It's going to be a hot week in the financial markets. PMI from Germany

The fourth week of July started in the financial markets with the publication of PMI indices. In the following days, investors' attention will be shifted to meetings of the main central banks, and the week will end with the publication of the latest data on inflation and GDP from the world's major economies.

Corrective strengthening of the dollar

The previous week was marked by, as it seems, only corrective, strengthening of the dollar against major currencies. This was clearly visible not only in EUR/USD, which fell from Tuesday's high of 1,1275 to $1,1125 at the close of Friday, but also on USD / JPY (increase from below 138 yen to 141,77 yen) or USD/PLN (increase from PLN 3,9355 to PLN 4,01).

The stock markets in the first half of the last week maintained very good moods, which resulted there were new records for the bull market on Wall Street that had been going on since the fall and the Warsaw Stock Exchange. At the end of the week, however, the desire to take profits appeared.

There was also considerable volatility in commodities. For it Bitcoin has been pretty boring lately. Since the second half of June, the quotations of this cryptocurrency have been in a wide consolidation with the axis at the level of USD 30500, and before the weekend, we also observed a mini-consolidation below USD 30000.

July PMI readings

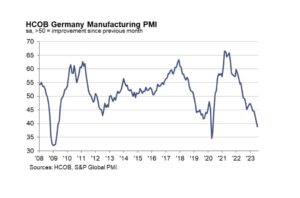

This week is going to be very interesting in the financial markets. There will be a lot going on. And from the very beginning. At night we got the July PMI readings for Australia and Japan, and in the morning similar data for France, Germany and the euro zone.

Data from the German economy in particular aroused a lot of emotions. Above all strong decline in the industrial PMI index. In July, it unexpectedly dived from 40,6 points. to 38,8 points, which was not only a result significantly worse than expected (41 points), but also the worst result since the pandemic. So it is not surprising that in reaction to this data EUR / USD exchange rate it dived below $1,11.

Even today, investors will get to know the July readings of PMI indices for the manufacturing and services sectors in the UK and the US.

They will be published on Tuesday ifo indexes for Germany (forecast: 88 points) and American consumer confidence prepared by the Conference Board (forecast: 111,5 points).

Wednesday's FED decision already in prices?

The most important event of the week, or rather one of the two most important, will take place on Wednesday. Then we'll know Fed decision on interest rates in Usa. The Fed is expected to raise interest rates by 25 basis points, thus raising the fluctuation range for the federal funds rate to 5,25-5,50 percent. And such a decision should already be in the prices. What is not included in the prices are suggestions on what to do next with monetary policy in the US.

Also on Wednesday, inflation data from Australia will be released, which may be an important point of reference for expectations regarding future decisions Reserve Bank of Australia (RBA). The next RBA meeting is scheduled for next week and economists predict that it will deliver an increase in interest rates In Australia.

On Thursday, July 27, the second important event of the week, i.e. the ECB meeting, will take place. The market assumes that the bank will raise interest rates by 25 basis points, thus raising the deposit rate to 3,75 percent and the refinance rate to 4,25 percent. And as in the case of the Fed, it will be crucial what suggestions from the monetary authorities regarding what will happen next with rates in the Eurozone.

A quarter of an hour before the Thursday ECB decision, investors will learn the latest data on American GDP for the second quarter of 2023 (forecast: 1,6% on an annualized basis). However, bearing in mind that it will be the day after the Fed meeting, then the impact of this report will be relatively small.

The Bank of Japan will decide on interest rates on Friday. This decision, however, will not evoke similar emotions as in the case of the Fed and the ECB. Therefore, on this day the attention of the markets will rather be concentrated on the publication of July CPI inflation data among others in Germany (forecast: 6,2% y/y), France (forecast: 4,4% y/y) and Spain. They will be an important point of reference for the signals sent the day before by the ECB. An additional "taste" will be the preliminary GDP estimates for France and Spain to be published on Friday.

Macro data and decisions of central banks are not everything. Don't forget that it's quarterly earnings season on Wall Street. It is an important reference point for stock exchanges. Especially that this week reports will be published by such well-known companies as A, Microsoft (July 25), Amazon, Meta Platforms (July 26) and Intel (July 27).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response