John Maynard Keynes - one of the richest economists in history

Economics students John Maynard Keynes is mainly known for his life work - "The General Theory of Employment, Interest and Money", which laid the foundations for a new current in economics called Keynesianism. His view of the economy revolutionized the economic policy of governments and contributed to the development of macroeconomics. However, Keynes was not just an economist. For many years he has been actively trading both in the stock, currencies and commodities markets. Although he was close to bankruptcy for some time after his death he left a fortune worth over £ 400. At present, this seems like a small amount, however at today's prices, his net assets would be over a dozen million dollars. In this article, you will learn about the history of this economist and trader and his views on the market. We invite you to read.

Keynes' family

John Maynard Keynes was born in 1883 (the same year Karl Marx died). His family belonged to the upper middle class. Father - John Neville - was an economist and lecturer at Cambridge University. In turn, mata - Florence Ada - was active in many organizations, incl. Charity Organization Societythat helped older people living in poverty. John Maynard Keynes also had two siblings: Brother Geoffrey, who became a surgeon, and sister Margaret, who married Archibald Hill (Nobel Prize winner in psychology).

Education

In January 1889, at the age of six, young John began attending the Perse School for Girls. He showed arithmetic skills very quickly. However, due to health reasons, he began to have large absences. For this reason, he began to be home tutored by his mother and governess Beatrice Mackintosh. In 1892, he enrolled at St Faith's. There he once again showed his talent for mathematics, becoming the best student in the class. In 1896, his teacher, Ralph Goodchild, was impressed by his skill and wrote that Keynes "is a headache at school". The teacher suggested that Keynes should move to Eton. In 1897, John Maynard received a royal scholarship at Eton College, where he once again showed his talent for mathematics and history. Four years later, he received the Tomline Award for Achievement in Mathematics. At the same time, young Keynes was very sociable and despite his origins, he was accepted by students from the upper social class.

Eton College

King's College Cambridge

In 1902, Keynes left Eton and moved to King's College, Camebridge. British economist Alfred Marshall persuaded John to become an economist. However, young Keynes leaned more towards philosophy, in particular the GE Moore ethical system. During this period, Keynes was a member of the University Pitt Club and the Cambridge Apostels. Before leaving Cambridge, Keynes was chairman Cambridge Union Society and Cambridge University Liberal Club.

Career

In 1908, Keynes entered a government job. The first position was a clerk Civil Service in India. After initial satisfaction with the job, he quickly fell into routine and decided to return to Cambridge where he began working on probability theory. A year later, he published his first professional article in The EconomicJournal. The topic of the article was the impact of the recent economic downturn on India. In the same year he founded Political Economy Club. Two years after the first article was published, John became editor for The Economic Journal. One year before the outbreak of World War I, Keynes published his first book: "Indian Currency and Finance". In 1913 he joined the Royal Commission, where he handled Indian affairs. In his work, he showed the ability to apply economic theories in practice. During World War I, Keynes worked at the Treasury. He earned a reputation as a very good worker there.

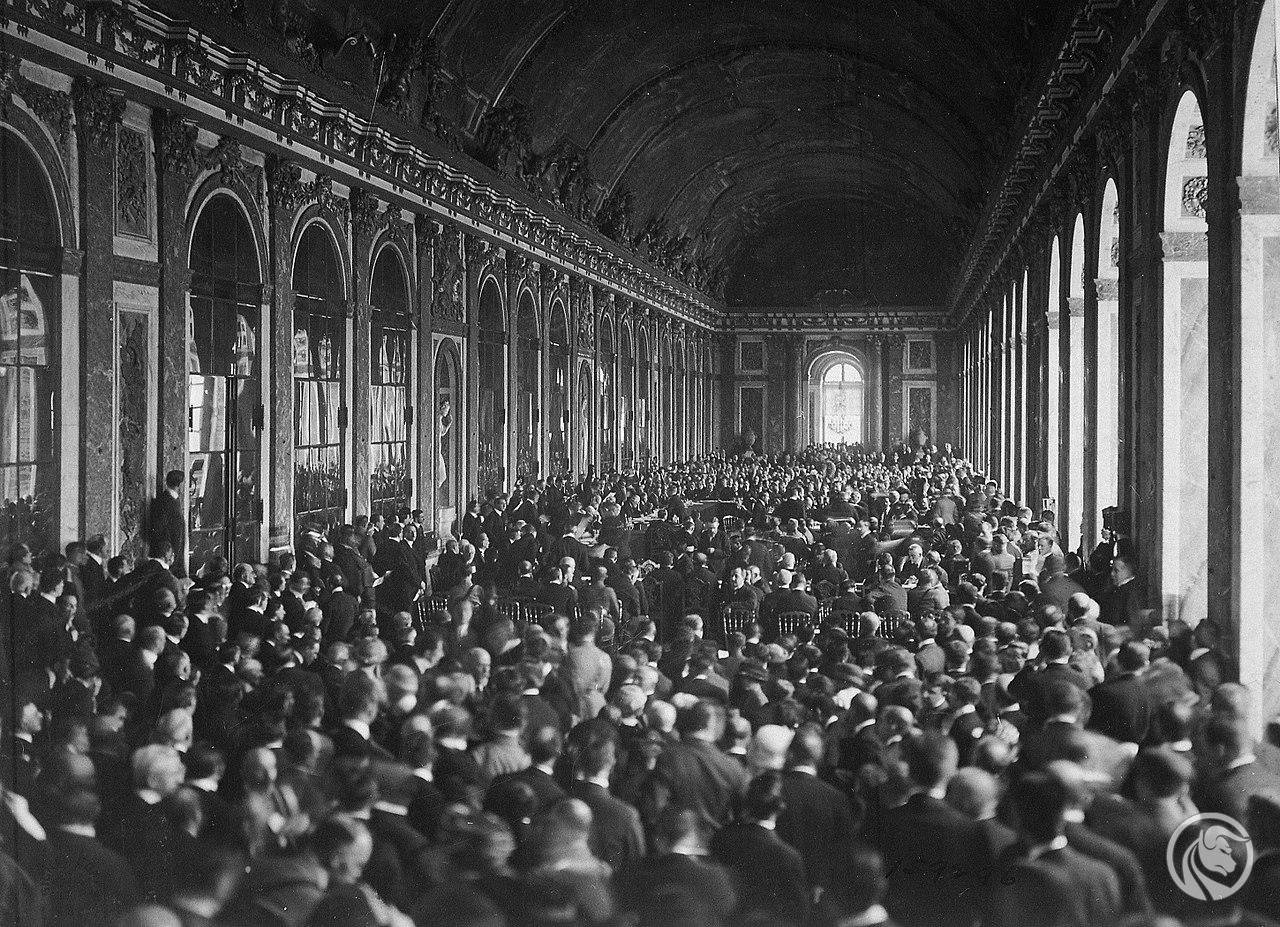

During the Versailles peace conference, he opted for a reduction in the contribution imposed on Germany. He believed that too heavy burdens imposed on this country would cause a collapse in imports, which would weaken the global economy. He included his thoughts in a book "The Economic Consequences of the Peace"which was released in 1919 and quickly gained popularity.

In the following years, Keynes postulated limiting German reparations in "A Revision of the Treaty" and encouraged the British government to be more active in economic policy, including by organizing public works. He also encouraged the pound to abandon gold in order to make monetary and fiscal policy more flexible. During the Great Depression, Keynes criticized the austerity policy of the British government, which he believed was supposed to reduce "aggregate demand" which was detrimental to economic growth.

General theory of relativity and the post-war years

Keynes also worked on his greatest work as it was "General theory of employment, interest and money". The book was published in 1936. The title itself "alluded" to Einstein's "General Theory of Relativity". In this book, Keynes criticizes economic liberalism and advocates greater state intervention in the economy. It was one of the most important economic works that brought about the "Keynesian Revolution" and placed macroeconomics at the center of the economy. Keynes argued in the book for governments to act "against the cyclical", that is, to increase spending during a recession and to reduce spending during an economic boom. He believed that the role of government was to seek "full employment" in the economy. According to the theory contained in the book, the level of employment did not depend on the price for labor (classical economy) but on aggregate demand. At the same time, he believed that wages and prices tended to be "sticky", meaning that they reacted late to changes in the forces of supply and demand.

During the Second World War and immediately after it ended, Keynes opted for the establishment of an international unit of account which was to be the bankor. This solution was to help conduct a balanced financial policy in the world. At the same time, he opted for more open trade and the establishment of international financial organizations. The International Monetary Fund and the World Bank began their wider activity after the economist's death in 1946.

John Maynard Keynes as an investor

However, the scientific achievements alone are not enough. Keynes was also an investor in the stocks, bonds, commodities and currencies. He died as the second richest economist in history (the first place is indisputably occupied by David Ricardo).

Keynes began his adventure with investing just after the war, at the age of 36. Initially, he was doing well and in 5 years, from £ 16 he managed to increase his fortune to £ 300. After the initial successes, however, came a cold shower. During the Great Crash, Keynes became technically bankrupt. My father and friends improved the financial situation. They supported him financially, which helped to end JM Keynes' worst period. Perhaps these experiences led him to believe in "animal instincts" that would have a decisive influence on stock market valuations. It is also not surprising that he is the author of the saying:

"The market can remain irrational longer than you can be solvent."

Over the decades, his investment portfolio and the method of searching for investments have changed. At first, Keynes focused on marko analysis. However, the strategy was not very successful. First, the boom of 1926-1928 was slept through. At the same time, the strategy did not save Keynes from the Great Depression. In the early 30s, he changed his strategy and started investing in discounted companies with solid foundations. Keynes preferred to concentrate his investment portfolio. The largest portfolio position was 11%, while the top 5 positions in the portfolio accounted for between 33% and 49%.

Over the years, it has reduced changes in the portfolio. Thanks to this, he saved on commission and gave companies time to show their value. The portfolio turnover in 1921-1929 was 55%. However, it dropped steadily in the following years. Between 1940 and 1946 "Turnover" was only 14%. In the years 1933-1936, he bought such companies as:

- Electric Power & Light - power plant;

- United Gas Preferred - gas supplier;

- South African Torbanite - mine;

- Austin Motors - car manufacturer;

- Leyland Motors - car manufacturer;

- Mortgage Bank of Chile - bank.

It is also worth adding that Keynes was not afraid either financial leverage. He used foreign capital to raise the rate of return on equity. As a result, within 4 years, he multiplied his assets 20 times, which allowed him to pay off all debts.

It should be noted that Keynes managed the King's College Trust Fund (known as the Chest Fund) from 1924 to 1946. In over 20 years of fund management achieved an average annual rate of return of 13,2%, which was a much better result than the broad British market (-0,5% per annum).

Keynes invested not only in stocks but also in bonds, towary or currency. The latter type of assets did not bring much return. It was because bad timing and position management. As a rule, the very direction of changes in exchange rates was well predicted. There was no market sense and patience. Despite everything, Keynes was able to achieve a satisfactory rate of return on the money invested. At the time of his death, he left behind a fortune worth £ 400 and a rich collection of art and other valuable assets (including Newton's manuscript).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-300x200.jpg?v=1709558918)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-300x200.jpg?v=1711601376)