US rating downgrade. Is this a blow to the public finances of the United States?

On August 1, 2023, after the session on the American market, information appeared that the Fitch rating agency downgraded the credit rating of the United States from AAA to AA+. Does this information affect the financial markets? It is worth remembering that many countries have lost their AAA status and are still able to roll over their debt. In this article, we'll take a closer look at credit ratings and see which countries still boast the highest ratings from all the major credit rating agencies, such as Standard & Poor's, Moody's and Fitch. We will also look at how Chinese agencies view US debt.

What are ratings?

The market of credit rating agencies is dominated by three entities that control about 90% of the market. They are: Standard&Poor's, Moody's and Fitch. These agencies assess the creditworthiness of governments or companies by giving them the so-called ratings. Rating agencies also give ratings to some financial products. These institutions play a very important role in the financial market.

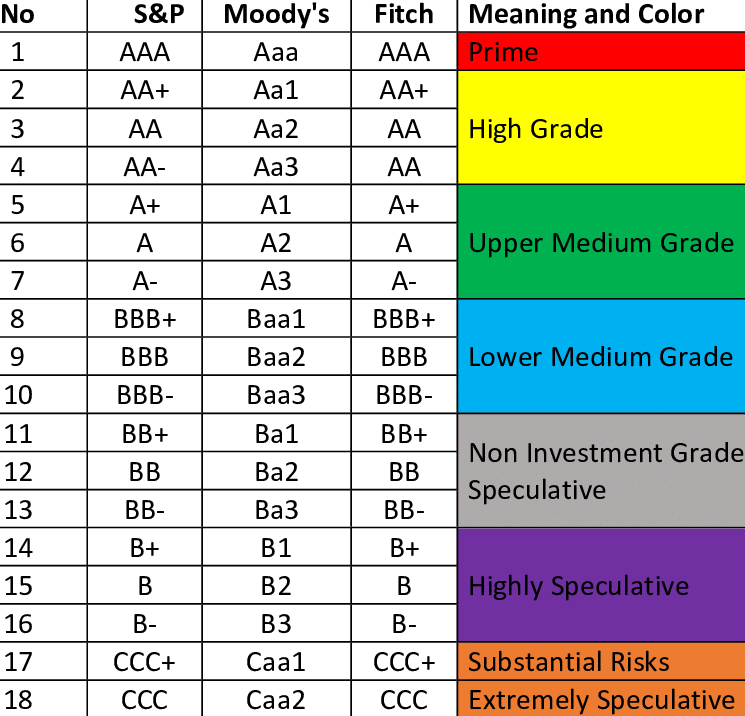

As a rule, changes in ratings are tracked by investors in the bond market. They allow you to assess the risk of investing in specific securities. The lower the investment rating, the greater the risk of investing in bonds. Below is a list of ratings awarded by agencies. Triple A is the highest possible rating a bond can receive.

Source: mof.gov.jm

Thus, the rating downgrade from AAA to AA+ means that US government bonds are no longer perceived by Fitch as "Prime", but will be established as “High Grade”. Still, the risk of US bankruptcy in the foreseeable future is practically zero, but cracks in the US image are noticeable.

It is worth remembering that this is not the first such case in the history of the United States. The last US rating downgrade was in 2011. It was then that Standard & Poor's (S&P) decided to downgrade the US debt rating from AAA to AA+. This means that two of the top three rating agencies do not consider US bonds as "Prime". Probably many analysts and investors are now wondering how Moody's will react to the behavior of competitors.

Why did Fitch downgrade?

In Fitch's communiqué, Fitch listed a number of factors that made it decide to downgrade:

- repeated deadlocks regarding the debt limit,

- political disputes that affect the lower stability of financial policy,

- increase in budget deficit levels,

- increase in the debt-to-GDP ratio.

Fitch is concerned that the US may not be able to meet its mid-term spending cap and revenue growth plans. Without these two factors, according to the agency, there is no chance to control the deficit and the level of debt.

The deterioration in the quality of financial management in the United States can be seen in the dispute over the debt limit. This undermines the credibility of the US government in the eyes of investors. In the medium term, the problem will also be fixed expenses related to e.g. with Medicare Social Security costs.

Another problem the agency sees in the "quality" of political disputes. Without the cooperation of Democrats and Republicans, it will be difficult to expect that long-term financial plans for the US budget will be developed. The agency fears that this could undermine the dollar's status as the world's reserve currency. This could reduce the financial flexibility of the US government.

Fitch is concerned about the US deficit over the next few years. The general government deficit will increase to 6,3% in 2023. The reason will be weaker federal revenue due to the economic slowdown. At the same time, in 2024 the General Government (GG) deficit is to amount to 6,6%. In 2025, the deficit is expected to increase to 6,9% of GDP in 2025. The agency itself estimates that the interest to income ratio will be 2025% in 10. For comparison, countries with an AA rating have such a relationship of 2,8%, while countries with an AAA rating have it at 1%.

What does Janet Yellen say about this?

The US Treasury secretary strongly disagrees with the rating agency's decision. In her opinion, Fitch's decision:

“(…) is arbitrary and based on outdated data.”

According to Janet Yallen, the US government has improved debt management and is of the opinion that:

“(…) US Treasuries will continue to be the most important and liquid asset in the world”.

She also added that the American economy is quite strong and unemployment is at one of the lowest levels in the history of the United States.

In her speech, Janet Yallen reiterated that recent years have been a period of dynamic economic growth in the US, and that the country still has the largest and most liquid financial market in the world.

From her statement, it can be inferred that considers U.S. government treasury securities to be TINA (Theres no alternatives). Due to the size of the US debt market, pension and investment funds will not be able to replace these securities with others treasury bonds. After all, the borrowing needs of Canada, Australia and Luxembourg are much smaller than those of the United States. Thus, financial institutions are unlikely to be able to replace US bonds and there will still be demand for these instruments.

Fitch also sees factors supporting the US rating

According to the agency, what supports the US rating is an advanced and diversified economy. In addition, a dynamic business environment that supports the innovativeness of the economy. One of the most important assets is the dollar, which is the most important reserve currency in the world. This creates an "organic" demand for government securities. This increases funding flexibility as demand for government debt remains strong.

Another positive factor is expected soft landing of the American economy. Thanks to this, it will reduce the pressure on the increase in budget expenditure, which would probably be introduced to stimulate the economy.

What supports the rating is also excellent ratings for the rule of law, institutional quality and corruption controli. The rating is also supported by the World Bank's high governance index (WBGI), which has a value of 79.

Rich history of US rating downgrades

For most investors, the downgrades of the US ratings end with the decision of S&P and Fitch. However, many agencies have taken similar steps. However, these are niche entities, which is why the media often ignore such information.

Media attention is focused on the Big Three of the rating market. However, smaller agencies also publish their opinions on the outlook for government and private company debt. One of them is Egan-Jones. He announced the first rating downgrade on June 16, 2011. It then downgraded its rating from AAA to AA+. After less than a year, there was a second reduction. On April 5, 2012, Egan-Jones downgraded the US debt rating from AA+ to AA. The reason for the reduction was the lack of sustainable solutions that would stop the growth of the debt-to-GDP ratio. On September 14, 2012, Egan-Jones downgraded its rating from AA to AA- due to the introduction of the third quantitative easing (QE3). AA- rating is the lowest level in high grade status.

Chinese Agencies Skeptical of US Debt

US debt does not have the best reputation in China. A great example is Dagong Global Credit Ratings, which downgraded the A rating to A- with a negative outlook for the US rating in subsequent years. In 2018, the Dagong agency downgraded the rating from A- to BBB+. Is this agency credible? Well, the Chinese regulator itself suspended the operation of the Dagong agency for a year. The reason was corruption allegations.

The agency had charge “fees” (i.e. consulting services) for giving a higher rating to the analyzed company. Interestingly, in 2011 China's national currency credit rating was AAA. According to a study by Chunping Bush the Dagong agency often assessed a country's rating more politically than in terms of objective considerations. In 2019, Dagong was nationalized by China Reform Holdings Corporation, which bought a majority stake.

China Chengxin Credit Rating Group is another rating agency from the Middle Kingdom. It is the oldest credit rating agency in China, established in 1992. The agency is one of the most important in China. On May 27, 2023, the agency lowered the rating for US debt from AAAq (the highest rating) to AA+. Concerns about the debt limit and the high deficit of the United States were the cause of concern. The agency feared that the political dispute would make it difficult to restore public finances.

Fewer and fewer AAA-rated countries

Currently, the number of countries with the highest ratings of all three major rating agencies is shrinking. This is because it is difficult to maintain fiscal discipline these days. Among the countries that currently have the highest rating are:

- Australia,

- Canada,

- Denmark

- Germany,

- Luxembourg,

- The Netherlands,

- Switzerland,

- Norway,

- Sweden,

- Singapore

Interestingly, in this list, many countries lost their top rating many years ago. An example can be Denmark, Australia or Canada, which a few decades ago had a "cut" rating, e.g. by the S&P agency. However, thanks to improved deficit and debt management, countries returned to the rating elite. Many countries that had AAA status did not regain it again. An example is France, which lost its AAA status with all major rating agencies more than a decade ago.

A long way to regain AAA rating

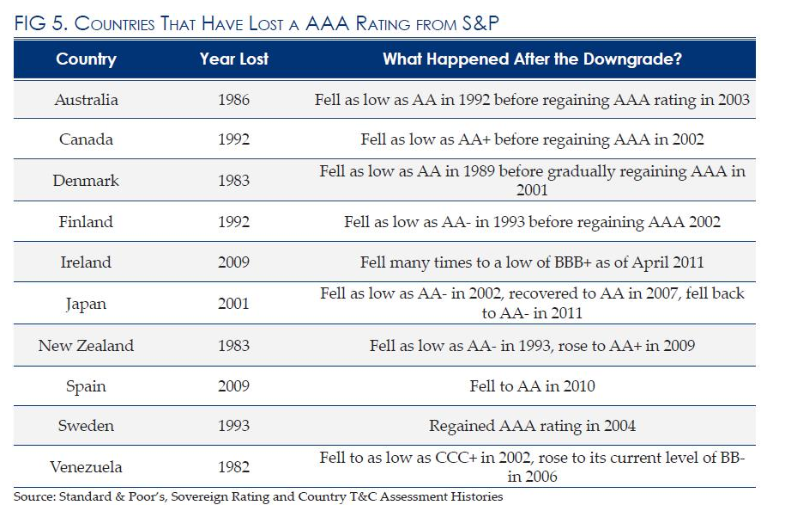

Some readers may say that “AAA rating can be restored, it just takes a little work”. Well, history shows that losing your top rating is hard to recover. It doesn't mean hard impossible. However, if someone thinks that this is an easy way, they are wrong. According to the study Committee for a Responsible Budget it takes many years for most countries to return to AAA rating. Some countries have not recovered it to this day.

Selected countries that have lost their AAA rating. Source: crfb.org

The table above shows that the list of countries that lost their AAA rating is really long. Even developed countries like Canada, Australia and Denmark have lost their top credit rating. Australia lost AAA in 1986 and it took 17 years to regain the title "Prime". There was also a demotion to AA level in 1992 on the way. It took Canada 10 years and Denmark 18 years to regain its AAA rating. So it requires comprehensive public finance reform and the need for a conservative approach to fiscal policy for many years to come. Are the political elites of the United States ready for this? The recent turmoil over the debt limit casts doubt on the chances of a quick recovery in US finances.

Not all stories have a happy ending. Venezuela is a great example. At the turn of the 70s and 80s, it was a country that benefited greatly from the boom in the oil market. Huge reserves of this raw material and low production costs meant that the country did not have budgetary problems. Rapid economic development made Venezuela one of the most popular destinations for migration from other Latin American countries. However, the development of the country was hampered by corruption and the waste of resources on failed investments. High oil prices allowed these problems to be hidden. Between 1977 and 1982, S&P maintained the AAA rating for Venezuela's debt. In 1982, the agency downgraded the rating. However, this did not have a motivating effect on the rulers. Corruption continued to flourish. After that, the situation was not improved by the governments of Chavez and Maduro. Venezuela has not used oil resources to transform its economy. Now the country is struggling with massive inflation and economic instability. Venezuela is an example of a country that has not used its potential. It is also an example that nothing is given forever. Even a stable country can become insolvent if society allows irresponsible people to rule.

A rating downgrade is not always a problem

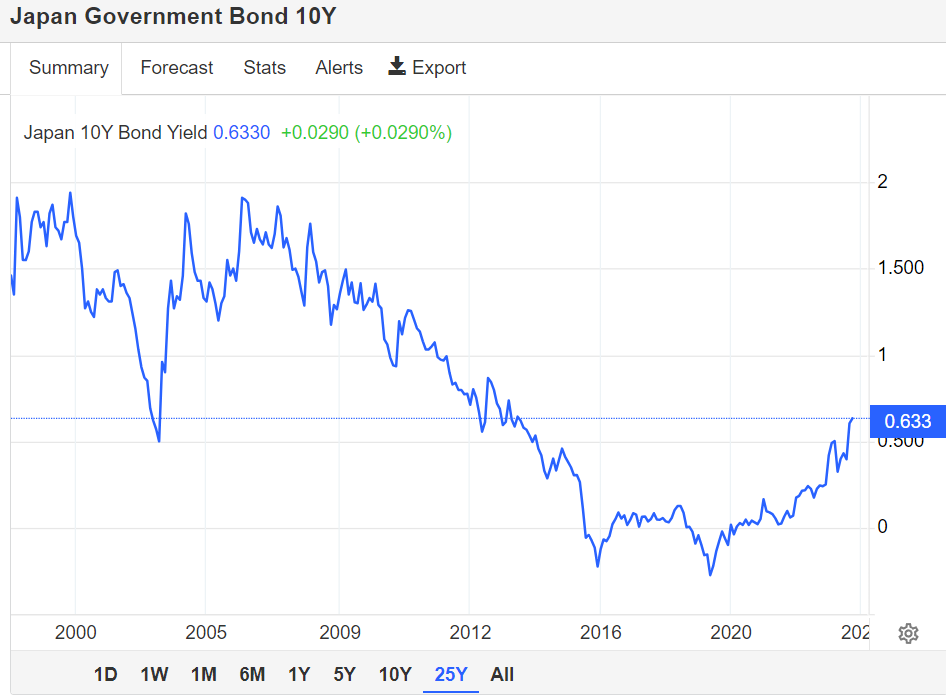

It may sound paradoxical, but a downgrade from AAA to a lower rating does not always mean higher interest costs. A great example is Japan, which lost its AAA rating in 2001. Due to the debt, the country has a systematically lowered rating, but this does not prevent the company from rolling over its debt. Also, the interest rate on the debt has been at a very low level for many years. This situation results from the specific situation of the country. Deep financial market and high level of Japanese savings. This allows Japan to roll its debt cheaply, regardless of its high debt-to-GDP ratio.

The interest rate on a 10-year debt. Source: tradingeconomics

For this reason many investors do not welcome the downgrade of the US ratingbecause they believe there will always be buyers for US debt. It is worth remembering, however, that problems with the deficit will not be solved, it may undermine faith in the dollar. And this will be a real tragedy for the United States.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)