EU energy security can mean going back to coal using CCS

Europe's fragmented energy policy has led to a national security crisiswhich Europe will now have to deal with as soon as possible. Of all the options, including coal, nuclear, solar and wind power, thermal coal is by far the fastest way for a power plant to move away from gas. Switching from gas to coal, however, comes with costs for the environment and for our European green transition narrative. Despite this sequestration technology, or carbon capture and storage ( carbon capture storage(CCS) is growing rapidly and Europe can revert to coal if it is combined with CCS, thus creating a new industry. We analyze the combination of coal and CSS and identify individual companies involved in these two areas.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

All options come into play

The events of the last week have existential significance for Europe, a defense policy and energy, from an uncoordinated strategy between individual countries, has turned into a supranational issue. Europe's dependence on Russian gas and oil has weakened its military flexibility, as a result of which the European energy policy will undergo a complete transformation in the coming years. Germany de facto stated that all options come into play, including nuclear, coal and LNG. German Chancellor Scholz said on Sunday in the Bundestag that "We have to change the course to become independent from imports from individual energy suppliers".

LNG terminals and nuclear power plants are long-term solutions, while renewable energy projects such as solar and wind energy are medium-term solutions as they take a long time to scale. In addition, increasing the share of renewable energy sources involves additional costs related to energy storage in order to mitigate discontinuities in jumps in renewable energy production.

Europe is moving rapidly in the direction "Gas crisis"and given the continent's recent mild weather conditions, this means Europe is likely to survive the cooling season, but European countries are under pressure to fill their natural gas storage facilities before next winter, and Russia is unlikely to lend a helping hand this time. Germany has announced that it is already building up coal reserves and extending the life of coal-fired power plants. Many gas power plants can be converted to coal, so a return to coal in energy policy is very likely at this point.

Realistically speaking, the only short-term solution that Europe has to deal with the energy crisis and change its energy security policy as quickly as possible is to focus on coal-fired power plants. There are significant reserves of coal in the world, whereby The United States is responsible for 24% of the world's carbon reserves, a Australia has the third largest reserves, accounting for approximately 14% of the world's carbon reserves. Coal is cheap, great for baseload electricity production, and Europe is able to source significant amounts of this raw material from its geopolitical partners; however, coal generates pollution, which is a problem in the context of climate change and the green transition.

Combination of coal power plants with carbon capture

Coal fired power plants are a fast and scalable solution to reduce the impact of Russian natural gas, but there will be resistance from environmental voters. One strategy, however, could be to accelerate the construction of coal-fired power plants with the possibility of implementing carbon dioxide capture (CCS) technology as soon as possible. Is it even possible?

First of all, it should be noted that when energy policy becomes a critical issue of national security, the decision in this regard is no longer a free market decision, just as the green transformation is a political decision that dilutes the forces operating in the free market. The additional cost of CCS over the cost of coal-fired power plants may simply be at the expense of energy independence from Russia and will have to be accepted by Europe in the short term.

The good thing about CSS is that the technology already exists and can be implemented faster and faster. Report prepared by the Global CCS Institute "Technology Readiness and Costs of CCS" ("Technological readiness and CCS costs”) (March 2021) presents the most important information about this technology on over 50 pages.

CCS is essentially a three-step process in which carbon emissions from industry and power plants are first captured and CO is then transported2 by ships, trucks or pipelines; the final step is storage, which requires the compression of the CO2 to a very high pressure of at least 74 bar, which can be reached at a depth of at least 800 m. Storage typically takes place in exhausted oil and gas fields or in brine formations. The graphic below shows the carbon capture process in the power plant.

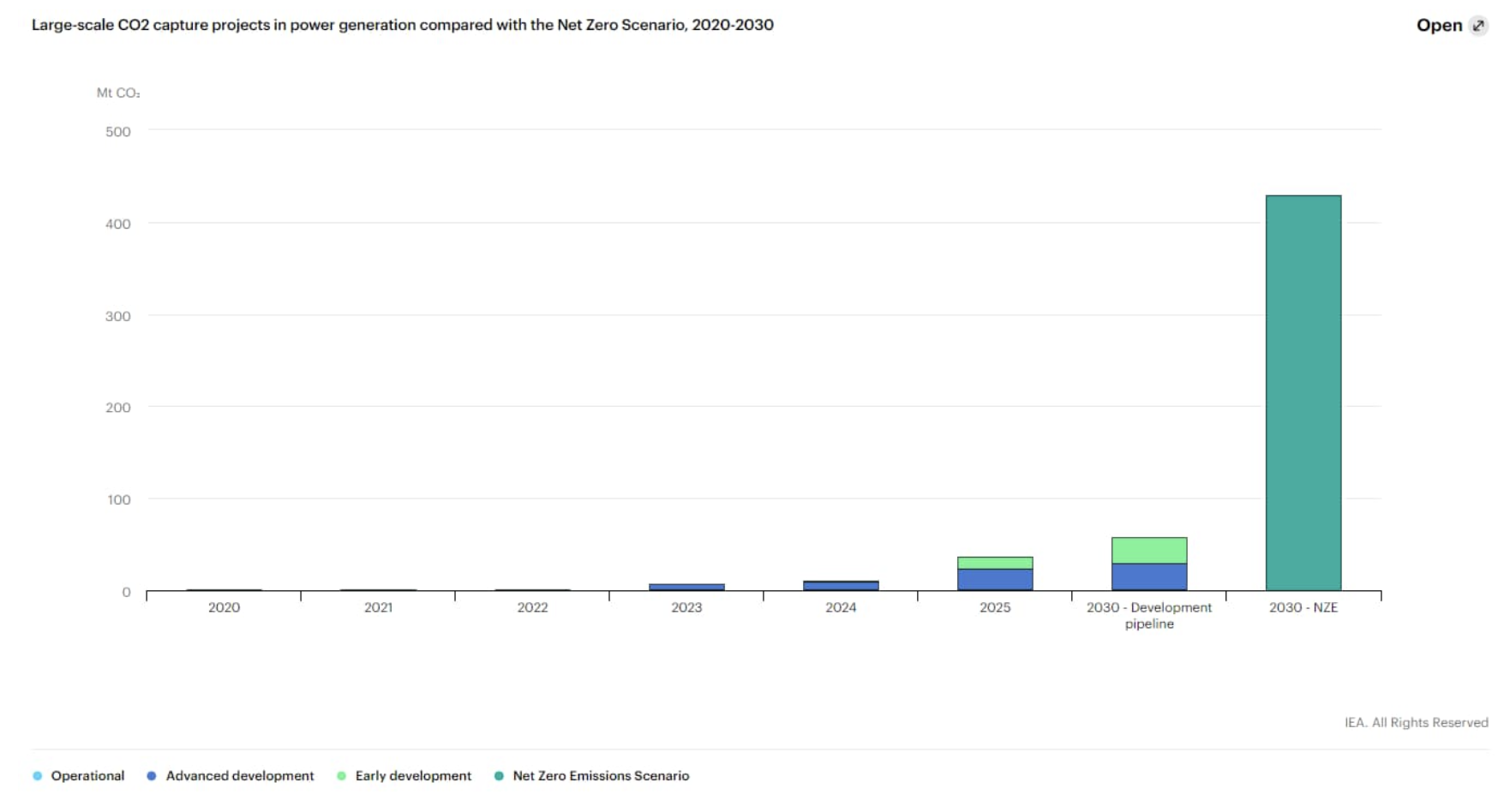

MAE also offers quite useful illustrations and information on CCS in relation to electricity productionand the graph below shows the CCS projects that are in progress in terms of capturing millions of tonnes of CO2. According to IEA, second-generation CCS capture would be possible at a cost of USD 45 / t CO2which means that a combination of cheap thermal coal (if supply has been significantly increased) with CCS could make this solution cost-effective enough to function alongside nuclear power and renewable energy sources. Second-generation CCS units will also have 67% lower investment costs and a capture rate of 95%.

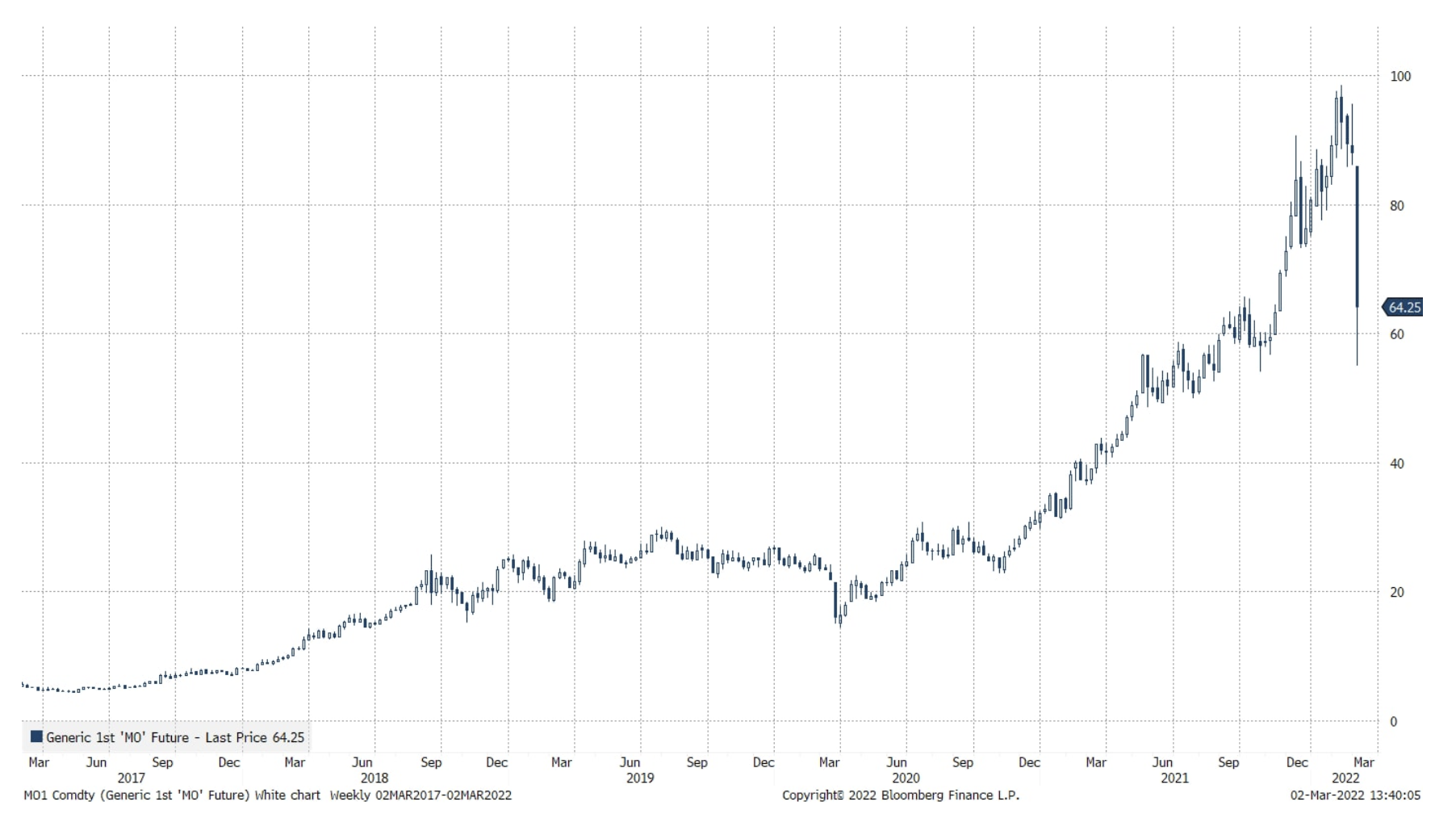

One of the key factors that has made it possible to use CCS on an unprecedented scale is carbon price in the EUwhich recently exceeded EUR 90 / t CO2However, rising energy and metal prices have resulted in a rise in the cost of manufacturing industrial goods in addition to the carbon price, reaching a level where demand is actually falling.

Companies with exposure to Carbon Capture and Coal Mining

The carbon capture industry is growing and maturing rapidly, and the lower implementation costs of CCS make this technology a viable solution to reduce the climate effects of carbon dioxide emissions. There are few investments solely for carbon capture, however we have tried to compile a stock list of companies operating fully and partially in the carbon sequestration area:

- Aker Carbon Capture (fully)

- CO2 Capsol (fully)

- Occidental Petroleum (partially)

- Schlumberger (partially)

- Equinor (partially)

- California Resources (partially)

The list below includes companies extracting coal or providing services related to coal extraction, listed in developed markets:

- Glencore

- China Shenhua Energy

- Yancoal

- Arch Resources

- Alliance Resource Partners

- Warrior Met Coal

- Console Energy

- PeabodyEnergy

- Whitehaven Coal

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)