The American consumer is still in good shape, and that's bad

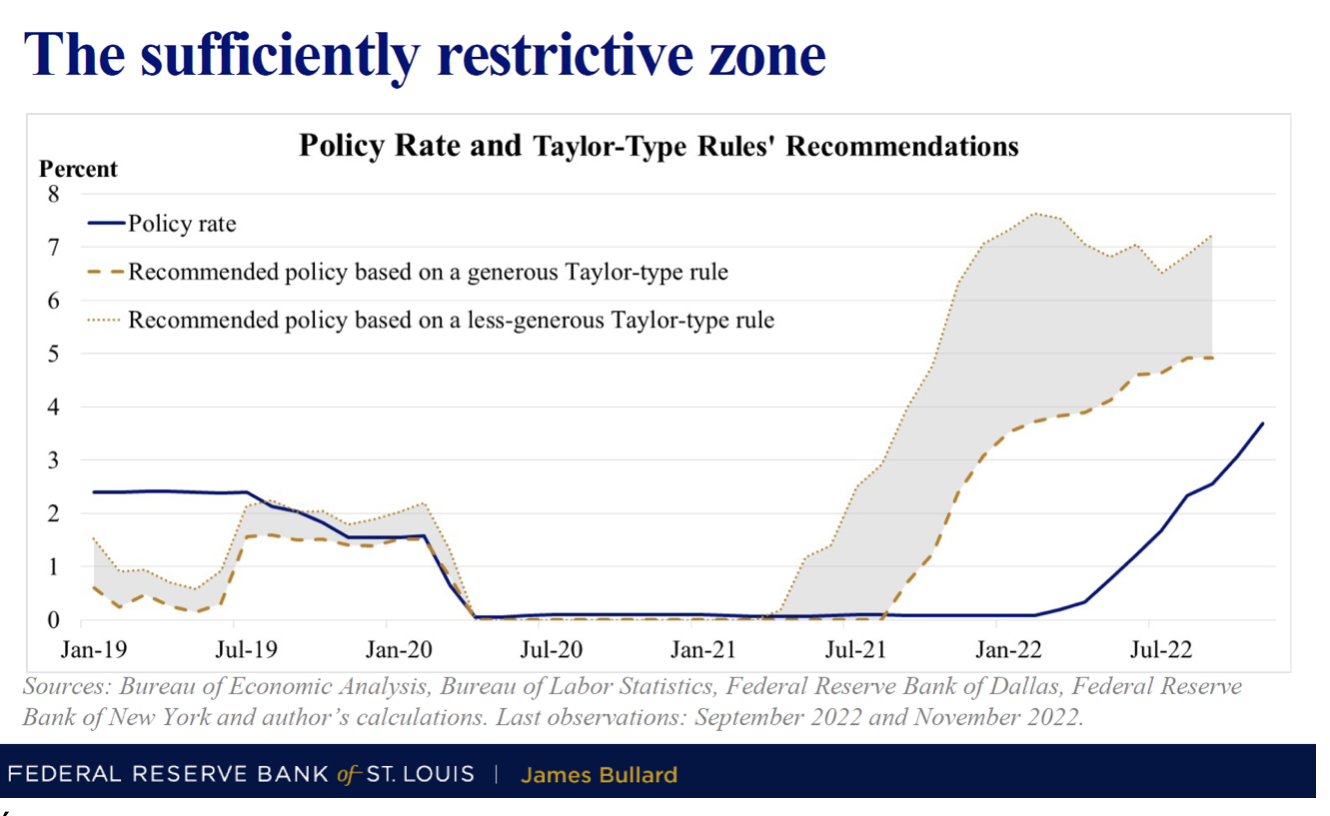

The past week has been a quieter one. The S&P500 ended the week slightly lower (-0,69%), while the WIG increased by 0,86%. Too good moods in the markets (which hinders the fight against inflation) was tried by one of the FED members, James Bullard (but generally without success) – showing the FED's restrictive interest rate zone in the range of 5-7%.

The FED has already raised the interest rate by 5,9 percentage points (about 1 percentage point of increase ahead of us), but it is not particularly visible in the economy. Simultaneously the American consumer is still in pretty good shape looking at the size of its expenses (which are expected to increase in real terms in Q4 2022 by as much as 4,8%).

7% US Fed rate?

The past week was a quieter one on the stock markets. S & P500 index fell 0,69% over the week and is now 10,9% above the bearish low from October 12.10.2022, 17,3 and only 3.01.2022% below the peak of the last bull market on January XNUMX, XNUMX.

Indeks S & P500 until 18.11.2022/XNUMX/XNUMX Source: own study, stooq.pl

Nevertheless the strong performance of the stock market may cause some frustration, at least for some members of the Fed. J. Bullard, currently a voting member FOMC said on Thursday that the Fed rate should eventually increase to "enough restrictive" levels of 5% to even over 7%, which he illustrated in his presentation "Getting into the Zone". The restriction zone was calculated based on various variants of Taylor's principle, an equation proposed by the well-known economist John Taylor of Stanford University. The Taylor Principle is widely accepted in the economist community and shows where the Fed's reference rate should be based on the current state of the economy.

Slide from J. Bullard's presentation showing the restrictive zone of monetary policy. Source: Federal Reserve Bank of St. Louis, James Bullard

J. Bullard's strongly hawkish communication fits in with recent attempts to cool down the stock market also by the chairman of the FED, J. Powell. The market will certainly not discount the possibility of raising the rate to 7% at the momentbut a year ago, when J. Bullard was probably one of the most hawkish members of the FED, pointing to the need for strong interest rate hikes, the market did not listen either, and it was Bullard who was most right then.

Indeks S & P500 until November 18.11.2022, XNUMX with the FED's hawkish communication. Source: own study, stooq.pl

Why Fed Members May Be Frustrated? And rates well above 5% are not just a theoretical possibility? There are several reasons that can make the fight against inflation more difficult:

- rate hikes have a long delay on the economy, and in the current cycle, the delay in the impact of rate hikes on the labor market may be even longer than historically (companies had big problems with hiring after the pandemic and will make decisions on laying off employees as soon as possible - hence possible delay)

- stocks are down "only" 17% from the peak of the previous bull market,

- the unemployment rate increased by only 0,2 percentage points from the low of the cycle (to 3,7%),

- unemployment benefits do not want to grow (e.g. initial claims),

- American consumer spending will increase by 4% in real terms in Q2022 4,8 (according to the forecast of the Atlanta FED model).

Polish stocks last week

WIG ended the week with a slight gain (+0,86%), but during the week we rebounded from the 200-session average. After such a strong rebound from the low of 13.10 (+23,6%), one cannot expect too much, at least in the short term. The chart below shows the details.

Indeks WEDGE until 18.11.2022/XNUMX/XNUMX Source: own study, stooq.pl

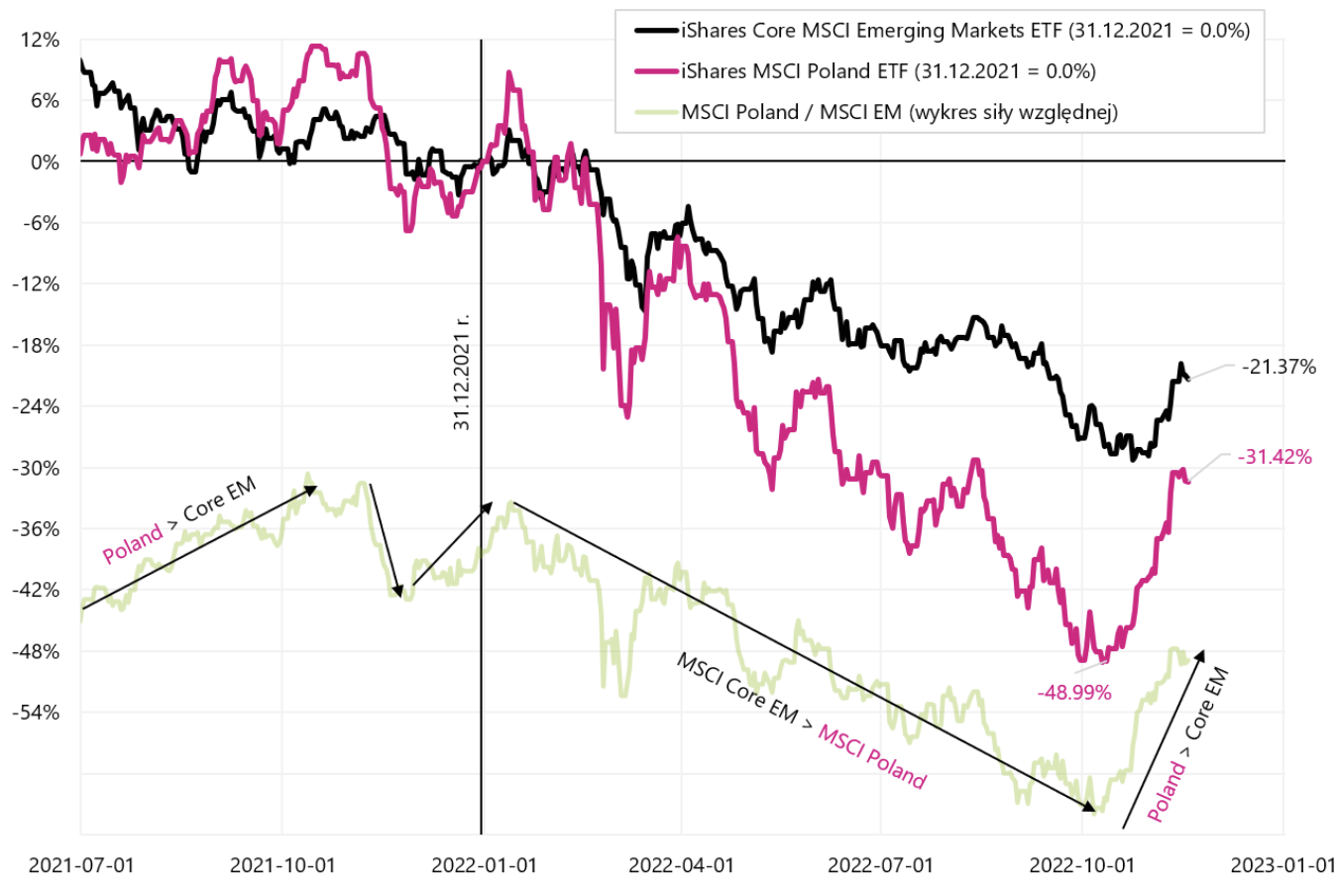

Polish stocks have been behaving stronger than other indices for over a month now. Comparing the MSCI Polska index with the MSCI Emerging Markets index, we see that our stocks have made up a lot recently (since October 12.10.2022, 34,4, the Polish MSCI has increased in USD by 9,0%, while MSCI EM only XNUMX%).

MSCI Poland (iShares MSCI Poland ETF) and MSCI EM (iShares Core MSCI Emerging Markets ETF) until November 18.11.2022, XNUMX. Source: own study, iShares.com

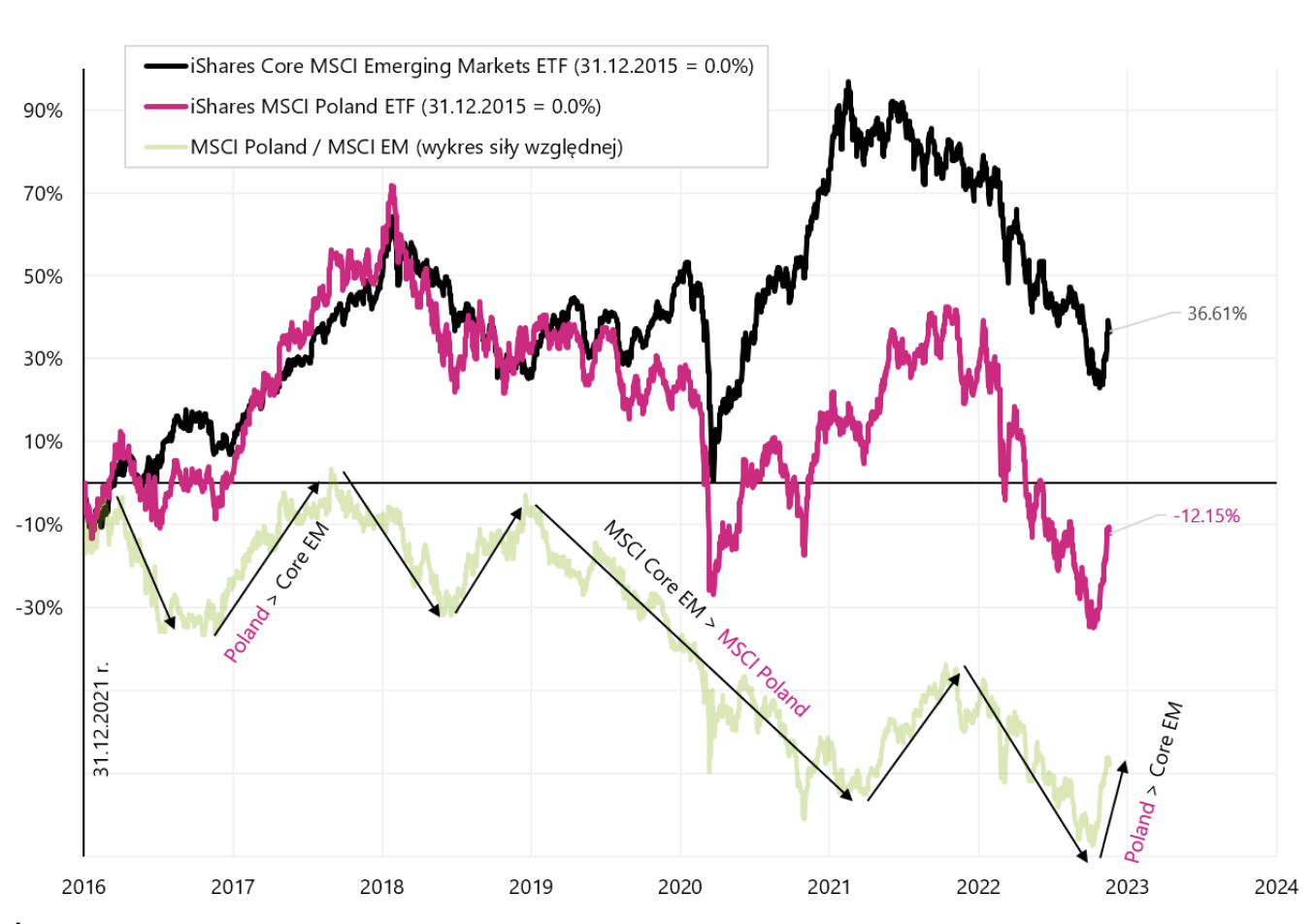

Comparing Poland with Emerging Markets in the longer term (since 2016) we can clearly see that we are growing stronger than EM in moments of "strong" risk-on (when investors increase their purchases of risky assets), such as (i) 2016/2017 election won by Trump, (ii) 2021 - wide opening of economies after covid, (iii) and currently strong risk-on (inflation behind us, the end of the year ahead). This also means that in a situation of risk aversion (so-called risk-off), our shares have the right to fall much faster and stronger than in the entire Emerging Markets segment.

MSCI Poland (iShares MSCI Poland ETF) and MSCI EM (iShares Core MSCI Emerging Markets ETF) since 2016. Source: own study, iShares.com

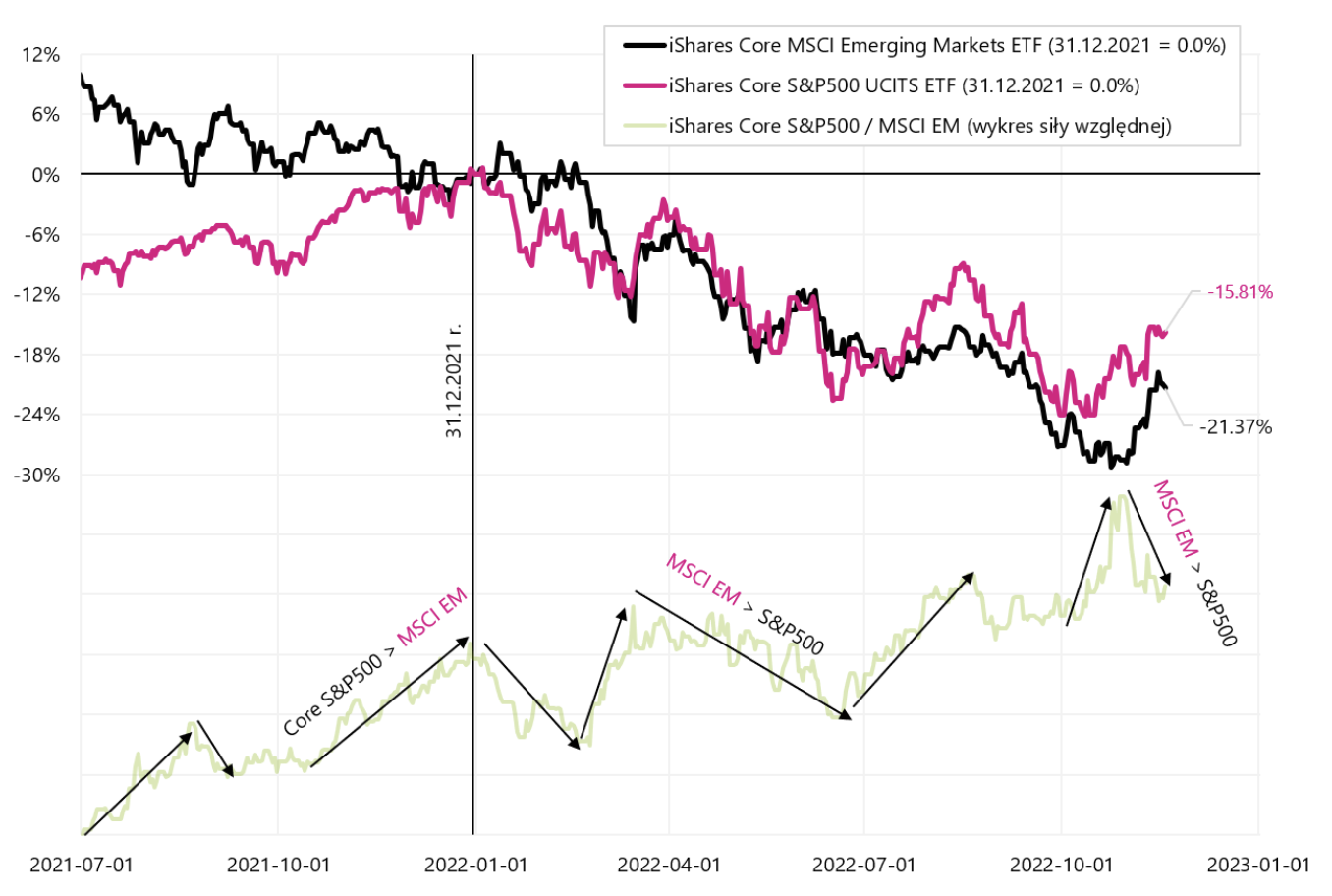

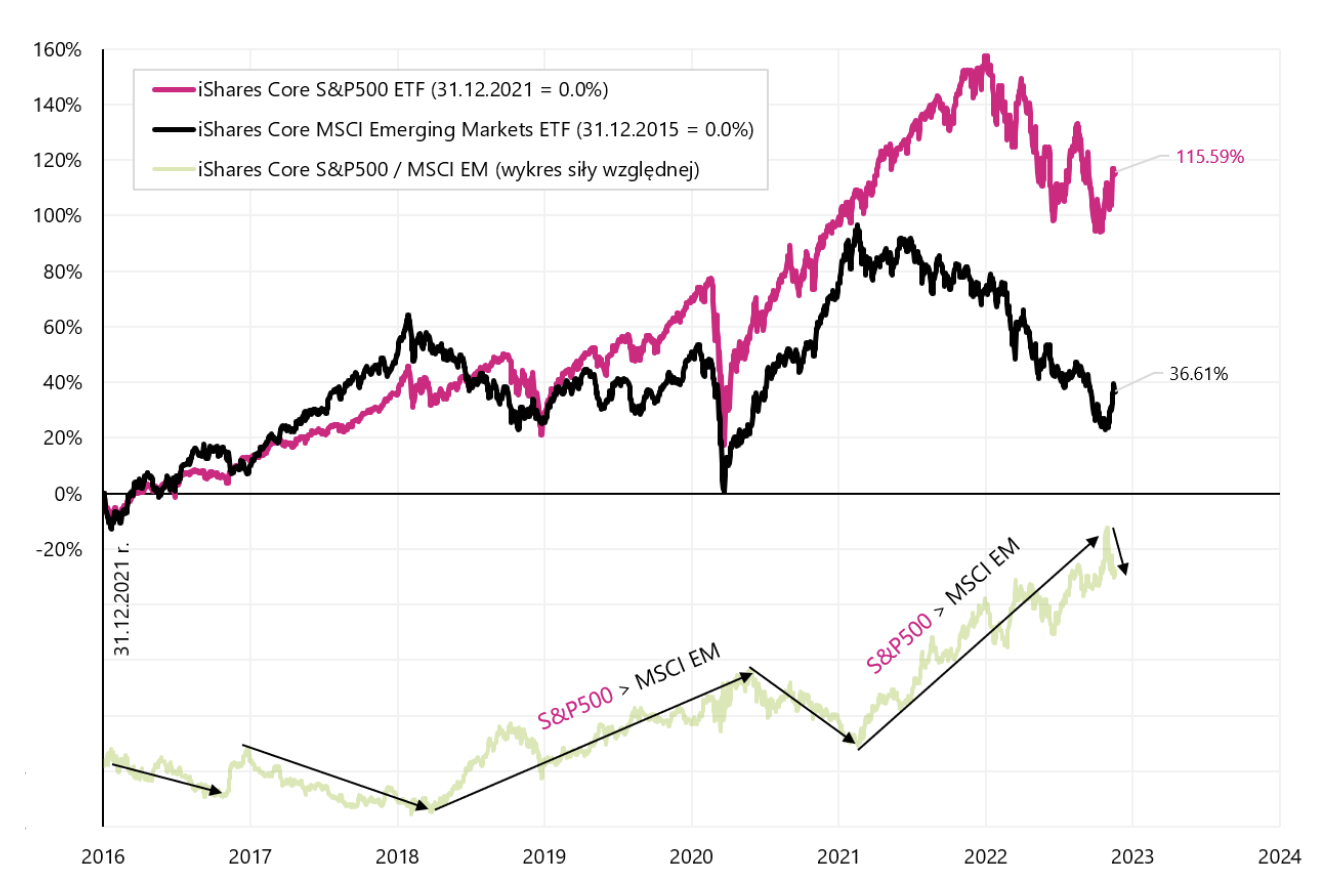

Let's compare the behavior of Emerging Markets against the background of the American S&P500 index. This year, the difference in favor of US equities is about 6 percentage points, and the recent rebound in equities did not necessarily turn out to be stronger (as one might expect) for Emerging Markets (another chart, from October 12.10.2022, 500, iShares S&P11.0 ETF increased in USD by 9,0%, while iShares Core MSCI EM ETF only XNUMX%).

S&P500 (iShares Core S&P5000 UCITS ETF) and MSCI EM (iShares Core MSCI Emerging Markets ETF) until November 18.11.2022, XNUMX. Source: own study, iShares.com

Since 2016, Emerging Markets has been losing significantly to the US stock index (next chart).

S&P500 (iShares Core S&P5000 UCITS ETF) and MSCI EM (iShares Core MSCI Emerging Markets ETF) from 2016. Source: own study, iShares.com

Big Picture: pause in interest rate hikes in the US and Poland

Markets are pricing in new information on future inflation on a daily basis, including comments from Fed members to dampen investors' enthusiasm for pivot Fed (or at least a pause in rate hikes). Every day we can learn new or changed probabilities of an increase at the next Fed meeting by 50 bps or 75 bps. Nevertheless from the point of view of the main bear/boom cycle, it does not matter much whether the FED raises rates to 4.75 or 5.25%.

“Don't miss the forest for the trees”

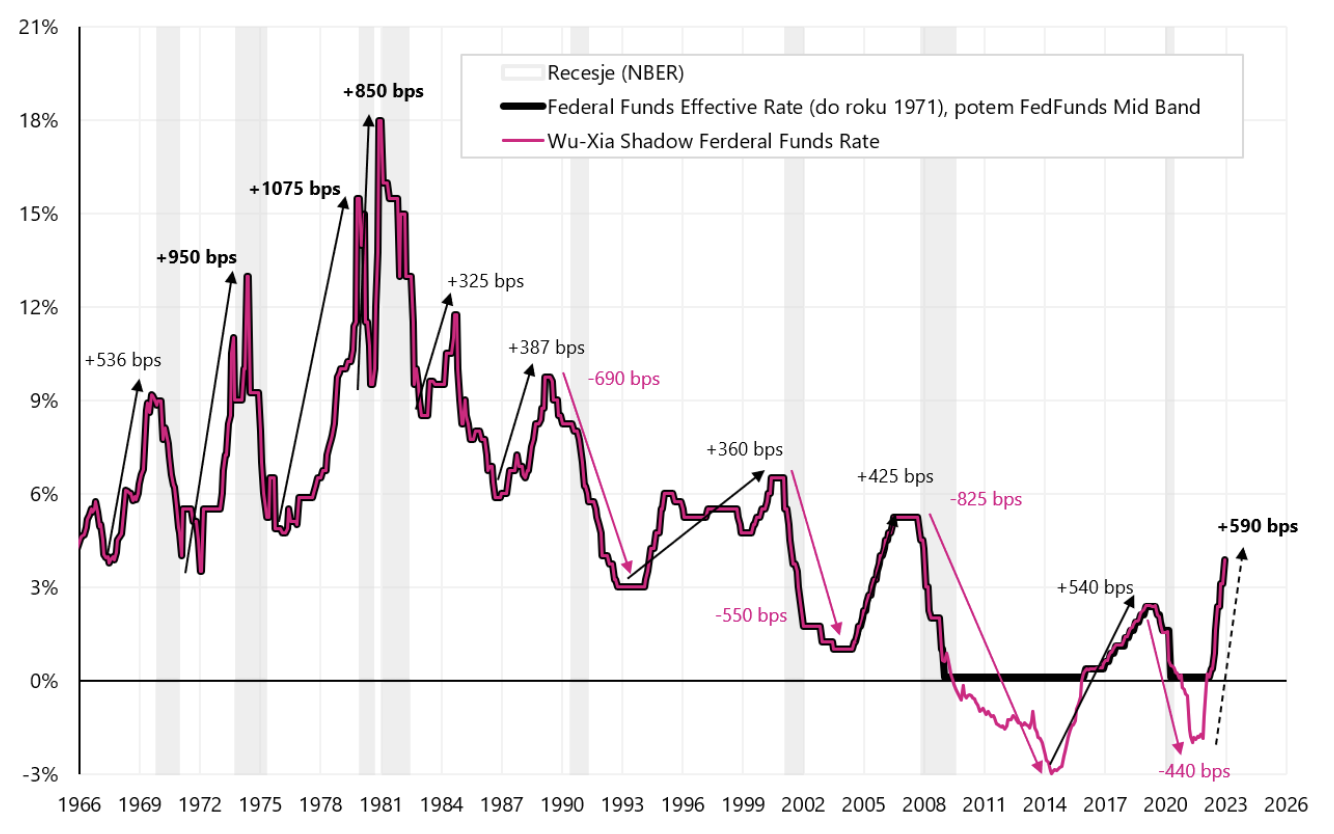

It will matter how long interest rates stay at such a high level, i.e. when the Fed can start cutting them. Currently, we already have a huge financial tightening, and if the FED raises rates by 100 basis points (bps), the total will be 690 bps (including the QE effect, when the so-called shadow rate in May 2021 reached -2%). There were bigger interest rate increases only in the 70s, when the economy was generally debt free. Once the central bank cuts rates to zero, it cannot in practice cut them further (although some banks have tried). However, when the economy needs even lower interest rates than 0%, then the central bank can launch QE (quantitative easing), the size of which can be converted into a negative central bank rate (so-called shadow rate). The shadow rate in May 2021 in the USA was -1,99% (according to the Wu-Xia model), which is shown in the chart below.

Fed reference rate and shadow rate since 1966. Source: own study, FRED, Atlanta FED

If after interest rate hikes in the US totaling 690 bps, the interest rate stays at this level for several quarters, it will have a significant impact on both the economy and corporate profits (in other words, it is the price of fighting inflation). Stocks are not pricing in such a scenario, currently focusing more on a possible quick pivot from the Fed. But the real pivot will take place around the first rate cut by the FED. Meanwhile, equities may be under pressure from a slowing economy and declining corporate profits.

Similarly, in Poland, the most important question will be whether the MPC will have to return to further interest rate hikes, but this may happen rather in the event of pressure from the markets for a weaker zloty. Currently, we have a global risk-on (investors are willing to buy risky assets), which will temporarily prevent us from playing markets for a weaker zloty. But when inflation surprises negatively, and there is a risk-off on the markets (investors sell risky assets), then we can see a downward pressure on the zloty. Let me just remind you that the central bank of Hungary, fighting the weakening of the forint, raised one of the interest rates to 25%.

The American consumer is too strong, and that's bad

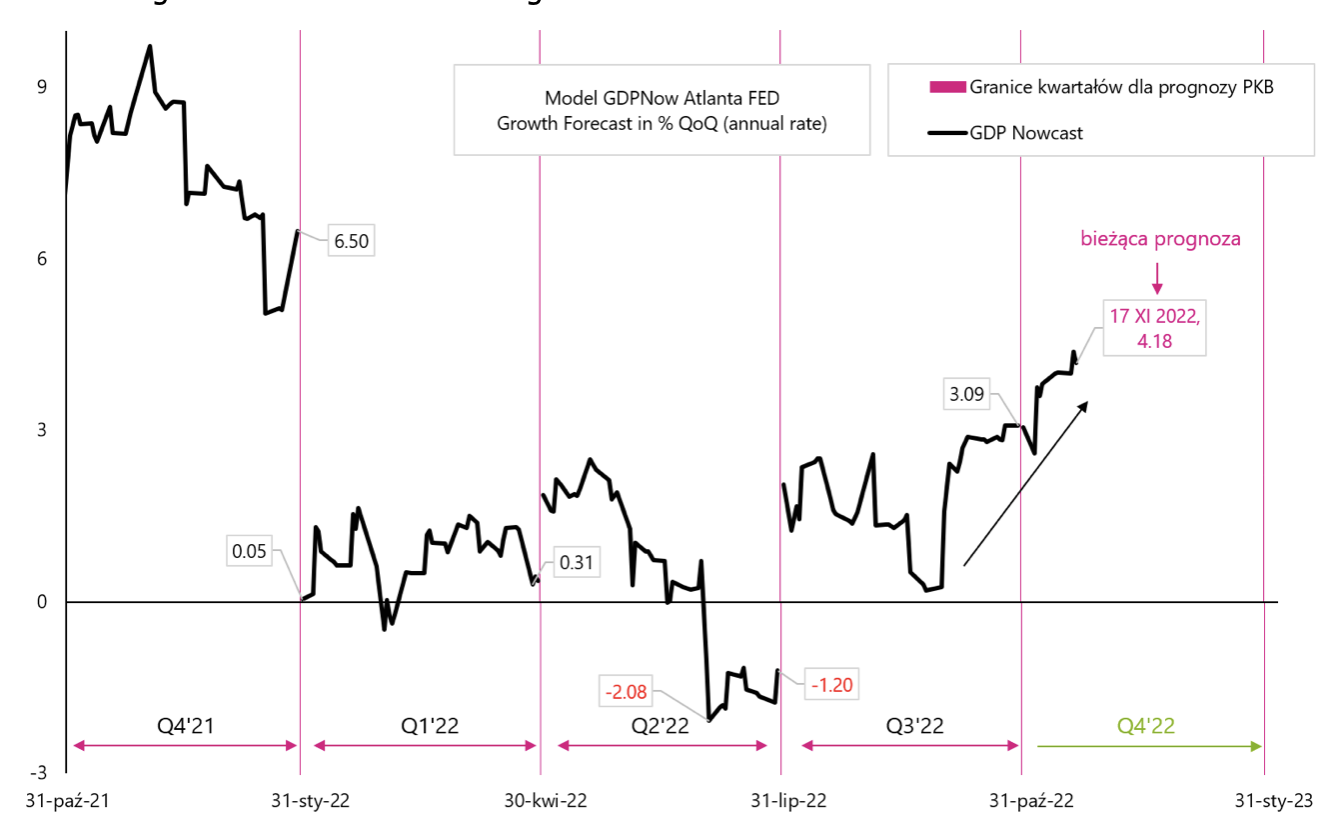

The forecast of US GDP growth in the fourth quarter of 2022 according to the GDPNow Atlanta FED model is currently as high as 4,18%. Normally, one would be happy, but in a situation of fighting inflation as the main priority, such strong economic growth "will not like" the Fed.

GDP growth forecast according to the GDPNow Atlanta FED model. Source: own study, Atlanta FED

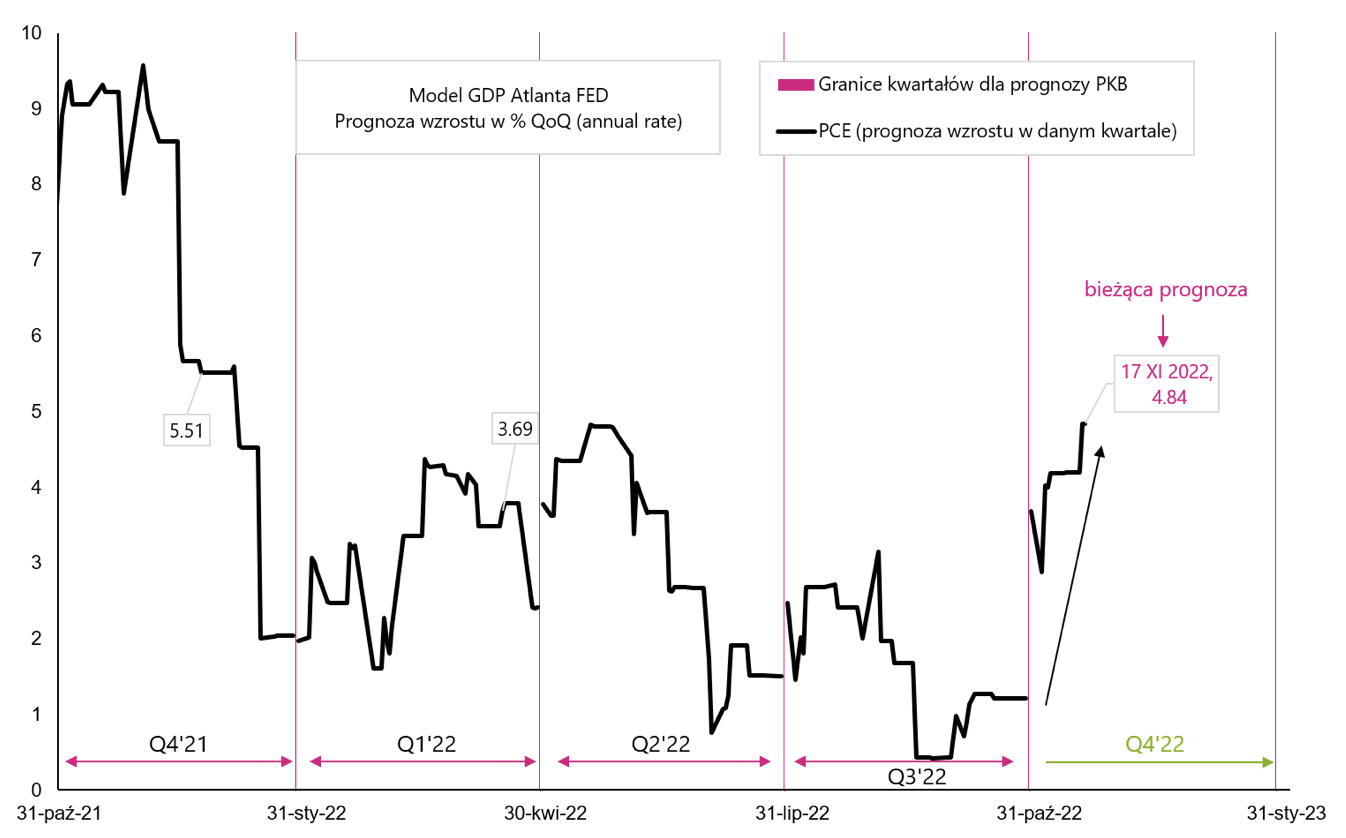

In addition, if we look at the largest component of GDP, i.e. real consumer expenditures (PCE - personal consumption expenditures), the growth forecast for Q4 2022 is currently 4,84% - which the FED will not like either.

PCE growth forecast according to the GDPNow Atlanta FED model. Source: own study, Atlanta FED

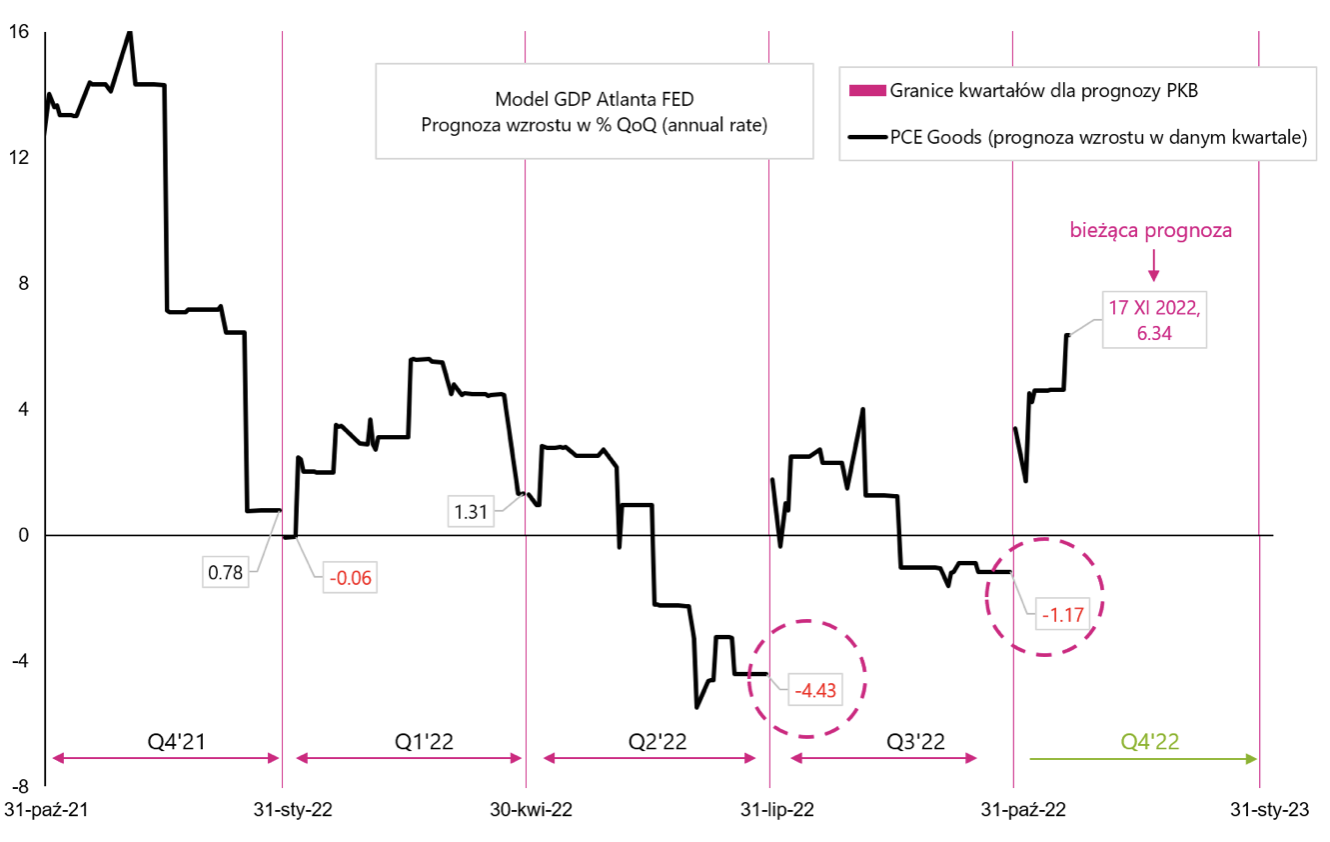

PCE consists of spending on durable goods (PCE Goods) and services (PCE Services). Of course, durable goods are a cyclical element (spending on services changes to a lesser extent depending on the economic situation). "Durable Goods", together with "Private Residential Fixed Investment" are the most cyclical elements of GDP and they are mainly responsible for the decline in GDP during the recession (as we wrote about in one of previous reports). In addition, let's remember that as part of core inflation, that's what it is core commodity inflation (Core Commodities Inflation) is responsible for lower than expected inflation (and the last strong reaction to lower inflation). This is why "it's not good" if PCE Goods expenses were to grow more strongly, and this is our latest forecast for Q4 2022. PCE Goods should fall as in the previous two quarters (marked with a circle in the next chart) and not grow at a rate of 6,34%!

PCE Goods growth forecast according to the GDPNow Atlanta FED model. Source: own study, Atlanta FED.

Last week we got to know the US retail sales data for October 2022. (this is a significant part of PCE), which increased nominally by 1,3% (the strongest since February this year, the market expected an increase of 1,0%). Spending on fuels (+4,1%), as well as cars and food, increased sharply. Partly stronger data can be explained by a one-time anti-inflation supplement paid in the state of California (so-called Middle Class Tax Refund). Nevertheless a stronger consumer for longer would be the last thing the Fed wants to see today.

PCE Services growth forecast according to the GDPNow Atlanta FED model. Source: own study, Atlanta FED

Summation

The past week has been a quieter one. Investors can be satisfied after the recent strong increases in share prices. But he doesn't necessarily have to be happy with this situation FEDbecause too good moods in the markets hinder the fight against inflation.

At the same time, the American consumer is still in pretty good shape considering the size of their spending (which is expected to increase in real terms in Q4 2022 by as much as 4,8%). To this we can add a job market that is quite resistant to rate hikes. Data like this could frustrate Fed members, unless the next data shows rapidly falling inflation.

About the Author

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)