BYD's success in the battery market is proven by the following: Tesla Model Y has a BYD Blade battery. Similarly, Mercedes-Benz, which also wants to use the Chinese company's batteries in some of its EV models.

BYD is not only cars for "mass" customers. Sales of premium cars are also being developed. A prime example is Yangwang U8 i Yangwang U9.

YangWang U9. Source: wikipedia.org

“The Nine” is sold for over 200 000 $, so it's only for those with deep pockets. On the other hand, Seagull is sold at a price of PLN 10 - PLN 12,5. dollars. As you can see, BYD is trying to enter every price range.

If we look at the company's financial results, they look decent in terms of profitability. Please remember that BYD operates in a competitive market, so it has no chance of achieving an operating margin of 20-30%. The company would have to start producing only luxury cars. An example of such a company is Ferrari, which, despite operating in the automotive industry, achieves spectacular profits. BYD wants to sell mainly to "ordinary consumers", hence the single-digit margin.

| million RMB | 2020 | 2021 | 2022 | TTM 23' |

| revenues | 156 597 | 216 142 | 424 061 | 578 648 |

| operational profit | 13 045 | 7 597 | 22 976 | 36 809 |

| operating margin | 8,33% | 3,51% | 5,42% | 6,36% |

| net profit | 4 234 | 3 045 | 16 622 | 28 678 |

Source: own study

Other Chinese companies

BYD is one of the largest automotive manufacturers in the world. But China is home to many companies operating in the automotive EC market or their components. The largest automotive companies listed in China, apart from BYD, include:

- NIO

- LiAuto

- XFeng

NIO

It is sometimes called "Chinese Tesla". The company was established in 2014, and after only two years it obtained significant financing, including: from Tencent (a Chinese technology company), the Sequoia fund or Lenovo. Interestingly, in 2018, the company launched the first battery replacement station in Shenzhen. It is worth mentioning that the dominant technology for charging cars are chargers (fast and slow). In the same year, Nio debuted on the New York Stock Exchange, where $1,8 billion was raised from the market. Despite great announcements, the company had problems with selling cars. Then there was COVID-19. The revenue collapse left Nio with a liquidity problem. The situation was saved by the Hefei authorities and Chinese investors, who in total provided over $1 billion in additional funds. As a result, 2020 was a great year for the company, with shares rising more than 20 times. However, investors had high expectations, which the company did not meet. As a result, the value of the company's shares dropped sharply. It is also worth adding as an interesting fact that NIO has started selling smartphones (NIO Phone).

| million RMB | 2020 | 2021 | 2022 | TTM 23' |

| revenues | 16 258 | 36 136 | 49 269 | 48 514 |

| operational profit | -4 608 | -4 496 | -15 641 | -21 792 |

| operating margin | -28,34% | -12,44% | -31,74% | -44,91% |

| net profit | -5 611 | -10 572 | -14 559 | -20 915 |

Source: own study

LiAuto

It is certainly a less known company than BYD or NIO. That doesn't mean it's not a small company. Its capitalization is currently over $45 billion. The company itself was established in 2015 as a result of Li Xiang's efforts. Thanks to its personality and the construction of an interesting plan for scaling the business, the start-up quickly obtained financing from meituan ("Chinese Pyszne.pl" on steroids) and Source Code Capital. 5 years after the company was founded, it debuted on NASDAQ. As part of the IPO, the company raised over $1 billion. Thanks to their interesting design and listening to customer expectations, Li's cars quickly gained popularity. However, it was not without controversy. For example, traces of mercury were discovered in one of Li One's cars, which is inconsistent with standards in China. “Mercurygate” had a negative impact on the company's stock price in 2021. It was an image crisis that hurt, especially since Li positioned itself in the premium segment.

| million RMB | 2020 | 2021 | 2022 | TTM 23' |

| revenues | 9 457 | 27 010 | 45 287 | 74 432 |

| operational profit | -669 | -1 017 | -3 655 | -232 |

| operating margin | -7,07% | -3,77% | -8,07% | -0,31% |

| net profit | -792 | -321 | -2 012 | 1 839 |

Source: own study

XPeng

XPeng was founded in 2014 by former employees of the state-owned GAC. It is worth mentioning that one of the co-founders - Xia Heng - was a scientist at GAC and thanks to his work, the state-owned company obtained several patents. Xia Heng believed that the company's advantage could be innovation. For this reason, he looked for former employees among his colleagues BMW, Lamborghini, BYD, Tencent, Huawei or Samsung. This policy sometimes backfired on the company. For example, engineer Cao Guangzhi copied the source code of the company's Autopilot system while working at Tesla. After some time, he got a job at Xpeng. The case ended up in court, where Tesla sued Guangzhi for unethical behavior. XPeng distanced itself from its new employee, but the bad taste remained.

XPeng is a company that develops in two directions: electric cars and autonomous. The company's CEO mentioned at the earnings conference at the end of 2023 that XPeng's autonomous cars cause fewer accidents than humans. The autonomous system uses solutions NVIDIA. It's about the product NVIDIA DRIVE Orin, which allows the G6 model to function, which controls the vehicle with the help of 31 sensors. NVIDIA's product is a so-called SOC, i.e Systems-on-a-chip. It can perform 508 trillion operations per second (TOPS, i.e Trillion Operations Per Second).

XPeng is a company that challenges Tesla, but at the same time has its own, often futuristic ideas. One of them is the X3, which was presented in 2022. The car was designed to both drive on the road and fly thanks to two large drones attached. Of course, the company does not only deal with such extravagant solutions. It also offers "ordinary" cars such as the XPeng G9, which was presented as:

“the fastest charging SUV in the world.”

The car could be charged from 20% to 10% in 80 minutes. In turn, XPeng P7 was supposed to conquer the Scandinavian market. This model was to compete for customers' favors, among others. with Tesla S. In China, it was received with moderate enthusiasm. In the first 6 months, sales in the Chinese market exceeded 10 units.

Of course, these are not all companies that sell electric cars, and above we have only described the most interesting ones. Other examples of such companies could be:

- SAIC,

- Geely,

- GAC Group.

In addition to car manufacturers, companies that offer key components are also listed in the Middle Kingdom. These include: CATL, which is a leading manufacturer of batteries for both combustion and electric cars.

Will Chinese electric cars wipe out European competition?

To summarize, the Chinese government's activities in the electric car industry can be summarized as follows:

- The choice of the automotive sector is "strategic". As a result, a lot of funds flowed to electric car manufacturers.

- Not only the central government was involved in the development of the sector, but also local governments, which, depending on their strategy, supported the demand side (car buyers) or car manufacturers.

- A lot of available capital meant that EV production companies appeared on the market like mushrooms after rain. As a result, companies such as Huawei, Xiaomi and others had or have exposure to this market Evergrande (famous real estate developer).

- A program has been launched to expand the infrastructure for electric cars (charging stations), battery replacement stations, etc. Thanks to this, car buyers do not have to worry that charging the car will be troublesome.

- Car manufacturers increased production capacity and spent a lot of money on R&D. This allowed us to improve the quality of the cars and improve their visual appearance. Thanks to the research, Chinese companies are no longer just imitators of solutions from the USA, Europe, South Korea or Japan.

- The next stage was the reduction of subsidies, which intensified competition. As a result, weaker companies are eliminated from the race. This results in a better allocation of funds in this sector of the economy. Strong competition also results in the emergence of companies with huge production capacities that were forced to strongly optimize costs. Thanks to this, firstly, they can produce in large quantities and cheaply, and they have extensive R&D teams that optimize EVs.

- Due to high competition on the domestic market, we are expanding to foreign markets. Chinese cars reach developed markets, where their offer is competitive or even better than that of domestic manufacturers. Europe is particularly at risk, as it has a very extensive automotive sector, but it has lagged behind in the production of BEV and PHEV cars.

In the automotive segment, China has gone from a cheap imitator to a supplier of interesting solutions that can be found in companies such as Volkswagen. This may be a significant threat to the current leaders of the automotive market. This is due to the fact that Chinese companies are gaining experience in mass production of EV cars. Thanks to this, they can learn from their mistakes and refine their products. It is not surprising that the United States is trying to protect its market with tariffs, while the European Union is seriously considering how to limit the risk of Chinese cars conquering the EU market. It seems that China is following the path set by the Japanese and Koreans in the automotive market. And so far they are doing it extremely well.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response