Retail investors positively assess the introduction of experienced customer status on the CFD market in Poland

Retail investors positively assess the introduction of the status of an experienced customer on the CFD market in Poland, according to a study on the impact of KNF product intervention on investors carried out in November this year. by the Chamber of Brokerage Houses. In August this year The Polish Financial Supervision Authority complied with the demands of the Chamber and introduced it as part of national intervention experienced customer status, which enabled investing in the CFD market using the 1: 100 leverage, while maintaining the protection appropriate for the retail client. The KNF's decision is to prevent the outflow of clients to foreign companies not regulated or not subject to ESMA regulations.

Read also: ESMA's intervention did not improve traders' results

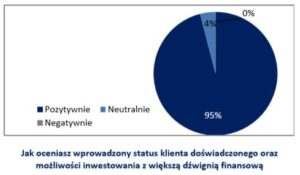

“Retail investors positively assess the impact of domestic product intervention on the CFD market in Poland. Due to the introduced status of an experienced client, approx. 95% of clients do not currently plan to change the broker and transfer their account to an entity registered outside the EU, while previously such plans were declared by over 2/3 of the surveyed investors ", says Marek Wołos, expert of the Chamber of Brokerage Houses for OTC markets.

In August this year The Polish Financial Supervision Authority complied with the demands of the Chamber and introduced status as part of national intervention experienced customer, which enabled investing in the CFD market using the 1: 100 leverage, while maintaining the protection appropriate for the retail client.

Investor survey

In November this year IDM conducted a survey among clients of domestic brokerage houses, retail investors on the CFD market. The survey results confirm that investors positively assess the impact of domestic intervention on their investment options. 95% positively assessed the experienced customer status introduced by the PFSA. 65% of clients also indicated that they were considering in August 2018 - after ESMA reduced the leverage - to change the broker to an entity not registered in the EU. Investors surveyed confirm that in the event of reduced leverage in the future they will reconsider transferring the account to a broker outside the EU (80% of respondents).

In November this year IDM conducted a survey among clients of domestic brokerage houses, retail investors on the CFD market. The survey results confirm that investors positively assess the impact of domestic intervention on their investment options. 95% positively assessed the experienced customer status introduced by the PFSA. 65% of clients also indicated that they were considering in August 2018 - after ESMA reduced the leverage - to change the broker to an entity not registered in the EU. Investors surveyed confirm that in the event of reduced leverage in the future they will reconsider transferring the account to a broker outside the EU (80% of respondents).

According to the Chamber's research conducted together with investor communities in 2018, half of active and experienced domestic traders, after introducing ESMA's product intervention, decided to transfer their brokerage account to a country outside the EU. The most active clients fled the domestic market - experienced investors who accept high risk and want to consciously use high leverage. The negative consequences of product intervention in Poland were also felt by a significant decline in the turnover of domestic investment companies. IDM members reported to the PFSA Office that CFD trading fell on average by 50% in the first months of intervention.

“Solutions introduced by domestic intervention on the CFD market meet the needs of retail investors and the challenges of the domestic brokerage industry. On the one hand, they increase the safety of clients and their trust in domestic brokerage houses under the supervision of the Polish Financial Supervision Authority, while at the same time improving the competitiveness of the domestic brokerage house industry ", says Marek Wołos from the Chamber of Brokerage Houses.

96% of surveyed investors confirm that the status of experienced customer and higher leverage did not worsen investment results. 54% of customers surveyed confirmed that the results have not deteriorated and 42% indicates an improvement in investment results.

Source: Chamber of Brokerage Houses, Press release

The study was carried out by the Chamber of Brokerage Houses in November this year. The questionnaire consisted of 5 questions whose purpose was to check how the national product intervention affected the CFD market. The survey involved clients of forex brokerage houses who have the status of an experienced client.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response